Deel Blog & Resources

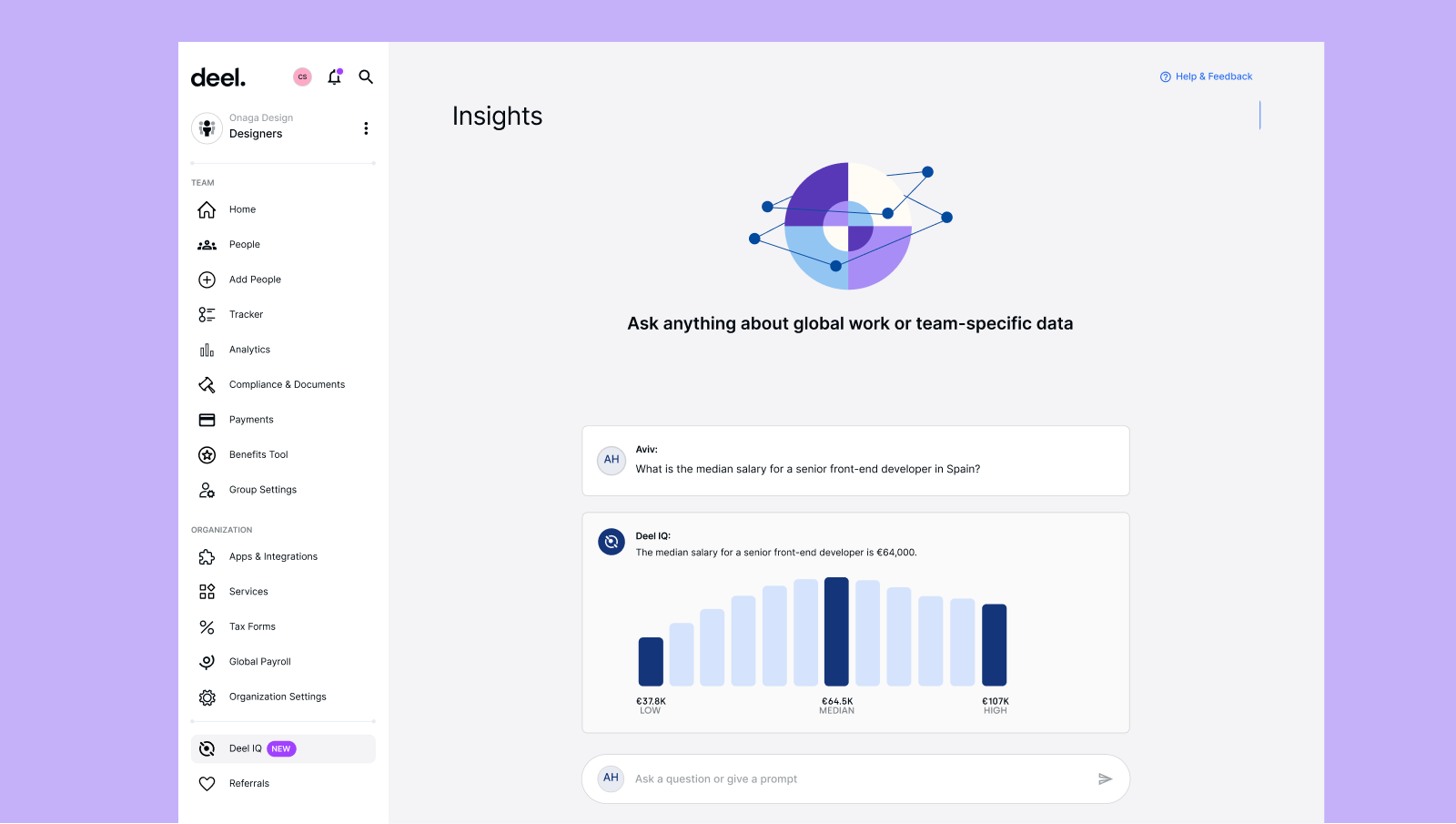

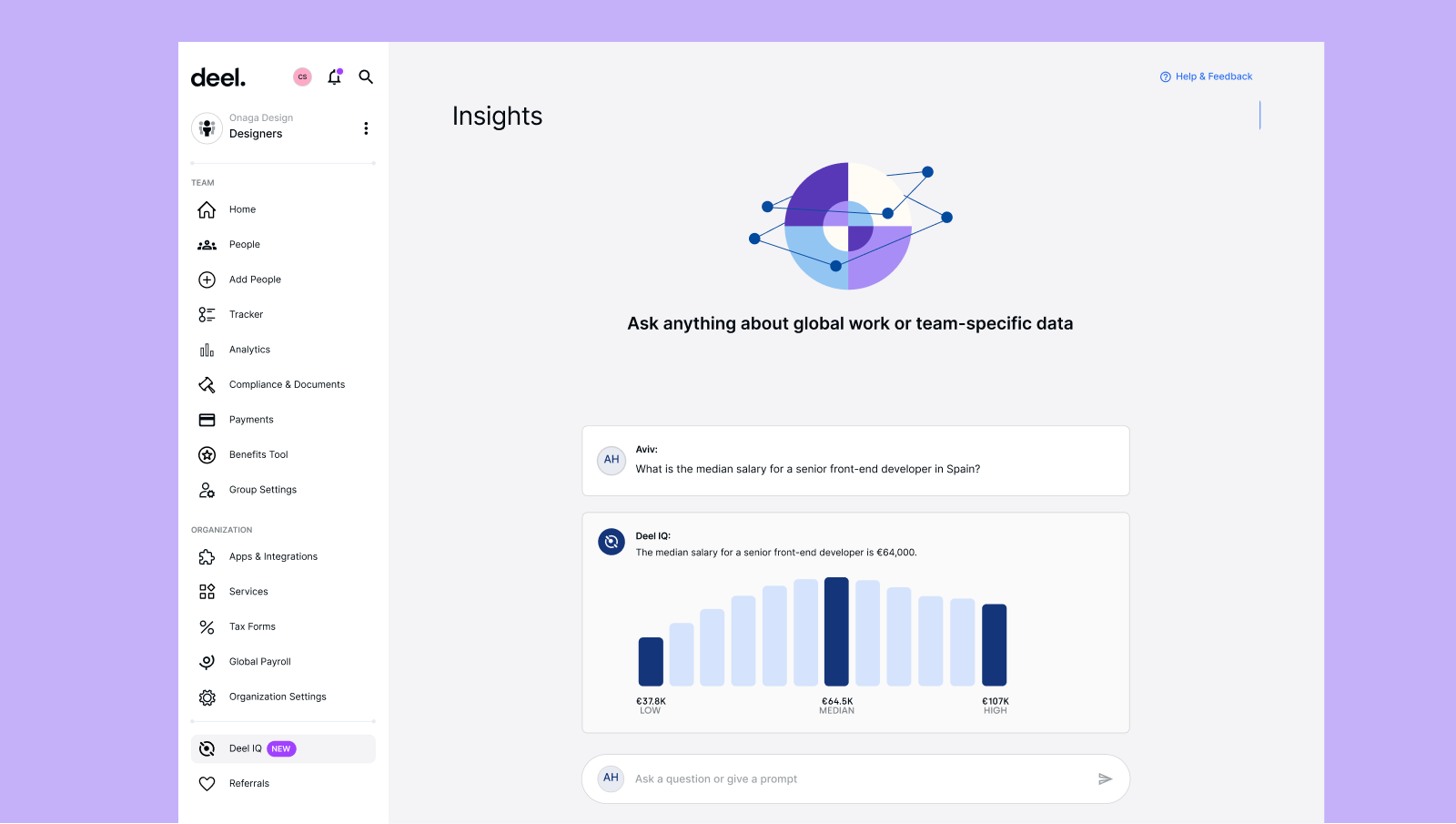

Deel AI’s Expertise, Now on Slack

Deel AI for Slack brings our AI-powered work assistant onto Slack so you can get answers about global HR in seconds. Answers are just a Slack message away.

Read this story

Deel AI for Slack brings our AI-powered work assistant onto Slack so you can get answers about global HR in seconds. Answers are just a Slack message away.

Read this story