Article

3 min read

How to Pay Employees with Mass Payment Solutions

Global payroll

Author

Shannon Ongaro

Last Update

January 24, 2025

Table of Contents

What is a mass payment?

How Deel simplifies payroll processing

How to mass pay your workers with Deel

Get more time to make payroll adjustments

Enjoy easier, more flexible payroll with Deel

Key takeaways

- A mass payment (or mass payout) service enables companies to fund their payroll with one bulk payment.

- With Deel’s mass payment function, clients can effortlessly pay their entire international team—from independent contractors to full-time employees—in a single click.

- To make payroll even easier, Deel’s extended cut-off dates allow businesses to adjust payroll beyond the standard deadlines.

Managing payroll for global teams can be difficult and time-consuming. From navigating different currencies and tax compliance requirements to ensuring timely international payments, traditional payment providers often fall short in meeting the needs of modern businesses.

Traditional systems often fall short, leaving payroll teams bogged down with manual processes. At Deel, we understand these complexities because we’ve helped thousands of businesses streamline their payroll operations across 150+ countries.

Our mass payment solution simplifies paying your workforce with just one click, saving time, reducing errors, and ensuring full compliance across jurisdictions.

In this blog, we’ll explore how Deel’s intuitive platform integrates global payroll, tax compliance, and currency conversion to take the stress out of paying employees anywhere in the world.

Experience the ease of seamless payroll management and empower your team to focus on business growth instead of administrative headaches.

What is a mass payment?

Mass payments refer to the process of sending multiple payments to various recipients simultaneously, typically in different currencies and across diverse regions. This method is commonly used by businesses to streamline payments for large groups of employees, contractors, or vendors.

By using a mass payment solution, companies can consolidate multiple transactions into a single, efficient process, reducing manual effort, errors, and processing time. Deel offers mass payment features that allow businesses to manage global payments easily.

Watch: Unlocking Payroll Potential: How to Optimize Your Global Operations

Payroll professionals are busier than ever. With evolving technology and increasing demands, choosing the right provider with top-tier features for your global workforce is essential. But what does an ideal solution look like? How can a payroll provider simplify your work and improve efficiency?

Watch this on-demand session to explore these critical questions and uncover how to leverage the latest advancements in modern payroll.

Topics we’ll cover include:

- Common challenges pushing global payroll professionals to explore new solutions

- How to assess your current payroll operations

- Must-have features in a global payroll platform

- Tips for evaluating vendors and selecting the best solution for your needs

How Deel simplifies payroll processing

Whether you’re paying a team of local independent contractors, direct employees, or EOR employees in another country, Deel makes the entire process as easy and efficient as possible.

Customized mass payments

Deel’s easy-to-use interface allows you to send mass payments, also known as mass payouts, to team members across the world simultaneously. With 15 payment options, Deel users can choose the payroll procedure that works best for them.

See also: How to Pay Foreign Independent Contractors: A Guide to International Payment Options and How to Pay International Employees: Payroll in Foreign Countries

Built-in compliance

Deel handles global payroll and tax compliance, so you don’t have to. With legal and tax experts in each jurisdiction, Deel ensures adherence to local payroll regulations and employment laws, while automating processes such as tax withholding and social security contributions.

Compliance

Integrated currency conversion

Some governments require you to pay workers in their local currency, even if your business operates in a different country. Deel’s mass payment services seamlessly handle currency conversions, providing real-time exchange rates and transparent fees. By centralizing currency conversion within the platform, you can avoid the hassle of dealing with multiple financial institutions or external foreign exchange services.

How Divbrands saves 8+ hours weekly on payroll

Divbrands is a digital direct-to-consumer e-commerce company that owns and operates multiple consumer brands across the globe—with a fully remote team.

Prior to finding Deel, DivBrands paid their global workforce manually which was time consuming and prone to error. With all of the components of global payroll and compliance, manual payment was no longer an option as the company grew.

Deel streamlined DivBrand’s payments and compliance—allowing them to hire and pay global workers with less stress and tedious work.

“Thanks to Deel, I just need to go to the payments section, press the pay button, and that’s it. It gives me the peace of mind that everyone is getting paid, on time, all over the world.” — Daniel Aksioutine, COO, DivBrands

How to mass pay your workers with Deel

With Deel, you can make one bulk payment to fund your payroll, and our team will ensure your global team gets paid accurately and on time. Here’s a look at the process.

Select the invoices you want to pay

Review the invoices that are ready for payment. You’ll see the amount due and the currency on the Deel dashboard (invoices can be in multiple currencies).

You can:

- Select ‘All teams’ to pay all the invoices at once or select which specific invoices you want to pay

- Pay individual contracts, individual teams, or entire entities under your organization

- Filter invoices based on contract type or make one large payment to cover every contract

Select the payment method and currency

Choose your preferred payment type, whether it’s a bank transfer, direct debit, Mercury, Transferwise, Revolut, or another available method. Choosing direct debit is typically the most streamlined process, as the workflow includes more automation compared to other methods.

Some payment methods allow you to select the currency you want to pay your workers in. We provide complete visibility of the costs associated with various methods to help you make the most cost-effective decision.

Your chosen payment method will determine the next step in the process. For example, if you select bank transfer, you’ll input your banking details, whereas choosing Coinbase will require you to connect your Coinbase account to Deel.

Platform Tour

Review and confirm payment

Review and confirm the payment summary, which details the total amount due, including salaries, payment processing fees, and more, depending on the type of workers you’re paying. The payment processing fee is typically $5 USD, a flat fee whether you’re paying 100 workers or one.

You can then download the summary or share the link to the page with your accounts payable team to process the payment.

Pay your invoice and distribute payments

After you make the invoice payment to Deel, our payroll team distributes the funds directly to your workers’ Deel accounts. You can then track the payment status in the payments tab.

Note: The funding workflow for our Global Payroll product is separate from mass payments for EOR employees or independent contractors. Through Deel Payroll, payment is carried out by Deel via payroll treasury services or by your company, depending on local compliance requirements. Watch the video below to learn more.

Deel’s treasury service takes so much stress off my plate. They take care of each country’s unique payroll and tax reporting needs, making my job much easier.

— Abbie Yeo,

Senior People Operations Business Partner, Petvisor

Get more time to make payroll adjustments

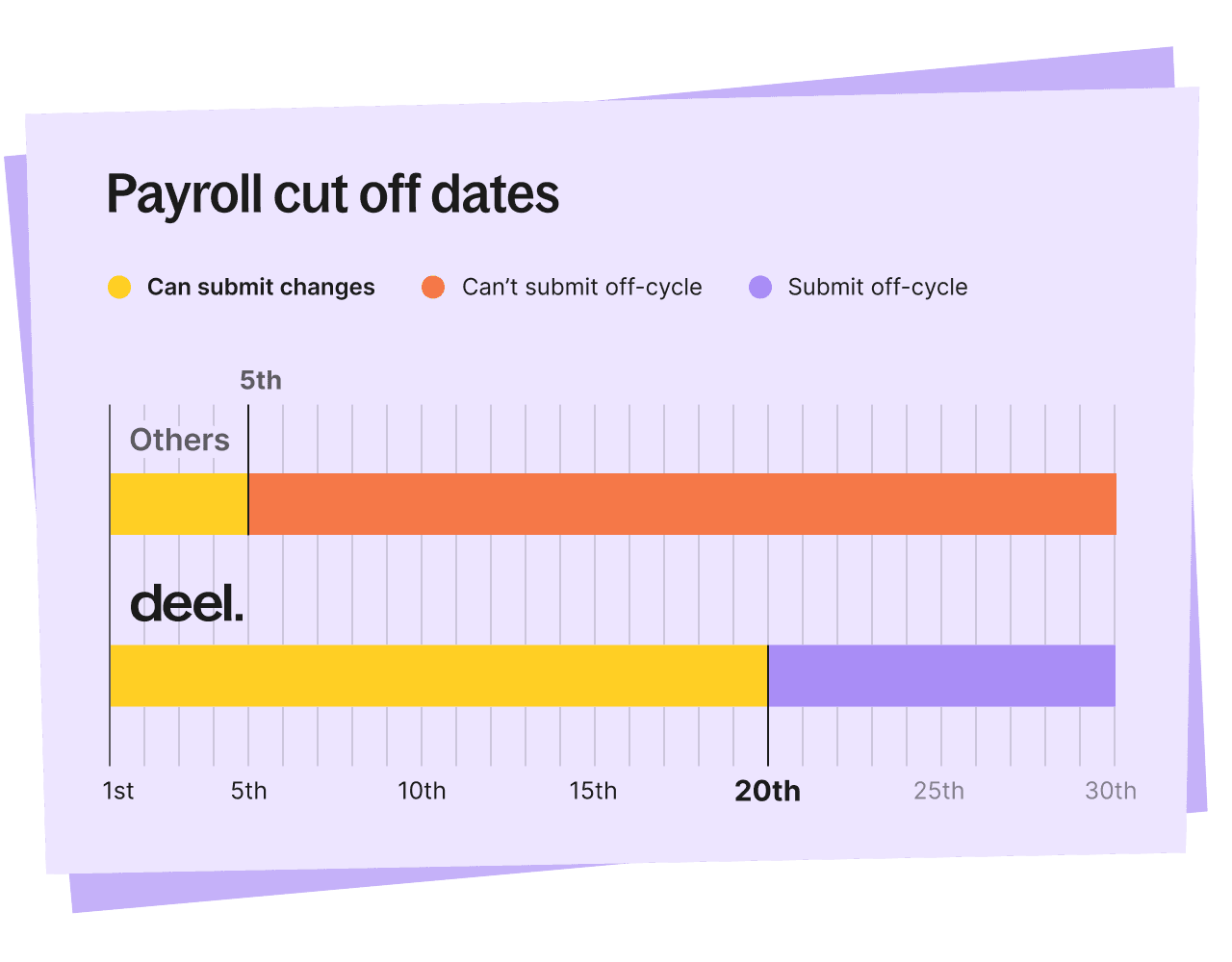

Deel’s industry-leading cut-off dates give EOR clients triple the amount of time to make payroll adjustments for their employees, whether you need to approve last-minute expenses, input time off, add commissions and bonuses, or submit monthly salaries.

Standard payroll service providers often have strict deadlines for adjusting payroll if they work with third parties. Since Deel processes payroll in-house, we can extend cut-off dates for payroll adjustments from the fifth of the month to the twentieth.

This flexibility allows you to make necessary modifications or additions to your payroll, ensuring accurate and timely payments without unnecessary stress.

See also: How On-Demand Pay Unlocks Higher Employee Productivity, Satisfaction, and Retention

Enjoy easier, more flexible payroll with Deel

With Deel’s global payment platform, you can streamline payroll, ensure compliance, and simplify currency conversions for your entire team. One click, and payroll is done.

But that’s not all you can do with Deel. Deel is an all-in-one payroll and HR solution for global teams. It enables you to hire and pay anyone, anywhere seamlessly. From hiring independent contractors to opening an entity to offering equity and immigration support, you can manage your entire international workforce in one centralized platform.

Learn more about making global payments with Deel or book a 30-minute product demo to explore the platform with an expert.

This content is for informational purposes only and does not constitute financial or legal advice. Please consult with professionals for specific guidance related to your business needs.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.