Stop payroll headaches. Start the year fresh with Deel Payroll.

Payroll errors cost millions each year. We can prevent that and help you save. Our built-in compliance cuts risk and errors, faster processing keeps paydays on time, and seamless integrations reduces manual work. Switching is simple and enterprises can go live in 1–3 months.

Payroll errors cost millions each year. We can prevent that and help you save. Our built-in compliance cuts risk and errors, faster processing keeps paydays on time, and seamless integrations reduces manual work. Switching is simple and enterprises can go live in 1–3 months.

One platform you can trust.

Payroll should push you forward, not hold you back. See what’s possible when paydays are accurate, compliant, and simple for your team.

Without Deel

- Extra admin hours and manual work create bottlenecks.

- Slow, error-prone processing leads to costly compliance risks.

- Limited integrations and scalability hinder business growth.

With Deel

- Automated, streamlined payroll saves time and reduces manual effort.

- Built-in compliance minimizes risk and prevents costly errors.

- 110+ integrations and global coverage support scale and expansion.

4.8/ 5

|

11978 Reviews

Book a free 30-minute product demo

Experience a personalized product demo and get all your questions answered by our experts.

One platform you can trust.

Payroll should push you forward, not hold you back. See what’s possible when paydays are accurate, compliant, and simple for your team.

Without Deel

- Extra admin hours and manual work create bottlenecks.

- Slow, error-prone processing leads to costly compliance risks.

- Limited integrations and scalability hinder business growth.

With Deel

- Automated, streamlined payroll saves time and reduces manual effort.

- Built-in compliance minimizes risk and prevents costly errors.

- 110+ integrations and global coverage support scale and expansion.

Trusted by 35,000+ companies from startups to enterprise

Proven results with Deel Payroll

Save 60% on payroll processing

Teams spend less time on admin by replacing disconnected systems with one platform and the support of a dedicated, local Deel Payroll Manager to run payroll after it’s submitted.

Get a 67% return on investment

Forrester TEI found our clients gained $2.33M in benefits over 3 years. Cutting errors, avoiding penalties, and retiring local vendors puts money back into your bottom line.

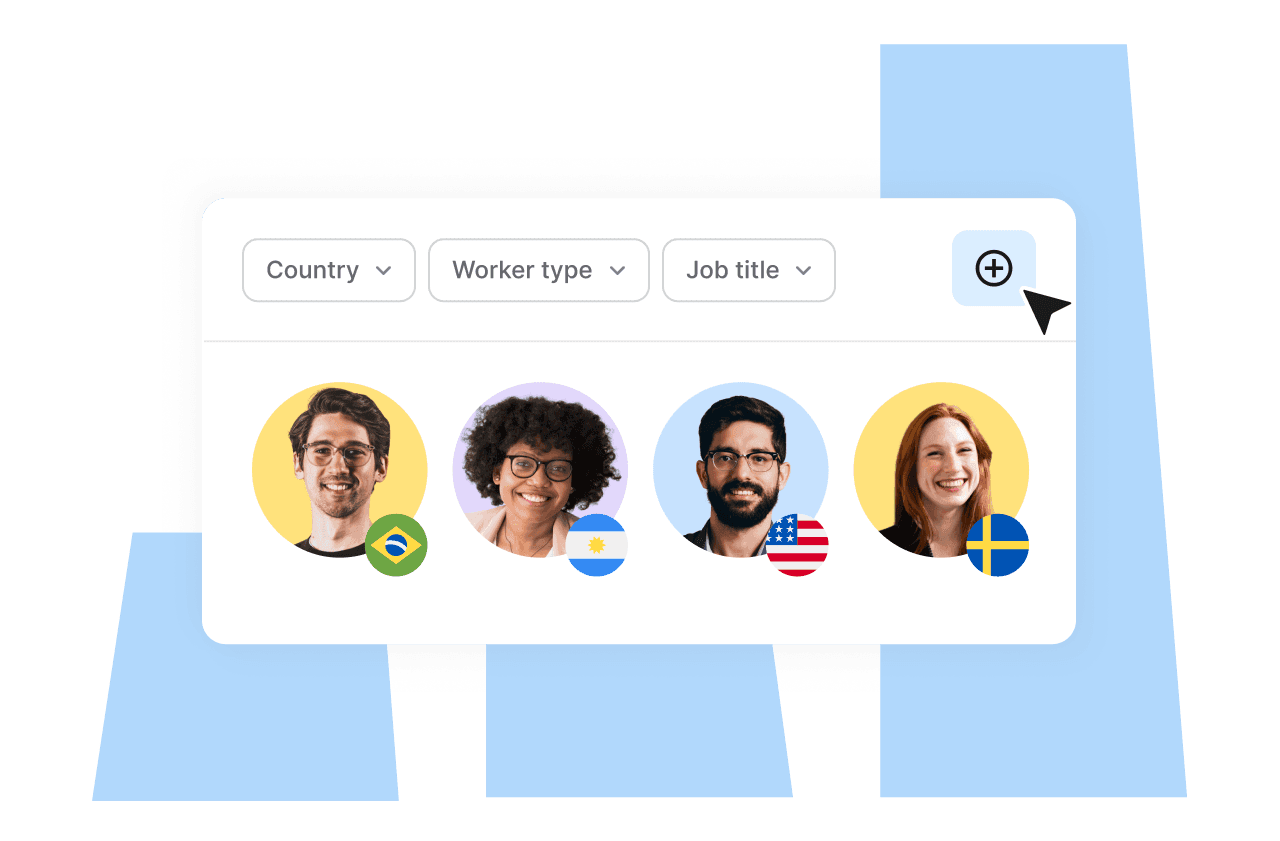

Expand payroll to 130 countries

Our payroll engine and 350 in-house experts keep you compliant with country-specific tax laws, benefits, and regulations so global expansion is reliable even when laws change.

Every solution you need handled in one platform

Hire

Expand into new markets without the hassle of local entities. Deel’s EOR and contractor solutions let you onboard top talent from 150+ countries, all while staying compliant.

Pay

Consolidate payroll for employees and contractors in one platform. Ensure accurate, on-time payments with built-in tax, benefits, and compliance coverage in 100++ countries.

Manage

With every tool for onboarding, time off, expenses, and more in one place and localized based on worker type and location, you’ll cut costs and get more data visibility.

Engage

Foster a connected culture and drive productivity with our talent management system. Empower teams with 1:1 meetings, career roadmaps, training courses, surveys, and more.

Save on costs and admin time

150

hrs

saved on hiring compliance

52%

saving in fees

$500K

saved yearly

Move faster with all of the solutions you need in one place

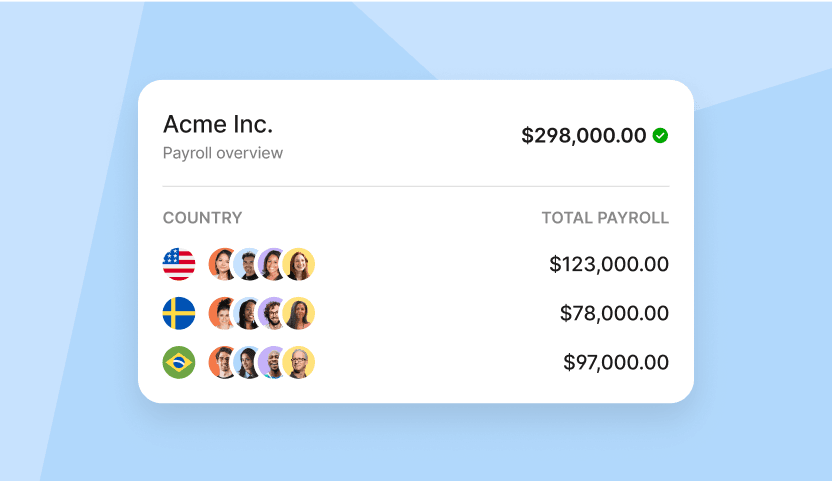

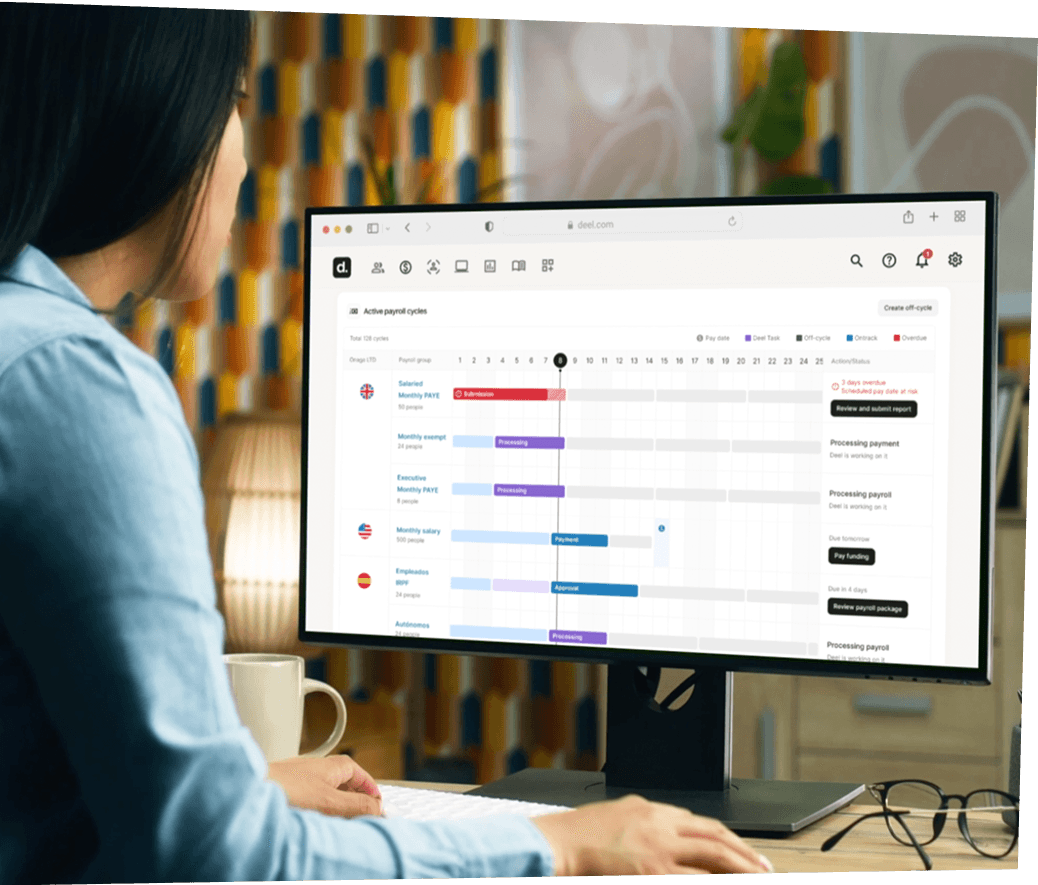

Deel Global Payroll

Consolidate and simplify your international payroll operations

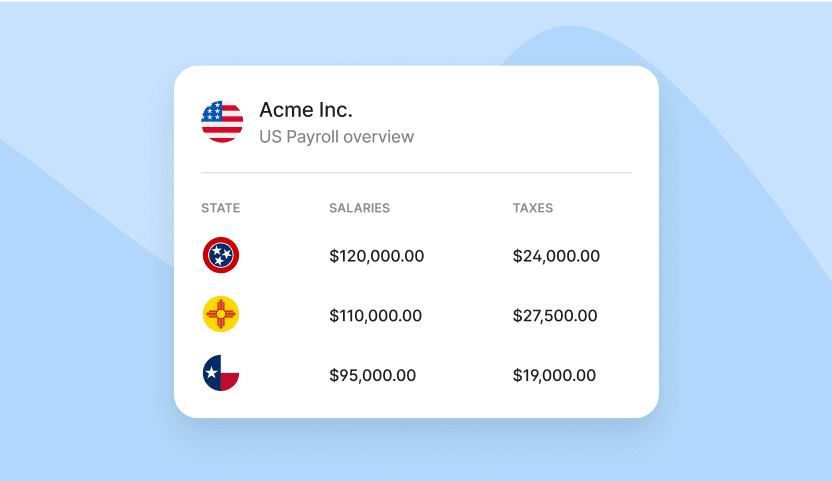

Deel US Payroll

Compliantly run US payroll in all 50 states

Deel HR

Manage every stage of your team's journey

Global HRIS

Manage and automate employee data, time off, reporting, and more

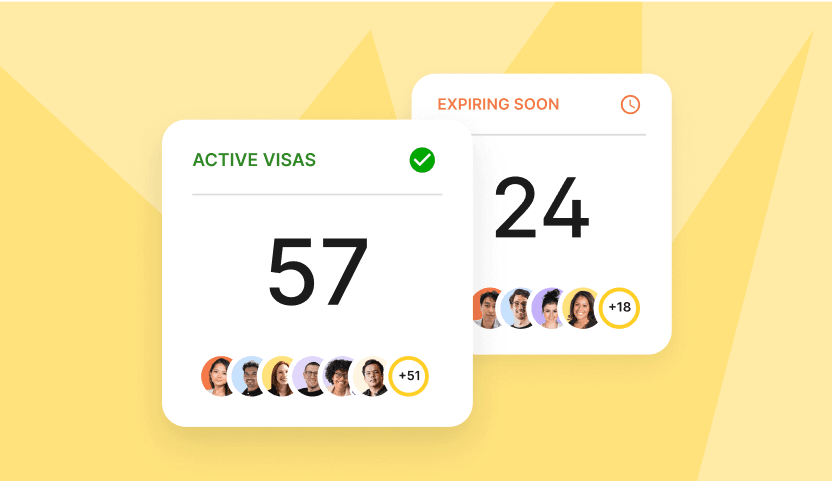

Deel Immigration

Secure visas for international hires without law firms or local entities

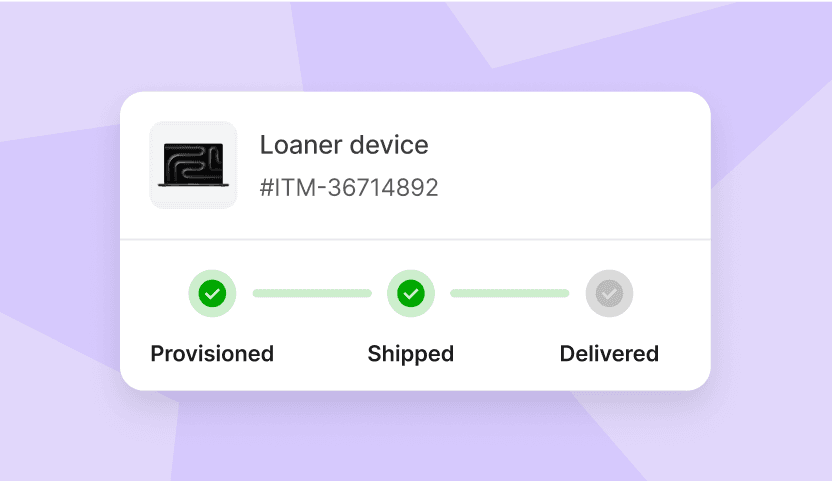

Deel IT

Buy, lease, secure, and manage equipment & apps

Pay, manage, and equip your global team with these solutions

Deel HR

Simplify workforce planning, compensation, performance, and more.

Starting at

$15

per employee/month

Shareable headcount, scenarios

Compensation reviews, planning

Career, survey, learning tools

Connect with staffing partners

Built-in HRIS features

Deel Global Payroll

Payroll for employees hired through your own entities.

Starting at

$29

per employee/month

Unified payroll processing

Exchange rate management

Employee self-service access

Integrated reporting & analytics

Local tax regulation compliance

Deel IT

Your foundation for running IT on a global scale.

Starting at

$10

per person /month

Real-time asset tracking

Global equipment marketplace

IT policy automations

HRIS-synced workflows

Reporting and auditing tools

Deel Services

Design competitive equity plans, expand your business globally, and protect data.

Get a

Quote

Data protection

Privacy consulting

Local tax and labor compliance

Tailored, compliant equity plans

GDPR representation

Excellent global HR

4.8/5 based on 11,978+ reviews

Fast 24/7 support that keeps your business moving

91%

of customer issues resolved at first contact with live chat

1 hr

to resolve most customer issues

6 min

to resolve most EOR and contractors’ issues

93%

Enterprise customers’ satisfaction

Book a demo

Book a demo with our global workforce consultants. We’ll set you up with a free account ready to suit your team’s needs.

Add your people

From new hires to your existing workforce, onboard effortlessly with our self-serve platform.

Dedicated onboarding

From navigating local laws to support for your team members, our dedicated team will help you get set up seamlessly.

FAQs

What is the Forrester TEI Study?

The 2025 Forrester Total Economic Impact™ study interviewed Deel Global Payroll clients and found they benefit from significant cost savings and payroll time efficiencies.

Deel commissioned Forrester Consulting to examine the ROI experienced by organizations with Deel Global Payroll. Forrester interviewed six clients using Deel Global Payroll, with each describing tremendous time savings across payroll processing, payroll vendor management, compliance, reporting, research, and employee support.

You can read more about the report here.

What does managed payroll mean and how is it different from self-service payroll?

Managed payroll providers handle several aspects of payroll processing and management on behalf of their clients. This includes calculating employee wages and taxes, processing payroll, generating pay stubs, and filing tax forms with the appropriate authorities.

Self-service payroll typically involves the employer handling most or all of these tasks in-house, using either manual or automated systems.

The key difference between managed payroll and self-service payroll processing is the level of involvement and responsibility required of the employer (you). With managed payroll, you can outsource many tasks and activities of the payroll process to the payroll processing vendor (us). This can save you significant time and effort to then focus on other strategic aspects of running your business.

How does Deel ensure compliance with tax and labor laws in different countries?

We maintain in-house legal and compliance experts in 130+ countries, continuously monitoring regulatory changes to ensure compliance. Our platform is updated automatically to reflect new tax laws, labor regulations, and statutory requirements. We also collaborate with local legal partners and participate in payroll compliance networks and industry forums to stay ahead of global payroll requirements.

Our Compliance Hub provides real-time notifications to end users in the Deel platform for employment law changes. It automatically scans, collects, and explains the latest relevant regulatory changes globally.

Lastly, Deel AI provides granular insights into your team and answers to local compliance laws. Trained by HR and compliance experts across 130+ countries, it's integrated with your people data for smarter, faster decision-making. Save time manually searching for compliance answers and get curated insights based on your people data.

Do you leverage in-country partners (ICPs)?

We currently support 53 countries with our single native payroll calculation engine, delivering instant gross-to-net calculations and real-time payroll. We only use ICPs in specific countries where we haven't localized the engine yet. With our native engine and ICPs, we deliver in-house payroll service and support to our clients across all 130 countries.

Can you pay my employees’ salaries and taxes on my behalf?

Yes, leverage Deel Treasury Services for employee payments. Depending on the country, we can pay the liabilities to the government and your employees on your behalf. If you prefer to pay, we will provide you with the payment files to help you expedite the execution. There is an additional fee for Deel Treasury Services.

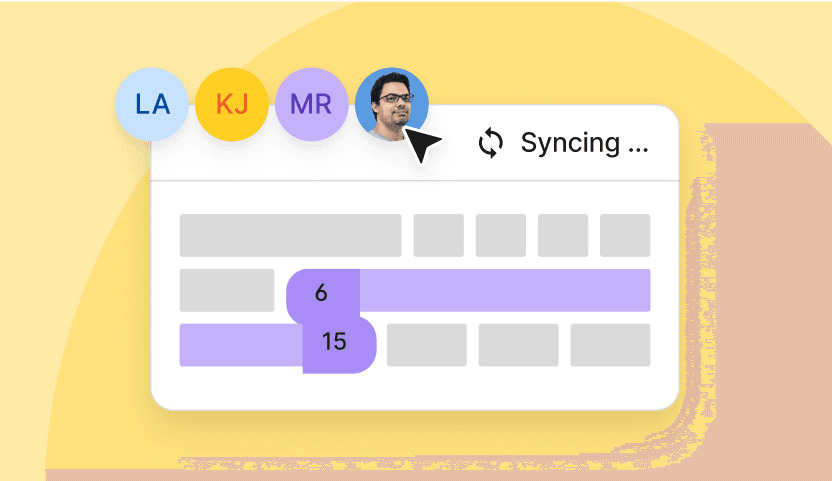

What type of integrations does your global payroll solution offer?

Deel provides 110+ enterprise-grade integrations and APIs for secure, flexible, and seamless data flow. Deel Global Payroll integrates with leading HRIS/HCM platforms, including Workday, SAP SuccessFactors, UKG, HiBob, BambooHR, and more. We are a GPC-certified (Global Payroll Cloud) partner of Workday for seamless, comprehensive integration.

We provide an open API that allows you to seamlessly integrate Deel Global Payroll with your existing tech stack, including ERP, accounting system, time tracking, learning management, expense management, benefits administration, and more.

What are the steps of the implementation process?

- Kick-off meeting between Deel and client stakeholders to discuss payroll requirements and align on desired go-live dates for each country entity

- Discovery call about payroll setup and migration for each entity

- Payroll system configuration and integration build

- Personalized training and QA testing to ensure a smooth transition

- Launch and go-live

Because Deel doesn't involve third party vendors or consultants for global payroll implementation, our process is much quicker than any other provider.

Do you offer other payroll solutions besides Deel Global Payroll?

Yes, we provide a comprehensive portfolio of payroll solutions to best serve the needs of our clients. In the US, we provide Deel US Payroll and Deel PEO.

If you’re looking for a self-service payroll option, we offer Deel Local Payroll powered by PaySpace in the UK, Brazil, and Africa. Deel EOR is also available for hiring employees in 150+ countries without the need to open an entity.

How does Deel maintain payroll compliance for my business in the US?

Whether operating in California, New York, or any of the states in between, we’ve got you covered. For all 50 states, Deel will accurately & automatically calculate and file payroll taxes with the IRS and with local, state and federal agencies on your behalf, along with necessary W-2, W-4, new hire and termination filings. We also offer human resources tools like digital i-9 verification to facilitate compliant new hire onboarding, and have 24/7 support to help you at every step of the way. Plus, clients can use our proactive monitoring tool, the Compliance Hub, to stay informed about compliance updates that are impactful, whether to small business or enterprise size clients.

Does Deel handle my W-2 forms for my employees?

Yes. Deel will automatically generate and take care of filing these documents with the respective tax authorities, usually the IRS and Social Security Administration. We will then distribute W-2s to employees at year-end.

Get a demo— live or on demand

Deel helps tens of thousands of companies expand globally with unmatched speed, flexibility and compliance. Get our all-in-one Global People Platform that simplifies the way you onboard, offboard, and everything else in between.

© Copyright 2025. All Rights Reserved.