Switch before the year ends. Start 2026 with confidence.

From 13th salaries in Brazil to W-2 filings in the US and more—payroll deadlines don’t wait. Don’t face them alone. Deel Payroll combines automation, local expertise, and hands-on implementation to help you migrate without disruptions and stay compliant with local deadlines.

From 13th salaries in Brazil to W-2 filings in the US and more—payroll deadlines don’t wait. Don’t face them alone. Deel Payroll combines automation, local expertise, and hands-on implementation to help you migrate without disruptions and stay compliant with local deadlines.

Why you should switch now

Year-end deadlines are closing fast. Wait too long, and you risk missed filings, compliance fines, and messy reporting. Switch now to finish migration on time. SMBs can go-live in a few weeks and enterprises in 1-3 months.

Without Deel

- Cut-off dates pass, delaying year-end reporting and reconciliation.

- Compliance gaps lead to costly penalties or manual rework.

- Valuable time lost fixing payroll issues instead of closing strong.

With Deel

- Full visibility and reporting that’s ready for year-end reconciliation.

- Automated compliance updates with every law change.

- Confident, accurate payroll ready for a seamless year-end close.

4.7/ 5

|

5912 Reviews

Book a free 30-minute product demo

Experience a personalized product demo and get all your questions answered by our experts.

Why you should switch now

Year-end deadlines are closing fast. Wait too long, and you risk missed filings, compliance fines, and messy reporting. Switch now to finish migration on time. SMBs can go-live in a few weeks and enterprises in 1-3 months.

Without Deel

- Cut-off dates pass, delaying year-end reporting and reconciliation.

- Compliance gaps lead to costly penalties or manual rework.

- Valuable time lost fixing payroll issues instead of closing strong.

With Deel

- Full visibility and reporting that’s ready for year-end reconciliation.

- Automated compliance updates with every law change.

- Confident, accurate payroll ready for a seamless year-end close.

Trusted by 35,000+ companies from startups to enterprise

What you gain after switching

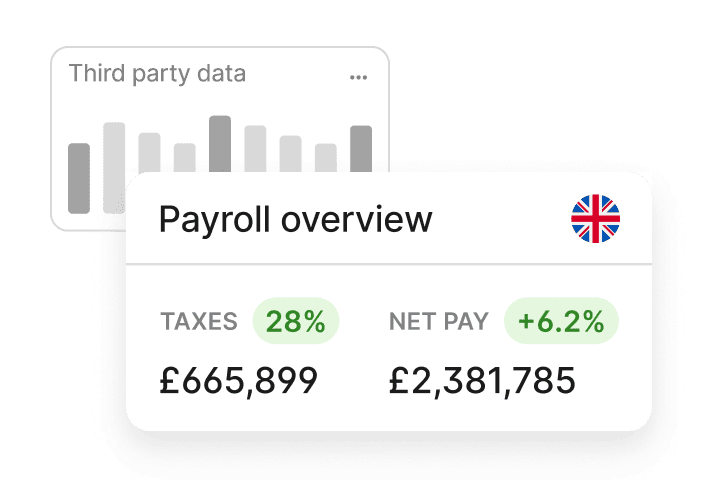

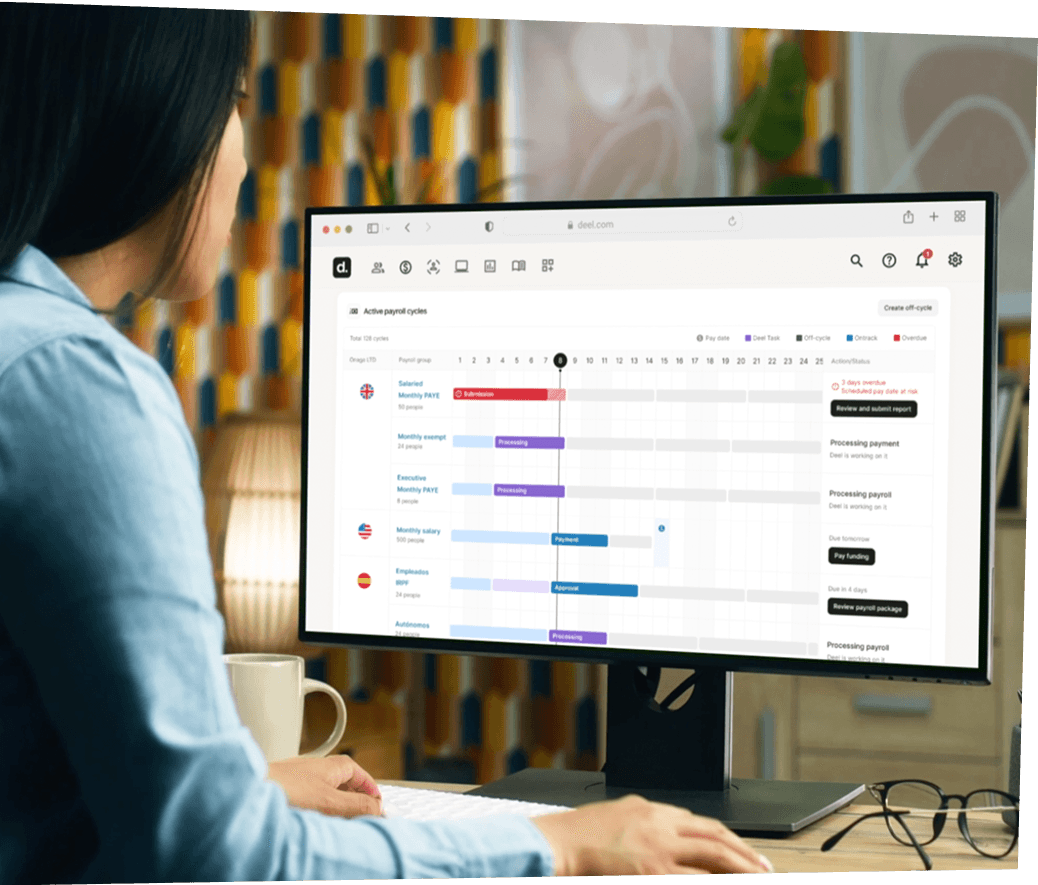

More visibility with unified payroll

Use Payroll Connect to combine Deel and third party data into one standardized Gross to Net report in the currency of your choice.

Improved real-time accuracy

Instant gross-to-net calculations catch issues before pay day so your teams are paid accurately with all the correct deductions.

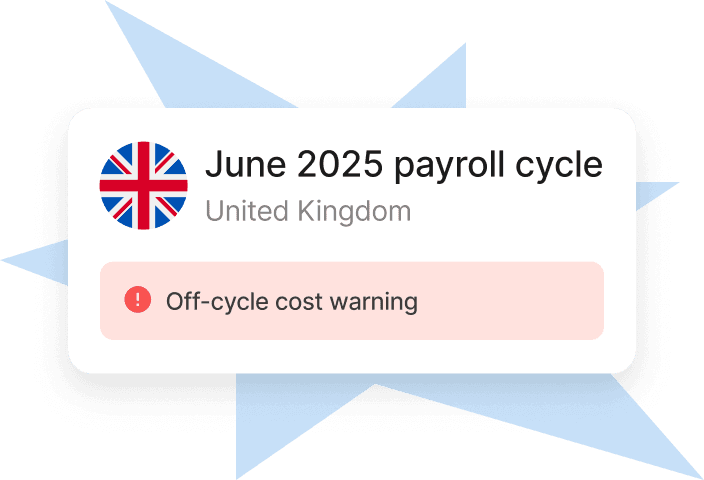

Less risk with local compliance

Our global compliance engine automatically updates your payroll as local laws evolve and is backed by our experts in 130+ countries.

Every solution you need handled in one platform

Hire

Expand into new markets without the hassle of local entities. Deel’s EOR and contractor solutions let you onboard top talent from 150+ countries, all while staying compliant.

Pay

Consolidate payroll for employees and contractors in one platform. Ensure accurate, on-time payments with built-in tax, benefits, and compliance coverage in 100++ countries.

Manage

With every tool for onboarding, time off, expenses, and more in one place and localized based on worker type and location, you’ll cut costs and get more data visibility.

Engage

Foster a connected culture and drive productivity with our talent management system. Empower teams with 1:1 meetings, career roadmaps, training courses, surveys, and more.

Save on costs and admin time

150

hrs

saved on hiring compliance

52%

saving in fees

$500K

saved yearly

How switching works

Kickoff and planning

We map your current payroll processes, integrations, and timelines. Enterprise clients receive a dedicated project team that coordinates with HR, Finance, and IT.

Data audit and parallel run

Our experts manage data cleansing, AI-powered mapping, and side-by-side testing with your existing provider. This validates calculations, filings, and outputs for complete accuracy.

Go-live and ongoing support

We align your go-live to local or fiscal deadlines for a seamless cut-over. After go-live, your dedicated Deel specialists remain engaged to monitor and optimize payroll cycles.

More key regional deadlines for switching

Pay, manage, and equip your global team with these solutions

Deel HR

Simplify workforce planning, compensation, performance, and more.

Starting at

$5

per employee/month

Shareable headcount, scenarios

Compensation reviews, planning

Career, survey, learning tools

Connect with staffing partners

Built-in HRIS features

Deel Global Payroll

Payroll for employees hired through your own entities.

Starting at

$29

per employee/month

Unified payroll processing

Exchange rate management

Employee self-service access

Integrated reporting & analytics

Local tax regulation compliance

Deel IT

Your foundation for running IT on a global scale.

Starting at

$10

per person /month

Real-time asset tracking

Global equipment marketplace

IT policy automations

HRIS-synced workflows

Reporting and auditing tools

Deel Services

Design competitive equity plans, expand your business globally, and protect data.

Get a

Quote

Data protection

Privacy consulting

Local tax and labor compliance

Tailored, compliant equity plans

GDPR representation

Excellent global HR

4.7/5 based on 5,912+ reviews

Fast 24/7 support that keeps your business moving

91%

of customer issues resolved at first contact with live chat

1 hr

to resolve most customer issues

6 min

to resolve most EOR and contractors’ issues

93%

Enterprise customers’ satisfaction

FAQs

How long does it take to implement for SMBs and enterprises?

- SMB / Mid-Market: Typically weeks and in as little as 10 days for GP SMB, minimizing disruption.

- Enterprise: 1-3 months for GP. Phased migrations are aligned with your system landscape and compliance requirements.

No matter your business size, implementation is guided by a dedicated Deel Implementation Manager and a dedicated Deel Onboarding Manager. Implementation is structured and aligned to your systems, timelines, and local compliance requirements. Our infrastructure supports both high-growth teams and large enterprises managing thousands of employees.

What are the steps of the implementation process?

- Kick-off meeting between Deel and client stakeholders to discuss payroll requirements and align on desired go-live dates for each country entity

- Discovery call about payroll setup and migration for each entity

- Payroll system configuration and integration build

- Personalized training and QA testing to ensure a smooth transition

- Launch and go-live

Because Deel doesn't involve third party vendors or consultants for global payroll implementation, our process is much quicker than any other provider.

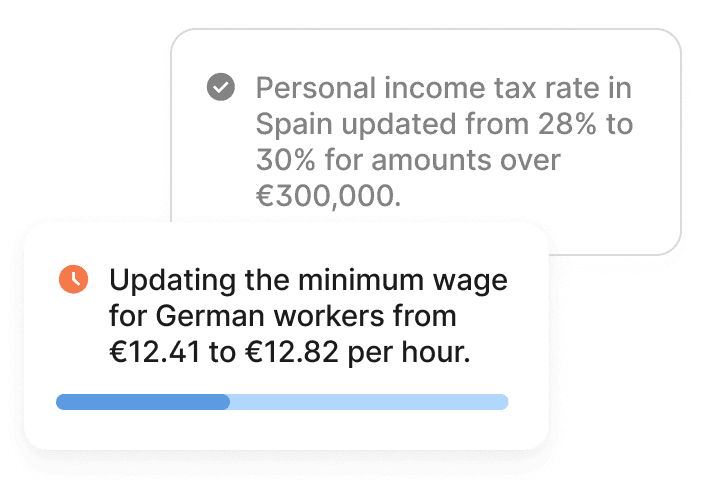

How does Deel ensure compliance with tax and labor laws in different countries?

We maintain in-house legal and compliance experts in 130+ countries, continuously monitoring regulatory changes to ensure compliance. Our platform is updated automatically to reflect new tax laws, labor regulations, and statutory requirements. We also collaborate with local legal partners and participate in payroll compliance networks and industry forums to stay ahead of global payroll requirements.

Our Compliance Hub provides real-time notifications to end users in the Deel platform for employment law changes. It automatically scans, collects, and explains the latest relevant regulatory changes globally.

Lastly, Deel AI provides granular insights into your team and answers to local compliance laws. Trained by HR and compliance experts across 130+ countries, it's integrated with your people data for smarter, faster decision-making. Save time manually searching for compliance answers and get curated insights based on your people data.

How does Deel Local Payroll simplify compliance and legislation updates across Africa?

Deel Local Payroll is purpose-built to support compliance across 44+ African countries, including South Africa. Our platform automates statutory deductions and submissions such as PAYE, UIF, SDL, and equivalents in each country, ensuring seamless handling of local payroll obligations.

With real-time legislative updates integrated into our system, your payroll calculations stay aligned with the latest tax and labour regulations without the need for manual intervention. Deel Local Payroll proactively alerts your team to compliance actions and deadlines, so nothing slips through the cracks.

Whether you're managing payroll in a single country or scaling operations across the continent, Deel Local Payroll ensures everything remains compliant, consistent, and secure within one cloud-native platform.

Does Deel Local Payroll automate statutory payroll calculations?

Yes. PAYE, National Insurance, Apprenticeship Levy, and statutory leave pay are calculated in real time. Tax code updates from HMRC are also applied automatically.

How does Deel Local Payroll’s pricing model support growing businesses?

Unlike traditional payroll providers, Deel Local Payroll offers a flexible, pay-per-employee model with no annual license fees. We scale with your business- no need for costly re-implementations or being locked into rigid contracts.

What is the price of Deel Global Payroll?

Deel Global Payroll starts at $29 per employee/month and is based on a tiered employee model. It includes a one-time set-up implementation fee ($1000 USD per entity). The total cost will also vary according to the number of payroll cycles in your country. Other factors that may influence the price include onboarding and offboarding needs.

The key difference between fully managed payroll and standard payroll processing is the level of involvement and responsibility required of the employer. With fully managed payroll, the employer can outsource the entire payroll process to the payroll processing company, which takes care of everything from start to finish. This can save time and effort for the employer, who can focus on other aspects of running their business.

Get a demo— live or on demand

Deel helps tens of thousands of companies expand globally with unmatched speed, flexibility and compliance. Get our all-in-one Global People Platform that simplifies the way you onboard, offboard, and everything else in between.

© Copyright 2026. All Rights Reserved.