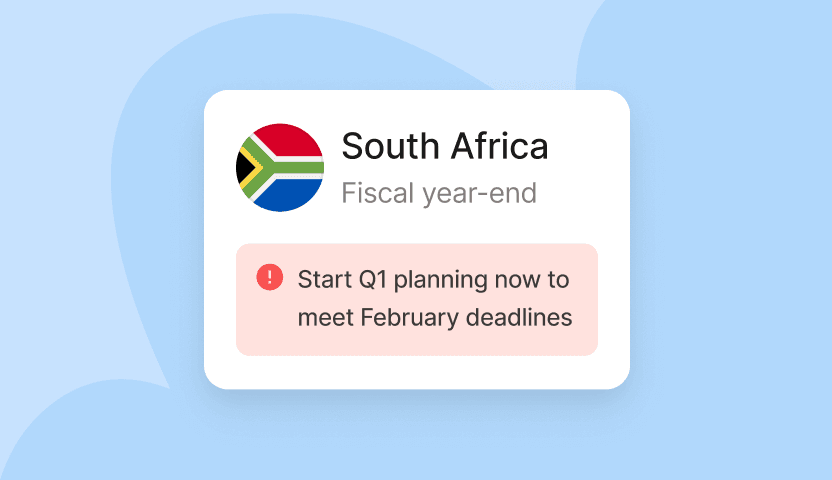

Switch before February. Start the new tax year off right.

IRP5 deadlines and PAYE filings are coming fast. Mistakes can cost you time and money. Don’t face them alone. Deel Local Payroll combines automation, local expertise, and hands-on implementation to help you migrate without disruptions and stay compliant in 40+ African markets.

IRP5 deadlines and PAYE filings are coming fast. Mistakes can cost you time and money. Don’t face them alone. Deel Local Payroll combines automation, local expertise, and hands-on implementation to help you migrate without disruptions and stay compliant in 40+ African markets.

4.8/ 5

|

5639 Reviews

Book a free 30-minute product demo

Experience a personalized product demo and get all your questions answered by our experts.

Why you should switch now

Switch early to get payroll right. Clean and migrate data safely, validate compliance, and avoid year-end delays. SMEs can go live in an hour, larger teams in weeks — all before deadlines hit.

Without Deel

- Juggling different rules, deadlines, and tax offices for African regions.

- Limited visibility into PAYE, UIF, and tax reconciliations creates errors.

- Regional teams waste time managing leave and payslip requests.

With Deel Local Payroll

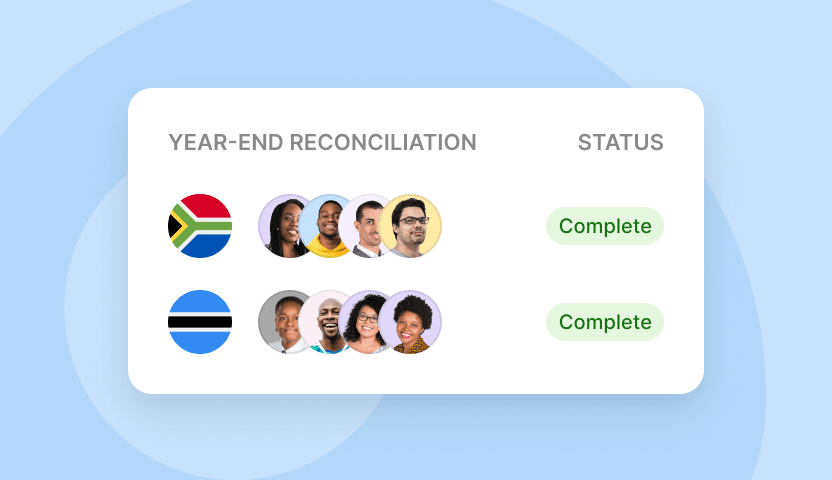

- Tax and legislative updates built-in for 40+ African countries

- Real-time visibility into every filing and pay run, from PAYE to UIF.

- WhatsApp self-service for payslips, tax forms, and leave requests.

Why you should switch now

Switch early to get payroll right. Clean and migrate data safely, validate compliance, and avoid year-end delays. SMEs can go live in an hour, larger teams in weeks — all before deadlines hit.

Without Deel

- Juggling different rules, deadlines, and tax offices for African regions.

- Limited visibility into PAYE, UIF, and tax reconciliations creates errors.

- Regional teams waste time managing leave and payslip requests.

With Deel Local Payroll

- Tax and legislative updates built-in for 40+ African countries

- Real-time visibility into every filing and pay run, from PAYE to UIF.

- WhatsApp self-service for payslips, tax forms, and leave requests.

Trusted by 17,000+ customers

Payroll built for any size business

SMEs: Onboard in one hour

Launch payroll in as little as one hour with free onboarding (under 20 employees), free HR features, and no annual license fees. Add on WhatsApp for Employees self-service.

MMs: Automate your admin load

Stay compliant with automated tax calculations, real-time filings, and legislative updates. Run payroll as often as you need—no rigid cut-offs or manual rework.

ENT: Payroll with SOC1 & SOC2

Integrate seamlessly with Workday and leading accounting platforms. Embed payroll securely into existing systems with full control and visibility using robust APIs and webhooks.

All the payroll support you need in one place

Payroll Connect

Sync accurate payroll results directly into your Deel dashboard. Consolidate data across teams and countries with real-time visibility and automated reporting.

Outsourcing

Let our specialists run your entire payroll function - from processing to compliance - so your team can focus on strategic work instead of admin.

Professional Services

Our experts guide you through implementation, optimisation, and ongoing management, ensuring smooth adoption and long-term success with Deel Local Payroll.

Training

Empower your team with instructor-led and online training. Learn system features, workflows, and best practices to ensure accurate and compliant payroll operations

Save on costs and admin time

150

hrs

saved on hiring compliance

52%

saving in fees

$500K

saved yearly

How switching works

Kickoff, planning, and data preparation

We plan your timeline, gather the necessary requirements, and migrate your employee & payroll data. This takes between 1-2 weeks.

System configuration, testing & validation

Our experts set up your payroll, employee profiles, and self-service like EMP201, UIF submissions, bank payments and more.) This takes between 1-2 weeks.

Go-live and ongoing support

Run your first pay and final approval. After go-live, your dedicated Deel specialists remain engaged to monitor and optimize payroll cycles. This takes about a week with 2-3 months support.

Why companies are switching

Unlimited pay runs

No hidden or annual license fees and scales with your business

Automated compliance

Tax and legislative updates are built in for 40+ African countries

Tailored onboarding

SMEs set up for free and larger firms with expert-led migration

Self-service on WhatsApp

Employees access payslips, tax certificates, and apply for leave

SOC1 & SOC2 security

Secure authentication protects sensitive payroll data

Pre-configured Workday integratioN

Auto-syncs payroll changes and generates audit-ready reports

Payroll software that flexes as you grow

Lite Edition

Seamless, low-complexity payroll for businesses up to 50 employees.

Starting at

R25.40

per employee/month

Unlimited payslip runs

Essential statutory & predefined reports

Tax configuration for single-country legislation

eOnboarding & role-based security

Automated UIF & medical rate submissions (SA)

Premier Edition

Fit for growing businesses needing advanced reporting and multi-entity management.

Starting at

R34.91

per employee/month

Comprehensive reporting & analytics

Multi-country tax configuration

Third-party payment files

Expense & asset management

Equity reporting (SA & Namibia)

Master Edition

Fit for large/multi-national orgs managing complex, multi-country payroll at scale.

Starting at

R41.49

per person /month

Advanced approval workflows

Dynamic, auto-generated org charts

Automated retro-active salary calculations

Multi-currency payment files (expat module)

Consolidated regional reporting

Pricing per edition is based on 1–10 employees. PEPM scales down as headcount increases. All plans include: flexible monthly billing, unlimited users and pay runs, and no upfront annual licence or software fees. Contact us for pricing across the rest of Africa.

Rianette Kemp

Finance Manager, Dr C Avenant Inc, SME

Excellent global HR

4.8/5 based on 5,639+ reviews

Elevating customer support to new heights

24/7

support for you and your team

10 sec

average support call waiting time

97 NPS

customer support

100%

in-house support team

FAQs

How does Deel Local Payroll simplify compliance and legislation updates across Africa?

Deel Local Payroll is purpose-built to support compliance across 44+ African countries, including South Africa. Our platform automates statutory deductions and submissions such as PAYE, UIF, SDL, and equivalents in each country, ensuring seamless handling of local payroll obligations.

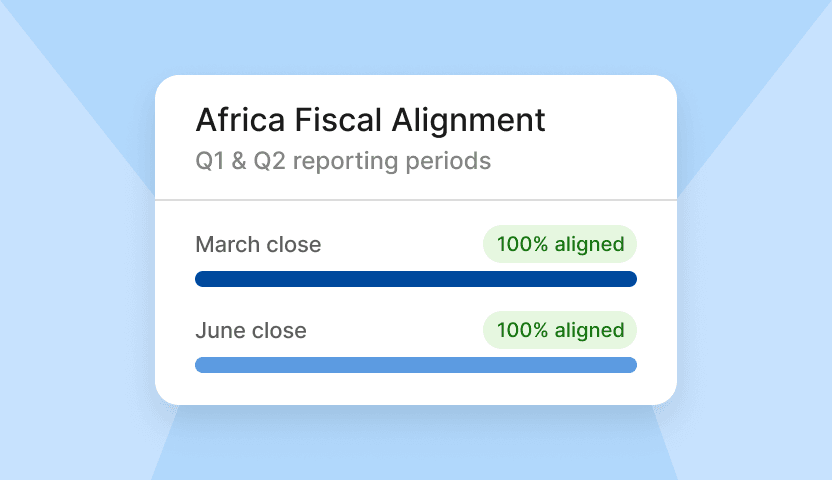

With real-time legislative updates integrated into our system, your payroll calculations stay aligned with the latest tax and labour regulations without the need for manual intervention. Deel Local Payroll proactively alerts your team to compliance actions and deadlines, so nothing slips through the cracks.

Whether you're managing payroll in a single country or scaling operations across the continent, Deel Local Payroll ensures everything remains compliant, consistent, and secure within one cloud-native platform.

How does Deel Local Payroll support onboarding and implementation?

We offer a seamless onboarding experience, guiding businesses through setup with expert support. Our team ensures smooth implementation, from data migration to compliance setup, across Africa, UAE, United Kingdom and Brazil.

How does Deel Local Payroll’s pricing model support growing businesses?

Unlike traditional payroll providers, Deel Local Payroll offers a flexible, pay-per-employee model with no annual license fees. We scale with your business- no need for costly re-implementations or being locked into rigid contracts.

Does Deel Local Payroll integrate with HR and accounting systems?

Yes. Deel seamlessly integrates with major HRIS and accounting platforms like Xero, Quickbooks, Sage Accounting and more, eliminating duplicate work and ensuring accurate payroll processing. With automated data sync, any changes made in your HR or ERP system—such as salary adjustments or employee details—are instantly updated in Deel, so payroll and HR teams have a single source of truth.

How does Deel Local Payroll process payroll faster than other providers?

Unlike traditional providers that rely on fragmented local engines, Deel Local Payroll is built on a native real-time payroll engine, meaning we own and control our payroll infrastructure. This allows us to process payroll much faster, with instant gross-to-net calculations in select countries and full transparency at every step.

Does Deel Local Payroll provide real-time payroll calculations?

Yes, Deel Local Payroll runs on a native real-time payroll engine, meaning gross-to-net calculations, tax deductions, and compliance updates happen instantly—no waiting for batch processing. Payroll managers get immediate visibility into local deductions, taxes, and net pay, reducing errors and last-minute surprises.

© Copyright 2026. All Rights Reserved.