Pay teams and file taxes faster without the legal headaches

Deel Payroll makes US and global payroll easy. Let us handle everything for you, or use our self-service features. Whatever you choose, we keep you compliant with local labor laws.

- Automate your payroll cycles in 130+ countries

- Access powerful analytics and unified reporting

- Manage everything and everyone from one platform

Deel Payroll makes US and global payroll easy. Let us handle everything for you, or use our self-service features. Whatever you choose, we keep you compliant with local labor laws.

- Automate your payroll cycles in 130+ countries

- Access powerful analytics and unified reporting

- Manage everything and everyone from one platform

4.8/ 5

|

5637 Reviews

Get started

Your global payroll and compliance expert

Automated compliance admin

Whether you're a startup or enterprise, our platform automatically reflects the latest tax changes to keep you protected.

In-house compliance expertise

Our 2,000+ in-house payroll, HR, and legal experts are ready to help. Get instant answers to local compliance laws with Deel AI.

Payroll taxes filed for you

We accurately calculate and file payroll taxes with local, state, and federal agencies on your behalf.

Trusted by 35,000+ companies from startups to enterprise businesses

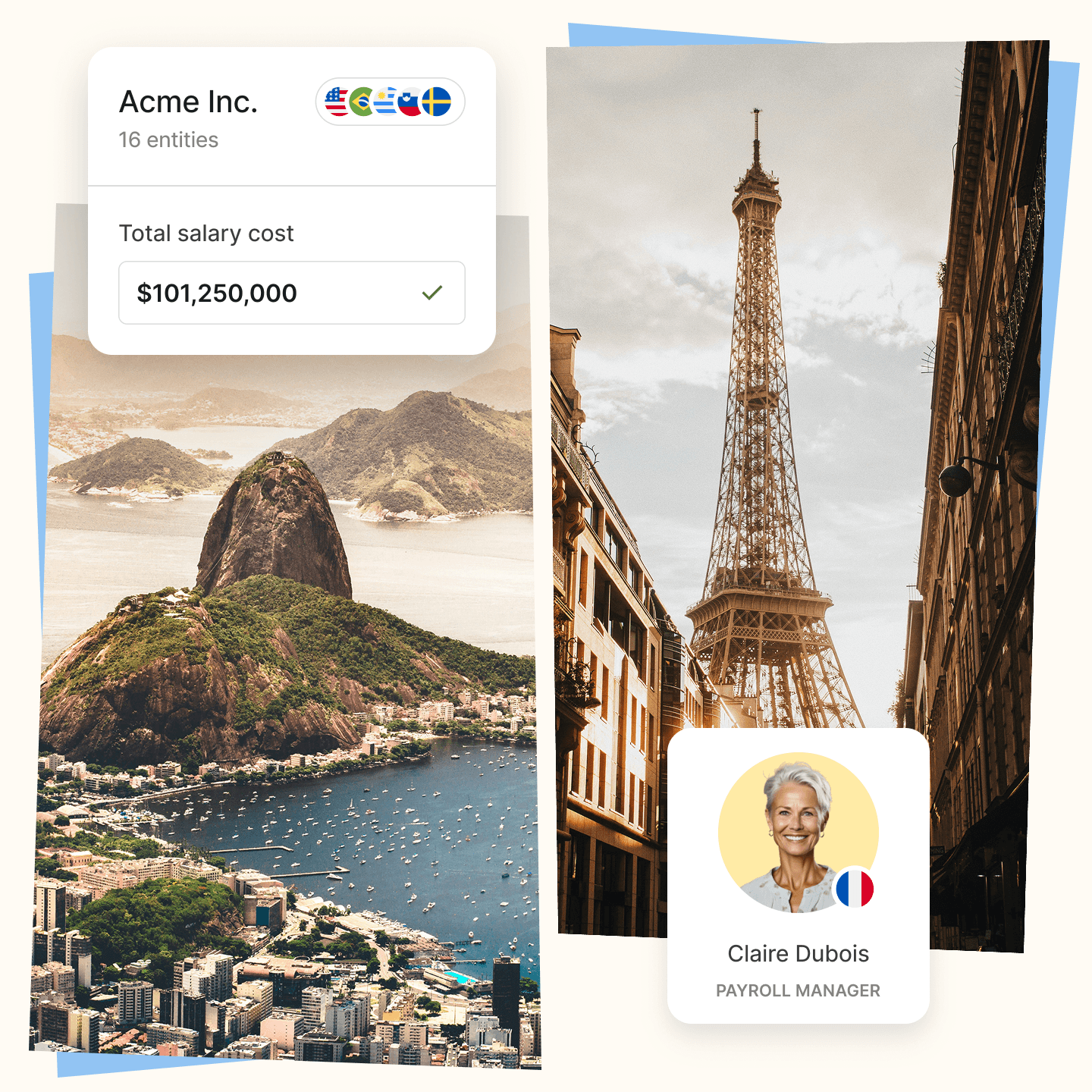

We handle the hard stuff. You focus on global expansion.

Deel Global Payroll is one of the fastest, fully managed providers. Just review, submit, and approve your payroll. We take care of instant gross-to-net calculations, taxes, benefit deductions, and more in 130+ countries.

- 67% ROI according to 2025 Forrester TEI study

- 60% reduction in payroll processing time

- Dedicated Deel Payroll Managers for every country

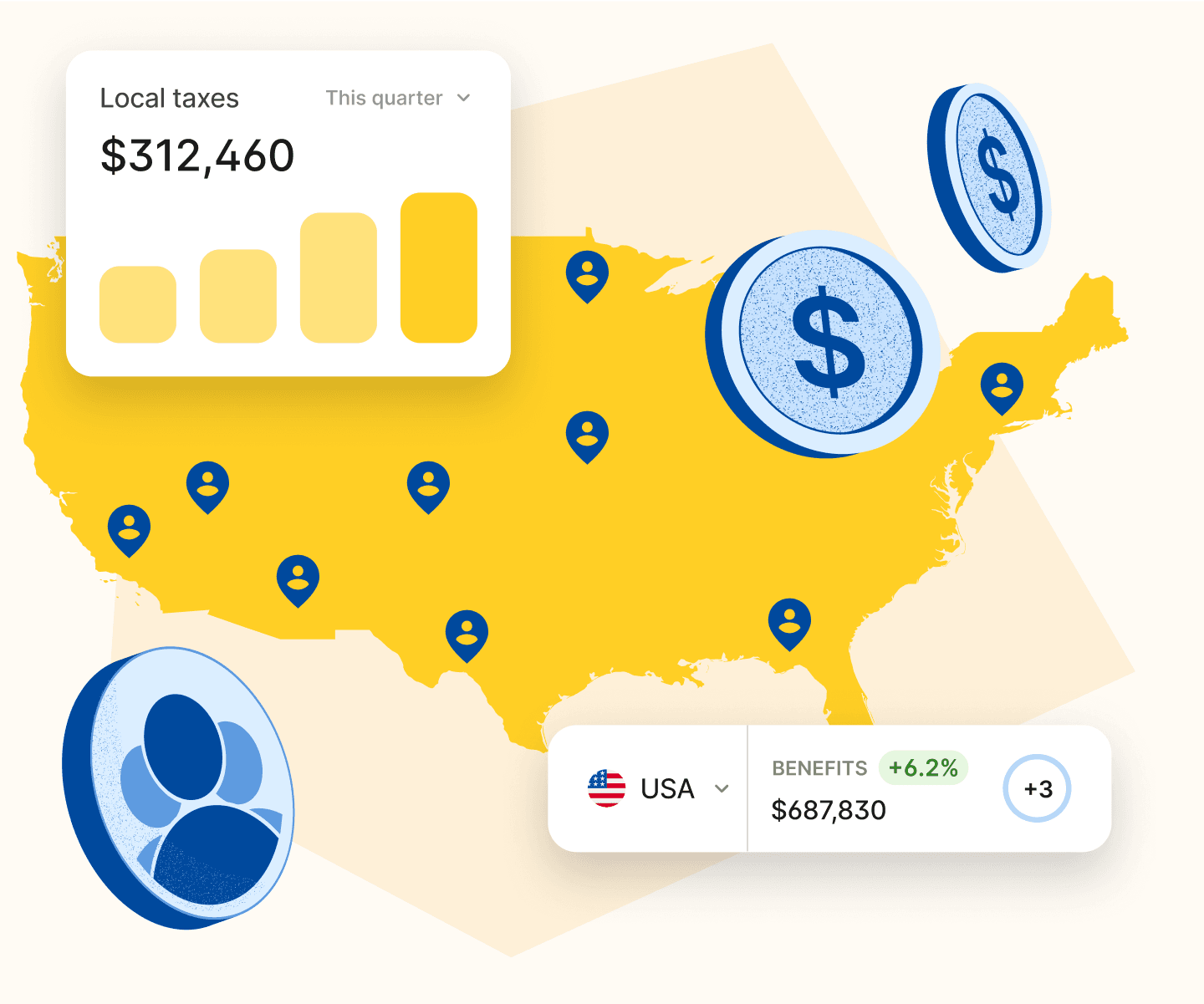

Make sure your US payroll and taxes are on time, every time

With Deel US Payroll, you can handle the admin, let us take care of it, or both. Our payroll management software automates payroll runs and integrates with your existing HRIS or ERP system to simplify workflows.

- In-house processing and automated calculations

- Flexible cut-off dates, state registration services

- Access to local payroll specialists and support

How we stand out from other providers

Quick & easy implementation

Dedicated teams make sure you're set up and ready through customized training, payroll parallel testing, and data transfer.

Advanced payroll speeds & accuracy

With our real-time payroll and instant gross-to-net calculations, payroll has never felt faster or easier.

Automated payroll processing

Calculate payroll instantly with built-in state & country-level tax compliance logic, automatic filing, and deposits.

Proactive compliance monitoring

Get the guidance and answers you need for state registration, payroll, taxes, and labor laws with our local experts.

In-house expertise

Get answers faster with dedicated payroll support and 24/7 in-app chat. First response times are less than two minutes.

Powerful integrations

Connect to 110+ of your favorite tools to reduce manual tasks and streamline workflows, or build custom integrations with our API.

Yunjung (Rina) Bae

Director of People at Marqvision

Resolve any issues faster to keep your business moving

Our dedicated customer success managers and in-house support teams will answer any questions you and your team may have.

- 24/7 email, phone, live chat, Slack & Teams support

- Connect with live chat in 2 minutes or less

- 90%+ customer satisfaction

FAQs

What are the steps to processing payroll with Deel?

1. Get notified- Based on your pre-selected payroll schedule, we’ll email you when your payroll is ready to review and submit.

2. Review and approve payroll- Before approving, review payroll at a general overview level or per employee. Make any adjustments, like adding bonuses or benefits. Changes are instantly calculated and applied to your payroll.

3. Submit and fund payroll - Once approved, you’ll receive a comprehensive payroll package, including a G2N report. Meanwhile, we handle the entire tax filing process with government agencies and automatically distribute payslips to your employees through the employee portal.

What type of integrations does your payroll solution offer?

We support 110+ integrations. We provide an open API that allows businesses to seamlessly integrate Deel Global Payroll with their existing tech stack. This automates essential functions like new hire onboarding via ATS or connecting to accounting systems.

Deel Global Payroll integrates with leading HRIS/HCM platforms, like Workday, SAP SuccessFactors, UKG, HiBob, BambooHR, and more. We are a GPC-certified partner of Workday for seamless, comprehensive integration.

How does Deel maintain payroll compliance if I have employees in the US?

We’ve got you covered in all 50 states. We automatically calculate and file payroll taxes with the IRS and with local, state, and federal agencies on your behalf. We also handle necessary W-2, W-4, new hire, and termination filings.

We provide human resources tools like digital I-9 verification to facilitate compliant new hire onboarding, with 24/7 support to help you every step of the way. Plus, our proactive monitoring tool, the Compliance Hub, keeps you informed about important compliance updates that impact every business size.

Do you leverage in-country partners (ICPs) for Deel Global Payroll?

We currently support 53 countries with a single native payroll calculation Deel engine, delivering real-time payroll and instant gross-to-net calculations. We only use ICPs in specific countries where we haven't localized the engine yet. With our native engine and ICPs, we deliver in-house payroll service and support to our clients across all 130 countries.

What's the cost of Deel Global Payroll and Deel US Payroll?

Deel Global Payroll starts at $29 per employee/month and is based on a tiered employee model. It includes a one-time set-up implemenation fee. The total cost will also vary according to the number of payroll cycles in your country. Other factors that may influence the price include onboarding and offboarding needs.

Book a demo to receive a custom quote for Deel US Payroll.

Does Deel handle W-2 Forms for my employees?

Yes, we automatically generate and file these documents with the respective tax authorities, like the IRS and Social Security Administration. We then distribute W-2s to employees at year-end.

© Copyright 2026. All Rights Reserved.