Managing US payroll shouldn’t be this hard

Your team is probably juggling up to 16 disconnected tools—maybe more—wasting time, money, and energy just to keep up with the shifting workforce landscape.

Payroll, taxes, and compliance feel like roadblocks instead of fuel pushing your company’s growth.

We can change that.

Your team is probably juggling up to 16 disconnected tools—maybe more—wasting time, money, and energy just to keep up with the shifting workforce landscape.

Payroll, taxes, and compliance feel like roadblocks instead of fuel pushing your company’s growth.

We can change that.

One platform. Zero headaches.

Deel US Payroll eliminates the chaos with a single, seamless solution so you can focus on growing and supporting your team.

Without Deel

- Complex state & local laws drain time on hiring, taxes, and compliance.

- Manual payroll processes cause errors, risks, and heavy admin burden.

- Employees lack reliable support for benefits, PTO, expenses, and payslips.

With Deel

- Automated local, state, federal tax calculations, filings and payments.

- Automated pay cycles with real-time calculations and flexible cut-offs.

- Employees can manage payslips, PTO data, tax info, and more with self-serve tools.

4.7/ 5

|

6234 Reviews

Book a free 30-minute product demo

Experience a personalized product demo and get all your questions answered by our experts.

One platform. Zero headaches.

Deel US Payroll eliminates the chaos with a single, seamless solution so you can focus on growing and supporting your team.

Without Deel

- Complex state & local laws drain time on hiring, taxes, and compliance.

- Manual payroll processes cause errors, risks, and heavy admin burden.

- Employees lack reliable support for benefits, PTO, expenses, and payslips.

With Deel

- Automated local, state, federal tax calculations, filings and payments.

- Automated pay cycles with real-time calculations and flexible cut-offs.

- Employees can manage payslips, PTO data, tax info, and more with self-serve tools.

Trusted by 35,000+ companies from startups to enterprise

Make US payroll feel effortless

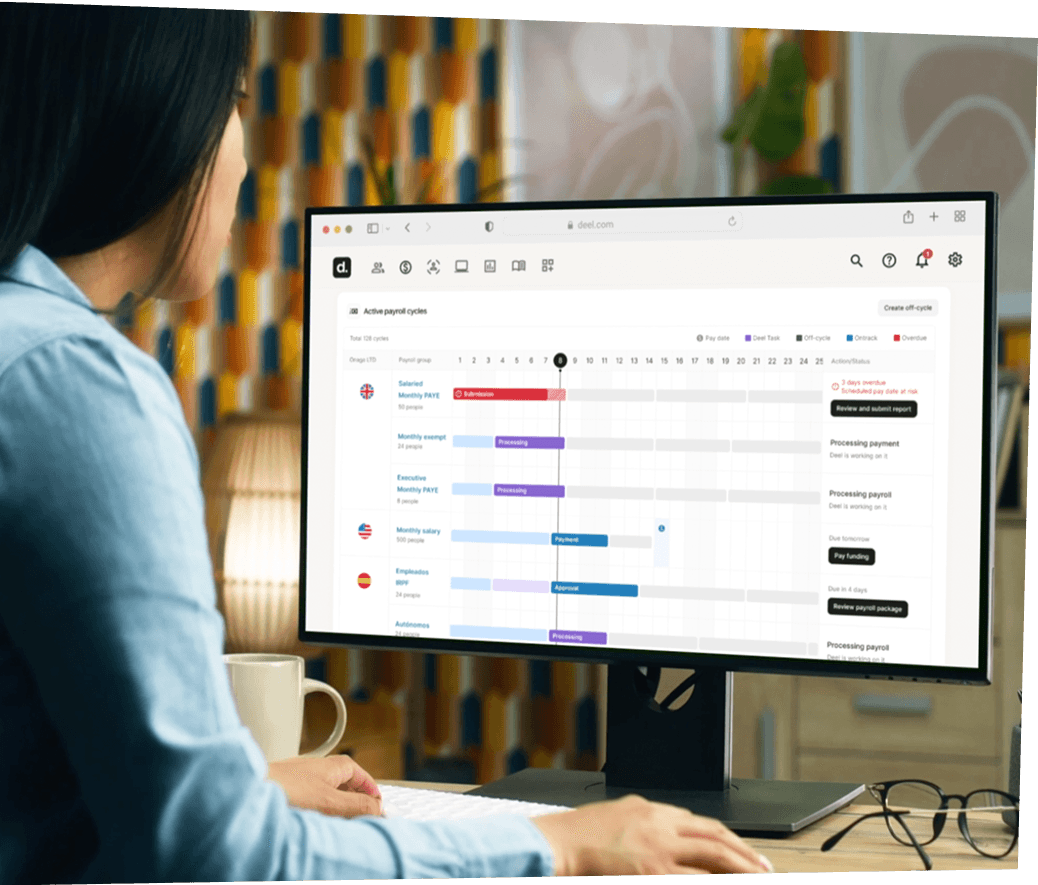

Save time with automated payroll

Run payroll in minutes instead of hours. Real-time calculations, flexible cut-offs, and off-cycle runs keep things moving with less admin.

Keep up with laws as you scale

Multi-state tax rules and filings are done automatically with real-time updates built in so you avoid costly errors and missed deadlines.

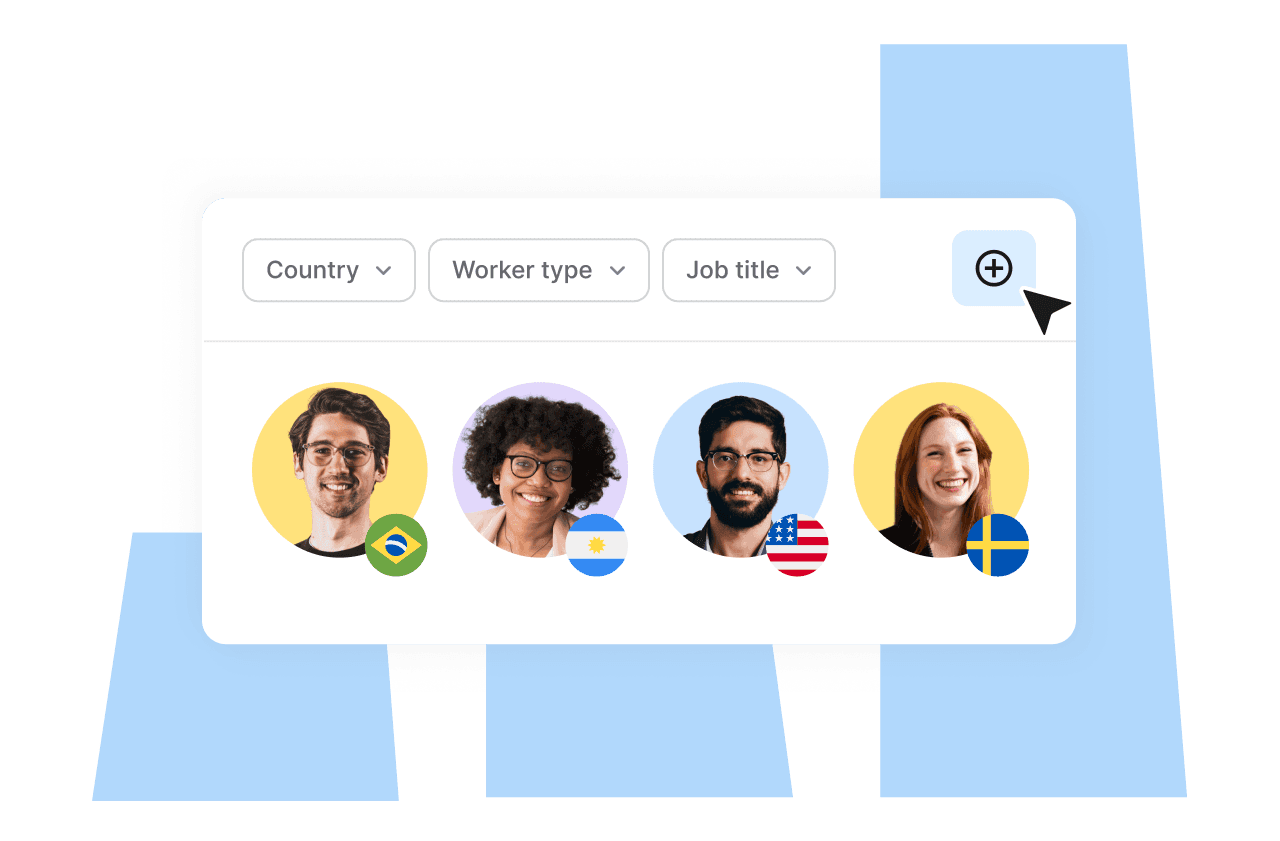

Manage all teams in one place

Unite payroll with HR, benefits, and compliance. Whether in New York or abroad, you get one view of your entire workforce.

Every solution you need handled in one platform

Hire

Expand into new markets without the hassle of local entities. Deel’s EOR and contractor solutions let you onboard top talent from 150+ countries, all while staying compliant.

Pay

Consolidate payroll for employees and contractors in one platform. Ensure accurate, on-time payments with built-in tax, benefits, and compliance coverage in 100++ countries.

Manage

With every tool for onboarding, time off, expenses, and more in one place and localized based on worker type and location, you’ll cut costs and get more data visibility.

Engage

Foster a connected culture and drive productivity with our talent management system. Empower teams with 1:1 meetings, career roadmaps, training courses, surveys, and more.

Save on costs and admin time

150

hrs

saved on hiring compliance

52%

saving in fees

$500K

saved yearly

Move faster with all of the solutions you need in one place

Deel Engage

Retain top talent with career paths, feedback, and learning courses

deel it

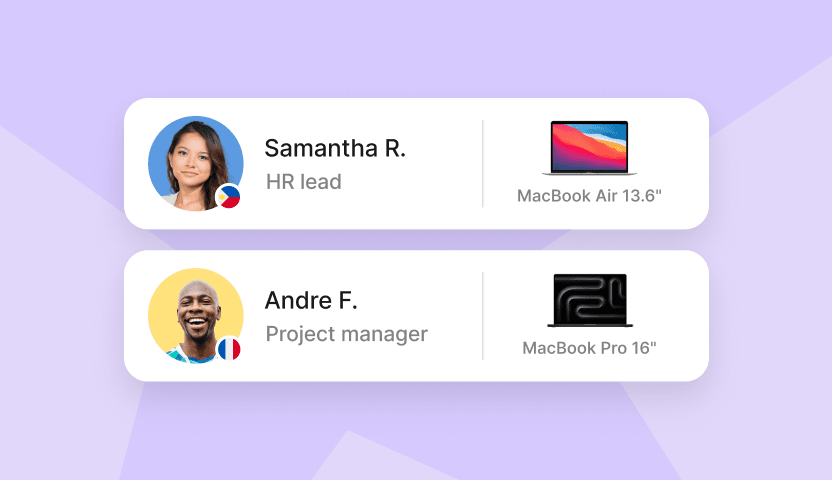

Buy, lease, secure, and manage equipment & apps

Pay, manage, and equip your global team with these solutions

Deel HR

Simplify workforce planning, compensation, performance, and more.

Starting at

$15

per employee/month

Shareable headcount, scenarios

Compensation reviews, planning

Career, survey, learning tools

Connect with staffing partners

Built-in HRIS features

Deel Global Payroll

Payroll for employees hired through your own entities.

Starting at

$29

per employee/month

Unified payroll processing

Exchange rate management

Employee self-service access

Integrated reporting & analytics

Local tax regulation compliance

Deel IT

Your foundation for running IT on a global scale.

Starting at

$10

per person /month

Real-time asset tracking

Global equipment marketplace

IT policy automations

HRIS-synced workflows

Reporting and auditing tools

Deel Services

Design competitive equity plans, expand your business globally, and protect data.

Get a

Quote

Data protection

Privacy consulting

Local tax and labor compliance

Tailored, compliant equity plans

GDPR representation

Excellent global HR

4.7/5 based on 6,234+ reviews

Fast 24/7 support that keeps your business moving

91%

of customer issues resolved at first contact with live chat

1 hr

to resolve most customer issues

6 min

to resolve most EOR and contractors’ issues

93%

Enterprise customers’ satisfaction

Book a demo

Book a demo with our global workforce consultants. We’ll set you up with a free account ready to suit your team’s needs.

Add your people

From new hires to your existing workforce, onboard effortlessly with our self-serve platform.

Dedicated onboarding

From navigating local laws to support for your team members, our dedicated team will help you get set up seamlessly.

FAQs

Is there a payroll tax in the USA?

Yes, there is a payroll tax in the USA. Payroll tax includes the taxes employees and employers pay on wages, tips, and salaries. It encompasses federal, state, and local income taxes, as well as the employee's share of Social Security and Medicare taxes (FICA). Both employers and employees have to pay an equivalent share of Social Security and Medicare taxes, with the Social Security tax rate at 12.4% and the Medicare tax rate at 2.9%, paid evenly by both employers and employees

How does Deel maintain payroll compliance for my business in the USA?

Whether operating in California, New York, or any of the states in between, we’ve got you covered. For all 50 states, Deel will accurately & automatically calculate and file payroll taxes with the IRS and with local, state and federal agencies on your behalf, along with necessary W-2, W-4, new hire and termination filings. We also offer human resources tools like digital i-9 verification to facilitate compliant new hire onboarding, and have 24/7 support to help you at every step of the way. Plus, clients can use our proactive monitoring tool, the Compliance Hub, to stay informed about compliance updates that are impactful, whether to small business or enterprise size clients.

How are benefits managed with US Payroll?

With our built-in Benefits Admin, Deel will consolidate all benefits into a single HR system so that all key information and deductions are synched and automated into your payroll. Your employees can easily manage their enrollment directly from the Deel platform. You can either use your own preferred broker, or Deel can refer you to a benefits provider partner to set up and manage your benefits program.

How many times can I run payroll in a month with Deel?

You can run payroll monthly, semi-monthly, or bi-weekly, and can also run off-cycle payroll as needed. Unlike other payroll services, we do not charge for off-cycle payments with US payroll.

Does Deel handle W-2 Forms for my employees?

Yes. Deel will automatically generate and take care of filing these documents with the respective tax authorities, usually the IRS and Social Security Administration. We will then distribute W-2s to employees at year-end.

Get a demo— live or on demand

Deel helps tens of thousands of companies expand globally with unmatched speed, flexibility and compliance. Get our all-in-one Global People Platform that simplifies the way you onboard, offboard, and everything else in between.

© Copyright 2026. All Rights Reserved.