Deel EOR

Hire employees globally with the #1 EOR service

Deel provides safe and secure EOR services in 150+ countries. No need to open an entity—we’ll quickly hire and onboard employees on your behalf, with payroll, tax, and compliance solutions built into the same, all-in-one HR platform.

The Global EOR leader

4.7/5 based on 6,234+ reviews

Hire employees anywhere, without the complexity

Industry leading global coverage

In-house infrastructure

Built-in compliance protection

Next-level automation

Unmatched data security

Stay compliant wherever you hire

Deel handles everything, so you’re compliant when it comes to contracts, minimum wage, terminations, and other local laws. And our always-on HR compliance mitigates more risk than any other provider, even as your business evolves.

Compliant through the employee lifecycle

We localize every aspect of our product, from country-specific documents to notice periods, leave and overtime policies, salary benchmarks, benefits, and termination practices in 150 countries.

Actionable regulatory insights

Unlike other platforms, we’ll help monitor and flag the latest and upcoming regulatory changes, including wage, pension, leave changes, and other updates.

In-house expert guidance

200+ legal experts specialized in employment regulations, local statutory benefits, and tax laws by country across the globe that are dedicated to upholding compliance and there to support your legal teams.

Manage your team with a self-serve HR platform

See it in action

Experience the seamless process of hiring globally

#1 Best EOR - Spring report 2025

Ranked the #1 Best Employer of Record (EOR) Software by G2.com reviewers

Dedicated customer experience

Give your people the experience they deserve

When employees are hired through fragmented EOR setups, they often face delays, confusion, and limited support. With Deel, everything is managed through our own entities, backed by a dedicated experience team, so your people enjoy a seamless, consistent journey from day one.

With Anytime Pay, Deel is the only EOR where employees can access a portion of their earned salary at any time, at no cost to them or to you. They gain the freedom to handle life’s expenses and plan smarter financially, without disrupting payroll cycles. That means less stress for employees, no extra burden for payroll teams, and a more supportive experience that helps people stay and thrive.

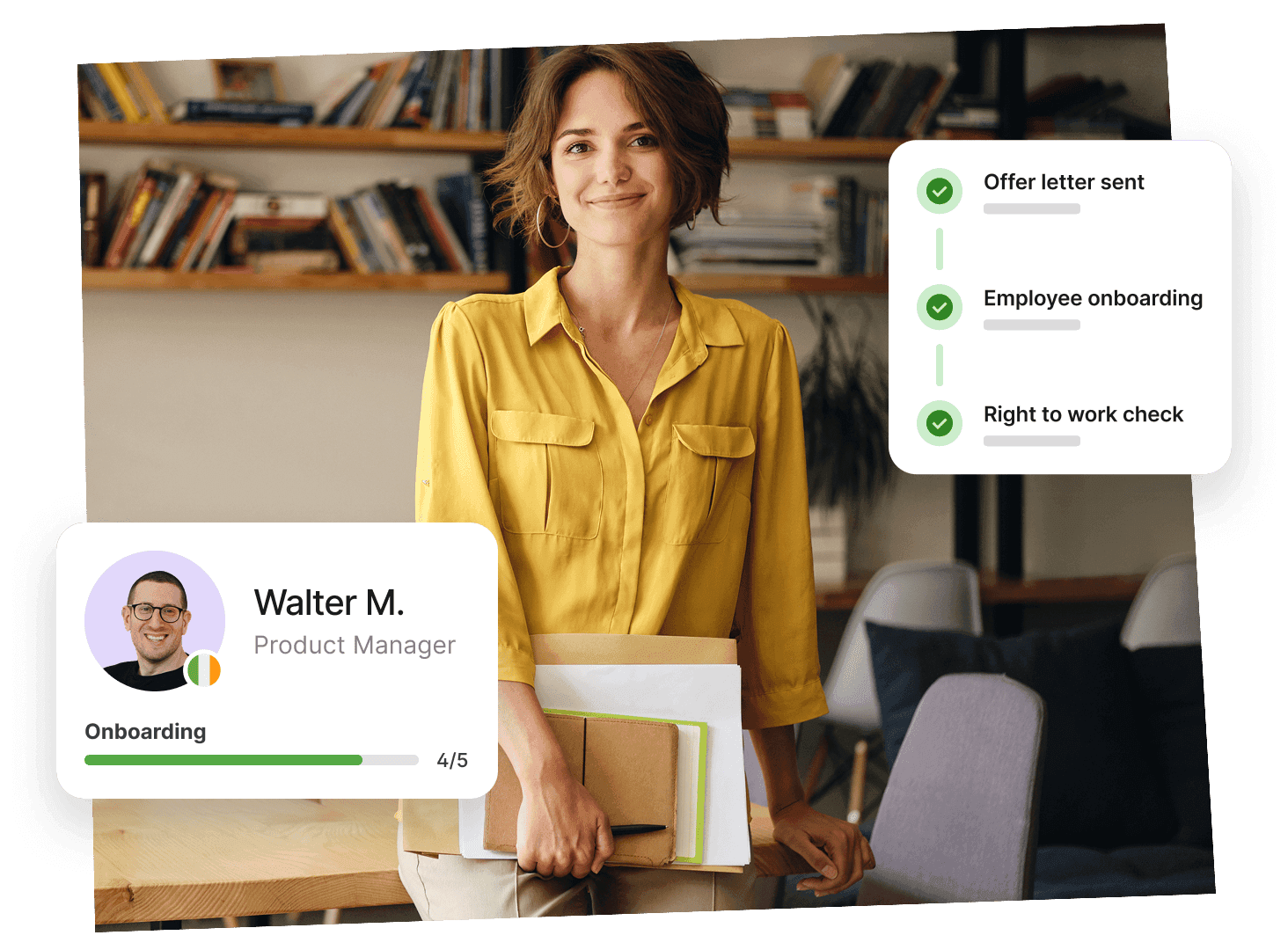

Dedicated employee onboarding

24/7 in-app support

Payslips, Anytime Pay, time off, and more

Best-in-class benefits plans

Multi-currency payouts

GLOBAL COVERAGE

Easily hire employees in 150+ countries

From establishing our entities to running payroll, we handle everything in-house to provide transparent pricing, consistent quality service, and manage more on-platform.

In-depth walkthrough

Watch the live demo of our Employer of Record (EOR) solution

Discover how an Employer of Record (EOR) can help your business scale seamlessly. In this live walkthrough, we’ll cover:

- What an Employer of Record (EOR) is

- When an EOR is the right solution for your business

- A live walkthrough of Deel's EOR product

- A real-world customer success story using Deel’s EOR

Why businesses choose us to hire employees globally

Learn more about EOR

We’ve poured our expertise into a series of thoughtfully crafted, easy-to-follow guides and templates for businesses of all sizes.

FAQs

What’s an employer of record (EOR)?

An employer of record (EOR) is a third-party organization that employs and pays one or more individuals on behalf of your business. EOR services enable your company to seamlessly hire and work with employees, either domestically or internationally, without the need to establish your own entity or navigate complex compliance requirements in the employee’s country.

Imagine you’re a UK-based company looking to employ a skilled professional residing in Brazil. By partnering with an employer of record with a Brazillian entity, the company can lawfully employ the Brazillian worker. The new hire works in Brazil while effectively contributing to the UK company’s operations.

The employer of record is responsible for ensuring adherence to local labor laws and regulations, running payroll, and managing various HR tasks and administrative duties, thus simplifying international employment processes.

How does the EOR relationship work?

When you use an employer of record, it officially assumes the role of the legal employer for any individuals you hire: These employees enter into contracts with the Employer of Record rather than with your own company.

While you maintain control over setting the employees’ salaries, defining their daily tasks, and assessing their job performance, the employer of record takes on all legal responsibilities for your workforce and manages all aspects related to employment, such as creating employment agreements, handling salary and benefits administration, and managing payroll tax obligations to ensure compliance with local employment laws when hiring internationally.

What are employer of record services?

Employer of Record services vary depending on the provider. The most comprehensive Employer of Record providers, such as Deel EOR, provides the following services:

- Legal employment of your domestic and international employees

- Creation of locally compliant employment contracts

- Background checks

- Global payroll processing and tax filing

- Employee benefits and perks administration

- Equity management

- Work visa and immigration support

- Intellectual property protection

- Equipment management

- Employee onboarding and offboarding

- Engagement tools to support remote work and distributed teams Contract termination

Can you use an EOR provider to hire independent contractors?

Companies don’t need an EOR partner to engage freelancers and contractors since they fall under the category of independent workers, which means they don’t have employee status. Therefore, a local entity is not required to process these workers’ payroll, taxes, and social security contributions.

However, employer of records like Deel understand that contractors are essential to the contingent workforce, and engaging intentional contractors can subject the company to legal and compliance risks, such as misclassification if you fail to follow local contractor laws.

Deel provides agent of record (AOR) services for hiring and paying contractors so that you can confidently and compliantly engage contractors and manage them under the same global platform alongside your Employer of Record employees and direct employees.

How can an EOR aid global expansion?

An employer of record allows companies to hire part-time and full-time employees abroad without setting up their own legal entity in the new country, which usually takes months and requires significant financial investment. Hiring global talent through an employer of record is cost-effective and removes the regulatory obstacles to international employment.

See a full-service EOR like a global expansion starter kit. Instead of handling each new country on an ad-hoc basis, with Deel EOR, you gain access to a fully assembled team of HR professionals, payroll, and compliance experts with local expertise.

✨ Discover how Revolut outpaces its competitors in entering new markets with Deel.

What is an EOR vs a global employer of record (GEO)?

Employer of records sometimes refer to themselves as global employers of record. This distinction in terminology often arises because while all EORs can employ individuals in the client company’s home country, not all possess extensive international coverage.

By designating themselves as global EORs, certain service providers emphasize their ability to facilitate employment across multiple different countries, highlighting their broader scope in assisting businesses with global hiring needs.

Deel has the most extensive country coverage, with EOR services in 150+ countries.

How does an EOR differ from a PEO?

An employer of record caters to businesses aiming to build and manage a global workforce without bearing compliance liabilities. Meanwhile, a professional employer organization (PEO) is tailored for companies seeking domestic HR services and workforce management support willing to accept a shared responsibility for any instances of non-compliance.

Unlike employers of record, who are the sole legal employers of your workers, PEOs provide co-employment services. A co-employment relationship means you and the PEO share legal liabilities and management responsibilities related to your employees. Another crucial difference is that PEOs operate locally, so you can’t hire international employees through a PEO.

How does an EOR differ from a staffing agency?

Companies can tap into a staffing agency’s existing talent pool to bolster their workforce, secure project support, or cover temporary positions.

Conversely, the employer of record services facilitates the compliant engagement of top talent directly recruited by the client company. To leverage EOR services, your company must first identify the talent it wishes to hire and then engage them through the Employer of Record’s legal framework.

See also: How Staffing Agencies Can Guarantee a Good Employee Experience With an EOR

How will my employee be onboarded?

With Deel, we can get your new employee onboarded in as little as one day. Your new employee will be invited via email to create an account with Deel, where they will will provide their personal and bank details, any required documentation and sign their new employment contract. You'll have a dedicated onboarding manager on hand to help with any questions along the way.

How does Deel EOR handle benefits?

Each country has its own set of laws that set out the benefits that must be provided for employees. These range from health and unemployment to insurance and social security. Deel exists to ensure every employee receives all necessary localized benefits, along with any optional benefits the employer would like to provide.

Can I give my new hires equity through Deel EOR?

Some people wonder if using an EOR means they can still grant employees equity. The short answer is "yes" but it really depends on the country. For example, in the U.S., companies can issue non-qualified stock options, also known as NSOs. Since the company doesn't have a direct employment relationship (on paper) with the employee, NSO is the only viable option.

How does Deel EOR handle termination and severance?

Handling severance and termination according to a country’s local labor laws is crucial. These laws often vary depending on an employee’s location. Typically though, you always need to pay attention to the proper termination notice, severance payouts, and managing any accrued benefits like unused vacation days. Deel manages the entire process to ensure everything goes smoothly.

How does Deel EOR deal with IP?

We have the strongest intellectual property protection clauses built into our contracts. This means that any and all IP passes through to you.

Deel makes growing remote and international teams effortless

150+

countries

37,000+

customers

200+

in-house experts