Remote Work Glossary

- Results for "undefined"

Table of Contents

What is Form W-4 used for?

What has the IRS changed in the new Form W-4?

How often do you fill in the form W-4? Does it expire?

What to claim in form W-4?

How do I claim exempt from income tax withholding? Who can claim exempt?

How to fill out Form W-4?

What is the difference between W-4 and W-2?

What if I don’t want my employer to know that I have a second job on my W-4?

How long does it take for my new W-4 to go into effect?

What if an employee doesn’t submit a W-4?

Where do I download Form W-4?

Are employees required to fill in a new Form W-4 in 2023?

Is the W-4 form for state or federal taxes?

Where do I submit the W-4 form?

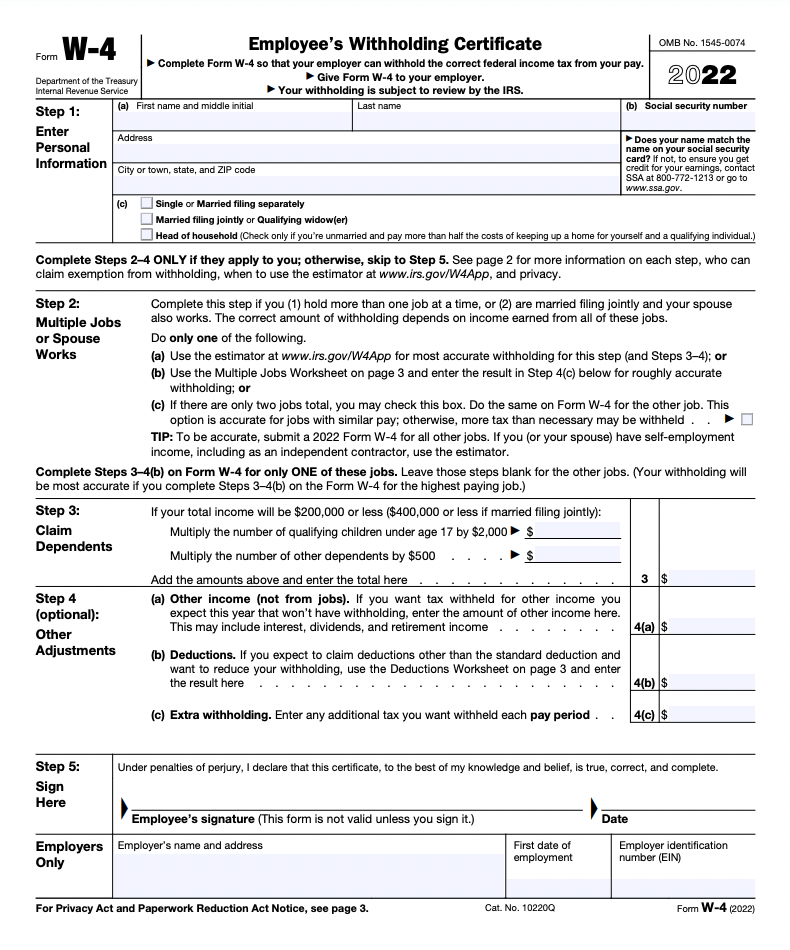

What is Form W-4

Form W-4, Employee’s Withholding Certificate is a US tax document that employees fill out to let their employer know the correct amount of money to withhold from their salary for federal taxes.

Depending on how much you earn and the personal details you provide, your employer will determine how much federal income tax they should withhold from your paycheck for taxes every pay cycle.

Accurately completing Form W-4 is particularly important because it directly affects how much your paycheck amount will be every time you get paid.

What is Form W-4 used for?

When you change your job or start a new one, your new employer needs to learn how much money they are supposed to withhold from your paycheck for taxes. In order to do that, they need you to fill in the Form W-4 and provide information about how much you estimate you'll make and any details that would let you pay less tax.

Filling out the form accurately gets you towards having the exact amount of income tax deducted throughout the year. You'll be able to avoid one of the two scenarios:

- Overpaying your taxes and consequently having less money to use during the year

- Underpaying your taxes and having to pay a large amount of money when you file your tax return

The first case is not a major issue because you can generally get a tax refund if your withholdings are too high and you end up overpaying. However, withholding too much means that you essentially lent your money to the government as an interest free loan.

The second case is usually a more worrying scenario because you'll have a tax bill to pay off, which can come with interest and penalties.

What has the IRS changed in the new Form W-4?

The tax withholding form you fill in might not look the way you remember it looked if it's been a while since you've had to complete one.

In 2020, Form W-4 stopped calculating allowances. Those who completed this form before may remember that the allowances worksheet used to be on page three of the document. Now, it’s no longer a part of the form, so the name has been revised to reflect that.

If you’re wondering why allowances have been removed, it's because the Tax Cuts and Jobs Act (TCJA) doesn’t allow personal exemptions anymore. Before, taxpayers could reduce their taxable income by deducting a specific amount of dollars from their total income. Allowances were a part of exemptions so they’re gone as well and you can’t claim dependency or personal exemptions anymore, so the number of allowances is irrelevant.

Luckily, you can still use the standard deduction to decrease your tax payments.

The IRS says the goal of removing allowances from Form W-4 was to make the filing of these tax forms more simple and accurate.

How often do you fill in the form W-4? Does it expire?

The IRS recommends you fill out a new Form W-4 each year, but it's not a requirement. The W-4 does not expire, so some people don’t fill in this form for years since there are no big changes in their career.

So if you haven’t gone through any significant changes that would require reporting in this tax form, you’re all set with your most recent Form W-4. However, there are several cases in which the IRS expects you to fill in this form again because the amount of tax you’re supposed to pay may have changed. That includes some events related to your personal life as well.

For example, you should revisit your tax situation if you:

- Start an additional job (or your spouse does)

- Start a new job

- Change your marital status (get married or get divorced)

- Have a baby

In these situations, you may qualify for new withholding exemptions so the amount your employer needs to withhold would decrease, leaving you with a larger paycheck! Therefore, you should fill in a new Form W-4 and submit it to your employer.

What to claim in form W-4?

To calculate your federal income tax correctly, you need to know what you’re supposed to claim in Form W-4.

What you’ll claim in this form may depend on several factors, so make sure you’ve gathered the following necessary documentation to start doing your taxes.

You’ll need:

- Your recent pay statements (and for your spouse, if married)

- Documents related to other income sources you might have

- Your recent income tax return

These documents allow you to use an online tax withholding estimator so you can estimate how much tax should be withheld from your paycheck.

How do I claim exempt from income tax withholding? Who can claim exempt?

Some people are eligible to claim a complete exemption from federal income tax. That means no federal taxes would be removed from your paychecks, though you still need to pay Social Security and Medicare taxes (FICA tax).

For the 2022 tax year, you can claim an exemption if you did not have a tax liability in 2021, and you don't expect to have one in 2022.

Having no tax liability generally means that your income was low enough that you had no income tax to pay. You can confirm this by checking that line 24 on your 2021 Form 1040 or 1040-SR tax return is either zero or less than the sum of lines 27, 28, 29, and 30.

What does "low enough" income mean? This refers to the standard deduction amount, which is the income threshold where the federal tax doesn't apply. The amount varies by your filing type. For 2021, if your annual income will be lower than the following, you will likely have no federal income tax to pay:

- Single or Married Filing Separately: $12,550 USD

- Married Filing Jointly or Qualifying Widow(er): $25,100 USD

- Head of Household: $18,800 USD

An example of someone who would be likely to claim an exemption on their W-4 is a high school or college student who works a part-time job in the summer.

To claim the exemption, write the word “Exempt” on the form in the space below Step 4(c). Then, complete Steps 1(a), 1(b), and 5. Don't complete any other steps. Give the form to your employer.

When is the deadline to claim exempt?

You need to submit a new W-4 form each year if you want to claim exemption from withholding tax. The deadline is February 15 of each year, unless it falls on a weekend. For 2022 taxes, the deadline is Tuesday February 15, 2022.

The deadline to claim an exemption for the 2021 tax year has already passed, so you'll continue to have income tax withheld from your paycheck. You'll likely receive a tax refund for the deducted 2021 taxes when you file your tax return in 2022.

How to fill out Form W-4?

For some people, filling in W-4 can be very simple. For example, single people with only one job and no specific tax deductions will be able to complete the form in five minutes. Others may have a more complex task - if they’re filing the taxes jointly, for instance, or if they need to fill in a multiple jobs worksheet.

Whatever your case is, here are the step-by-step instructions to ensure that the W-4 form is filled in accurately.

Step 1

First, you’re required to enter your personal information - your name and address, your social security number, and your tax-filing status. You’ll also need to select your marital status here. Point out how you file your tax return: as a single person (or married, but filing separately) or jointly with your spouse.

Step 2

If you have more than one job, you’ll need to account for them in this section. The same goes if your wife or husband also works and you’re filing your taxes jointly. This is because your combined income may result in higher income taxes, so the amount that is withheld from your pay may need to increase.

If these conditions don’t apply to your situation, you can skip it.

Here, the IRS has given you three options to choose from. They have different trade-offs in accuracy, privacy, and ease of use. You can choose any option you like.

Option A: Online Calculator

This option gives you the most accurate withholding calculation. Use the IRS Tax Withholding Estimator to get a guided walkthrough of your estimated withholding amount, to be entered in Step 4(c).

Option B: Multiple Jobs Worksheet

This is a paper version of Option A. Go through the worksheet on Page 3 and enter your result in Step 4(c) on the W-4 form for the highest-paying job.

Option C: Similar Second Salary

If you have a second job with a similar salary, or you and your spouse both have similar salaries, you can check the box for option (c). If you just want to increase your withholding, you're allowed to just check this box as a quick way to cut your standard deduction and tax bracket in half and significantly reduce your paycheck amount.

Step 3

If you’re a parent, you can complete this step if you’re eligible for the child tax credit. If you’re filing jointly with your spouse and your salaries put together don’t exceed $400,000, you’re eligible. The same goes if you’re a single taxpayer and your income is less than $200,000 per year. Enter the number of dependents to claim your tax credit and reduce your withholding amount.

You may have other eligible dependents if you support other relatives with your income. If you’re not sure whether these relatives qualify for your tax withholding calculation, you can refer to IRS Publication 972, Child Tax Credit and Credit for Other Dependents.

Step 4

This step will help you increase the accuracy of your total tax withholding. You can claim your itemized deductions here in Step 4(b). If you just want to claim the standard deduction, there's no need to fill in this section.

Who may need to add information to this section?

- People receive pension benefits from their old jobs, but still work

- People who receive Social Security benefits

- People who use Form-1099 to report other types of income (such as self-employment)

Use Step 4(c) to instruct your employer to deduct additional tax. The higher the amount, the more your employer would deduct from each paycheck.

Step 5

The last step is to review the form once more, then sign and date it to certify that the information you’ve provided is true and complete. You should fill in a separate Form W-4 for every job you may have.

Your employer may not send your Form W-4 to the IRS, but file it into their own archive. The main purpose of the document is for the employer to calculate your tax withholding.

What is the difference between W-4 and W-2?

The Form W-2 is also a tax statement. However, in this case, the employer sends the W-2 to the employee and to the IRS in December each year. The W-2 reports the total annual wage of the particular employee and the total amount of taxes that the employer has withheld from the employee’s wages.

Unlike Form W-4, Form W-2 is the employer’s responsibility to complete. Employers use the W-2 form to report the FICA taxes during the year for each of their employees. These taxes refer to the federal payroll tax that’s deducted from your paycheck as part of your Social Security.

This form is filed directly to the IRS, unlike the W-4, which is kept by the employer.

Using technology for higher accuracy

The IRS encourages people to use their Tax Withholding Estimator to estimate their withholding. The software can be particularly helpful for those who had a big tax refund from the previous year, are self-employed, or generate a side income.

What if I don’t want my employer to know that I have a second job on my W-4?

It’s not unheard of that an employee doesn’t want their employer to know about their additional income. If that’s your case, here’s what you can do.

While filling in Form W-4, don’t mention another source of income. As you still need to report that income to the IRS, you can pay estimated tax payments for the side income directly to the IRS as quarterly estimated taxes.

You can also use the IRS Tax Withholding Estimator to estimate the amount of tax to pay and use Step 4(c) to directly request the employer to withhold this additional amount of tax from your salary.

How long does it take for my new W-4 to go into effect?

Generally, if you start a new job and submit a new W-4 form to your employer, the appropriate withholdings will be in effect on your next paycheck.

Depending on your employer and their payroll processes, it may take some time to process your form. By law, if you already have a W-4 on file with your employer, your employer has 30 days to process your revised form.

What if an employee doesn’t submit a W-4?

Employers often want to know what happens if their employees fail to fill out a new Form W-4.

In this case, the employer needs to treat the employee as a single filer, with zero allowances. They will then calculate the income tax withholding for this particular person based on how it’s calculated for single filers.

However, the employee is allowed to submit a Form W-4 at any time to update their withholding amount.

Where do I download Form W-4?

You can download the PDF Form W-4 for 2023 from the IRS website here. If you've been asked to submit a new W-4, you must use the latest version (you can't use a Form W-4 from 2011, for example). If you are a Spanish speaker, you can also fill out Form W-4 (SP).

Are employees required to fill in a new Form W-4 in 2023?

No, W-4 forms do not expire, so there is no need to submit a new form if there has not been any changes from the employee to report. The employer may ask an employee to submit a new Form W-4 but if the employee doesn’t want to, the employer will continue to calculate their income taxes based on the previously submitted form.

If something has changed since the last time an employee has filled in the Form W-4, such as their marital status, they should submit a new one to the employer to avoid inaccuracies in tax withholding.

Is the W-4 form for state or federal taxes?

The W-4 is for federal tax, but most states can use what you submit on the federal W-4 form for state taxes. However, some states have their own version of the W-4, and some only accept their version. For example, Arizonans need to fill out Form A-4 for state taxes. Your employer should be able to tell you if you need to fill out a state W-4.

Where do I submit the W-4 form?

You submit your completed and signed Form W-4 to your employer. Your employer may ask you to do this entirely online.

Disclaimer: This article is for informational purposes and does not constitute legal, tax, or any other advice. Use official Internal Revenue Service documentation such as Publication 505 for more information.