Free Payroll Offer

Get 6 months of free payroll, on us

In just 10 days, you’ll run payroll that’s accurate, compliant, and stress-free. You pay employees correctly and on time, avoid costly fines, and get back valuable hours each week.

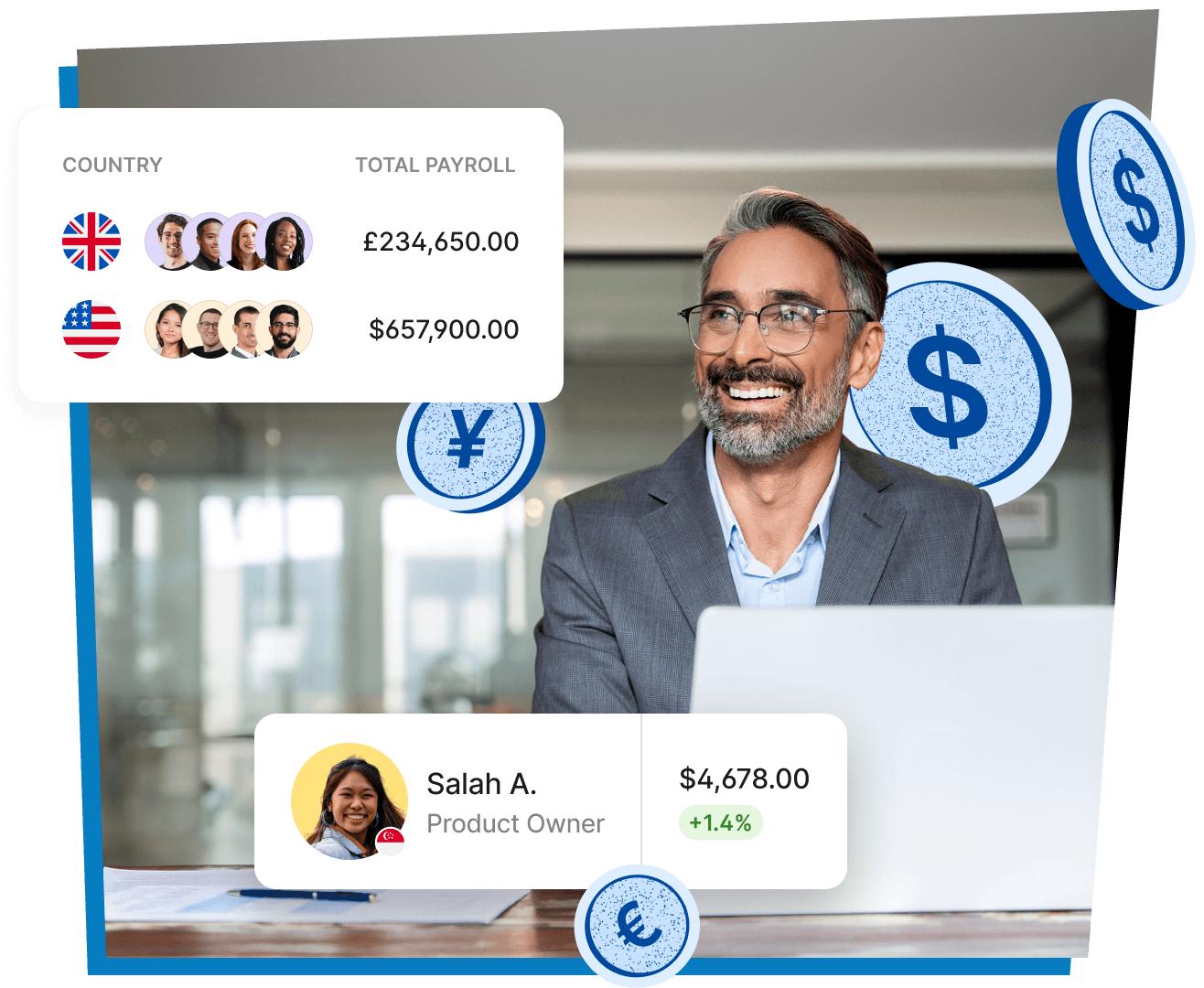

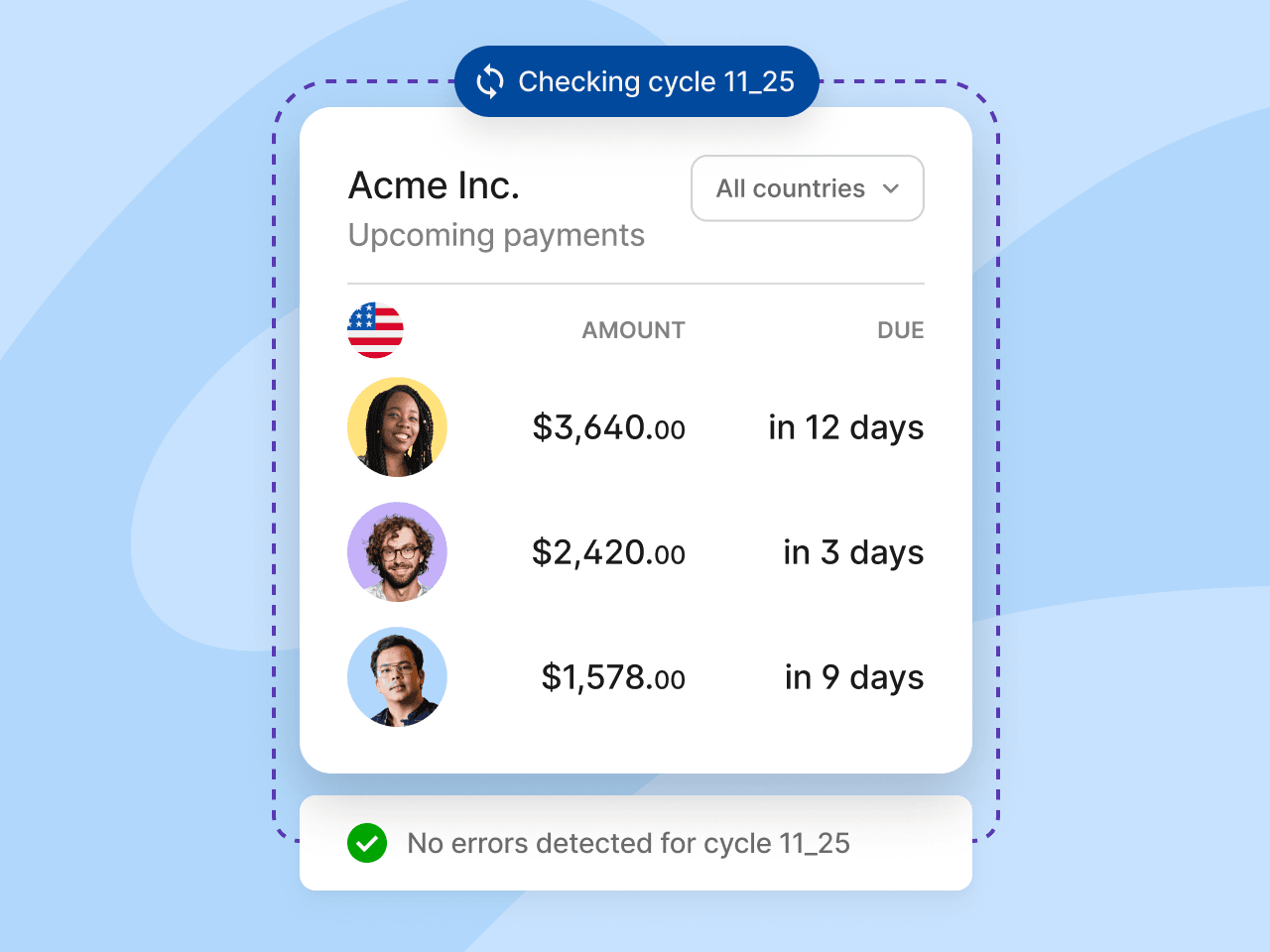

View all payroll cycles and know your costs upfront

You don't need to juggle multiple logins. Every entity lives in one platform that connects with your HR, accounting, and expense tool. With a clearer view of data, you always know what to expect every cycle and teams are paid correctly.

Take the hassle out of compliance management

You don’t have to track every tax rule or filing deadline. Compliance is handled by Deel experts who stay ahead of changing laws to protect you, so you avoid costly fines, never scramble at month-end, and get hours back to grow your business.

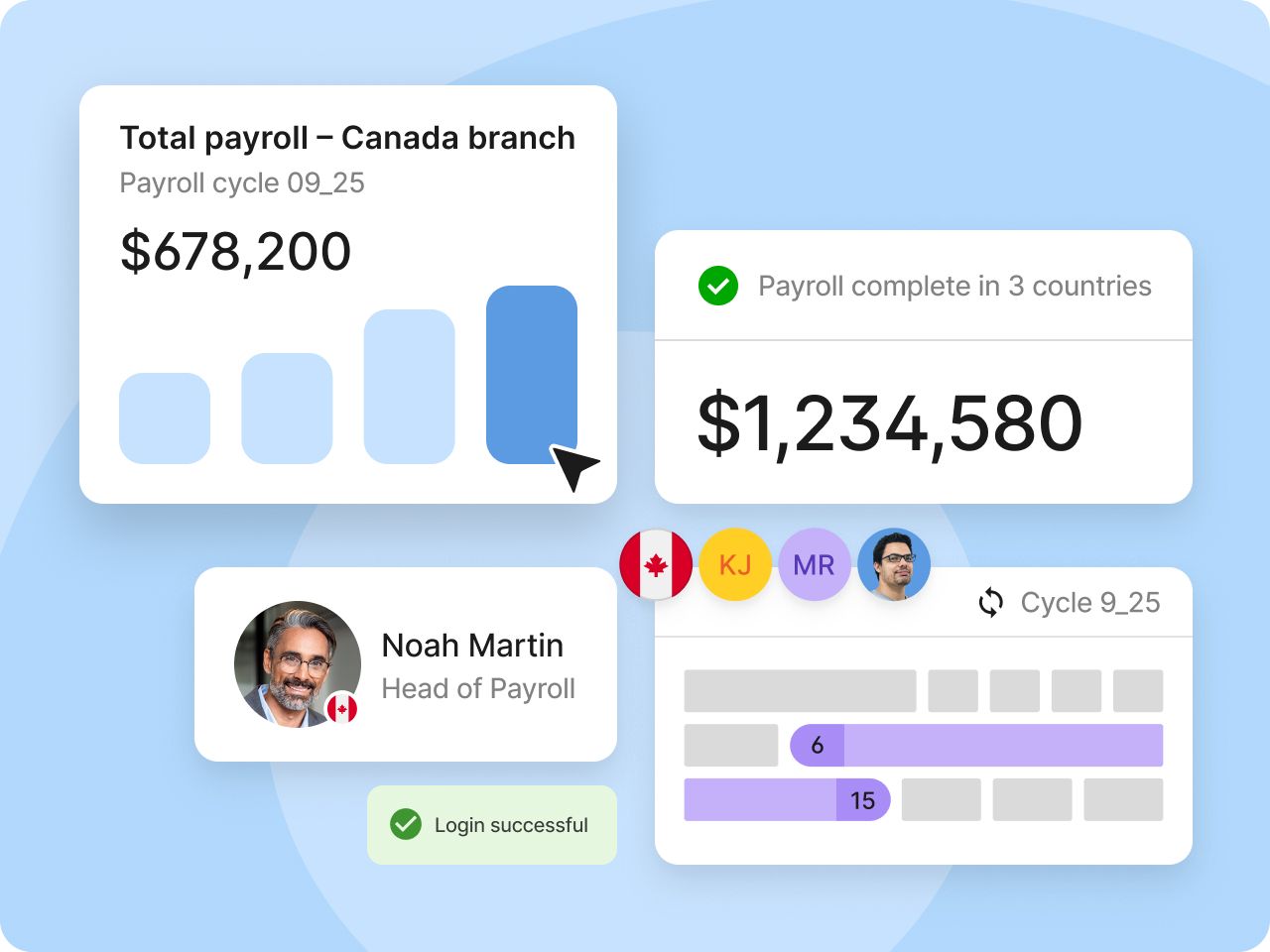

Keep payroll error-free automatically every cycle

You don’t have to worry about payroll mistakes or last-minute corrections. Proactive, built-in checks ensure every cycle runs smoothly, employees are paid correctly and on time, and you gain confidence knowing payroll just works.

FAQs

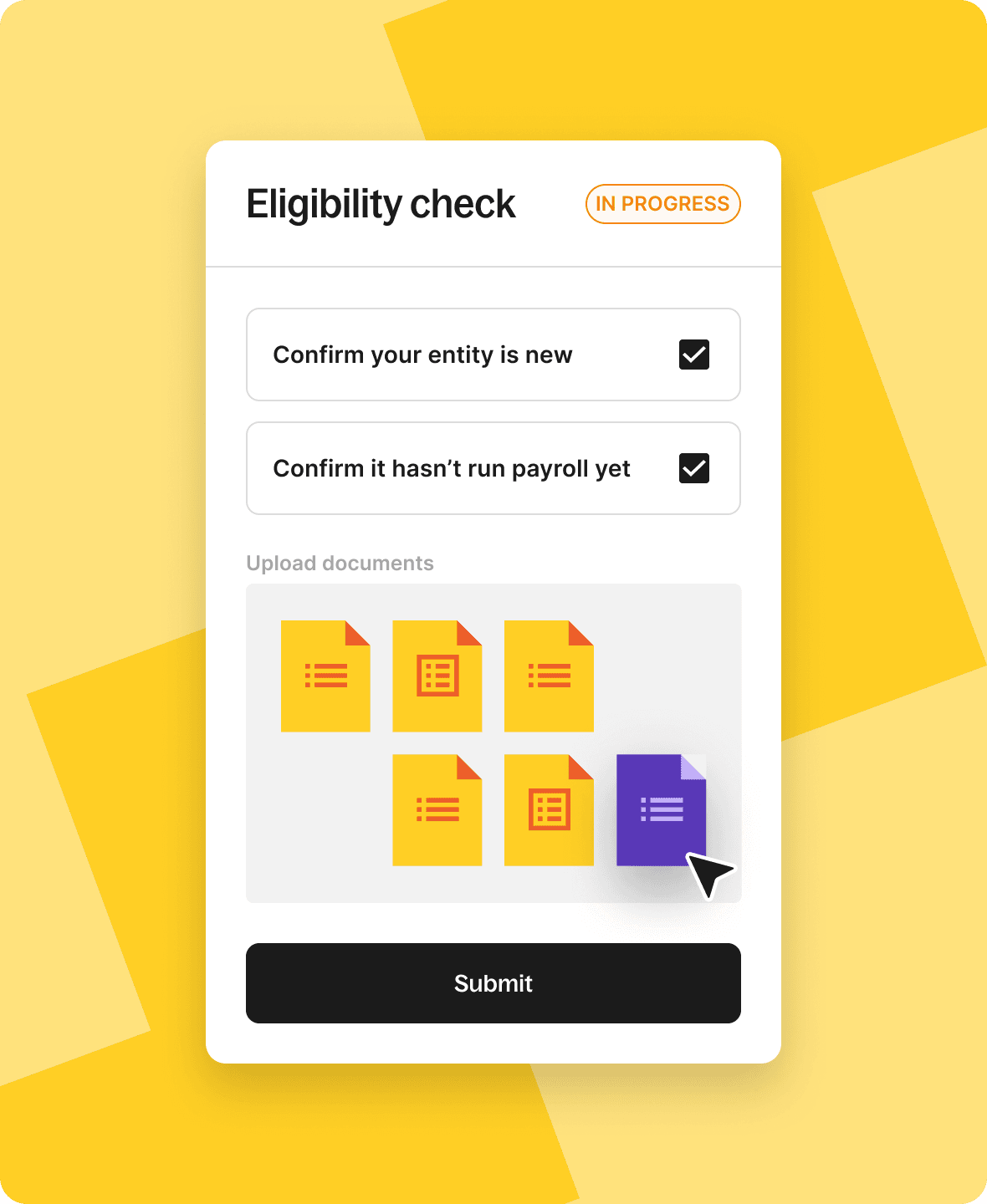

What are the qualifications and terms?

This offer is only eligible for:

- Existing SMB Deel customer (up to 20 employees) with an active contract

- Only applies to new domestic entities for the United States, Canada, the United Kingdom, and Singapore

- Entity must be newly registered and has not yet processed payroll (no prior runs)

Offer terms:

- 6 months free of Deel payroll for a new entity in the client’s home domestic country (entity has not run payroll before)

- Valid for payroll activations by December 31, 2025 (or, offer ends December 31, 2025)

Additional terms and conditions apply.

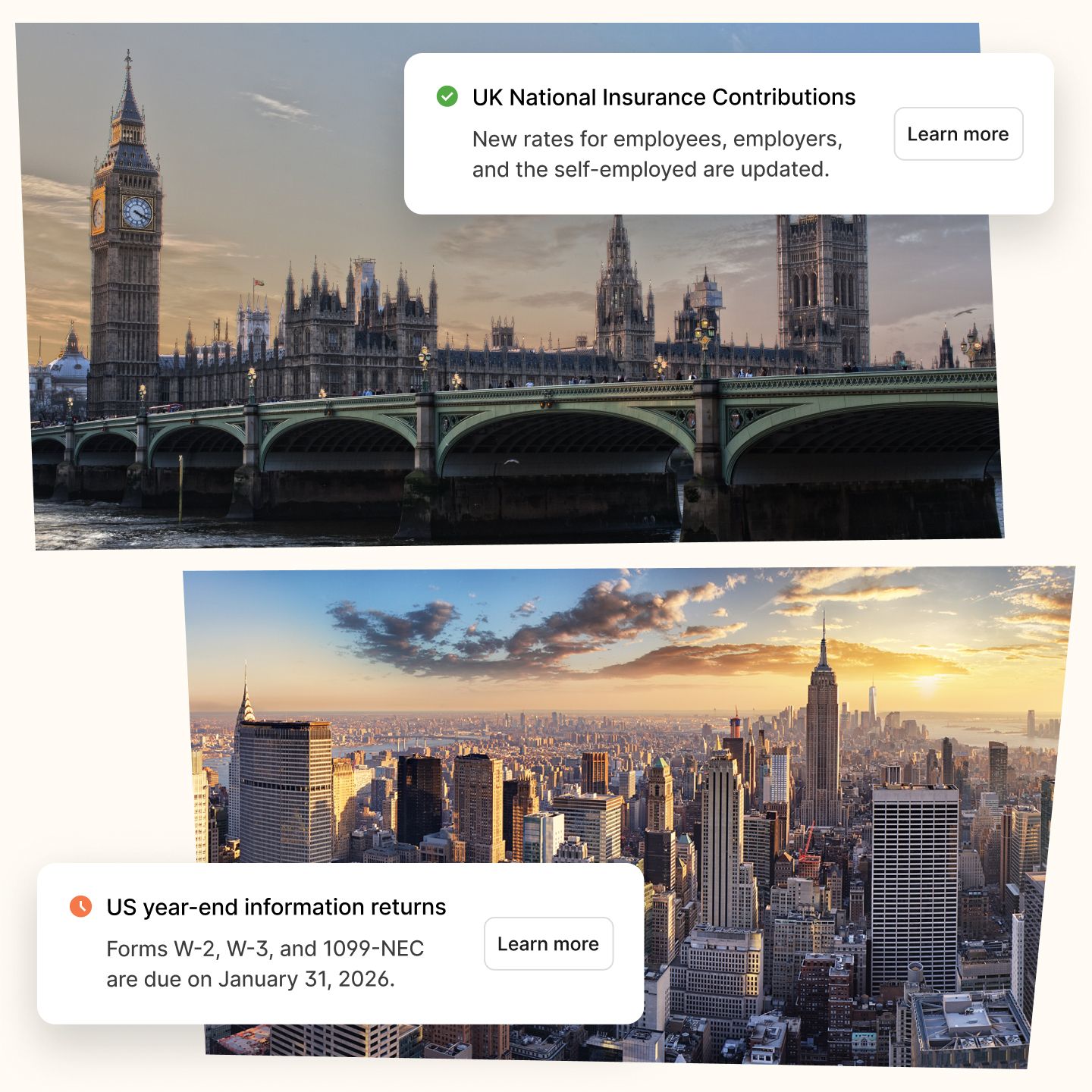

How does Deel ensure compliance with tax and labor laws in different countries?

We maintain in-house legal and compliance experts in 130+ countries, continuously monitoring regulatory changes to ensure compliance. Our platform is updated automatically to reflect new tax laws, labor regulations, and statutory requirements. We also collaborate with local legal partners and participate in payroll compliance networks and industry forums to stay ahead of global payroll requirements.

Our Compliance Hub provides real-time notifications to end users in the Deel platform for employment law changes. It automatically scans, collects, and explains the latest relevant regulatory changes globally.

Lastly, Deel AI provides granular insights into your team and answers to local compliance laws. Trained by HR and compliance experts across 130+ countries, it's integrated with your people data for smarter, faster decision-making. Save time manually searching for compliance answers and get curated insights based on your people data.

What type of integrations do you offer?

Deel provides 110+ enterprise-grade integrations and APIs for secure, flexible, and seamless data flow. Deel Global Payroll integrates with leading HRIS/HCM platforms, including Workday, SAP SuccessFactors, UKG, HiBob, BambooHR, and more. We are a GPC-certified (Global Payroll Cloud) partner of Workday for seamless, comprehensive integration.

We provide an open API that allows you to seamlessly integrate Deel Payroll solutions with your existing tech stack, including ERP, accounting system, time tracking, learning management, expense management, benefits administration, and more.

Deel makes growing remote and international teams effortless

150+

countries

37,000+

customers

200+

in-house experts