Local Payroll / brazil

Run payroll in Brazil with less effort and more confidence

With our self-serve platform, Deel Local Payroll keeps you in full control. Automate payroll, stay eSocial-compliant, and run unlimited cycles to cut costs and admin time.

join 16,000+ customers running payroll locally

All-in-one local payroll software

Manage payroll, benefits, and employee data in one place. Our proprietary software calculates in real time without third parties.

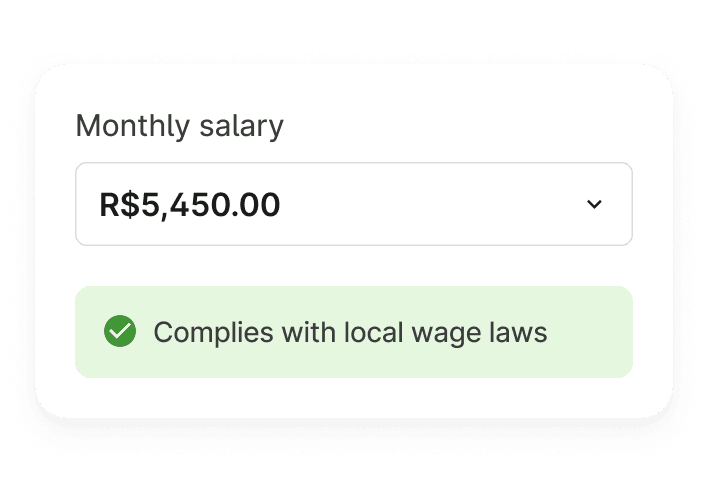

Designed for compliance

Stay compliant with automated tax calculations, real-time filings, legislative updates, and secure payroll processing.

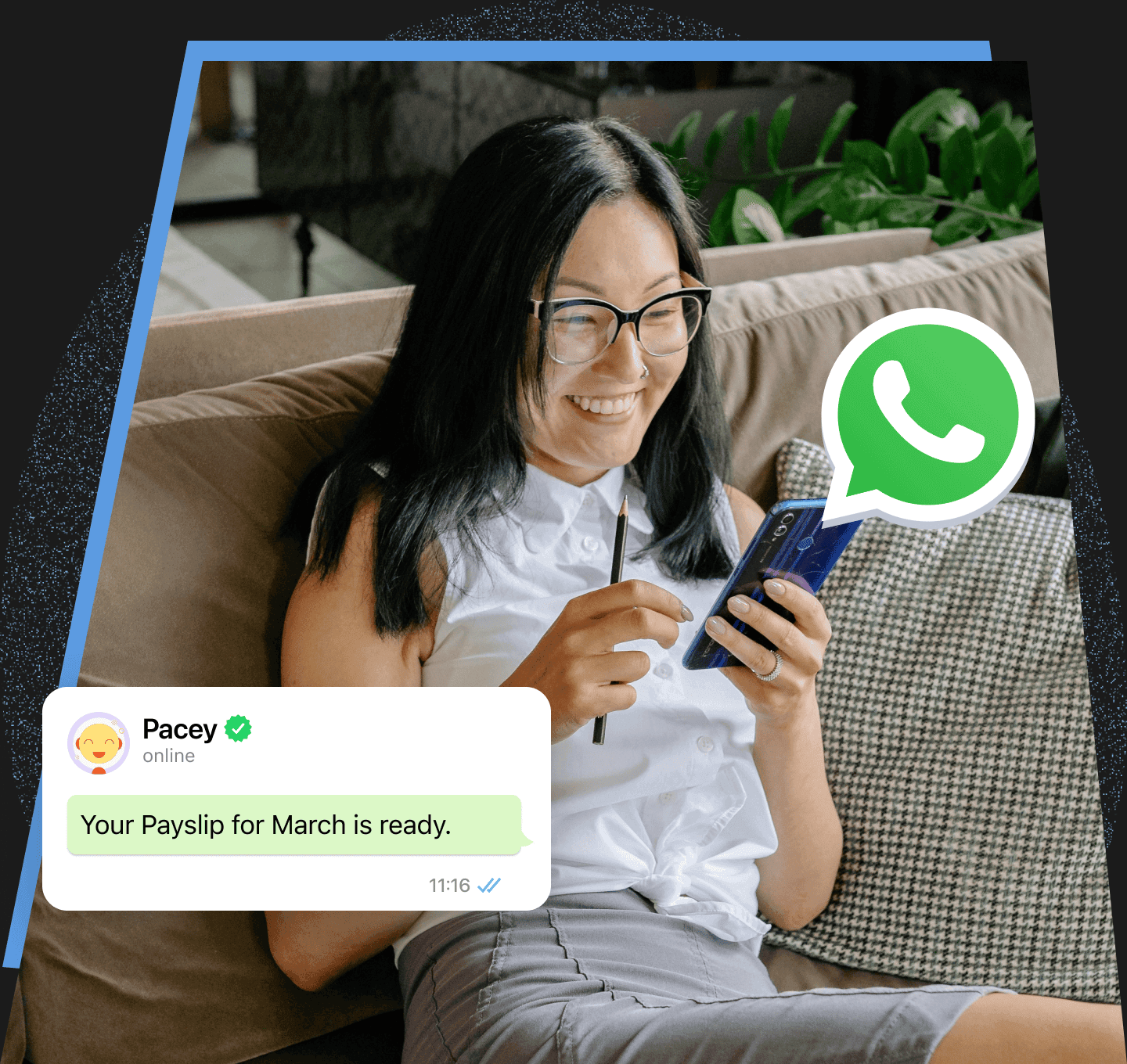

Smoother employee experience

Employees can access self-serve features via our dashboard or WhatsApp to view payslips & tax certificate data, and update details.

Leading compliance protection

Avoid hefty fines with built-in compliance expertise

No matter your business size, Deel Local Payroll simplifies Brazil’s complex eSocial rules for you with automated compliance, real-time gross-to-net calculations, API integrations, and ready-to-go reports.

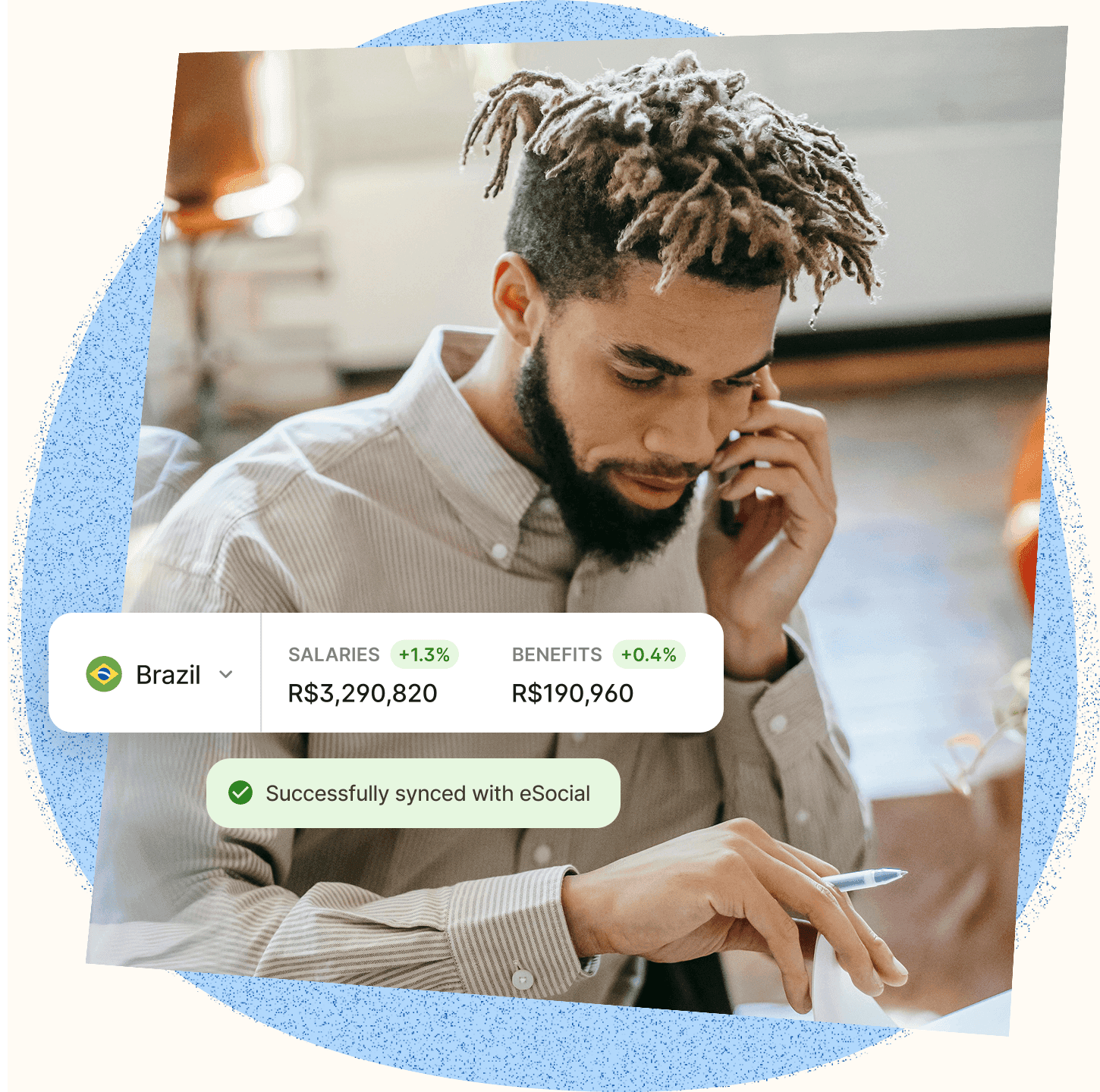

Cut down admin

Simplify mandatory eSocial reporting with intuitive tools

Our built-in eSocial integrator automates legal code maps and data syncs so you stay compliant with contracts, salaries, leave, terminations, and social contributions. No devs needed—just drag, drop, and go live in days.

Employee self-service

WhatsApp functionality for employee self-service

- Easily access payslips in PDF or text format

- Apply for leave, check balances, and get approvals fast

- Submit claims, request tax certificates, and more

- Send announcements and automate work anniversary messages

eSocial and SEFIP compliance

Automate FGTS, INSS, and social security reporting—fully aligned with eSocial.

Real-time tax calculations

Instantly calculate INSS, FGTS, IRRF, and region-specific payroll deductions.

13th salary and leave pay

Automate 13th salary, prorated bonuses, and paid leave with zero manual effort.

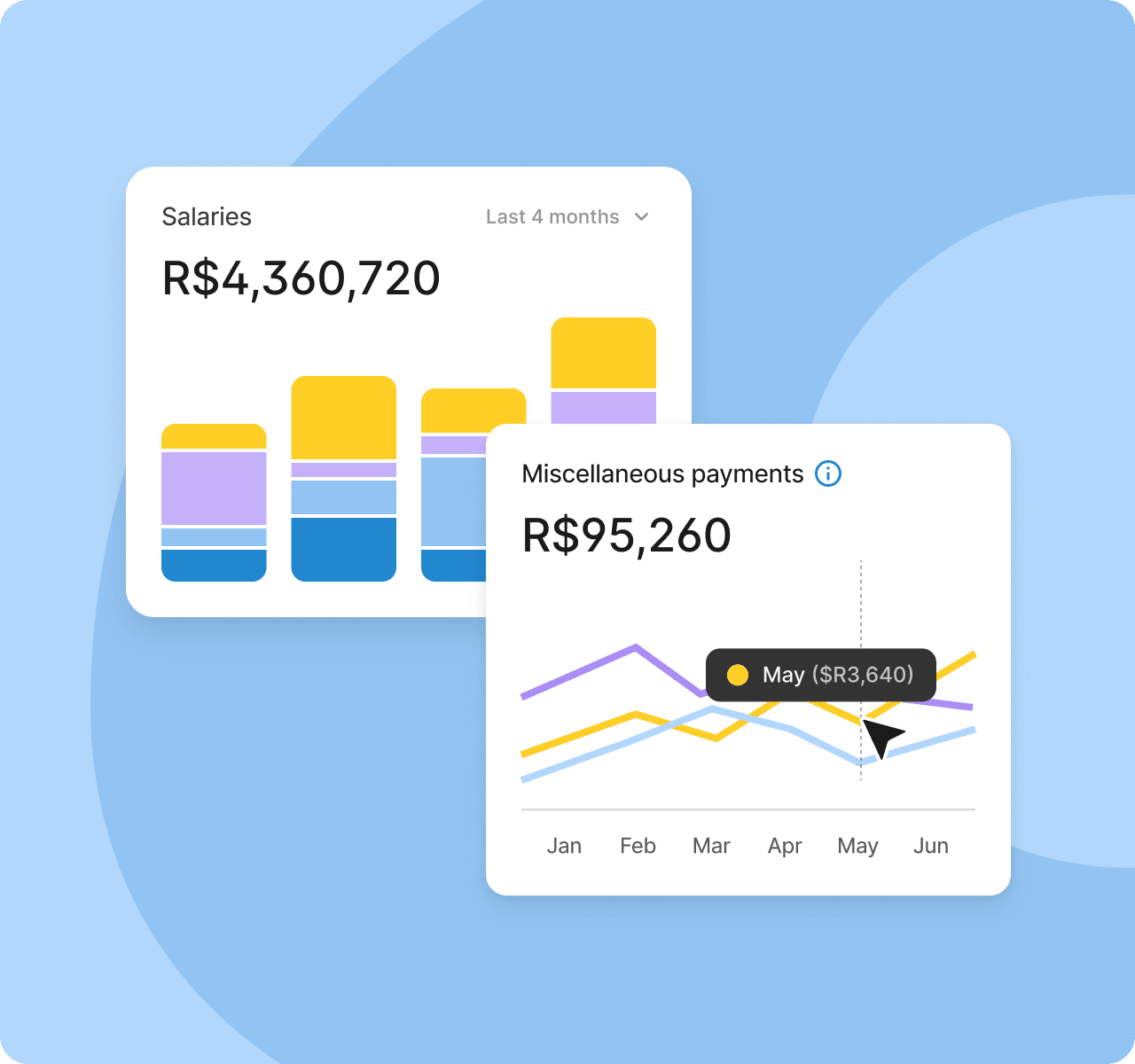

Financial reporting insights

Get pre-built and custom payroll reports to guide compliance and cash flow plans.

Advanced access control by role

Set role-based permissions to edit, view, or hide payroll info at every level.

Highest security standards built-in

ISO 27001, SOC 1 & 2, GDPR, and LGPD certified—your data stays protected, always.

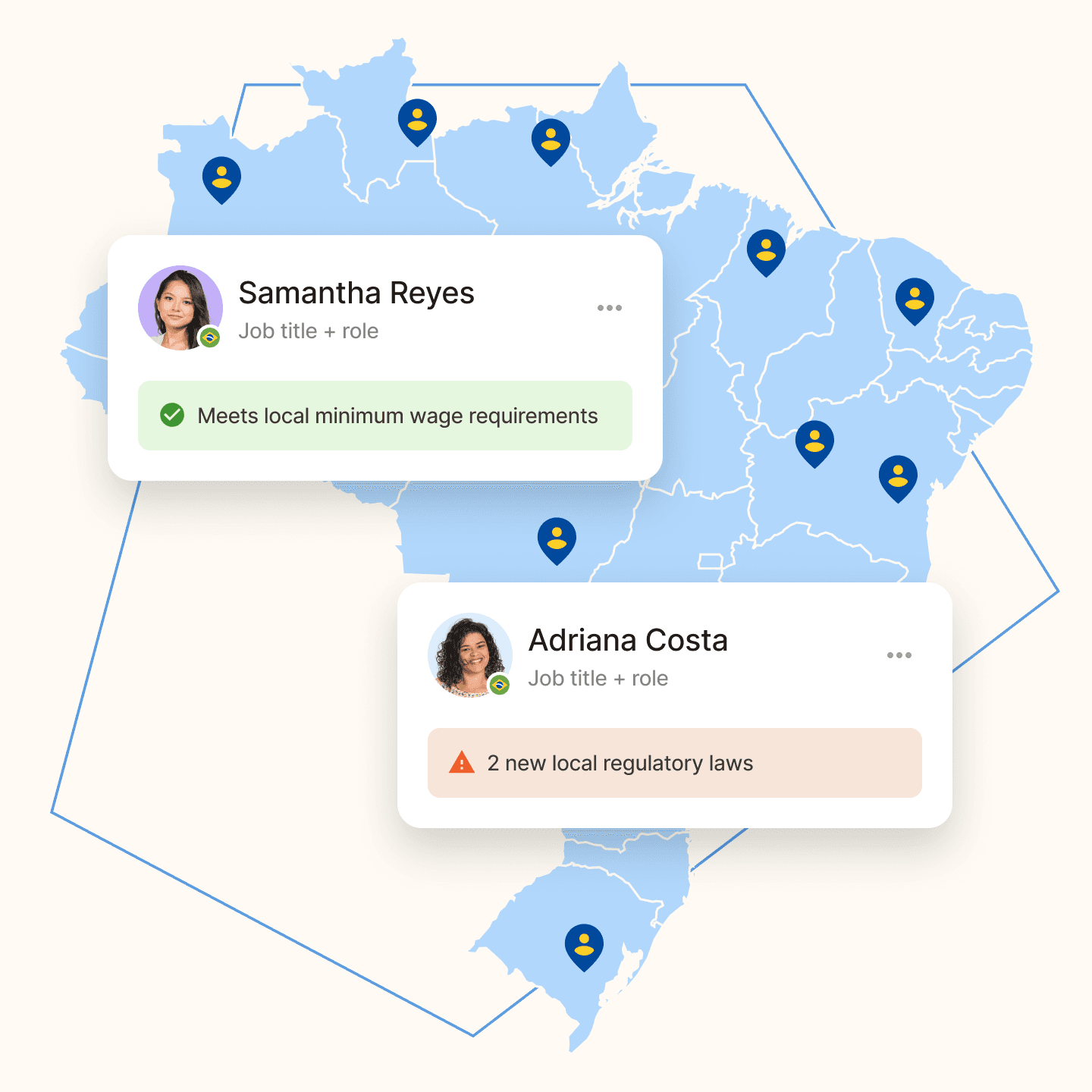

Built for Brazil

We keep you prepared for any audit at any time

Our platform works across multiple regions & tax zones, automating labor, tax, and social security reporting, eliminating manual work, reducing errors, and ensuring full compliance.

Hear what customers are saying

FAQs

How does Deel Local Payroll simplify compliance and legislation updates?

Deel Local Payroll is built for compliance, with direct integrations to eSocial, ensuring automated tax filings, statutory deductions, and real-time legislative updates. Our platform notifies payroll managers of key compliance events, reducing manual effort and eliminating the risk of missed deadlines. With everything managed in one system, payroll teams can easily track and adapt to changes across multiple regions, ensuring accuracy and peace of mind.

How does Deel Local Payroll support onboarding and implementation?

We offer a seamless onboarding experience, guiding businesses through setup with expert support. Our team ensures smooth implementation, from data migration to compliance setup.

How does Deel Local Payroll’s pricing model support growing businesses?

Unlike traditional payroll providers, Deel Local Payroll offers a flexible, pay-per-employee model with no annual license fees. We scale with your business- no need for costly re-implementations or being locked into rigid contracts.

Does Deel Local Payroll integrate with HR and accounting systems?

Yes. Deel seamlessly integrates with major HRIS and accounting platforms like Xero, Quickbooks, Sage Accounting and more, eliminating duplicate work and ensuring accurate payroll processing. With automated data sync, any changes made in your HR or ERP system—such as salary adjustments or employee details—are instantly updated in Deel, so payroll and HR teams have a single source of truth.

How does Deel Local Payroll process payroll faster than other providers?

Unlike traditional providers that rely on fragmented local engines, Deel Local Payroll is built on a native real-time payroll engine, meaning we own and control our payroll infrastructure. This allows us to process payroll much faster, with instant gross-to-net calculations in select countries and full transparency at every step.

How does Deel Local Payroll provide real-time payroll calculations?

Yes, Deel Local Payroll runs on a native real-time payroll engine, meaning gross-to-net calculations, tax deductions, and compliance updates happen instantly—no waiting for batch processing. Payroll managers get immediate visibility into local deductions, taxes, and net pay, reducing errors and last-minute surprises.