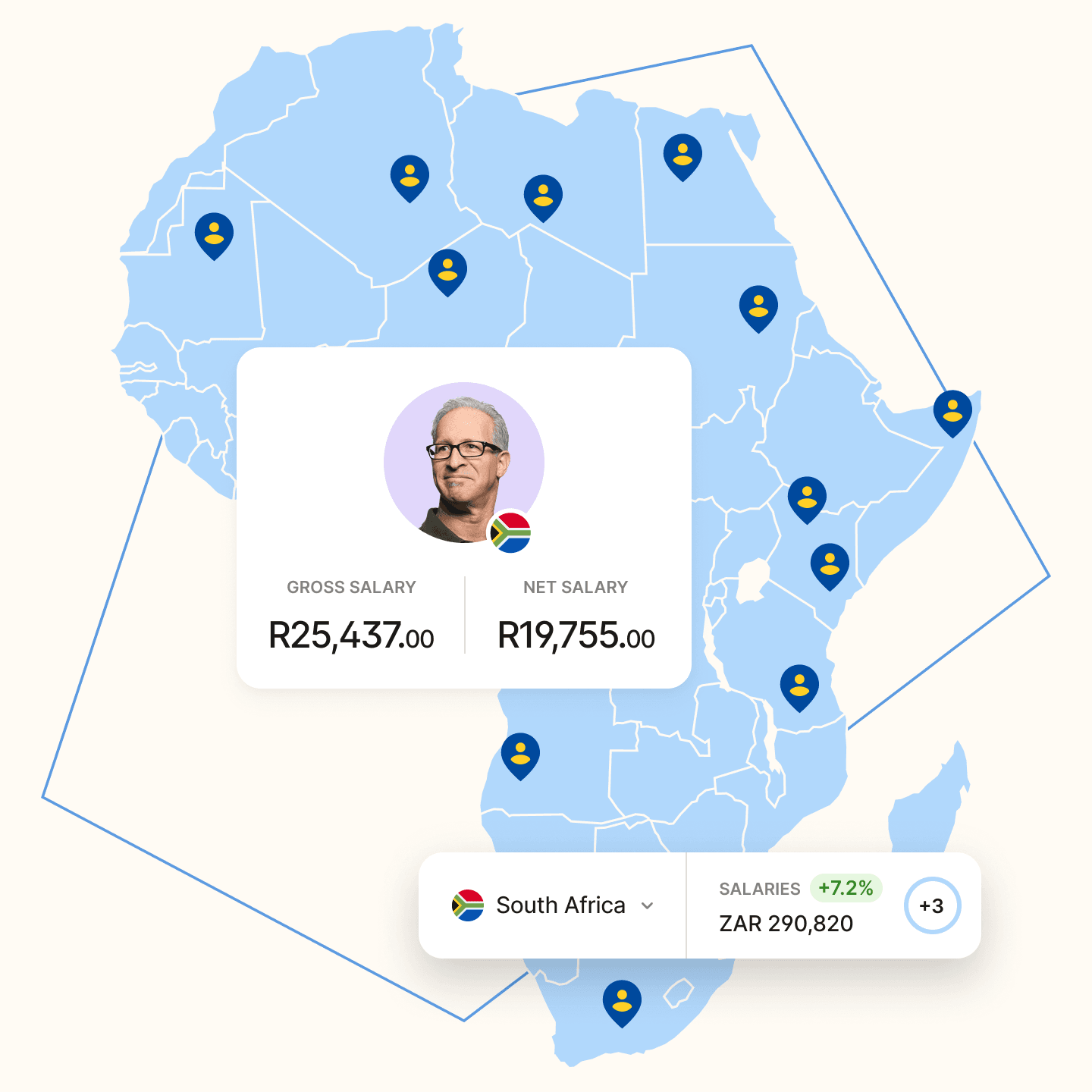

Local Payroll / south africa

Run payroll in Africa with less effort and more confidence

Deel Local Payroll powers fast, accurate, and secure self-service payroll in 44 African countries with real-time calculations, automated legislative updates, seamless integrations, and advanced reporting built for any business size.

join 16,000+ customers running payroll locally

All-in-one local payroll software

Manage payroll, benefits, and employee data in one place. Our proprietary software calculates in real time without third parties.

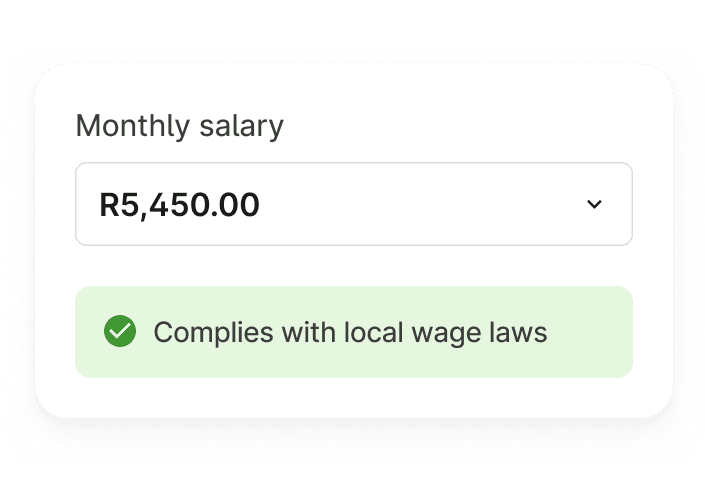

Designed for compliance

Stay compliant with automated tax calculations, real-time filings, legislative updates, and secure payroll processing.

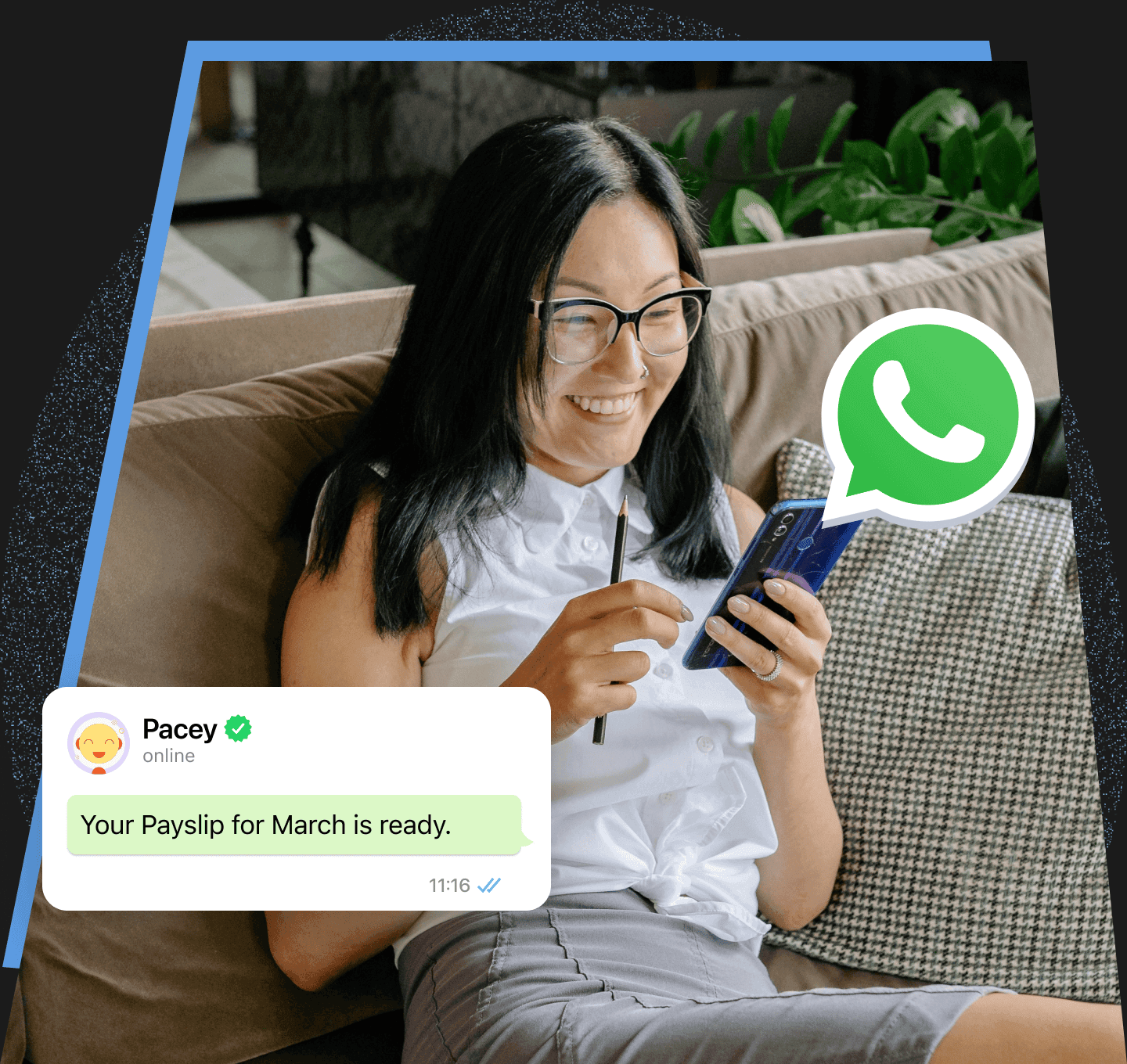

Smoother employee experience

Employees can access self-serve features via our dashboard or WhatsApp to view payslips & tax certificate data, and update details.

Choosing local payroll over global payroll

- Made for managing significant employee bases in one region

- Built-in local tax & compliance updates help avoid fines

- Always-on real-time G2N calculation

- Only add monthly changes—default expenses apply automatically

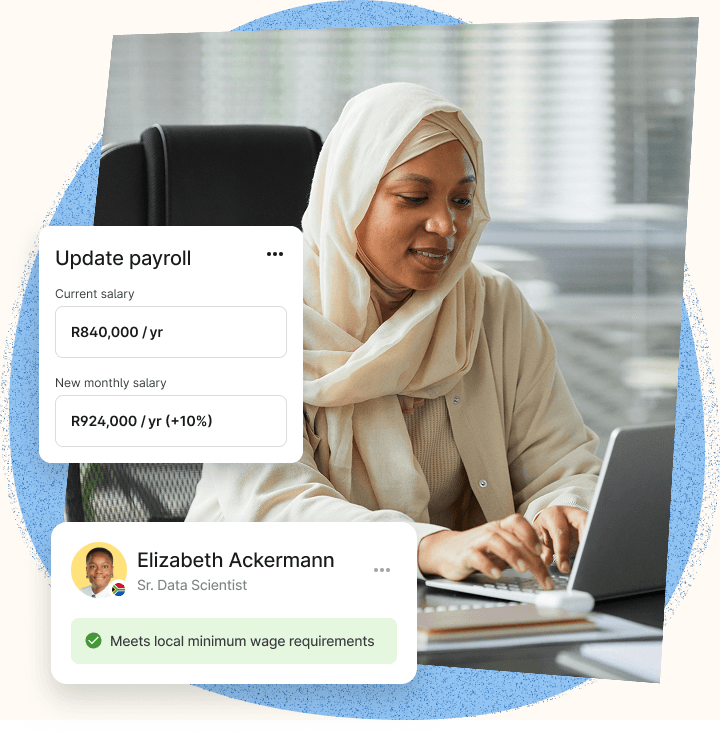

Run local payroll with global reach and full control

Built for small businesses and complex workforces to support diverse employee types, contracts, and union rules. Gain deeper insights, integrate with HRIS & accounting platforms, and streamline payslip management.

- Scales with you as your needs grow from simple to complex

- Customize costing with advanced configuration and controls

- Improve decisions with instant Gross-to-Net/Net-to-Gross view

- IS27001 certified, SOC 1 & 2 compliant, adapts to local tax requirements

Employee self-serve

WhatsApp functionality for employee self-service

- Easily access payslips in PDF or text format

- Apply for leave, check balances, and get approvals fast

- Submit claims, request tax certificates, and more

- Send announcements and automate work anniversary messages

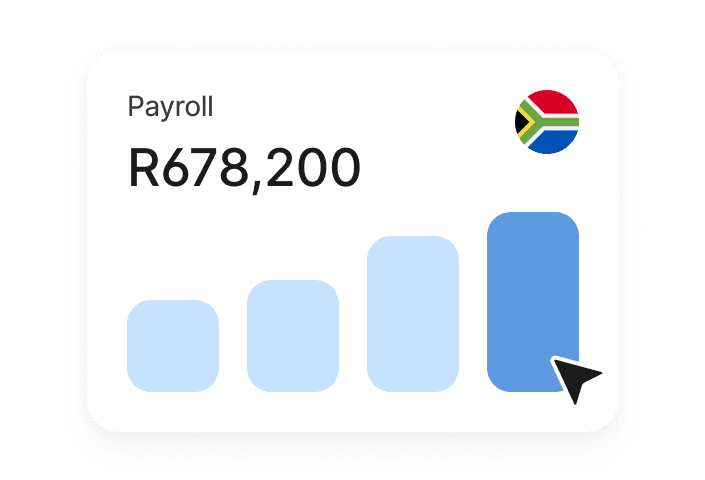

Unlimited runs, real-time updates

Run payroll as often as needed—no extra costs, no stress over rigid cut-offs.

No annual upfront license fees

Reduce wastage. You only pay per active employee, not your entire database.

Accessible from any device

Our cloud-native platform easily scales with growing teams and changing needs.

Automated local tax & compliance

Built-in rules and auto tax updates for 44 African countries—accurate, on-time payroll.

Simplified retroactive calculations

Easily backdate salary or tax changes with full compliance and audit trail.

Advanced General Ledger mapping

Generate payroll journals with multi-level General Ledger mapping by cost center, country, or entity.

Seamless integration with your workflow and processes

With Deel-built integrations and open API, you can effortlessly connect with top accounting, onboarding, and HR systems, while automating and syncing data across your HR tech stack.

Hear what customers are saying

FAQs

How does Deel Local Payroll simplify compliance and legislation updates across Africa?

Deel Local Payroll is purpose-built to support compliance across 44+ African countries, including South Africa. Our platform automates statutory deductions and submissions such as PAYE, UIF, SDL, and equivalents in each country, ensuring seamless handling of local payroll obligations.

With real-time legislative updates integrated into our system, your payroll calculations stay aligned with the latest tax and labour regulations without the need for manual intervention. Deel Local Payroll proactively alerts your team to compliance actions and deadlines, so nothing slips through the cracks.

Whether you're managing payroll in a single country or scaling operations across the continent, Deel Local Payroll ensures everything remains compliant, consistent, and secure within one cloud-native platform.

How does Deel Local Payroll support onboarding and implementation?

We offer a seamless onboarding experience, guiding businesses through setup with expert support. Our team ensures smooth implementation, from data migration to compliance setup, across Africa, UAE, United Kingdom and Brazil.

How does Deel Local Payroll’s pricing model support growing businesses?

Unlike traditional payroll providers, Deel Local Payroll offers a flexible, pay-per-employee model with no annual license fees. We scale with your business- no need for costly re-implementations or being locked into rigid contracts.

Does Deel Local Payroll integrate with HR and accounting systems?

Yes. Deel seamlessly integrates with major HRIS and accounting platforms like Xero, Quickbooks, Sage Accounting and more, eliminating duplicate work and ensuring accurate payroll processing. With automated data sync, any changes made in your HR or ERP system—such as salary adjustments or employee details—are instantly updated in Deel, so payroll and HR teams have a single source of truth.

How does Deel Local Payroll process payroll faster than other providers?

Unlike traditional providers that rely on fragmented local engines, Deel Local Payroll is built on a native real-time payroll engine, meaning we own and control our payroll infrastructure. This allows us to process payroll much faster, with instant gross-to-net calculations in select countries and full transparency at every step.

How does Deel Local Payroll provide real-time payroll calculations?

Yes, Deel Local Payroll runs on a native real-time payroll engine, meaning gross-to-net calculations, tax deductions, and compliance updates happen instantly—no waiting for batch processing. Payroll managers get immediate visibility into local deductions, taxes, and net pay, reducing errors and last-minute surprises.