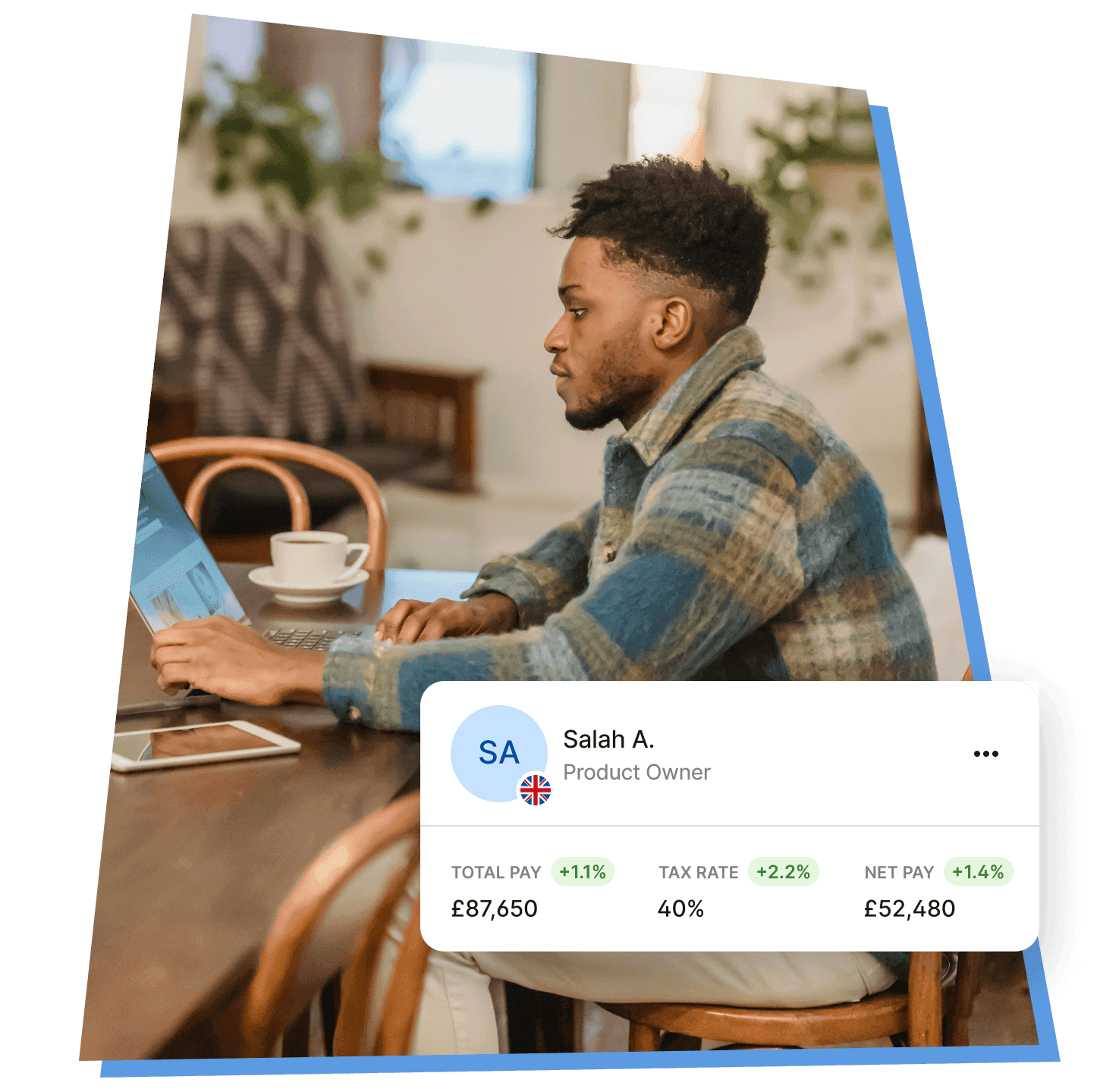

Local Payroll / united kingdom

Self-service payroll for any UK business

Eliminate manual work and third-party providers with automated in-country payroll & tax compliance, real-time gross-to-net calculations, HMRC integrations, and business reporting.

join 16,000+ customers running payroll locally

All-in-one local payroll software

Manage payroll, benefits, and employee data in one place. Our proprietary software calculates in real time without third parties.

Designed for compliance

Stay compliant with automated tax calculations, real-time filings, legislative updates, and secure payroll processing.

Smoother employee experience

Employees can access self-serve features via our dashboard or WhatsApp to view payslips & tax certificate data, and update details.

Smart payroll compliance with HMRC

Simplify payroll reconciliations, meet statutory requirements, and avoid errors. Submit reports to HMRC with our RTI Dashboard and automatically retrieve Coding Notices to keep payroll accurate and hassle-free.

- View PAYE and NI and adjust interactively

- Track levy calculations monthly or quarterly

- Manage payments to and from HMRC in one place

Award-winning innovation in payroll and compliance

We’re committed to making payroll simpler, faster, and more reliable. With a focus on automation, embedded compliance, and API integrations, we help businesses run payroll with confidence—no manual admin, no guesswork.

- Global Payroll Association Software Supplier 2024 Winner

- Workday Global Payroll Cloud (GPC) Certified Partner

- First African-based partner of Workday GPC

- Innovation award for WhatsApp Employee Self-Service (ESS)

Seamless integrations

Integrate with industry-leading systems like Xero, Quickbooks, and your favorite HRIS.

Advanced reporting

Generate detailed payroll insights for cost analysis, headcounts, and tax obligations.

Simple dashboard, BACS payments

Manage payroll, taxes, and compliance. Pay employees with secure BACS file generation.

Compliant in 45+ countries

We keep you aligned with UK payroll laws while supporting global expansion.

SOC 1, SOC 2, ISO 27001 certified

Get top-tier data security, privacy, and risk management.

Pay-per-employee pricing

Choose the pay run frequency that works for your business with no upfront annual license fees.

Transparent, pay-per-employee pricing that grows with your business

Lite Plan

Easy to use payroll for small UK teams

Starting at

£2.99

per employee/month

Cloud-native software

Real-time lightning fast calculations

Basic statutory reporting

Automated processing of HMRC coding notices

Automated mid-month changes

Unlimited pay runs

Bacs Payments

100+ essential reports

Built-in security roles

Employee and manager self service

Only pay for active employees

QuickBooks and Xero integration

Local support

Sandbox environment

Premier Plan

More control as your operation grows

Starting at

£3.31

per employee/month

Everything in Lite+

API integrations

Bulk uploads

Basic approval workflows

Auto schedule reports

Multi-level GL configuration

Comprehensive reports

Build your own custom fields & forms

Expense claims: one approver

Automated P11D support

Master Plan

All the bells and whistles

Starting at

£3.56

per employee/month

Everything in Premier+

Multi currency payment file

Custom fields and forms

Custom report writer

Build your own custom payslip

Retro active calculations

Advanced, multi-step, approval workflows

Complex, multi-country configurations

Expat gross up currency conversions

Expense claims: multi-level approval

Bureaus/accountants

Choose any edition to suit your needs

Starting at

£0.75

per employee/month

Cloudroom (secure client communication)

Process orchestration tool

Local support team in the UK

WhatsApp employee self-service

Unlimited number of users

Phone support

Discounts available based on volume and growth

Hear what customers are saying

FAQs

How does Deel Local Payroll ensure UK payroll compliance?

Deel Local Payroll stays fully compliant with UK laws, automating tax calculations, RTI submissions, and statutory pay processing while keeping up with legislative updates.

Does Deel Local Payroll automate statutory payroll calculations?

Yes. PAYE, National Insurance, Apprenticeship Levy, and statutory leave pay are calculated in real time. Tax code updates from HMRC are also applied automatically.

How does Deel Local Payroll handle pension auto-enrolment?

Our system automates pension auto-enrolment, including workforce assessments, enrolment letters, contribution tracking, and pension provider integrations.

Can employees access payroll details and self-service tools?

Yes. Employees can view payslips, request leave, and update details via the dashboard. WhatsApp ESS also allows instant access to payroll info on mobile. Additional per message pricing applies.

What is the pricing model for Deel Local Payroll?

We use a flexible pay-per-employee model with no annual license fees. You only pay for what you use, making payroll processing cost-efficient and scalable.