Article

19 min read

Minimum Wage by Country: Global Guide for 2025

Legal & compliance

Global payroll

Author

Deel Team

Last Update

June 20, 2025

Table of Contents

Minimum wages by region

Countries with the lowest minimum wages (below $500 USD per month)

Countries with a moderate minimum wage, between $500 and $1,000 USD per month

Countries with a high minimum wage, over $1,000 USD per month

Countries with no specified minimum wage

Limitations of comparing the minimum monthly wage per country

Stay compliant with local labor laws with Deel

Key Takeaways

- Minimum wage laws differ by country, and they often come with hidden complexities, like extra payments or regional variations.

- This guide covers 70+ countries, with monthly wage data in both USD and local currency for easy benchmarking.

- Deel helps global teams stay compliant with local wage laws, backed by in-house legal experts and on-the-ground payroll support.

Hiring internationally means playing by local rules, including when it comes to pay. Minimum wage laws vary widely from one country to the next, and they’re rarely straightforward. Some countries have no official minimum at all.

Others mandate 13 or 14 salary payments per year. And exchange rates can make cross-border comparisons even more complex.

At Deel, we help businesses stay ahead of shifting regulations. Our team of local experts and in-house legal professionals ensures every employee and contractor you hire is paid accurately and compliantly, wherever they are in the world.

This guide gives you a clear, side-by-side view of monthly minimum wages by country, presented in both local currency and USD and based on 2025 exchange rates.

Whether you're planning expansion, managing payroll, or benchmarking compensation, it’s a practical starting point.

Minimum wages by region

How does minimum wage vary across the world? To start, here’s a look at how rates differ from region to region, with country-specific data.

Asia-Pacific

Australia

-

USD: 2,742.32

-

Local: AUD 3,965.85

China

-

USD: 258.16–383.68

-

Local: CNY 2,200–2,330

Hong Kong

-

USD: 810.58

-

Local: HKD 6,300

India

-

USD: 212.85 – 280.90

-

Local: INR 18,456 – 24,356

Indonesia

-

USD: 24.54

-

Local: IDR 396,761

Japan

-

USD: 1,198.13 (average)

-

Local: ¥173,692

Malaysia

-

USD: 363.64

-

Local: MYR 1,500

New Zealand

-

USD: 2,354.63

-

Local: NZD 1,496.33

Pakistan

-

USD: 90.04

-

Local: PKR 25,000

Philippines

-

USD: 250.56

-

Local: PHP 14,028.75

Singapore

- No government-mandated minimum wage

South Korea

-

USD: 1,571.24

-

Local: KRW 2,060,740

Sri Lanka

-

USD: 41.83

-

Local: LKR 12,500

Taiwan

-

USD: 869.58

-

Local: TWD 28,590

Thailand

-

USD: 336.42

-

Local: THB 11,160

Global Hiring Toolkit

North America

Canada

-

USD: 1,920.91–2,433.15

-

Local: CAD 2,598–3,290.80

Puerto Rico

-

USD: 1,160

-

Local: USD 1,160

United States

-

USD: 1,253.97 (federal minimum)

-

Local: USD 1,253.97

Latin America

Argentina

-

USD: 274.04

-

Local: ARS 286,711

Bolivia

-

USD: 360.23

-

Local: BOB 2,500

Brazil

-

USD: 259.74

-

Local: BRL 1,518

Chile

-

USD: 555.40

-

Local: CLP 500,000–510,500

Colombia

-

USD: 310.73

-

Local: COP 1,623,500

Costa Rica

-

USD: 678.99–1,447

-

Local: CRC 352,164.91–752,220.04

Dominican Republic

-

USD: 196.86–347.39

-

Local: DOP 11,900–21,000

Ecuador

-

USD: 460

-

Local: USD 460

Guatemala

-

USD: 409.20

-

Local: GTQ 3,544.2

Honduras

-

USD: 506.79

-

Local: HNL 12,597.91

Mexico

-

USD: 175.26–263.94

-

Local: MXN 3,457.40–5,206.80

Peru

-

USD: 275.93

-

Local: PEN 1,130

Uruguay

-

USD: 867.42

-

Local: UYU 36,180

Free course

Europe, Middle East, Africa

Albania

-

USD: 451.72

-

Local: ALL 40,000

Austria

-

USD: 1,679.03

-

Local: EUR 1,500

Belgium

-

USD: 2,317.60

-

Local: EUR 2,070.48

Bosnia and Herzegovina

-

USD: 569.08

-

Local: BAM 996.78

Bulgaria

-

USD: 534

-

Local: BGN 1,077

Croatia

-

USD: 938.41

-

Local: EUR 970

Cyprus

-

USD: Based on tenure: 1,119.04 / 1,007.14

-

Local: EUR 1,000 / EUR 900

Czech Republic

-

USD: 839.50

-

Local: CZK 20,800

Denmark

- No government-mandated minimum wage

Estonia

-

USD: 916

-

Local: EUR 886

Finland

- No government-mandated minimum wage

France

-

USD: 1,977.19

-

Local: EUR 1,801.80

Germany

-

USD: 2,406.98

-

Local: EUR 2,151.00

Greece

-

USD: 927.23

-

Local: EUR 830

Hungary

-

USD: 748.65

-

Local: HUF 290,800

Iceland

- No government-mandated minimum wage

Ireland

-

USD: 2,401.72

-

Local: EUR 2,146.30

Israel

-

USD: 1,584.91

-

Local: NIS 5,880.02

Italy

- No government-mandated minimum wage (some sectors)

Latvia

-

USD: 781.48

-

Local: EUR 740

Lithuania

-

USD: 1,034.23

-

Local: EUR 1,038

Luxembourg

-

USD: 3,452.13

-

Local: EUR 3,085

Malta

-

USD: 1,032.95

-

Local: EUR 924.63

Netherlands

-

USD: 2,800.87

-

Local: EUR 2,503

North Macedonia

-

USD: 606.18

-

Local: MKD 22,567

Norway

- No government-mandated minimum wage

Poland

-

USD: 1,122.55

-

Local: PLN 4,666

Portugal

-

USD: 915.79

-

Local: EUR 820

Romania

-

USD: 830.06

-

Local: RON 4,050

Russia

-

USD: 229.45

-

Local: RUB 22,440

Serbia

-

USD: 413.58

-

Local: RSD 73,275

Slovakia

-

USD: 837.61–1,485.37

-

Local: EUR 816

Slovenia

-

USD: 1,403.49

-

Local: EUR 1,254

Spain

-

USD: 1,305.51 (14 payments), 1,480.44 (12 equivalent)

-

Local: EUR 1,166.67 (14), EUR 1,323 (12 equivalent)

Sweden

- No government-mandated minimum wage

Switzerland

- No government-mandated minimum wage

Turkey

-

USD: 585.49

-

Local: TRY 22,104.67

Ukraine

-

USD: 194.13

-

Local: UAH 8,000

United Kingdom

-

USD: 2,219.60

-

Local: GBP 1,982.93

South Africa

-

USD: 279.59

-

Local: ZAR 4,781.27

Kenya

-

USD: 117.21

-

Local: KES 15,120

Morocco

-

USD: 291.74

-

Local: MAD 2,828

Mauritius

-

USD: 326.44

-

Local: MUR 15,000

Cote D'Ivoire

-

USD: 127.44

-

Local: XOF 75,000

Madagascar

-

USD: 57.72–98.11

-

Local: MGA 262,680–446,500

Uganda

-

USD: 35.23

-

Local: UGX 130,000

Countries with the lowest minimum wages (below $500 USD per month)

| Country | Minimum Wage in USD | Minimum Wage in Local Currency |

|---|---|---|

| Albania | 451.72 | ALL 40,000 |

| Argentina | 274.04 | ARS 286,711 |

| Armenia | 242.25 | AMD 93,750 |

| Azerbaijan | 176.47 | AZN 400 |

| Bolivia | 360.23 | BOB 2,500 |

| Brazil | 259.74 | BRL 1,518 |

| China | Based on region Lowest: 258.16 in Guangxi Highest:383.68 in Shanghai | CNY 2,200-2,330 |

| Colombia | 310.73 | COP 1,623,500 |

| Cote D'Ivoire | 127.44 | XOF 75,000 |

| Dominican Republic | 196.86–347.39 | DOP 11,900–21,000 |

| Ecuador | 460 | USD 460 |

| Guatemala | 409.20 | GTQ 3,544.2 |

| Indonesia | 24.54 | IDR 3,96,761 |

| Kenya | 117.21 | KES 15,120 |

| Madagascar | Based on sector and tenure 57.72–98.11 | MGA 262,680–446,500 |

| Malaysia | 363.64 | MYR 1,500 |

| Mauritius | 326.44 | MUR 15,000 |

| Mexico | Based on employee location In NBFZ: 263.94 Outside NBFZ: 175.26 | In NBFZ: MXN 5,206.80 Outside NBFZ:MXN 3,457.40 |

| Morocco | 291.74 | MAD 2,828 |

| Nigeria | 41.94 | NGN 70,000 |

| Pakistan | 90.04 | PKR 25,000 |

| Peru | 275.93 | PEN 1,130 |

| Philippines | 250.56 | PHP 14,028.75 |

| Russia | 229.45 | RUB 22,440 |

| Serbia | 413.58 | RSD 73,275 |

| South Africa | 279.59 | ZAR 4,781.27 |

| Sri Lanka | 41.83 | LKR 12,500 |

| Thailand | 336.42 | THB 11,160 |

| Uganda | 35.23 | UGX 130,000 |

| Ukraine | 194.13 | UAH 8,000 |

Countries with a moderate minimum wage, between $500 and $1,000 USD per month

| Country | Minimum Wage in USD | Minimum Wage in Local Currency |

|---|---|---|

| Bosnia and Herzegovina | 569.08 | BAM 996.78 |

| Bulgaria | 534 | BGN 1,077 |

| Chile | 555.40 | For those above 18 but under 65 years, CLP500,000.00 to CLP510,500.00 per month; and For those under 18 and over 65 years, CLP372,989.00 to CLP382,875.00 per month. |

| Costa Rica | Based on education level 678.99–1,447 | CRC 352,164.91–752,220.04 |

| Croatia | 938.41 | EUR 970 |

| Czech Republic | 839.50 | CZK 20,800 |

| Estonia | 916 | EUR 886 |

| Georgia | 869.96 | GEL 2,375 |

| Greece | 927.23 in 14 payments Equivalent of 1081.40 in 12 | EUR 830 in 14 payments Equivalent to EUR 968.33 in 12 |

| Honduras | 506.79 | HNL 12,597.91 |

| Hong Kong | 810.58 | HKD 6,300 |

| Hungary | 748.65 | HUF 290,800 |

| India | 212.85 – 280.90 (varies by state and skill level) | INR 18,456 – INR 24,356 |

| Latvia | 781.48 | EUR 740 |

| North Macedonia | 606.18 | MKD 22,567 |

| Portugal | 915.79 in 14 payments Equivalent to 1,023.07 in 12 payments | EUR 820 in 14 payments Equivalent to EUR 956.66 in 12 |

| Romania | 830.06 | RON 4050 |

| Slovakia | 837.61–1485.37 | EUR 816 |

| Taiwan | 869.58 | TWD 28,590 |

| Turkey | 585.49 | TRY 22,104.67 |

| Uruguay | 867.42 | UYU 36,180 |

Countries with a high minimum wage, over $1,000 USD per month

| Country | Minimum Wage in USD | Minimum Wage in Local Currency |

|---|---|---|

| Australia | 2742.32 | AUD 3965.847 |

| Austria | 1679.03 | EUR 1,500 |

| Belgium | 2317.60 | EUR 2,070.48 |

| Canada | 1920.91–2433.15 Based on province: Alberta: 1920.91 British Columbia: 2228.25 Manitoba: 2023.36 New Brunswick: 1959.33 Newfoundland and Labrador: 1997.75 Northwest Territories: 2137.73 Nova Scotia: 1945.34 Nunavut: 2433.15 Ontario: 2201.16 Prince Edward Island: 2048.97 Quebec: 2016.07 Saskatchewan: 1920.91 Yukon: 2252.29 | CAD 2598-3290.80 Based on province: Alberta: CAD 2598 British Columbia: CAD 3013.68 Manitoba: CAD 2736.56 New Brunswick: CAD 2649.96 Newfoundland and Labrador: CAD 2701.92 Northwest Territories: CAD 2891.24 Nova Scotia: CAD 2631.04 Nunavut: CAD 3290.80 Ontario: CAD 2977.04 Prince Edward Island: CAD 2771.20 Quebec: CAD 2726.70 Saskatchewan: CAD 2598 Yukon: CAD 3046.18 |

| Cyprus | Based on tenure 1119.04 1007.14 for first 6 months | Based on tenure EUR 1000 EUR 900 for first 6 months |

| France | 1977.19 | EUR 1801.80 |

| Germany | 2406.98 | EUR 2,151.00 |

| Ireland | 2401.72 | EUR 2,146.30 |

| Israel | 1584.91 | NIS 5,880.02 |

| Japan | 1,198.13 (average—varies by prefecture) | ¥173,692 |

| Lithuania | 1034.23 | EUR 1038 |

| Luxembourg | 3452.13 | EUR 3,085 |

| Malta | 1,032.95 | EUR 924.63 |

| The Netherlands | 2800.87 | EUR 2,503 |

| New Zealand | 2354.63 | NZD 1,496.33 |

| Poland | 1,122.55 | 4,666PLN |

| Puerto Rico | 1160 | USD 1160 |

| Slovenia | 1403.49 | EUR 1,254 |

| South Korea | 1571.24 | KRW 2,060,740 |

| Spain | 1305.51 in 14 payments Equivalent to 1480.44 in 12 | EUR 1,166.67 in 14 payments Equivalent to EUR 1323 in 12 |

| United Kingdom | 2219.60 | GBP 1,982.93 |

| United States | 1253.97 is US Federal Minimum Wage Many states enforce a higher minimum wage | USD 1253.97 is US Federal Minimum Wage Many states enforce a higher minimum wage |

Countries with no specified minimum wage

The following countries don't have a government-mandated minimum wage:

- Denmark

- Finland

- Iceland

- Italy (some sectors)

- Norway

- Singapore

- Sweden

- Switzerland

- Norway

However, this doesn't translate into cost savings for employers. Wages are negotiated and set through collective bargaining agreements between employers and trade or labor unions.

Limitations of comparing the minimum monthly wage per country

Employers should consider the following limitations of the country data shared above:

Variable minimum wages

The minimum monthly wages outlined are based on a full-time employee, aged over 18. The minimum salary entitlement often varies, based on factors such as:

- Sector

- Employee age

- Benefit in kind received

- Region

- Level of education

- Role type

- Internship, apprenticeship, or student status

Currency

The USD equivalent to local currency varies, dependent on exchange rates. Employees should usually be paid in their local currency, but exemptions may apply.

Working hours per week

Each country's minimum monthly wage is based on the average number of working hours per week. This varies between countries, ranging from 35 hours per week in France to 48 in Peru. This should be considered when calculating hourly salaries.

Salary payment installments

The article lists monthly salaries based on the number of payments, which varies between countries. Typically, monthly salaries are paid across 12 annual installments. However, a 13th salary, or a 13th and 14th salary payment, are mandatory in some countries. For example:

- It's mandatory to pay an employee a 13th base salary in Brazil, and it's typically paid in two installments, in November and December. In the Philippines, the mandatory 13th base salary is usually paid in December.

- Employers in Greece must pay employees' annual base salaries in 14 payments, with extra payments typically made around Easter, summer, and Christmas. Similarly, in Portugal, the base salary is divided into 14 payments and extra payments are made around Christmas and the summer holidays.

These practices are often mandated by law or collective bargaining agreements and are considered part of the employee's regular compensation, not a bonus.

In other countries, paying salaries in 13 or 14 payments is customary but not mandatory. It can vary across companies and industry sectors, and may include bonuses as well as base pay.

To remain compliant with local labor laws, employers should verify how many salary payments per year are required for their country and industry, and the number of installments the listed minimum monthly wage applies.

Other employee costs to consider

In addition to the minimum wage, employers must be aware of other costs associated with hiring in a particular location. Mandatory employee benefits and paid and unpaid leave entitlement vary between countries, as well as corporate tax rates and mandatory contributions.

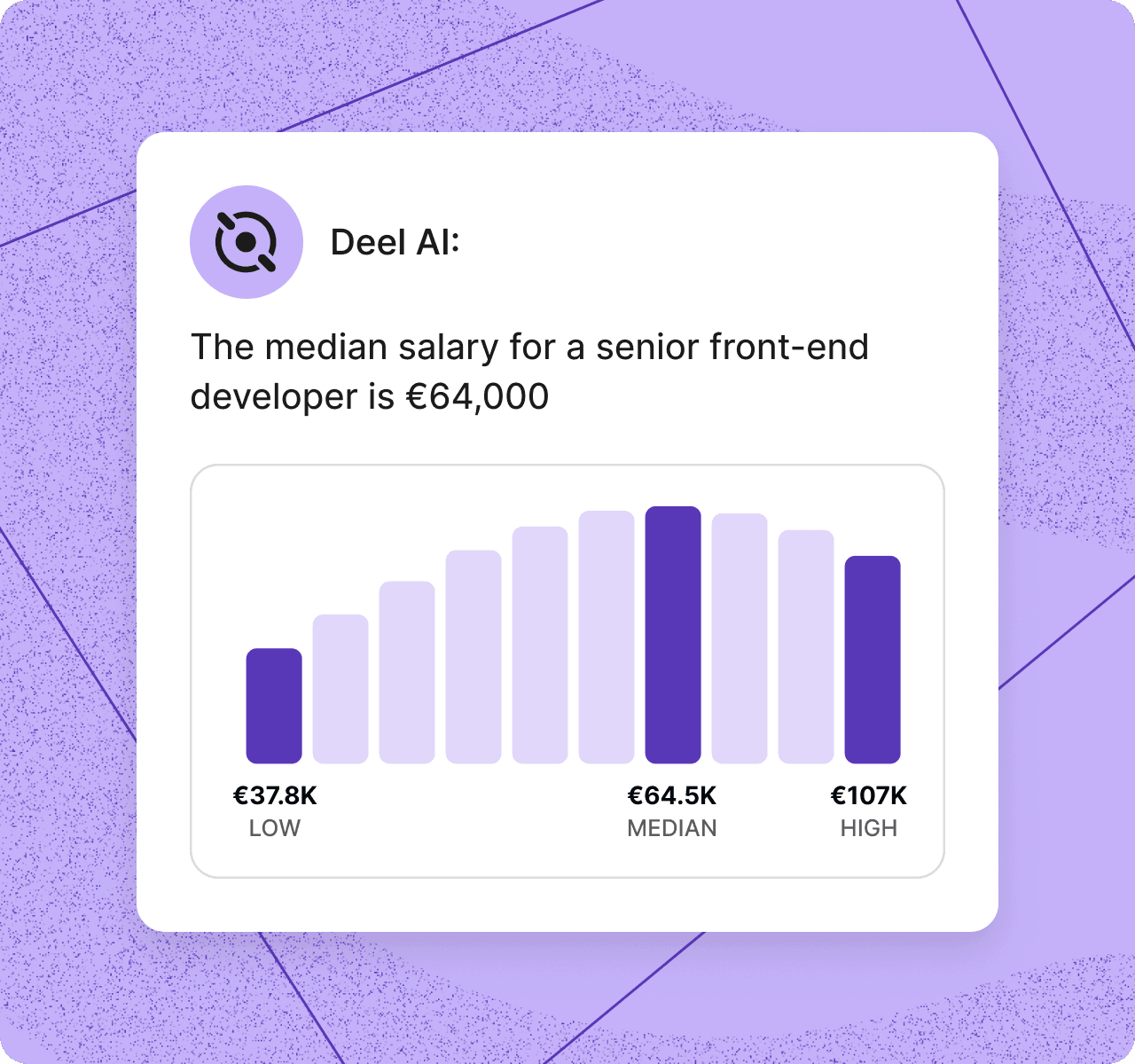

With Deel AI, you can get fast, accurate insights into salary benchmarks and data.

Stay compliant with local labor laws with Deel

Staying compliant with local employment laws (like minimum wages) is the number one concern for many employers wanting to hire internationally. Still, it shouldn’t stop you from diving into the global talent pool.

Deel generates employment contracts that comply with local regulations for every international employee and independent contractor. You don’t need to learn a new set of rules each time you hire in a new country: we take care of it for you.

Book a demo today to streamline international hiring, compliance, and payroll.

Disclaimer: This article is intended for informational use only and shouldn't be considered legal, business, or tax advice. Consult an expert for guidance on your specific case. Users shouldn't rely on this information without independently verifying it.

Further resources

FAQs

What is the highest minimum wage in the US?

The District of Columbia (DC) has the highest minimum wage in the US at $17.50 per hour. The minimum wage will be raised to $18.00 per hour on July 1, 2025.

Learn more in our guide to minimum wage in the US.

What is the lowest minimum wage in the US?

The states with the lowest minimum wage in 2025 are those that use the federal minimum wage rate of $7.25 per hour. These states have not set a higher state minimum wage, so the federal rate applies. The states are:

- Alabama

- Georgia

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Wisconsin

- Wyoming

Note: Georgia and Wyoming technically have state minimum wages below $7.25, but the federal minimum applies to most workers, making $7.25 the effective minimum in these states.

What is the average salary in the world?

The average monthly minimum wage globally is approximately $867.15 USD.

This is a rough estimate and does not account for:

-

Countries with no minimum wage

-

Regional wage variations within countries (e.g., Canada, US, China)

-

Non-standard payment structures (e.g., 14-month salaries in Spain)

What country has the highest minimum wage?

The country with the highest minimum wage is Luxembourg, with a monthly minimum wage of approximately $3,452.13 USD.