Global payroll

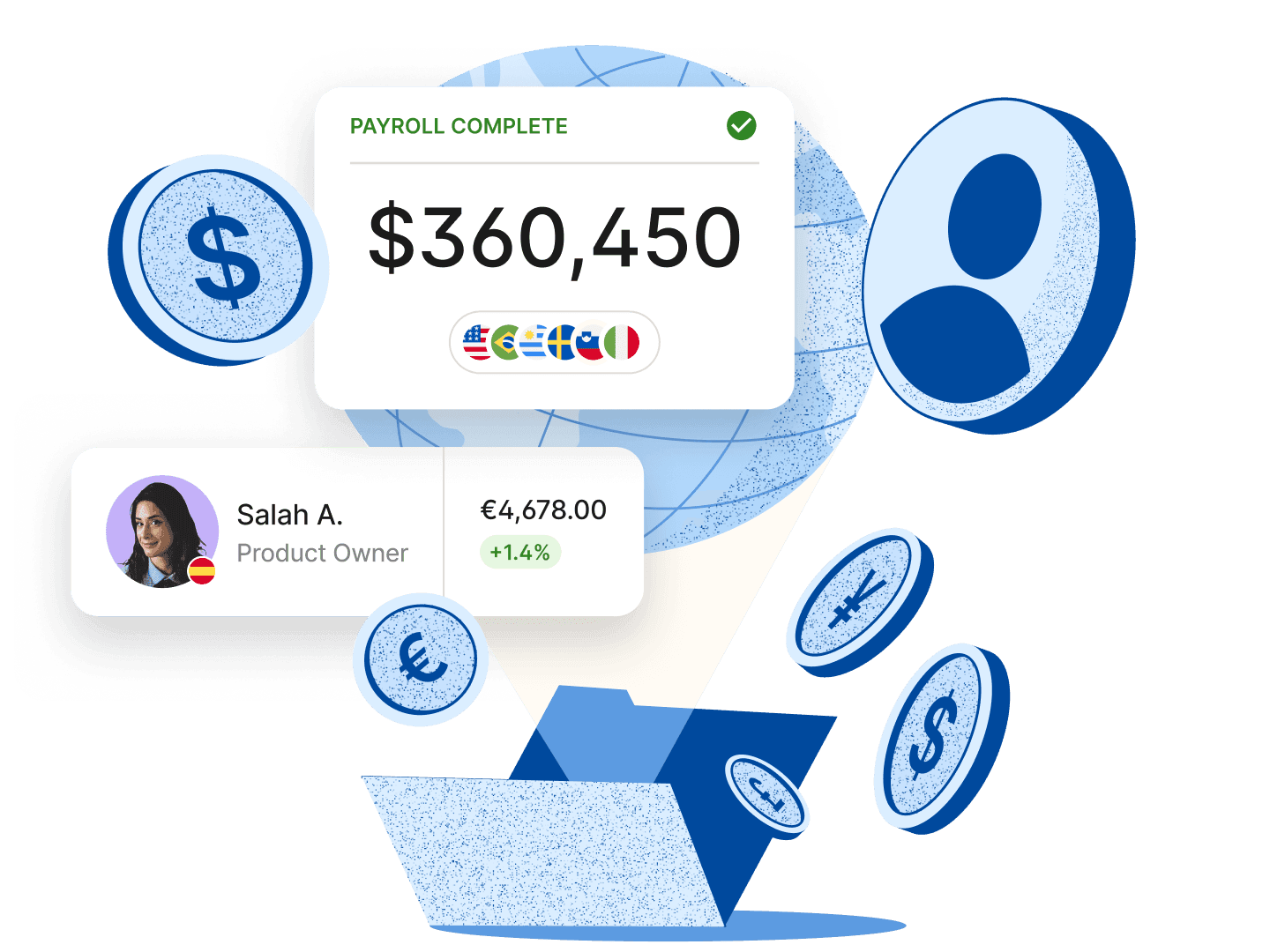

Global payroll is hard. We make it easy by managing it for you.

We’re one of the fastest fully managed payroll providers, cutting your processing time by 60% with in-house, local compliance expertise in 130+ countries so you’re always audit-ready.

Simplify your workload so you can focus on growth

All you need to do is submit payroll data, review the final package, and approve from one dashboard. We take care of the rest, like instantly calculating gross-to-net payroll, taxes & withholdings, benefit deductions, and currency conversions.

- 67% ROI according to 2025 Forrester TEI study

- 2,000+ in-house experts in payroll, HR, and legal

- Deel AI included for instant compliance & HR answers

- Dedicated Deel Payroll Managers local to your employees

- 24/7 support via email, phone, live chat, Slack, and Teams

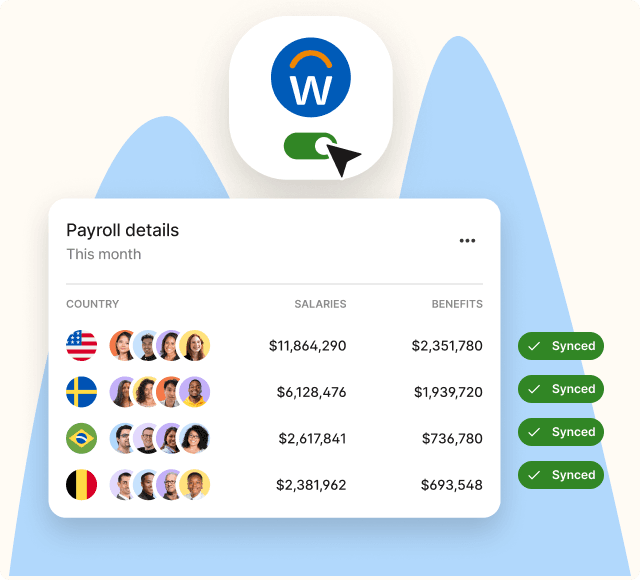

Expand your view by integrating with leading accounting platforms

Don’t say goodbye to your favorite tools like Workday. Get secure, flexible, and complete data flow across HR and payroll with our 110+ advanced integrations and API for human capital management (HCM) and enterprise resource planning (ERP).

- Workday Global Payroll Cloud-certified for faster data syncs

- Deep partnerships with SAP, Oracle, UKG, and more

- Custom connections and automations with API

- Dedicated integration support for a smooth implementation

Win back time and protect your business with our compliance expertise

We proactively monitor local labor laws, tax updates, and filing deadlines in 130+ countries. You receive alerts and action plans anytime something changes.

Automated platform updates when regulations change

Local tax filing & payroll authority compliance

Instant tax calculations & automated salary payments

Payslip automation & detailed deductions breakdown

Country-specific monitoring & tailored workforce reports

HR-compliant employee onboarding & offboarding

See it in action

Experience how easy Deel Global Payroll is to use

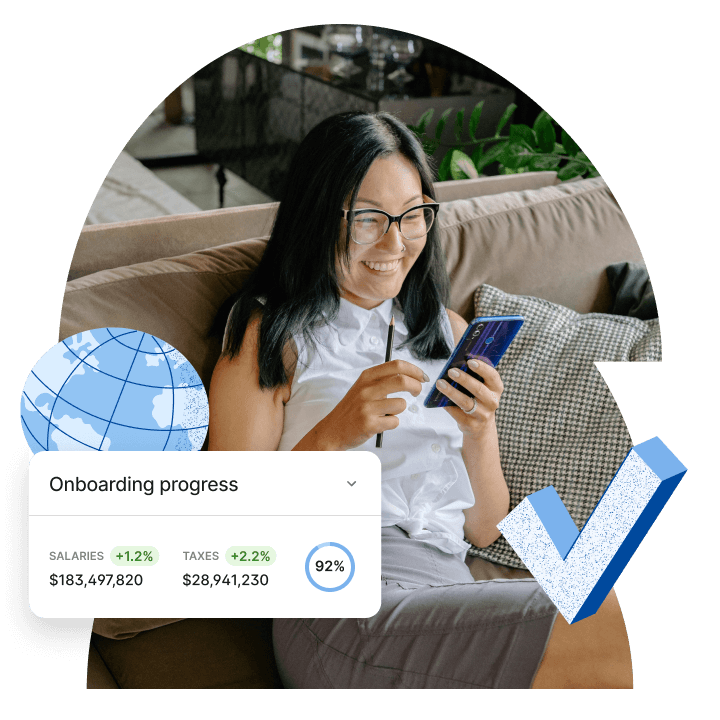

Lightning-fast onboarding and payroll setup for growing teams

Our implementation process doesn’t involve third parties, so you get up and running faster. Enterprises can go live in 1-3 months per entity. SMBs can setup payroll in as little as 10 days through our self-guided onboarding.

- Dedicated Deel Implementation Manager per country

- Dedicated Deel Onboarding Manager per region

- 16+ years of experience supporting enterprises through our payroll acquisitions

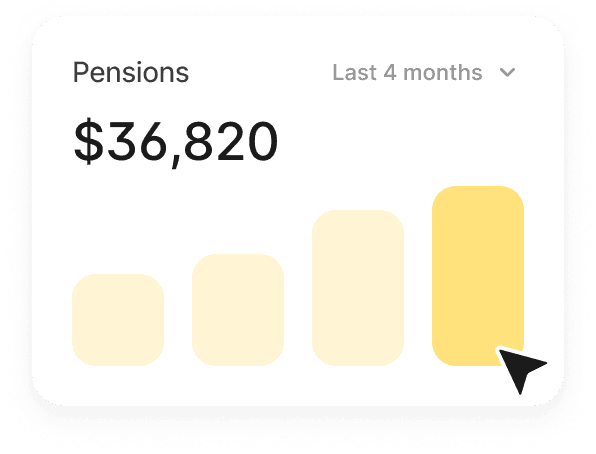

reporting

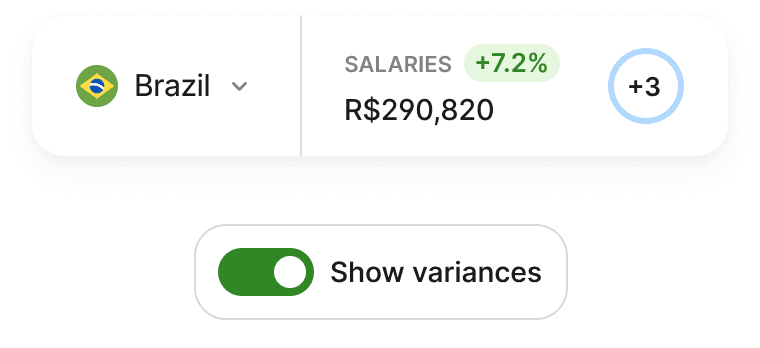

Track global payroll costs with real-time reporting and analytics

Global analytics

Understand your global payroll spend at a glance. Our gross-to-net payroll reporting compares bonuses, benefits, employer taxes, and total costs in a single standardized currency across all countries and entities.

Payroll reports

Spot payroll errors and currency mismatches with ease. Our multi-country payroll reporting gives you a consolidated view of wages, taxes, deductions, and variance tracking across payroll cycles.

Custom dashboards

Build custom payroll dashboards for finance, HR, and leadership teams. Filter reports by category—like 401(k), pensions, or social security—to generate actionable payroll insights in real time.

Advanced security, data protection, and reliability

We meet the highest standards of data privacy, cybersecurity, and regulatory compliance. It’s what enterprises expect and every size business deserves. You’ll have full confidence that sensitive payroll data is protected in every country you hire.

- SOC 2, SOC 1, and SOC 3 certified

- GDPR, CCPA, ISO 27001 compliant

- AES-256 encrypted and HIPAA security

Every country you can run compliant payroll

Albania

Angola

Argentina

Armenia

Australia

Austria

Bahrain

Bangladesh

Belgium

Benin

Bolivia

Bosnia and Herzegovina

Essential global payroll resources

We’ve poured our expertise into a series of thoughtfully crafted, easy-to-follow guides and templates for businesses of all sizes.

Excellent global payroll

4.7/5 based on 6,183+ reviews

FAQs

What does managed payroll mean and how is it different from self-service payroll?

Managed payroll providers handle several aspects of payroll processing and management on behalf of their clients. This includes calculating employee wages and taxes, processing payroll, generating pay stubs, and filing tax forms with the appropriate authorities.

Self-service payroll typically involves the employer handling most or all of these tasks in-house, using either manual or automated systems.

The key difference between managed payroll and self-service payroll processing is the level of involvement and responsibility required of the employer (you). With managed payroll, you can outsource many tasks and activities of the payroll process to the payroll processing vendor (us). This can save you significant time and effort to then focus on other strategic aspects of running your business.

How does Deel ensure compliance with tax and labor laws in different countries?

We maintain in-house legal and compliance experts in 130+ countries, continuously monitoring regulatory changes to ensure compliance. Our platform is updated automatically to reflect new tax laws, labor regulations, and statutory requirements. We also collaborate with local legal partners and participate in payroll compliance networks and industry forums to stay ahead of global payroll requirements.

Our Compliance Hub provides real-time notifications to end users in the Deel platform for employment law changes. It automatically scans, collects, and explains the latest relevant regulatory changes globally.

Lastly, Deel AI provides granular insights into your team and answers to local compliance laws. Trained by HR and compliance experts across 130+ countries, it's integrated with your people data for smarter, faster decision-making. Save time manually searching for compliance answers and get curated insights based on your people data.

What is the price of Deel Global Payroll?

Deel Global Payroll starts at $29 per employee/month and is based on a tiered employee model. It includes a one-time set-up implementation fee ($1000 USD per entity). The total cost will also vary according to the number of payroll cycles in your country. Other factors that may influence the price include onboarding and offboarding needs.

The key difference between fully managed payroll and standard payroll processing is the level of involvement and responsibility required of the employer. With fully managed payroll, the employer can outsource the entire payroll process to the payroll processing company, which takes care of everything from start to finish. This can save time and effort for the employer, who can focus on other aspects of running their business.

Do you leverage in-country partners (ICPs)?

We currently support 53 countries with our single native payroll calculation engine, delivering instant gross-to-net calculations and real-time payroll. We only use ICPs in specific countries where we haven't localized the engine yet. With our native engine and ICPs, we deliver in-house payroll service and support to our clients across all 130 countries.

Can you pay my employees' salaries and taxes on my behalf?

Yes, leverage Deel Treasury Services for employee payments. Depending on the country, we can pay the liabilities to the government and your employees on your behalf. If you prefer to pay, we will provide you with the payment files to help you expedite the execution. There is an additional fee for Deel Treasury Services.

What type of integrations does your global payroll solution offer?

Deel provides 110+ enterprise-grade integrations and APIs for secure, flexible, and seamless data flow. Deel Global Payroll integrates with leading HRIS/HCM platforms, including Workday, SAP SuccessFactors, UKG, HiBob, BambooHR, and more. We are a GPC-certified (Global Payroll Cloud) partner of Workday for seamless, comprehensive integration.

We provide an open API that allows you to seamlessly integrate Deel Global Payroll with your existing tech stack, including ERP, accounting system, time tracking, learning management, expense management, benefits administration, and more.

What are the steps of the implementation process?

- Kick-off meeting between Deel and client stakeholders to discuss payroll requirements and align on desired go-live dates for each country entity

- Discovery call about payroll setup and migration for each entity

- Payroll system configuration and integration build

- Personalized training and QA testing to ensure a smooth transition

- Launch and go-live

Because Deel doesn't involve third party vendors or consultants for global payroll implementation, our process is much quicker than any other provider.

Do you offer other payroll solutions besides Deel Global Payroll?

Yes, we provide a comprehensive portfolio of payroll solutions to best serve the needs of our clients. In the US, we provide Deel US Payroll and Deel PEO.

If you’re looking for a self-service payroll option, we offer Deel Local Payroll powered by PaySpace in the UK, Brazil, and Africa. Deel EOR is also available for hiring employees in 150+ countries without the need to open an entity.

Deel makes growing remote and international teams effortless

150+

countries

37,000+

customers

200+

in-house experts