Article

12 min read

10 Essential Steps to Grant Equity to International Employees

Equity

Author

Shannon Ongaro

Last Update

January 27, 2026

Table of Contents

1. Create a standardized equity grant template

2. Review equity grant details thoroughly

3. Consult legal and equity experts for compliance

4. Understand and customize vesting structures

5. Assess tax implications by jurisdiction

6. Choose the right type of equity instrument

7. Establish robust compliance and registration processes

8. Communicate equity value and obligations clearly with employees

9. Collaborate across legal, finance, and HR teams

10. Monitor, evaluate, and adjust your equity plan regularly

Deel: Simplifying global equity management

Explore this topic with AI

Key takeaways

- A repeatable global equity process starts with standardized templates, rigorous pre-issue reviews, and clear cross-functional ownership.

- Compliance hinges on localizing vesting and instruments, tracking country-specific tax triggers and filings, and communicating value and obligations in plain language.

- Deel helps you operationalize global equity in 90+ countries by automating local compliance workflows and payroll tax events, while integrating with tools like Carta for unified reporting.

Offering equity and perks internationally can transform your talent strategy—if you do it compliantly. The right plan aligns incentives across borders, attracts experienced candidates, and boosts retention, but it also introduces securities, tax, and payroll complexity.

This playbook shows HR and finance leaders how to offer equity and perks internationally with a repeatable, compliant process. You’ll learn how to standardize grants, tailor vesting, navigate tax triggers, and coordinate legal, finance, and HR so employees understand and value what they receive.

Throughout, we highlight where compliance automation and international payroll integration reduce risk and administrative work. Use these ten steps as your roadmap to launch or scale a thoughtful global equity program.

1. Create a standardized equity grant template

An equity grant template is a standardized set of documents and workflows that define how you issue equity across roles and countries. It captures required terms, local disclosures, and approval steps, ensuring every grant is accurate, consistent, and auditable. Use an equity grant template to ensure consistency and accuracy in managing equity grants, especially at scale.

Build your template to include:

- Plan name and entity, grant date, number of options or units, strike price or reference price

- Vesting schedule (cliff, frequency, acceleration), termination and forfeiture rules

- Country addenda with securities, exchange control, and labor disclosures

- Signature blocks, board approvals, and acceptance workflow

Equity & Token Services

2. Review equity grant details thoroughly

Before issuing offers, double-check the essentials to avoid costly errors and rebuilds later. Verify:

- Quantity and instrument type match approvals and the cap table

- Vesting structure, cliff, and frequency align with policy and local norms

- Strike price is at or above fair market value and in the correct currency

- Correct employing entity, employee legal name, and local addenda are attached

- Eligibility criteria, probation periods, and start dates are reflected

Establish a review protocol: a 4-eyes sign-off, automatic validation (currency, dates, FMV), and a pre-issue checklist. Accurate documentation underpins compliance and employee trust.

3. Consult legal and equity experts for compliance

Global grants cross employment, tax, and securities laws. Engage a cross-functional team with local expertise early.

Role matrix

- Legal: Interpret local securities, employment, data privacy, and exchange control rules; draft plan/addenda

- Tax advisors: Map taxable events and withholding/filing obligations; advise on employer social charges and reporting

- Finance: Budget equity cost, manage dilution, approve FMV, and coordinate accounting (IFRS/US GAAP)

- HR/People: Own eligibility, communications, and employee experience

- Equity admin/Payroll: Operationalize grants, withholdings, filings, and reporting

Key focus areas

- Legal risks: Offer timing, solicitation, data transfer, and insider rules

- Local securities laws: Filings, exemptions, translations, marketing restrictions

- Labor regulations: Enforceability of forfeiture and post-termination terms, clawbacks, and benefit classification

Compliance

4. Understand and customize vesting structures

A vesting structure is the schedule and rules that determine when an employee earns ownership rights in their equity over time (e.g., cliffs, monthly vesting, performance triggers, and forfeiture on exit). Thoughtful vesting boosts retention across distributed teams and influences tax timing and treatment.

Tailor vesting to local expectations and plan goals, noting that vesting can influence when tax arises and what must be withheld. Common practices globally include:

- United States: 4-year vest with 1-year cliff; monthly vest thereafter; double-trigger acceleration for some roles

- United Kingdom/IE: Time-based vesting over 3–4 years; performance conditions more common in later-stage companies

- DACH/Nordics: Time-based vesting with annual or quarterly cadence; emphasis on local tax-favored schemes where available

- APAC: Mix of time- and performance-based vesting; local addenda often required

5. Assess tax implications by jurisdiction

Tax treatment varies widely. Taxable events may occur at grant, at vesting, or on exercise/settlement, and employer reporting and withholding obligations differ by country. Some jurisdictions impose employer social contributions that can rise with share value, increasing costs as prices climb.

Create a country-by-country register that tracks:

- Tax triggers (grant, vest, exercise/settlement, sale)

- Employee taxes (income, payroll, capital gains) and required withholdings

- Employer obligations (withholding, social contributions, filings)

- Deadlines, forms, translations, and employee self-filing steps

Partner with local tax advisors as you enter new jurisdictions and before large grant cycles.

Deel Payroll

6. Choose the right type of equity instrument

Consider legal frameworks, tax regimes, employee expectations, and administrative effort when selecting instruments:

- Stock options: Right to purchase shares at a set strike price after vesting

- RSUs: Promise to deliver shares (or cash equivalent) at vesting/settlement

- PSUs: RSUs that vest on performance goals

- Phantom stock/SARs: Cash-settled units tied to share value; no actual shares issued

Most countries allow offering equity, but tax and compliance rules vary widely—plan terms should adapt to local law.

| Instrument | What it is | Pros | Cons | Common use cases |

|---|---|---|---|---|

| Stock options | Right to buy shares at strike price | Aligns with upside; employee-funded exercise | May trigger tax at exercise; admin for FMV/409A equivalents | Early-stage tech; growth roles |

| RSUs | Shares/cash delivered at vest | Simple to value; no exercise required | Tax due at vest/settlement; needs withholding | Mid/late-stage; global consistency |

| PSUs | RSUs with performance gates | Links pay to outcomes | More complex tracking | Leadership; sales/operations |

| Phantom/SARs | Cash linked to share value | Avoids securities filings in some markets | Cash cost; may feel less “ownership” | Countries with strict securities or FX controls |

7. Establish robust compliance and registration processes

Before issuing equity in a new country, check securities, exchange control, and labor rules; non-compliance can trigger penalties and bar future grants. Many jurisdictions require filings, translations, employer registrations, or employee notices. A consistent global plan with localized addenda simplifies administration across regions.

If you engage talent via an Employer of Record, remember the equity must be granted by your company, not the EOR entity; separate equity agreements are typically required. Map all filings and consents by country, assign owners, and calendar deadlines.

8. Communicate equity value and obligations clearly with employees

Employees should understand both the upside and the obligations. Explain vesting, dilution, and potential outcomes—and clarify tax triggers, withholding, and any required self-filing in plain language.

Provide:

- A personalized grant summary and plain-English equity overview

- Country-specific tax guidance and links to official forms or portals

- A timeline of grant, vesting, settlement/exercise, and what happens on exit or relocation

- FAQs and an employee portal for tracking, documents, and support

9. Collaborate across legal, finance, and HR teams

A unified operating model reduces risk and improves employee experience. Convene a core project team for plan design and ongoing governance.

Recurring ownership checklist

- Legal: Update plan/addenda; monitor regulations; oversee data privacy and securities compliance

- Tax/Payroll: Maintain tax registers; configure withholdings; submit filings and remittances

- Finance: Approve FMV; expense recognition; dilution modeling; audit support

- HR/Equity Admin: Eligibility, grants issuance, employee communications, lifecycle events

- IT/Security: Access controls, document retention, and data residency

This coordination helps you handle local complexities efficiently and compliantly.

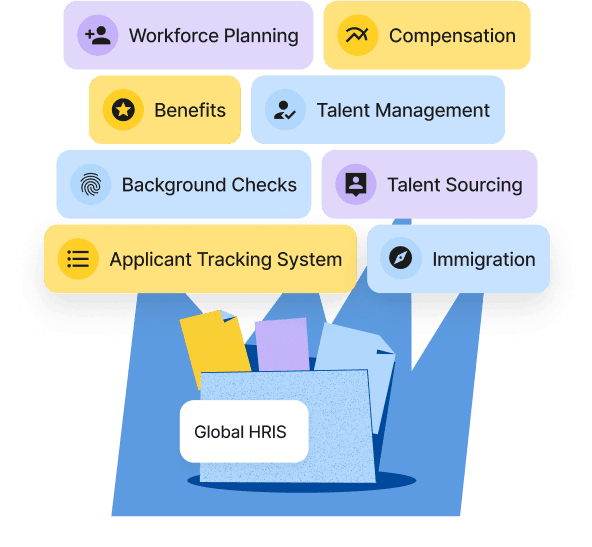

Deel HR

10. Monitor, evaluate, and adjust your equity plan regularly

Schedule periodic reviews—at least annually and before large grant waves—to assess plan effectiveness, market competitiveness, and compliance status. Track regulatory and tax updates in key jurisdictions and adjust instruments, vesting, or processes as needed. Leverage Deel’s automation to monitor filings and expirations, trigger country-specific workflows, and consolidate reporting across entities.

Deel: Simplifying global equity management

Deel makes it easy to grant and manage employee equity for global teams in 90+ countries, with built-in compliance support. Our Equity & Token Services and in-house specialists help you understand your equity options, handle local tax and reporting requirements, and proactively flag regulatory changes so you stay compliant without extra admin.

Deel also connects with your existing equity management system (like Carta) to sync equity data, centralize total compensation in one place, and generate clear reports on taxable events and employee rewards. Deel never holds the securities, only processes payroll for taxable equity events.

Take a deeper look at how Deel operationalizes equity globally, or book a demo to speak with an expert.

Leading Global Hiring Platform

FAQs

What types of international workers are eligible to receive equity?

Companies can grant equity to full-time employees, contractors, and EOR hires, but each category carries distinct legal, tax, and documentation requirements.

How can companies ensure compliance with local laws when granting equity?

Consult local legal experts, map securities and employment rules, and maintain country addenda, registrations, and proof of employee disclosures for every grant.

What are the common tax considerations for international equity grants?

Taxable events may occur at grant, vesting, exercise/settlement, or sale, and both employee and employer obligations vary by country—plan for withholdings and reporting.

How should vesting schedules be structured for global teams?

Use multi-year vesting with clear cliffs and cadence, then localize for legal norms and tax timing while aligning with retention goals.

What tools help manage equity grants across multiple countries?

Global equity and HR platforms like Deel centralize grants, automate compliance and payroll withholding, and provide employees a clear portal for documents and timelines.

Disclaimer: The information available in this article is provided for general informational purposes and should not be treated as legal and/or accounting advice; consequently, you should not rely upon this material for making any business decision. Seek professional advice before taking action.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.