Article

8 min read

The Paycheck Paradox: Do People Really Understand Where Their Paychecks are Going?

Worker experience

Deel news

US payroll

Author

Deel Team

Last Update

September 04, 2025

Table of Contents

People are stressed about payroll accuracy, and that could potentially get worse with AI.

People say they’re keeping a close eye on their earnings, but how close?

More people know how much they’re paying for things like Netflix than the amounts of their payroll deductions.

As workers age, they develop more confidence in being able to explain pay deductions

Where’s the confusion coming from, and how can employers help?

Thanks to a veritable parade of banking apps and online workplace resources, it should be easier than ever to know the ins and outs of your paycheck and where your hard-earned money is going before it hits your account. Truth is, it’s complicated.

To explore just how much people understand their paychecks, we recently conducted research that reveals some surprising disconnects. According to a survey of 1,000 U.S.-based, full-time employees, while a striking 80% of workers say they monitor their bank accounts closely on payday and nearly half check their paystubs weekly, almost a third are confused about their deductions.

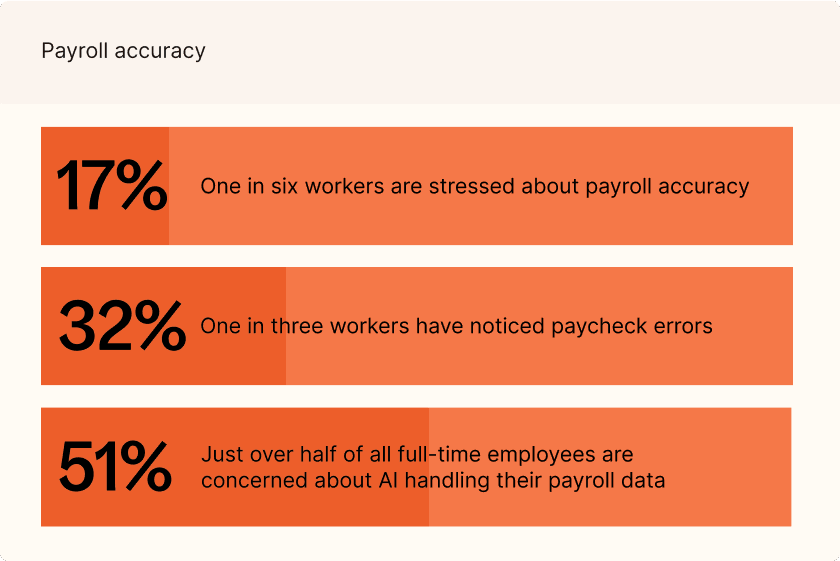

People are stressed about payroll accuracy, and that could potentially get worse with AI.

Given that nearly a third of respondents have detected errors in their paychecks at some point, their stress is not unfounded. And as artificial intelligence (AI) increasingly gets incorporated into payroll systems, that anxiety may intensify.

- One in six workers (17%) are stressed about payroll accuracy

- One in three workers (32%) have noticed paycheck errors

- Just over half (51%) of all full-time employees are concerned about AI handling their payroll data

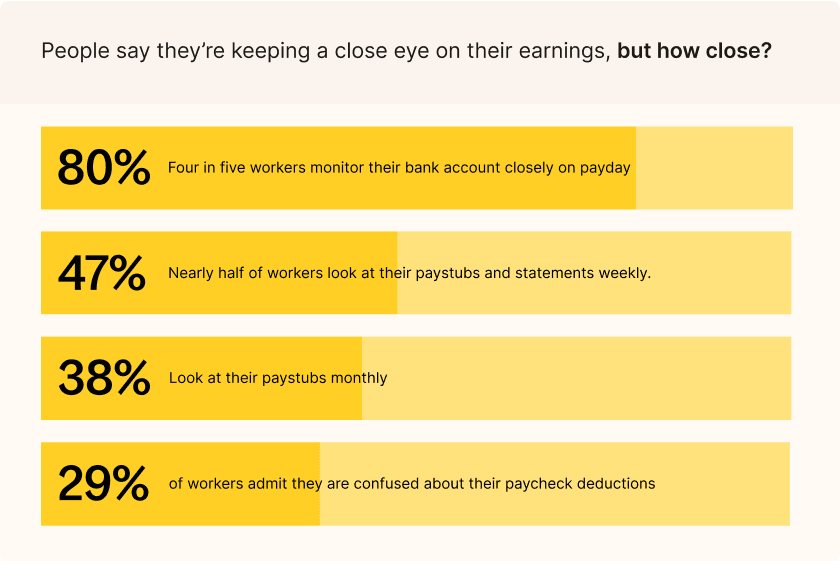

People say they’re keeping a close eye on their earnings, but how close?

The majority of workers actively check their paystubs and monitor their bank accounts on payday, but do they know what they’re looking at?

👀 on their paycheck:

- Four in five workers (80%) monitor their bank account closely on payday

- Nearly half (47%) of workers look at their paystubs and statements weekly, while another 38% look at them monthly

- For those who make under $100,000, the weekly vigilance is higher:

- Make less than $100,000: 52%

- Make more than $100,000: 41%

- For those who make under $100,000, the weekly vigilance is higher:

- Only 2% of workers say they never look at their paystubs/statements

- Of the 98% who do look at their paystubs/statements, 63% look at their paystubs to check for inaccuracies or mistakes every pay period (1-2 times a month), while 22% only check it when they notice a change in pay

- While the majority of people say they are actively checking their paystubs and monitoring bank accounts on payday, confusion abounds:

- 29% of workers admit they are confused about their paycheck deductions

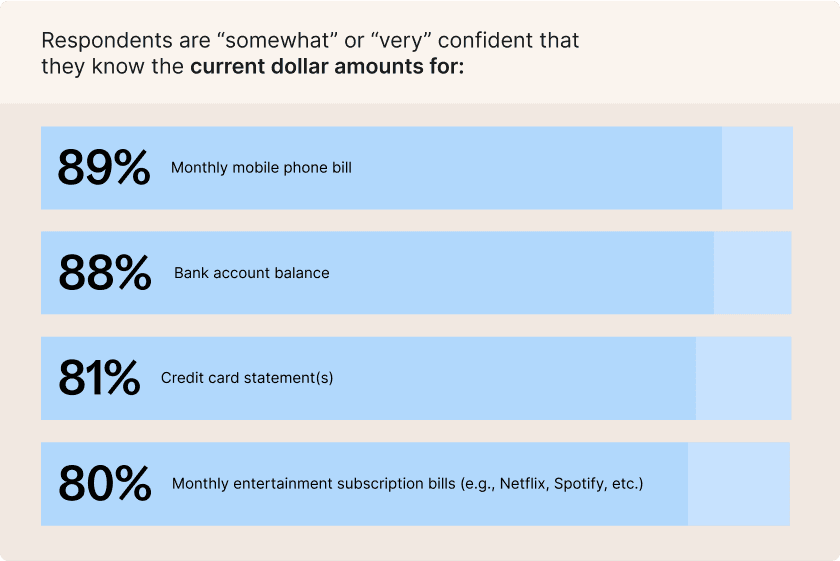

More people know how much they’re paying for things like Netflix than the amounts of their payroll deductions.

According to the research, workers are more confident they know the amounts of their streaming subscriptions and phone bills than whether they understand critical paycheck deductions like federal taxes, health insurance premiums, and retirement contributions. Often the amounts being deducted from paychecks are much higher than streaming service bills, but people still don’t know them. Is there a level of willful ignorance at play here?

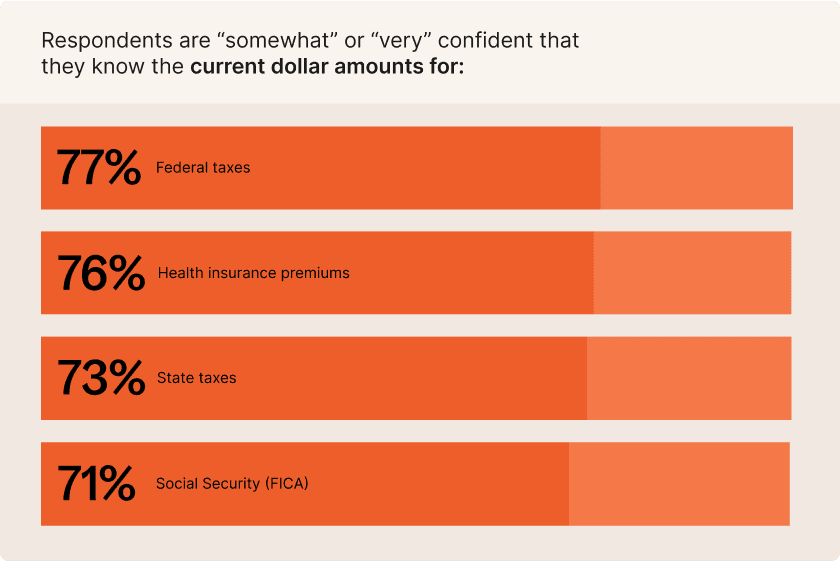

- Respondents are “somewhat” or “very” confident that they know the current dollar amounts for:

- Monthly mobile phone bill: 89%

- Bank account balance: 88%

- Credit card statement(s): 81%

- Monthly entertainment subscription bills (e.g., Netflix, Spotify, etc.): 80%

- Respondents are “somewhat” or “very” confident that they know the current dollar amounts deducted from their paycheck for:

- Federal taxes: 77%

- Health insurance premiums: 76%

- State taxes: 73%

- Social Security (FICA): 71%

- Retirement contributions: 70%

- Other insurance premiums (e.g.life, disability, etc.): 64%

- Other deductions (e.g., onsite parking): 53%

- Nearly one in 10 say they are “not at all confident” about knowing the dollar amounts for federal (8%) or state taxes (7%) deducted from their paychecks

As workers age, they develop more confidence in being able to explain pay deductions

- Boomers and Gen X reported more confidence in being able to fully explain paycheck deductions compared to Gen Z and Millennials:

- 63% of Boomers feel confident in explaining federal income tax withholding compared to 27% of Gen Z and 34% of Millennials

- The same percentage (63) of Boomers feel confident in explaining FICA compared to 28% of Gen Z and 33% of Millennials

- 53% of Boomers feel confident in explaining state tax withholding compared to 22% of Gen Z and 35% of Millennials

Where’s the confusion coming from, and how can employers help?

In part, paychecks in the U.S. don’t include standard deductions and tax codes. FICA, Social Security, Medicare, expense reimbursements, etc. can be different from employer to employer resulting in confusion on which deductions are what, if they are being deducted or added to pay, and if they are pre or post-tax deductions. But there’s more to it.

It’s clear that workers need greater payroll transparency and a boost to their financial literacy. Stressed out workers who aren’t informed can’t work to their fullest potential.

This doesn’t have to be a heavy lift for finance or people teams. It can be as simple as:

- Breaking down paychecks clearly:

- Ensure payslips use clear, human-readable descriptions, instead of sometimes cryptic codes like “401K PRE” or “MED EE.” Instead, consider using “401k Pre-Tax” or “Medical Health Deduction—EE Only.”

- Tying payslip literacy to financial literacy training:

- Teach employees how to understand their net income, track deductions year-over-year, and plan for benefits changes or withholding adjustments by creating an internal training that employees must complete during onboarding and once per year thereafter.

- Creating a “How to Read Your Paycheck” guide:

- Build an easy-to-read document for employees to access and reference that describes all earning codes and deductions. Showing a picture of a redacted payslip with examples would be helpful to demonstrate to employees.

- Hosting “Payroll Office Hours:”

- Have your payroll team available for drop-in time monthly or quarterly to answer questions about paychecks, taxes, changes in deductions, etc.

As employee engagement globally hovers at near dismal lows of less than a quarter (23%), employers who invest in clear compensation education will have a competitive edge. The boost to confidence about their hard-earned wages and knowledge about savings and deductions can directly drive engagement.

Methodology

Deel generated this research using an online survey prepared by Method Research and distributed by Cint among n=1,000 white-collar full-time workers (age 18+) who work in the technology, healthcare, and finance sectors. The sample was split between four age groups by the generation of respondents (Gen Z, Millennials, Gen X, and Boomers) and a spread of company sizes. Data was collected from February 11 to 18, 2025.