Deel Payroll

From startups to enterprises, we’ve got payroll covered

From startups to enterprises, we’ve got payroll covered

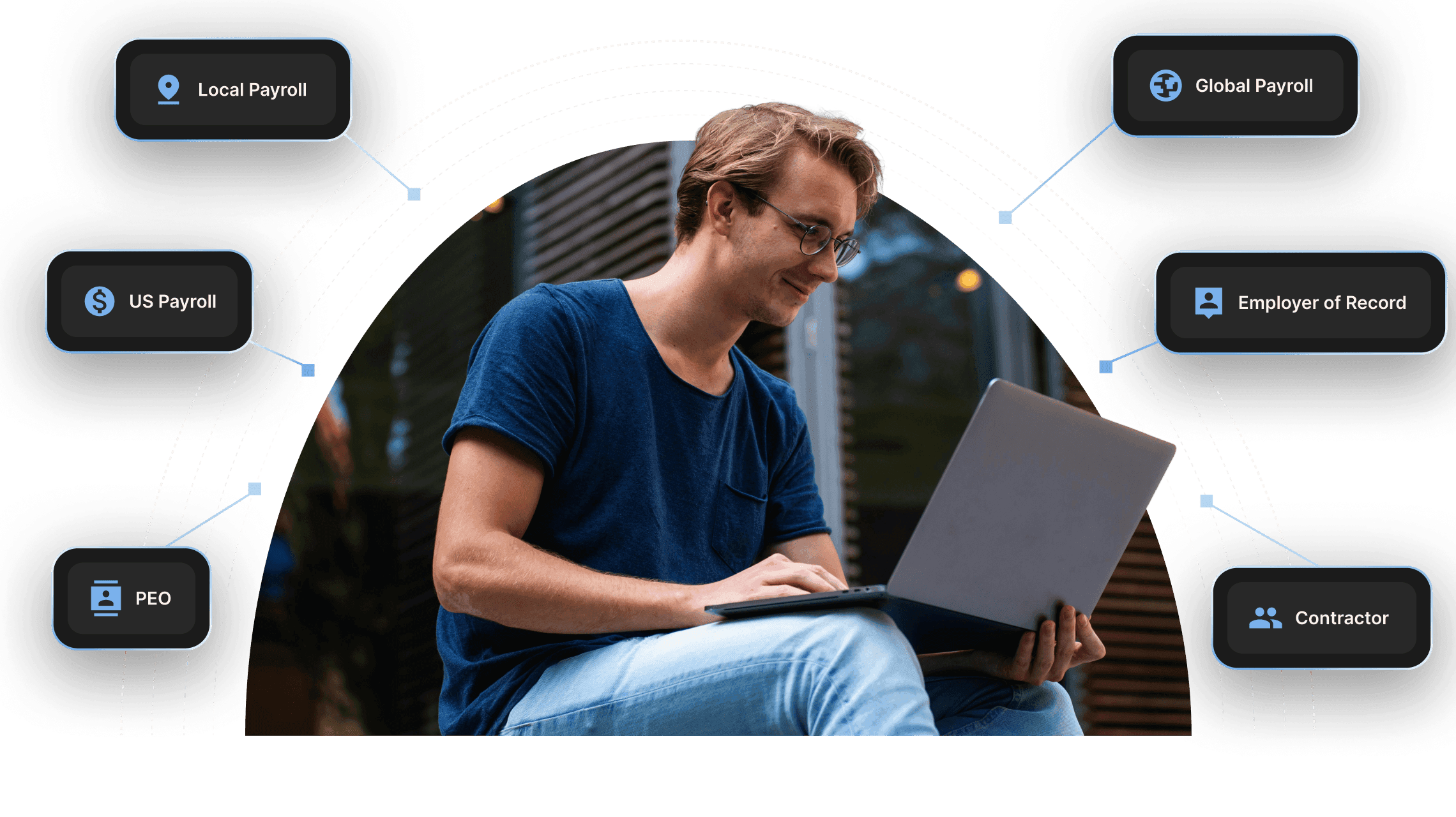

Deel Payroll is a product suite that helps you hire and pay employees & contractors in 130+ countries. Whether through our entities or your own, everyone gets paid on time, faster, in full compliance with local laws.

Excellent global payroll software

4.7/5 based on 6,234+ reviews

Everything needed for a global team in one platform

One global engine

Get more control and run faster cycles

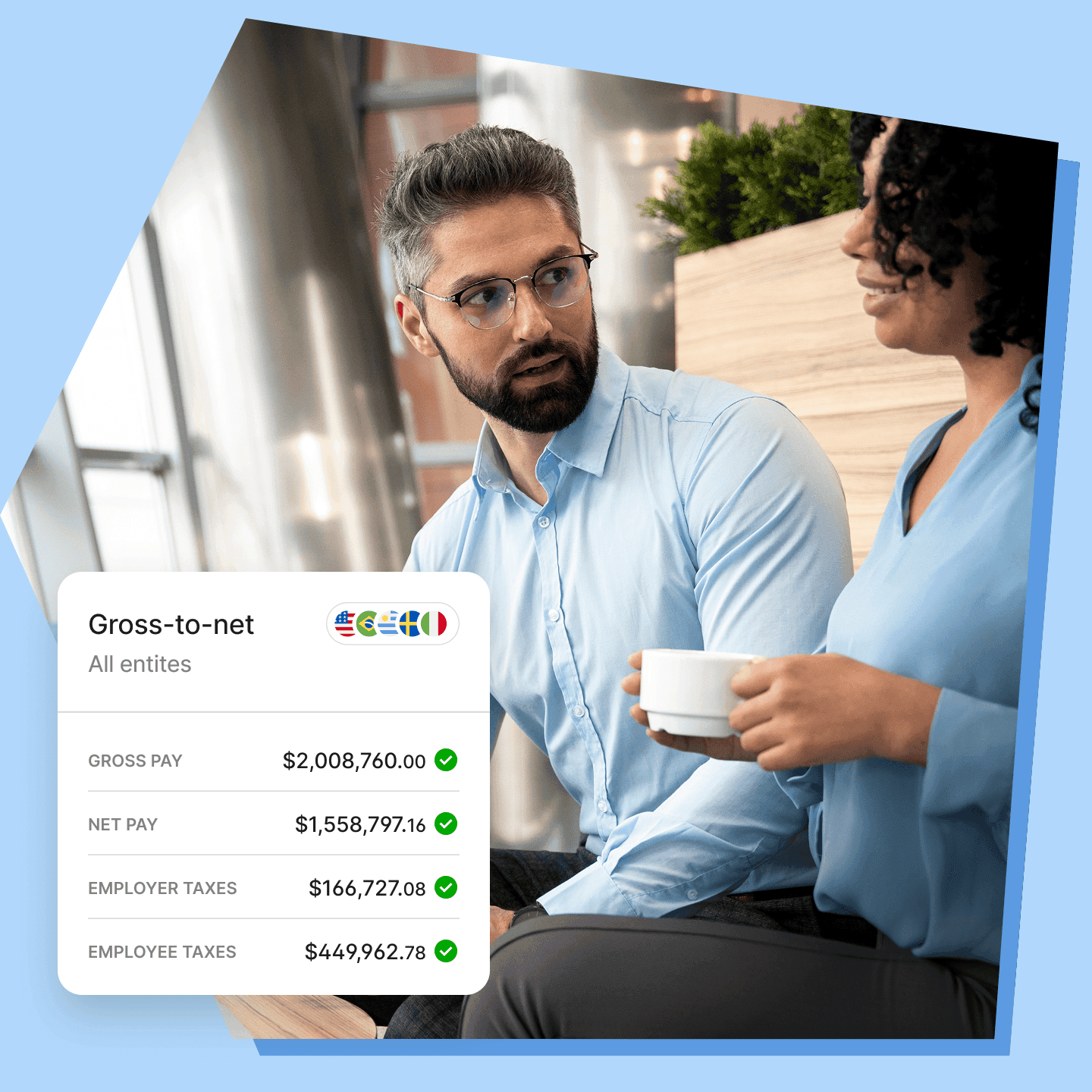

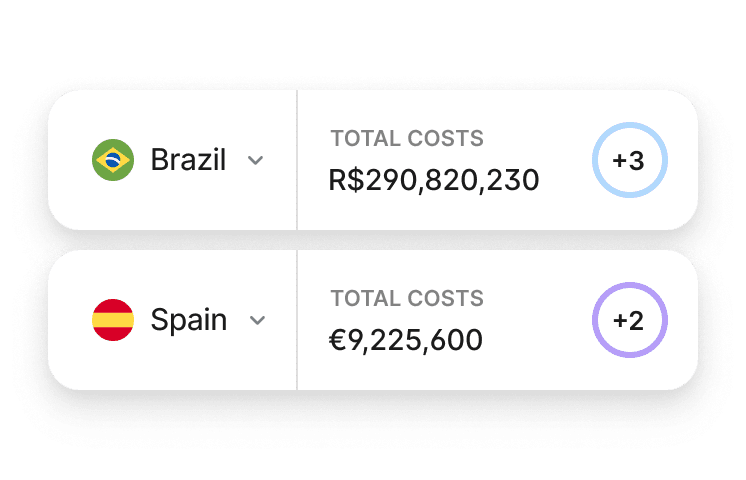

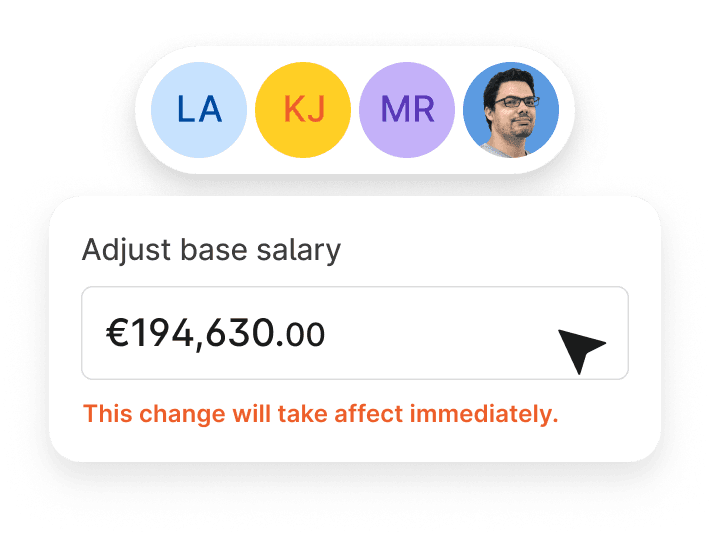

We just set a new standard for payroll efficiency. Our single calculation engine was built in-house to replace the patchwork method of local systems. With instant visibility of gross-to-net costs, you can make changes to payroll in real time.

One platform, 150+ countries

Say goodbye to your fragmented systems. Run payroll, consolidate data, unify workflows, and manage HR for your entire global team.

Deel Payroll Connect

Centralize global payroll data and workflows from in-country providers into one standard Gross-to-Net report within Deel.

Real-time payroll

Preview payroll data instantly as you make changes. From salaries to taxes, calculations update live so there’s no month-end surprise.

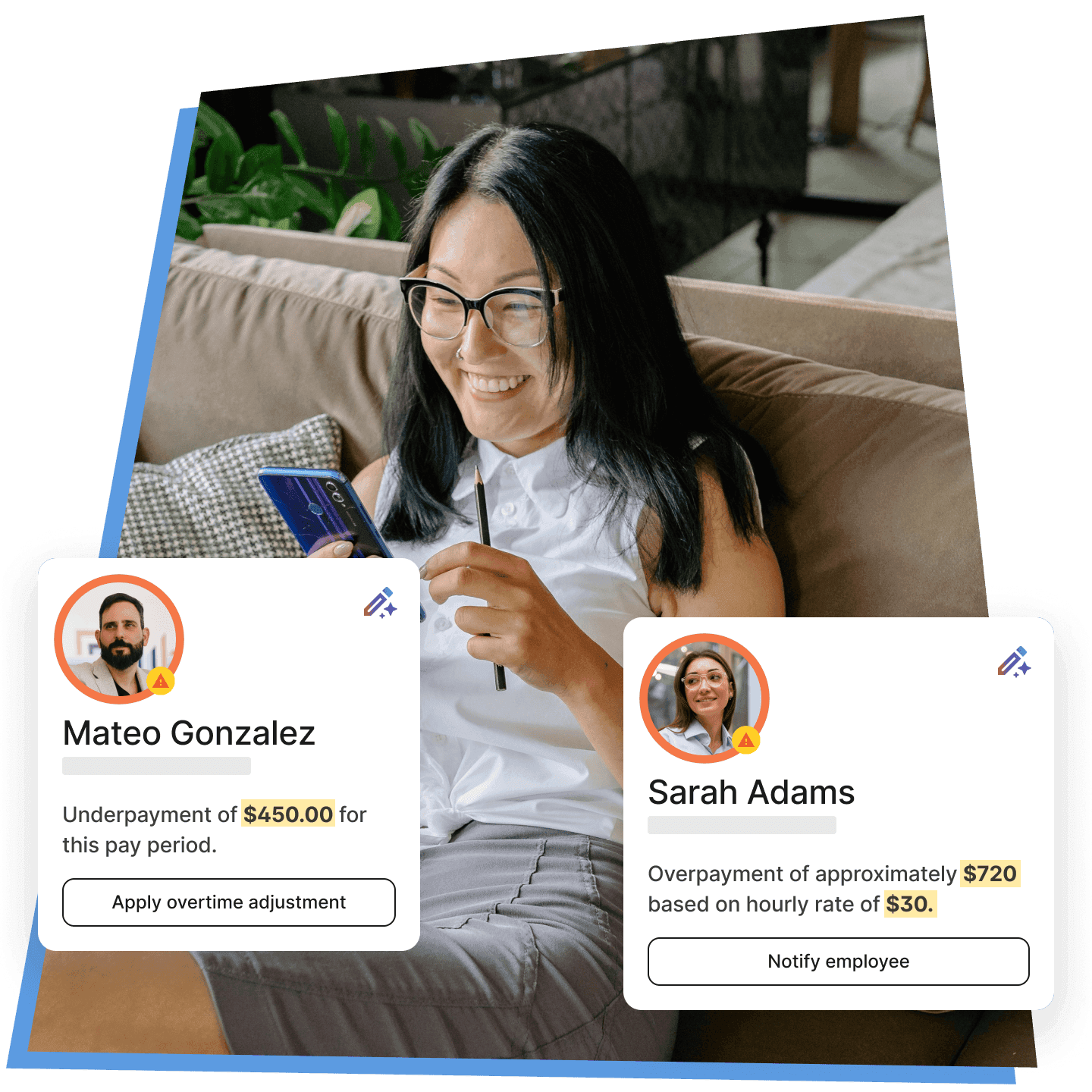

AI-powered payroll

See and fix errors before they become costly with AI

We use AI assistance to flag anomalies, suggest corrections, and automate your daily tasks so you reduce errors, stay compliant, spend less time on manual work, and run faster payroll cycles.

See it in action

Experience how simple managing payroll can be

Why Deel for global payroll solutions?

Unified workflows

Powered by our own engine, we combine all your hiring and payroll processes into one platform. Improve efficiency, reduce errors, and get a complete view of your workforce.

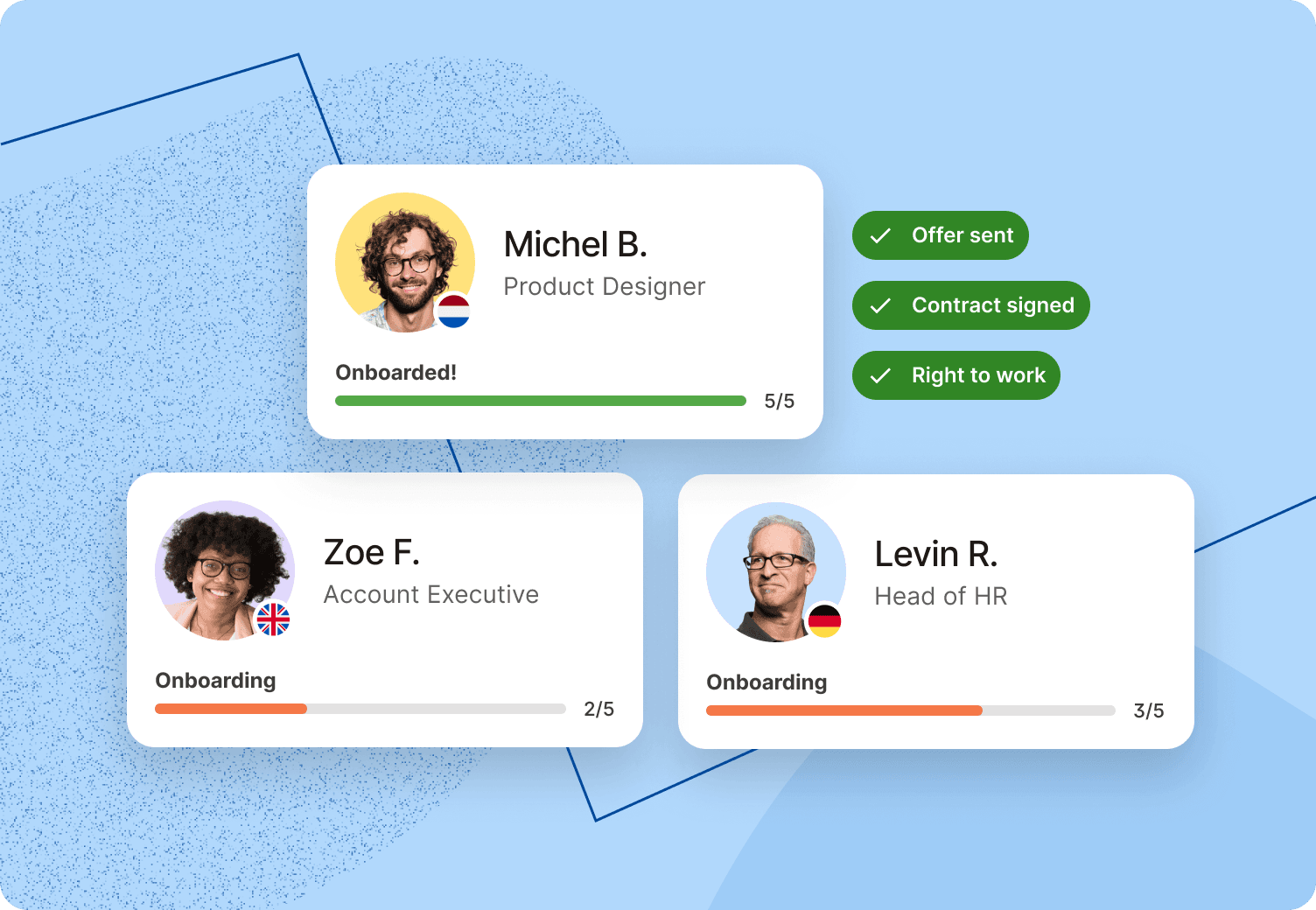

Self-serve capabilities

Give your team control. Speed up onboarding, payment management, and compliance. Empower managers to handle payroll tasks faster to reduce bottlenecks.

Built-in compliance

We ensure full compliance with local, state, and federal regulations with automated updates. Stay ahead of tax filings, labor laws, and reporting requirements.

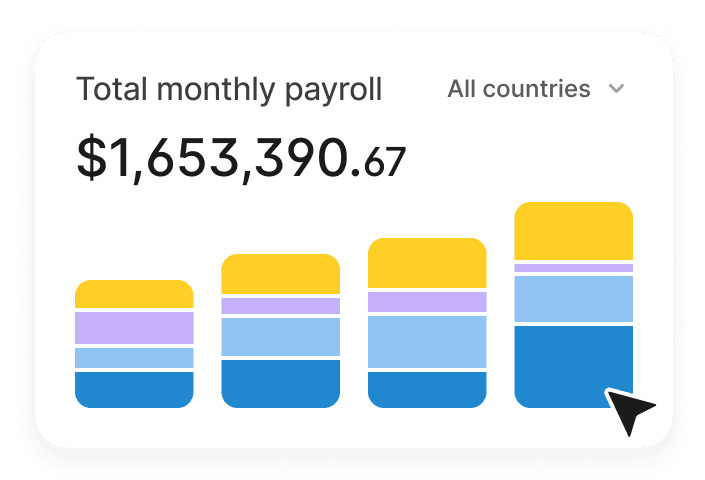

Real-time spending insights

Monitor your workforce expenses in real time with actionable insights. Stay on top of budgets, optimize costs, and make informed decisions without delays or manual reports.

Scalable for any size team

Whether you have a startup or enterprise, we adapt to your needs. Our payroll platform supports teams of all sizes with flexible features that grow alongside your business

Advanced data security

We meet top standards for data privacy, security, and compliance—SOC 1, 2 & 3 certified, GDPR, and more so your sensitive payroll data stays protected worldwide.

Seamless integration with your workflow and processes

Integrate with your existing systems like SAP and Workday to reduce manual effort, ensure data consistency, and optimize workflows across your organization.

FAQs

What does managed payroll mean and how is it different from self-service payroll?

Managed payroll providers handle several aspects of payroll processing and management on behalf of their clients. This includes calculating employee wages and taxes, processing payroll, generating pay stubs, and filing tax forms with the appropriate authorities.

Self-service payroll typically involves the employer handling most or all of these tasks in-house, using either manual or automated systems.

The key difference between managed payroll and self-service payroll processing is the level of involvement and responsibility required of the employer (you). With managed payroll, you can outsource many tasks and activities of the payroll process to the payroll processing vendor (us). This can save you significant time and effort to then focus on other strategic aspects of running your business.

How does Deel Local Payroll simplify compliance and legislation updates?

We offer a seamless onboarding experience, guiding businesses through setup with expert support. Our team ensures smooth implementation, from data migration to compliance setup, across Africa, the United Kingdom, and Brazil.

How does Deel maintain payroll compliance in the USA?

Whether operating in California, New York, or any of the states in between, we’ve got you covered. For all 50 states, Deel will accurately & automatically calculate and file payroll taxes with the IRS and with local, state and federal agencies on your behalf, along with necessary W-2, W-4, new hire and termination filings. We also offer human resources tools like digital i-9 verification to facilitate compliant [new hire onboarding](new hire onboarding), and have 24/7 support to help you at every step of the way. Plus, clients can use our proactive monitoring tool, the Compliance Hub, to stay informed about compliance updates that are impactful, whether to small business or enterprise size clients.

How does Deel PEO work?

When a company engages with a PEO, they enter into a co-employment arrangement. As co-employers, the PEO and client contractually share employer responsibilities and liabilities.

The client company retains ownership and control over its operations, including day-to-day management of employees and product development, marketing, sales, and service. The PEO will typically assume responsibility for many human resources-related projects, including administrative tasks, employee records, employee benefits, payroll processing, and employment taxes.

Both the client company and the PEO have compliance obligations. However, PEOs typically assume much of the liability for the business of employment, such as risk management, human resource management, payroll taxes, and employee tax compliance—all of which contribute to peace of mind for business owners.

How does an EOR differ from a PEO?

An employer of record caters to businesses aiming to build and manage a global workforce without bearing compliance liabilities. Meanwhile, a professional employer organization (PEO) is tailored for companies seeking domestic HR services and workforce management support willing to accept a shared responsibility for any instances of non-compliance.

Unlike employers of record, who are the sole legal employers of your workers, PEOs provide co-employment services. A co-employment relationship means you and the PEO share legal liabilities and management responsibilities related to your employees. Another crucial difference is that PEOs operate locally, so you can’t hire international employees through a PEO.

How does an EOR differ from a staffing agency?

Companies can tap into a staffing agency’s existing talent pool to bolster their workforce, secure project support, or cover temporary positions.

Conversely, the employer of record services facilitates the compliant engagement of top talent directly recruited by the client company. To leverage EOR services, your company must first identify the talent it wishes to hire and then engage them through the Employer of Record’s legal framework.

See also: How Staffing Agencies Can Guarantee a Good Employee Experience With an EOR

How do I pay an international contractor through Deel?

Paying contractors around the world can be a complex process that takes time and focus from your team. With Deel you can easily pay contractors in 150+ countries, in more than 120 currencies and using more than 8 payment methods. Additionally you can use Deel to pay your contractors in bulk and automate the invoicing process that allows you to pay contractors effortlessly and on time with our global payroll services.

What type of integrations do you offer?

Deel provides 110+ enterprise-grade integrations and APIs for secure, flexible, and seamless data flow. Deel Global Payroll integrates with leading HRIS/HCM platforms, including Workday, SAP SuccessFactors, UKG, HiBob, BambooHR, and more. We are a GPC-certified (Global Payroll Cloud) partner of Workday for seamless, comprehensive integration.

We provide an open API that allows you to seamlessly integrate Deel Payroll solutions with your existing tech stack, including ERP, accounting system, time tracking, learning management, expense management, benefits administration, and more.

Deel makes growing remote and international teams effortless

150+

countries

37,000+

customers

200+

in-house experts