Deel Payroll - US

Stay compliant, save time, and pay your US team with confidence

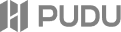

Enjoy a US payroll process that’s free from constant checking, manual updates, or deadline tracking. Tax updates, filings, and wage calculations automatically align with federal and state rules, giving you a clean, consistent payroll every cycle.

スタートアップ企業から大企業まで35,000社以上の企業から信頼されています

Two ways to run US Payroll: Which is right for you?

Self-Serve

Ideal for US-based teams with established payroll expertise. Best if your needs are straightforward—like paying salaried or exempt employees in one or a few states—and you want a fast, automated way to handle calculations, taxes, and filings yourself without adding complexity.

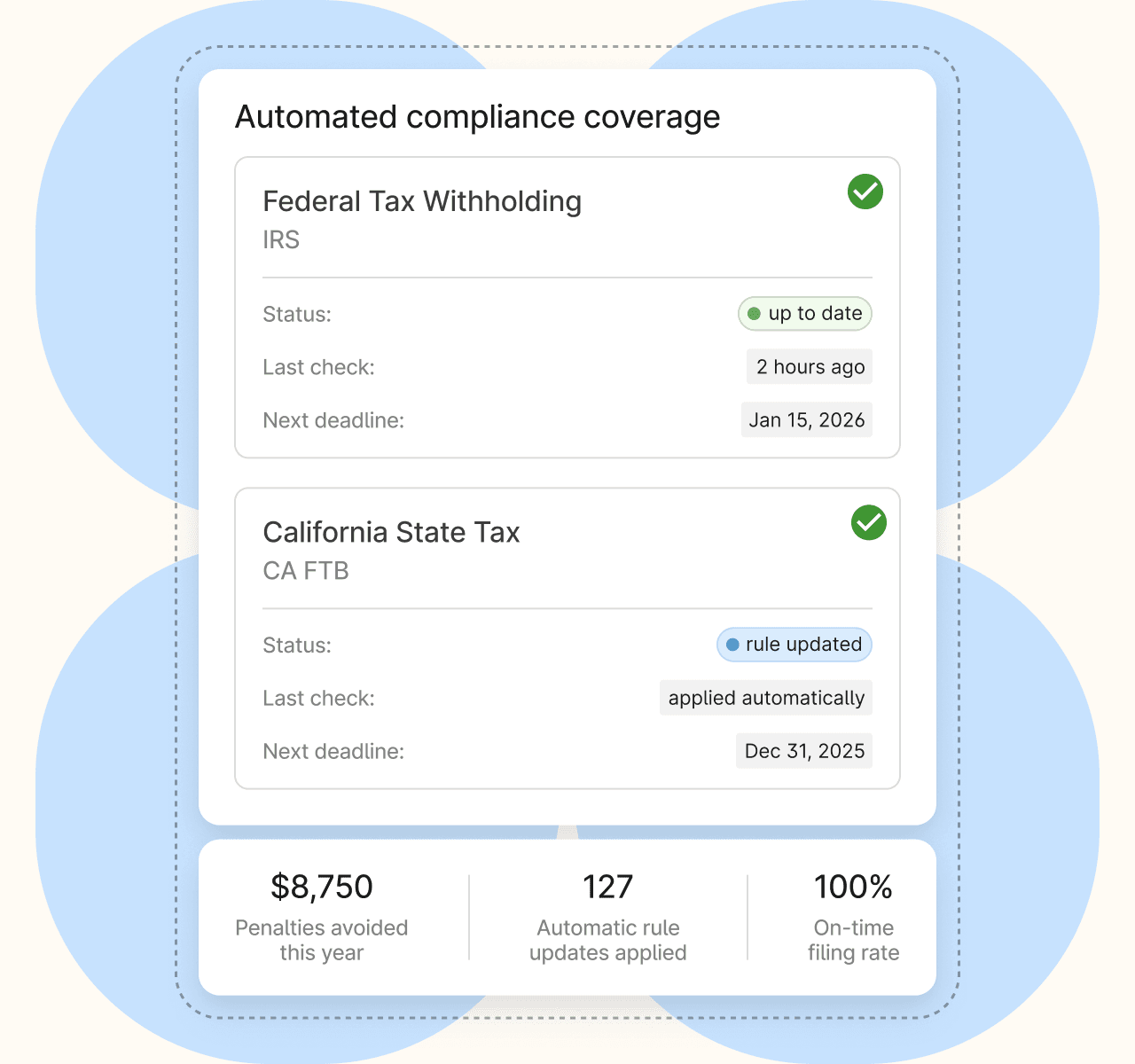

Automated compliance coverage

Protect your business from costly mistakes

Built-in IRS and state-level tax logic keeps payroll aligned with every US rule and deadline, so you don’t have to track changes. Early compliance checks help you avoid penalties and last-minute corrections for predictable, accurate cycles.

Unified workforce management

Scale your team without juggling multiple tools

Running different payroll systems adds manual work and unnecessary complexity. With US payroll integrated into your global platform, data stays consistent, onboarding is smoother, and teams spend less time maintaining systems.

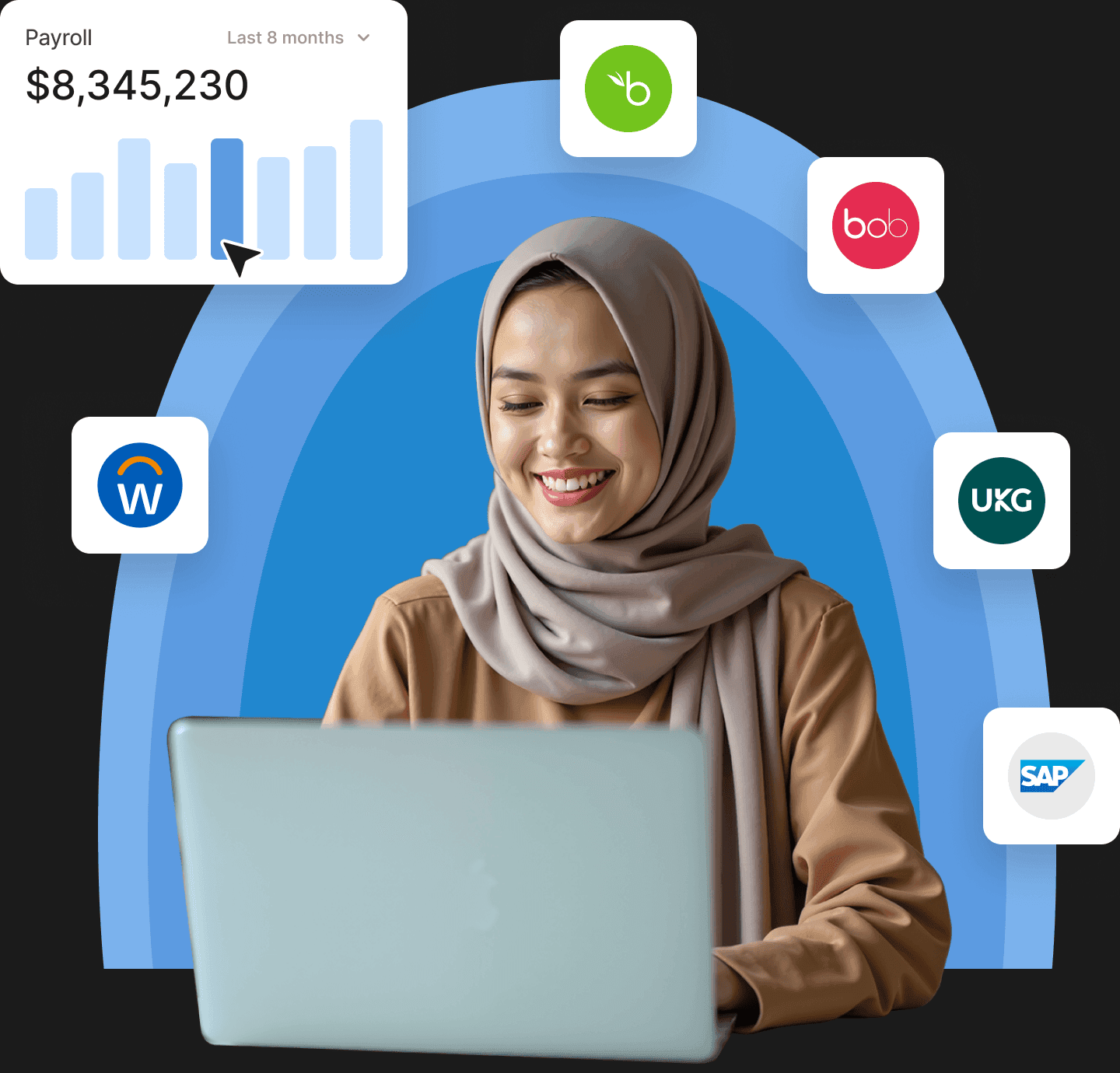

Keep payroll and HR in sync with integrations

Connect payroll with the systems your team already relies on, so employee information stays consistent and up to date across HR, benefits, and finance without duplicate data entry.

- HRIS: Workday, BambooHR, HiBob, UKG, SAP SuccessFactors

- Benefits & 401(k): Employee Navigator, Human Interest

- Accounting: NetSuite

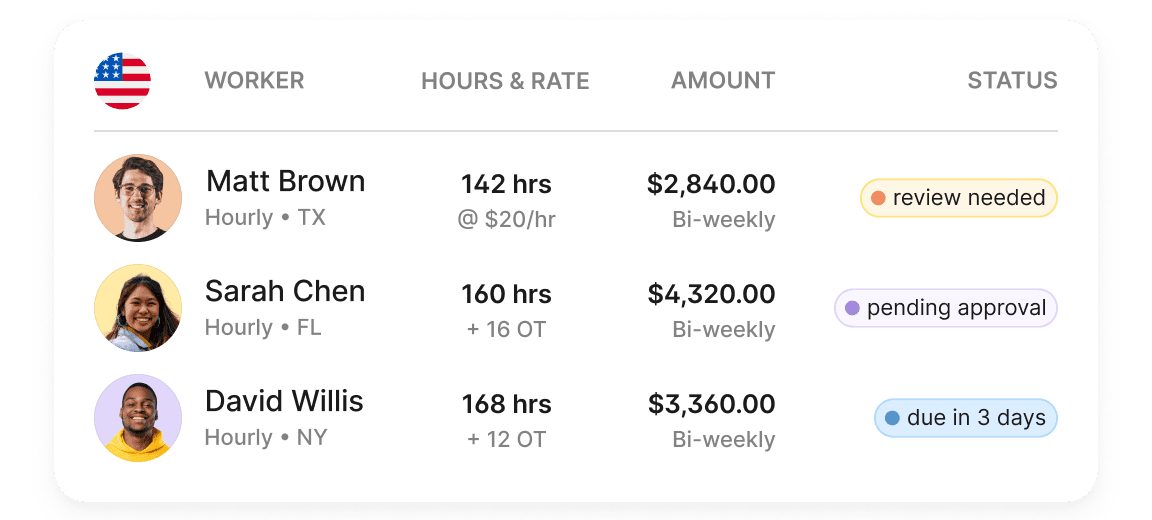

Instant gross-to-net calculations

See accurate wages update in real time as changes are made, to catch any issues early and avoid reruns or surprises at the end of the cycle.

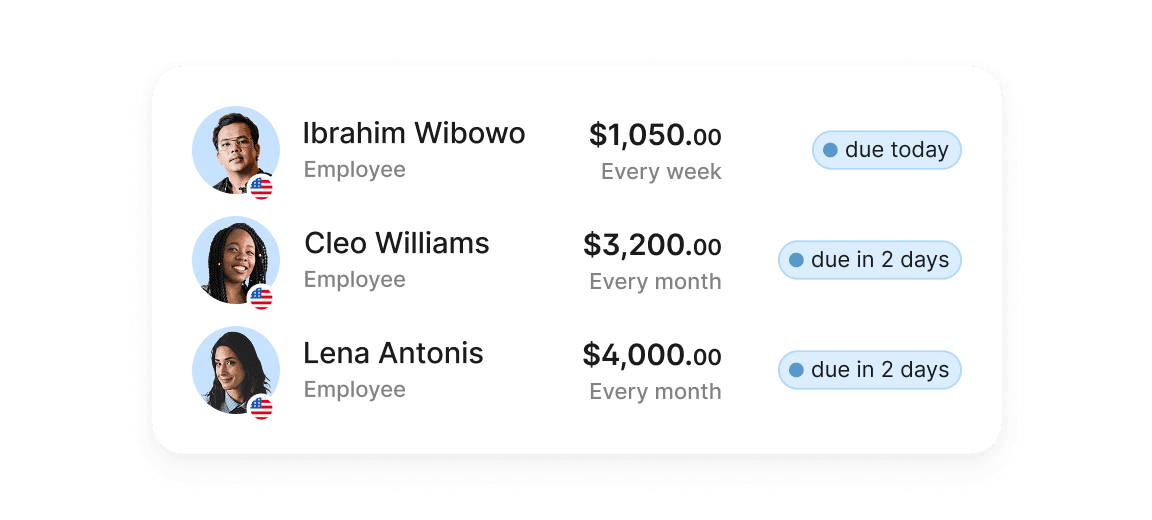

Flexible payroll cycles

Choose pay schedules that match how your business operates—biweekly, semimonthly, or monthly—without extra work or custom setup.

Easy off-cycle runs

Handle bonuses, corrections, or last-minute payments before the next scheduled cycle, so employees never have to wait to get paid.

Last-minute changes

Adjust pay details, earnings, or deductions close to your cutoff time with automatic recalculation that keeps payroll accurate as edits come in.

State registration support

Get help registering in new states so you can hire where you need to without delays, paperwork bottlenecks, or compliance setbacks.

Customizable dashboards and reporting

View summary reports, year-to-date information, and reconciliation details in one place, giving you visibility and confidence across every cycle.

よくある質問

How does US payroll work?

US payroll typically involves:

- Collecting employee and tax setup information

- Calculating gross wages

- Deducting federal, state, and local taxes

- Withholding benefits and other deductions

- Paying employees

- Filing payroll taxes and submitting employer liabilities

- Producing reports and employee tax forms (e.g., W-2s)

Because every state—and many cities—have different tax rules, companies rely on US payroll services, online payroll systems, or a trusted payroll company to stay compliant. Modern online payroll services make it easier to automate calculations, tax filings, and secure payroll processing across all 50 states.

How do I choose the right payroll provider for my US team?

Look for:

- Automated compliance across federal, state, and local laws

- Real-time calculations and transparent payroll reporting

- Ability to support employees in multiple states

- Integrations with HRIS, benefits, accounting, and time tracking

- The option for expert review or support

- Scalability if you employ workers outside the US

Deel checks all of these boxes by offering a single platform for both global teams and US payroll services, making it a strong alternative to traditional payroll companies or local payroll firms.

Is there a payroll tax in the US?

Yes, there is a payroll tax in the US. Payroll tax includes the taxes employees and employers pay on wages, tips, and salaries. It encompasses federal, state, and local income taxes, as well as the employee's share of Social Security and Medicare taxes (FICA). Both employers and employees have to pay an equivalent share of Social Security and Medicare taxes, with the Social Security tax rate at 12.4% and the Medicare tax rate at 2.9%, paid evenly by both employers and employees.

If you paid $1,500 or more in wages during any calendar quarter, or you had at least one employee working part of a day in 20 or more weeks in the current or previous year, you are required to pay the Federal Unemployment Tax Act (FUTA) annually.

Deelはどのようにして米国でのビジネスが給与関連法令に常に準拠している状態を維持しますか?

For all 50 states, Deel will accurately & automatically calculate and file payroll taxes with the IRS and with local, state and federal agencies on your behalf, along with necessary W-2, W-4, new hire and termination filings. We also offer human resources tools like digital I-9 verification to facilitate compliant new hire onboarding, and have 24/7 support to help you at every step of the way. Plus, clients can use our proactive monitoring tool, the Compliance Hub, to stay informed about compliance updates that are impactful, whether you’re a small business or enterprise.

US Payrollは福利厚生をどのように管理しますか?

With our built-in Benefits Admin, Deel will consolidate all benefits into a single HR system so that all key information and deductions are synched and automated into your payroll. Your employees can easily manage their enrollment directly from the Deel platform. You can either use your own preferred broker. Deel can refer you to a benefits provider partner like Employee Navigator or Thatch to set up and manage your benefits program.

Deelでは月に何回給与計算を行えますか?

給与計算は月次、半月ごと、または隔週で実行できます。また、必要に応じてオフサイクル給与計算を実行することもできます。他の給与計算サービスとは異なり、米国の給与計算ではオフサイクルの支払いに料金はかかりません。

Deelは従業員のW-2フォームに対処しますか?

はい。 Deelはこれらの書類を自動的に生成し、それぞれの税務当局 (通常は IRSと社会保障局) に提出します。その後、当社は年末にW-2を従業員に配布します。

Is online payroll safe for US companies?

Yes. Modern online payroll systems (like Deel) include secure data handling, audit trails, automated reconciliation, and built-in compliance logic to reduce errors and risks.

Can startups use Deel for US payroll?

Absolutely. Deel Payroll - US is built for companies with fewer than 200 US employees.

Deelを利用すると、世界中の優秀な人材を貴社の戦力として活用できます

150+

国

37,000+

お客様

200人以上

社内の専門家