Article

16 min read

How One Startup Founder Uses Deel PEO for US Expansion

PEO

Author

Shannon Ongaro

Last Update

October 14, 2025

Table of Contents

Challenges of US expansion for startups—and how Deel PEO helps

A day in the life of a founder expanding in the US with Deel PEO

The ROI of using Deel PEO for US expansion

Streamline US Hiring and HR ops with Deel PEO

With lean teams, fragmented systems, and ambitions to add new entities, US expansion is high-stakes for startup founders. One misstep and the whole effort stalls.

Even founders who already have a foothold in the US face constant friction: registering additional entities in new states, navigating diverse federal and state regulations, managing benefits administration, and consolidating payroll across those entities. It’s easy to get bogged down in paperwork and lose momentum.

Deel supports thousands of scaling organizations worldwide, so we understand how daunting even incremental US expansion can be. By taking on benefits administration, payroll, tax reporting, and HR tasks under one roof, Deel PEO lets founders focus on growth instead of paperwork.

This article follows Sophia, a fictional startup founder, as she uses a professional employer organization (PEO) throughout a typical day to expand her US operations in Texas, California, and Florida. You’ll see how she leverages Deel PEO to onboard employees, configure benefits, run payroll for all entities, ensure compliance, and generate reports, without leaving the platform.

Challenges of US expansion for startups—and how Deel PEO helps

For founders building US operations, every state can feel like its own country:

-

Entity setup and registration require navigating layered federal, state, and local regulations, including business filings, tax registrations, and workers’ compensation mandates

-

Benefits administration must comply with the Affordable Care Act (ACA), COBRA, and myriad state mandates, yet small teams can’t absorb that workload

-

Payroll and tax reporting demand precise calculations for federal and state income tax withholdings, unemployment insurance, and local filings in each jurisdiction

-

Handing HR tasks—from onboarding paperwork to maintaining employee records—across multiple entities often means disjointed systems or manual processes

Deel PEO shifts all of these processes onto a single platform. It provides state registration support, benefits administration and compliance, and fully managed payroll with tax filing for every US entity.

Plus, you get in-house infrastructure, licensed experts, and exclusive access to Aetna International benefits plans.

That means founders can easily onboard employees, enroll them in benefits, and run payroll with confidence, without a large back-office team.

To see how this plays out in practice, let’s walk through Sophia’s day.

A day in the life of a founder expanding in the US with Deel PEO

8:30 AM — Onboarding new Florida hires

Sophia’s team just closed a customer in Miami and needs local customer service support. Florida means new employment regulations, tax rules, and required benefits.

With Deel PEO:

- Onboard Florida employees via compliant, state-specific workflows

- Deel handles state registration, tax setup, and employment notices

- Built-in HR compliance means no scramble for local attorneys

Problem solved: Sophia doesn’t touch the paperwork. Instead, her HR lead handles setup in under an hour, with Deel's team reviewing for accuracy.

We hired in Florida without scrambling to decode state rules. Deel handled the tax setup and compliance docs—my HR lead had it live in under an hour.

—Sophia,

Startup founder

10:00 AM — Monitor open enrollment

It’s open enrollment time, and Sophia wants to check in on her team’s progress. There are just three days left in their enrollment period, and she needs to make sure everyone is on track.

With Deel:

- Deel’s report dashboard includes a PEO benefits open enrollment report

- Quickly review enrollments not started, in progress, in review, and completed

Problem solved: Sophia can see that 85% of her team members have completed open enrollment. She’ll send out a reminder to the remaining employees to ensure they complete enrollment on time.

I used to dread open enrollment season. Now I get a live view of who's in, who's lagging, and we don’t risk missing ACA deadlines.

—Sophia,

Startup founder

12:00 PM — Update employee handbook for compliance

The Department of Labor just issued new guidance that affects PTO accrual and classification rules. Sophia knows that even minor compliance slip-ups can snowball into fines or disputes, especially across multiple states. But instead of spending hours parsing legalese or hiring outside counsel, she logs into Deel.

With Deel:

- Receive alerts on regulatory changes

- Processes are automatically updated for payroll and compliance

- Access customizable handbook templates for updates

- Distribute updated policies to employees with acknowledgment tracking

Problem solved: Sophia keeps company processes and policies current and compliant, mitigating legal risks.

Deel flagged the policy update before I even saw the news alert. We pushed the new processes and handbooks out right away.

—Sophia,

Startup founder

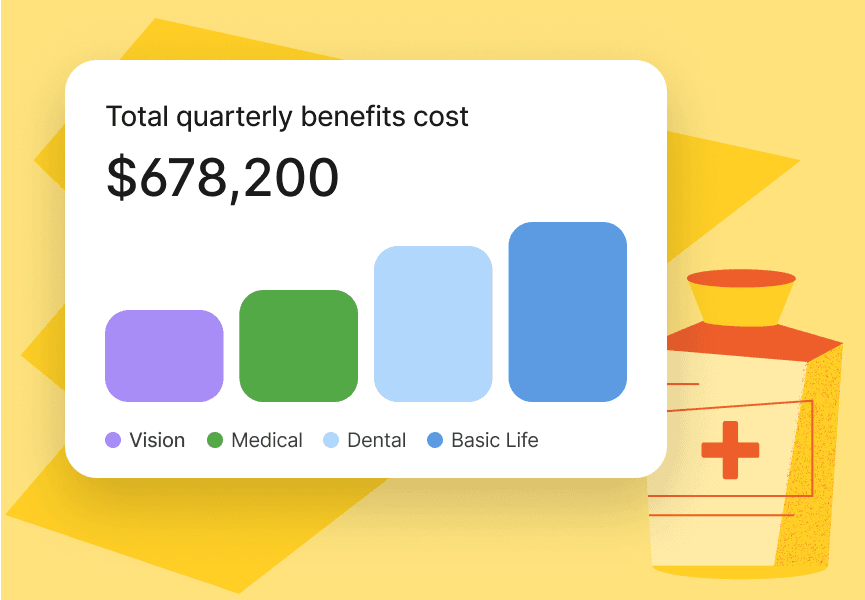

2:00 PM — Review current benefits costs for the California entity

Burn rate check-in. California benefits costs are twice the amount of Texas, which is worth reviewing.

With Deel:

- See a consolidated benefits report containing employee details, benefit details, provider details, election type, employer and employee costs, and benefit start dates

- Customize and generate a one-time or saved report

- Export PDF for board update

- Identify which plans are driving spend

Problem solved: Instead of manually tracking benefits costs in a spreadsheet, Sophia sees every piece of data in one dashboard. Sophia flags one unused vision plan and cuts it in the next cycle, saving $7k/year.

See also: A Guide to Offering Small Business Employee Benefits for US Teams

We spotted $7K in wasted benefits spend just by filtering the report. That’s real savings we can reinvest in the team.

—Sophia,

Startup founder

4:00 PM — Run payroll across multiple states

Payroll used to be Sophia’s monthly stress test—especially with employees in New York, Texas, and California, each with different tax rules and deposit timing. Now, she just needs to confirm the final numbers.

With Deel PEO:

- Automate payroll calculations, including state-specific taxes

- Process direct deposits and generate pay stubs

- Ensure compliance with all federal and state payroll regulations

Problem solved: Sophia reviews and approves payroll in minutes. Deel’s system has already validated the details, applied the right tax logic, and queued the payments. No late deposits, no CPA back-and-forth, and no compliance gaps.

Payroll used to be a monthly fire drill. Now it’s scheduled, automated, and Deel’s already accounted for all the state tax stuff.

—Sophia,

Startup founder

The ROI of using Deel PEO for US expansion

When founders like Sophia use Deel PEO to manage US entities, they turn common roadblocks into measurable gains. By consolidating all US entity needs—entity setup, benefits, payroll, tax, and compliance—Deel PEO saves founders like Sophia hours of admin each week. That time goes straight back into product roadmaps, investor pitches, and building customer relationships.

| Challenge | Without Deel | With Deel PEO |

|---|---|---|

| Hiring in new states | Founder or ops scrambles to interpret state regs, register entities, chase down tax IDs | Deel handles state registrations, tax setup, and onboarding via compliant workflows |

| Open enrollment stress | Manual tracking in spreadsheets, risk of missing ACA/Cobra deadlines | Real-time enrollment dashboard ad built-in compliance |

| Cross-state payroll | Juggling multiple systems, calculating taxes manually, and prone to late payments | Automated payroll with state-specific tax logic, early deposit handling, and one-click approvals |

| Policy and compliance updates | Manually monitoring legal changes, pushing updates over email, zero tracking | Deel alerts you to new regulations with expert-created employee handbooks |

| Benefits cost control | Fragmented data, no clarity on employer vs. employee costs, hard to cut waste | Consolidated reporting with custom configurations to surface and remove underused plans |

Streamline US Hiring and HR ops with Deel PEO

Sophia is fictional, but her challenges are real. Her story mirrors what we hear from growing startups and SMB founders—leaders expanding across states while juggling compliance risk, benefits complexity, and payroll admin overhead.

Deel PEO helps them skip the HR chaos and scale with confidence. Hear from Superfiliate’s CEO on how he uses Deel to grow his team.

With Deel PEO, founders and lean ops teams can:

- Skip legal headaches with built-in state registration and compliant onboarding

- Centralize payroll, benefits, and compliance tracking in one platform

- Offer “big-company” benefits that help attract talent, without HR bloat

- Eliminate manual filings and year-end tax stress with automated reporting

- Offer exclusive access to Aetna International benefits plans for W2 employees traveling abroad

As your team scales across the US, Deel PEO keeps operations lean, compliant, and audit-ready, with no extra headcount required. Book a demo today to learn more.

FAQs

What does PEO stand for?

PEO stands for professional employer organization. A PEO is a third-party company you can partner with under a co-employment model. Under this partnership, the PEO assumes some legal liability. The PEO handles the back office and compliance tasks involved in US workforce management, such as payroll calculations and deductions, state-specific compliance, taxes, and more. Meanwhile, you manage the day-to-day operations of your workforce.

Does Deel offer benefits?

Yes. Through Deel PEO, you get access to Fortune 500-caliber benefits without the cost. You can also bring your own benefits provider. Deel offers exclusive access to Aetna International plans, which provide W2 US employees with continued coverage when they travel abroad.

How much does Deel cost per month?

Deel PEO is currently priced at $95 per employee, per month. See Deel’s pricing page for the most up-to-date pricing and inclusions.

What is the difference between HR and PEO?

HR (human resources) is an organization within a company that manages a variety of tasks, such as payroll, hiring, onboarding, employee support, and compliance. HR teams are typically in-house and are direct employees of the company. A PEO is a third-party solution that organizations hire to support their HR operations.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.