Article

11 min read

Contractor vs Employee: Key Differences When Hiring Globally

Legal & compliance

Global hiring

Author

Jemima Owen-Jones

Last Update

January 12, 2026

Table of Contents

Contractor vs employee: a global comparison

What is an employee?

What is an independent contractor?

Hiring and onboarding: employees vs contractors

Compensation and payments

Employer supervision and control

Work schedule and location

Tools, equipment, and expenses

Training and skill development

Employment laws and benefits

Ending the working relationship: employees vs contractors

How authorities determine worker classification

Tax forms and reporting

Intellectual property ownership

How Deel helps companies hire compliantly worldwide

Hire contractors and employees compliantly with Deel

Key takeaways

- Contractors and employees are treated very differently under labor and tax laws worldwide, and misclassifying workers is one of the most common (and costly) global hiring mistakes.

- The right classification depends on control, independence, and the nature of the relationship, not job title or payment method.

- Deel helps companies hire both contractors and employees compliantly in 150+ countries, managing classification, contracts, payments, and compliance in one platform.

Understanding the difference between hiring a contractor vs an employee is essential for companies operating internationally. Misclassification can lead to fines, back taxes, IP disputes, and forced reclassification—often years after the work is done.

This guide explains the core differences between contractors and employees worldwide, highlights how authorities determine worker status, and shows how companies can hire compliantly across borders without setting up local entities.

Independent contractors and employees differ in how they’re hired, managed, paid, taxed, and protected by law. While the details vary by country, the underlying principles are consistent globally.

Note: Where US-specific rules are mentioned, they’re provided as examples. Always follow local laws in the worker’s country.

Contractor vs employee: a global comparison

| Category | Employee | Independent Contractor |

|---|---|---|

| Relationship | Employed by one company | Works with one or more clients |

| Control | Employer controls schedule, process, and tools | Contractor controls how and when work is done |

| Compensation | Salary or hourly payroll | Project, milestone, or hourly fees |

| Taxes | Employer withholds and contributes | Contractor pays their own taxes |

| Benefits | Statutory benefits required | No mandatory benefits |

| IP ownership | Often defaults to employer | Must be explicitly assigned |

| Termination | Protected by labor laws | Governed by contract terms |

What is an employee?

An employee is hired directly by a company to perform work under its control and direction. Employees usually:

- Work ongoing or permanent roles

- Follow company schedules and policies

- Receive statutory benefits (which vary by country)

- Are protected by labor and employment laws

Employees are typically used for core, long-term functions where the company controls how work is performed.

What is an independent contractor?

An independent contractor is a self-employed individual or business that provides services to a company under a commercial agreement. Contractors usually:

- Work on a project or fixed-term basis

- Control how, when, and where work is done

- Invoice for services

- Pay their own taxes and benefits

Contractors are best suited for specialized, flexible, or short-term work.

See also: Independent Contractor Agreements: Client Guide + Free Template

Hiring and onboarding: employees vs contractors

Employees

Employees typically go through a formal hiring process involving HR, interviews, onboarding, and training. Employers invest heavily in ramp-up and long-term development.

Deel Hire

Contractors

Contractors are engaged faster, often through portfolios or referrals. There’s usually minimal onboarding because contractors are hired for their existing expertise.

See also: How US Companies Can Legally Hire International Contractors

Deel Hire

Compensation and payments

Employees

Employees are paid via payroll on a fixed schedule. Employers must handle tax withholding, social contributions, and benefits.

Contractors

Contractors are paid based on invoices, milestones, or hourly rates. The contractor is responsible for taxes and insurance.

Hiring and paying contractors internationally adds complexity due to currencies, payment methods, and local regulations—this is where platforms like Deel simplify global payments and documentation.

See also: How to Pay International Contractors in 2025: A Complete Guide

Deel Payroll

Employer supervision and control

One of the most important classification factors worldwide is control.

- Employees are supervised, trained, and directed

- Contractors control their own methods and workflows

Excessive control over a contractor often triggers reclassification.

Work schedule and location

Employees typically follow company-defined schedules. Contractors usually set their own hours and work independently, as long as deadlines are met.

Tools, equipment, and expenses

Employees typically use employer-provided tools and receive expense reimbursements. Contractors generally supply their own tools and cover business expenses unless otherwise agreed.

Training and skill development

Employees often receive ongoing training and career development. Contractors are hired because they already possess the required expertise and usually don’t require training.

Deel IT

Employment laws and benefits

Employees are covered by labor protections such as:

- Minimum wage

- Paid leave

- Termination protections

- Social security or pension contributions

Contractors are generally excluded from these protections and must self-manage benefits.

See also: How Enterprises Can Offer Contractor Benefits—Without Increasing Risk

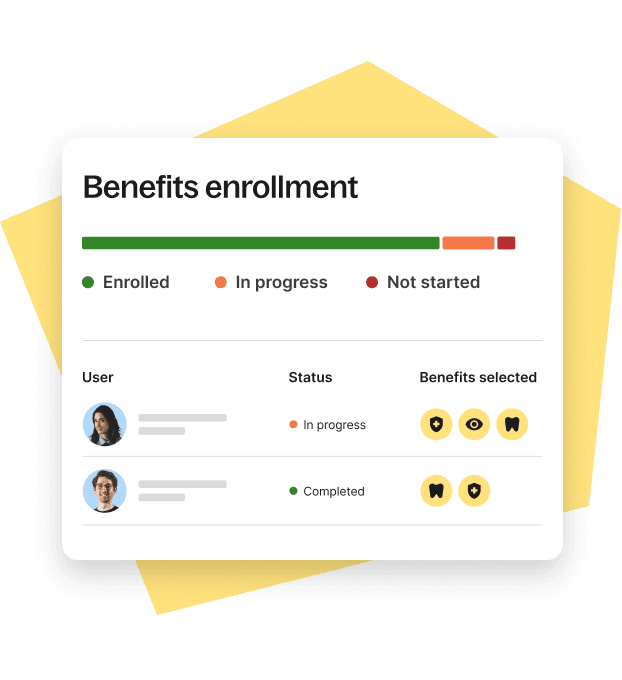

Deel Benefits Admin

Ending the working relationship: employees vs contractors

Termination rules are another major difference.

- Employees: Termination often requires notice, severance, and justification depending on local law (outside the US, at-will termination is rare).

- Contractors: Termination is governed by the contract terms and is usually simpler—provided the agreement is well drafted.

Improper termination can retroactively expose companies to misclassification claims.

See also:

- How to Legally Terminate an Employee with Grace

- Terminating an Independent Contractor: How to Do It Compliantly

How authorities determine worker classification

Governments don’t rely on job titles to determine classification. Instead, they assess the actual working relationship.

Example: United States

US authorities evaluate:

- Behavioral control

- Financial control

- Nature of the relationship

Some states apply an “ABC test,” which presumes employment unless strict criteria are met.

See also: IRS Contractor vs. Employee Test: How to Classify Workers

Globally

Other countries assess:

- Economic dependence

- Ability to substitute work

- Integration into the business

- Permanence of the relationship

The principles are similar worldwide—even if the tests differ.

Global Hiring Toolkit

Tax forms and reporting

Tax obligations vary by country, and responsibilities differ by worker type.

In the US, for example:

- Employees complete Form W-4, while employers file Form W-2 to report wages and taxes withheld

- Independent contractors submit Form W-9 (or Form W-8BEN/W-8BEN-E if non-US), and clients file Form 1099-NEC to report payments made

Other countries use entirely different reporting systems, which is why localized compliance matters when hiring globally.

Intellectual property ownership

IP ownership is a common hidden risk.

- In some countries, employee-created IP automatically belongs to the employer

- In others, IP transfer must be explicitly stated—even for employees

- Contractors almost always require explicit IP assignment clauses

Without proper contracts, companies may not legally own the work they paid for.

See also: Protecting Intellectual Property in Global Teams

How Deel helps companies hire compliantly worldwide

Deel enables companies to confidently hire both contractors and employees across 150+ countries.

With Deel, you can:

- Correctly classify workers using local legal standards

- Generate compliant contracts with built-in IP protections

- Pay contractors and employees globally in one system

- Monitor misclassification risks proactively

- Convert contractors to employees via EOR when needed

Deel Contractor and Employer of Record services remove legal complexity while allowing companies to scale globally.

Hire contractors and employees compliantly with Deel

Misclassification is one of the fastest ways to accumulate global risk. Deel gives companies a single platform to engage talent correctly—whether as contractors or employees.

Book a demo to see how Deel simplifies global hiring, compliance, and payments.

More resources

FAQs

What’s the difference between hiring a contractor vs an employee?

Employees work under company control and receive statutory protections. Contractors operate independently and manage their own taxes and benefits.

Can a contractor later be reclassified as an employee?

Yes. Authorities can reclassify workers retroactively if the relationship resembles employment.

Is hiring contractors safer than hiring employees?

Not inherently. Contractors reduce payroll complexity but increase misclassification risk if not managed correctly.

Do I need a local entity to hire contractors?

No. Contractors can be hired without a local entity—but compliance still matters.

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.