Article

7 min read

Rhode Island TDI (Temporary Disability Insurance) in 2025

PEO

US payroll

Author

Shannon Ongaro

Last Update

June 27, 2025

Table of Contents

Understanding Rhode Island TDI

Rhode Island TDI eligibility

What Rhode Island TDI covers

Rhode Island TDI benefits

Job protections

How to claim TDI benefits in Rhode Island

Keep compliant with Deel PEO

Key takeaways

- Rhode Island's Temporary Disability/Caregiver Insurance (TDI) provides wage replacement but does not inherently offer job-protected leave, requiring employees to rely on PFMLA or FMLA for protection.

- Claiming TDI benefits in Rhode Island involves submitting medical documentation through the state's Department of Labor and Training.

- Deel PEO helps employers manage Rhode Island-specific compliance, benefits, and leave administration, significantly reducing operational complexity and risk.

Rhode Island’s Temporary Disability Insurance (TDI) program can present complex challenges for employers and HR professionals, particularly around compliance, wage replacement calculations, and evolving state regulations.

At Deel, we help businesses across the US, including Rhode Island, navigate payroll, benefits administration, and regulatory compliance with ease.

In this guide, you’ll learn how TDI works, share practical steps for managing claims and documentation, and highlight how Deel’s PEO services simplify the compliance process for your teams.

Understanding Rhode Island TDI

Rhode Island's Temporary Disability Insurance (TDI) system provides partial wage replacement benefits to eligible workers who are unable to work due to a non-work-related illness or injury.

Contributions to the Temporary Disability Insurance (TDI) program include contributions for the related Temporary Caregiver Insurance (TCI) program.

| Coverage: | Paid parental leave and Caregiving |

|---|---|

| Employee contribution | 1.3% of salary up to $89,200 |

| Employer contribution | 0% |

| Maximum entitlement | $1,070 per week |

| Duration | up to 30 weeks |

Rhode Island TDI eligibility

Employees must be covered by the Temporary Disability Insurance (TDI) program to qualify for Caregiver benefits.

Base Period Earnings: Base period is defined as the first four of the five completed calendar quarters immediately preceding the claim.

Base period earnings are used to assess eligibility for benefits. To qualify, an employee must have earned:

- $18,000 in wages during the base period; or

- $3,000 during one of the base period quarters and a total base period earnings that are 1.5 times the highest quarter's earnings, with a total base period earnings of at least $6,000

- Medically certified by a Qualified Healthcare Provider as functionally unable to perform work duties for a minimum of 7 consecutive days

What Rhode Island TDI covers

TDI benefits are not cumulative and are capped at a maximum of 30 weeks per benefit period. The benefit period is defined as the 52-week period starting on the first day of the week in which a claim is made.

| Coverage reason | Length of benefit |

|---|---|

| Personal Medical Conditions, including any non-work-related illness or injury that prevents the employee from performing their job duties. This includes physical illnesses or mental health conditions, recovery from major surgery, complications, and disabilities arising from pregnancy or childbirth | 30 weeks |

The TDI cannot be used for maternity or parental leave benefits. Those benefits are available through the Temporary Caregiver Program. Please note that the 7 weeks of benefits provided by the TCI are separate from the 30 weeks of benefits provided by the TDI.

Rhode Island TDI benefits

Employee’s weekly benefit rate will be equivalent to 4.62% of the wages earned in the highest quarter of their base period. The minimum benefit is $139 per week, and the maximum benefit is $1,070 per week.

The exact benefit amount will vary based on the employee's salary and will be calculated by the Temporary Caregiver Insurance Program.

Learn more about paid sick leave in the US.

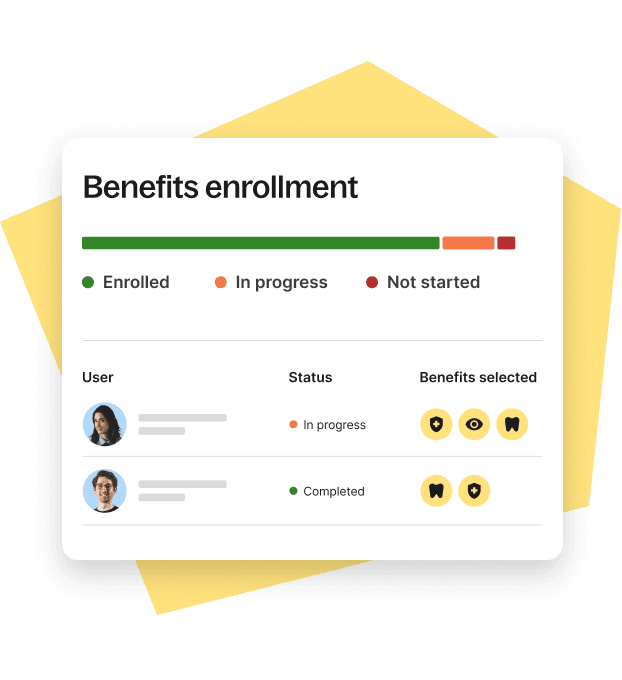

Deel Benefits Admin

Job protections

The Temporary Disability/Caregiver Insurance Program is a wage replacement program that does not, in itself, provide job-protected leave. Employees who seek wage replacement under the TDI may benefit from job protections through the Rhode Island Parental and Family Medical Leave Act (PFMLA) or the federal Family and Medical Leave Act (FMLA).

How to claim TDI benefits in Rhode Island

Employees must apply for benefits through the Department of Labor and Training (DLT). Employees will be required to provide medical documentation, such as a birth certificate for bonding leave or a medical certification for caregiving leave. Apply online for TDI Benefits with the Department of Labor and Training.

Keep compliant with Deel PEO

New to managing benefits and leave in Rhode Island? With Deel PEO, you can offload compliance risks and processes to ensure state-specific alignment.

- Fully in-house operations for improved support and workflows

- Expert payroll administration, HR, and benefits compliance

- Exclusive Aetna International benefits plans for W2 employees travelling abroad

- Built-in compliance for local and federal coverage

- 60+ domestic benefits plans with Fortune 500-caliber benefits

- Trainings, HR policies, and on-demand HR support

- And more

To learn more about how you can use Deel PEO to scale in the US, book a 30-minute call with one of our dedicated experts.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.