Article

5 min read

Run Global Benefits Where Payroll Lives

Deel news

Global HR

Author

Deel Team

Last Update

September 25, 2025

Table of Contents

Why running global benefits feels harder than it should

A better way to run benefits has arrived

How Deel Benefits Admin works

Why this matters to HR and Finance

How you get started

Today, we are introducing Deel Benefits Admin: a global, payroll-native way to configure plans, run enrollment and qualifying life events (QLEs), stay compliant, and sync deductions automatically. That means fewer vendors, fewer off-cycles, and correct payslips the first time.

Why running global benefits feels harder than it should

Benefits shouldn’t mean five logins, endless spreadsheets, and a scramble every time someone has a life event. But that’s the reality for most HR teams today. Every new plan, renewal, or exception creates another handoff and another chance for payroll errors to creep in.

The pressure doesn’t stop there. In the US, rules like ERISA and COBRA are continually shifting. Abroad, pensions and statutory programs are updated constantly. Missing a requirement or misreporting a deduction can quickly lead to costly penalties.

Meanwhile, HR teams are buried in admin, and Finance teams are left without a clear picture. Employees expect commuter benefits in New York, meal vouchers in Berlin, and family coverage in Austin—and they expect it all to work seamlessly. Without a unified system, the experience falls short for everyone.

A better way to run benefits has arrived

Deel Benefits Admin runs inside Deel Payroll. Employees enroll in the same platform they already use for pay. Elections sync directly to deductions with built-in eligibility, so payslips are right the first time.

This isn’t an integration that still relies on spreadsheets or connectors. It’s one workflow from plan setup to paycheck. Fewer systems, fewer surprises.

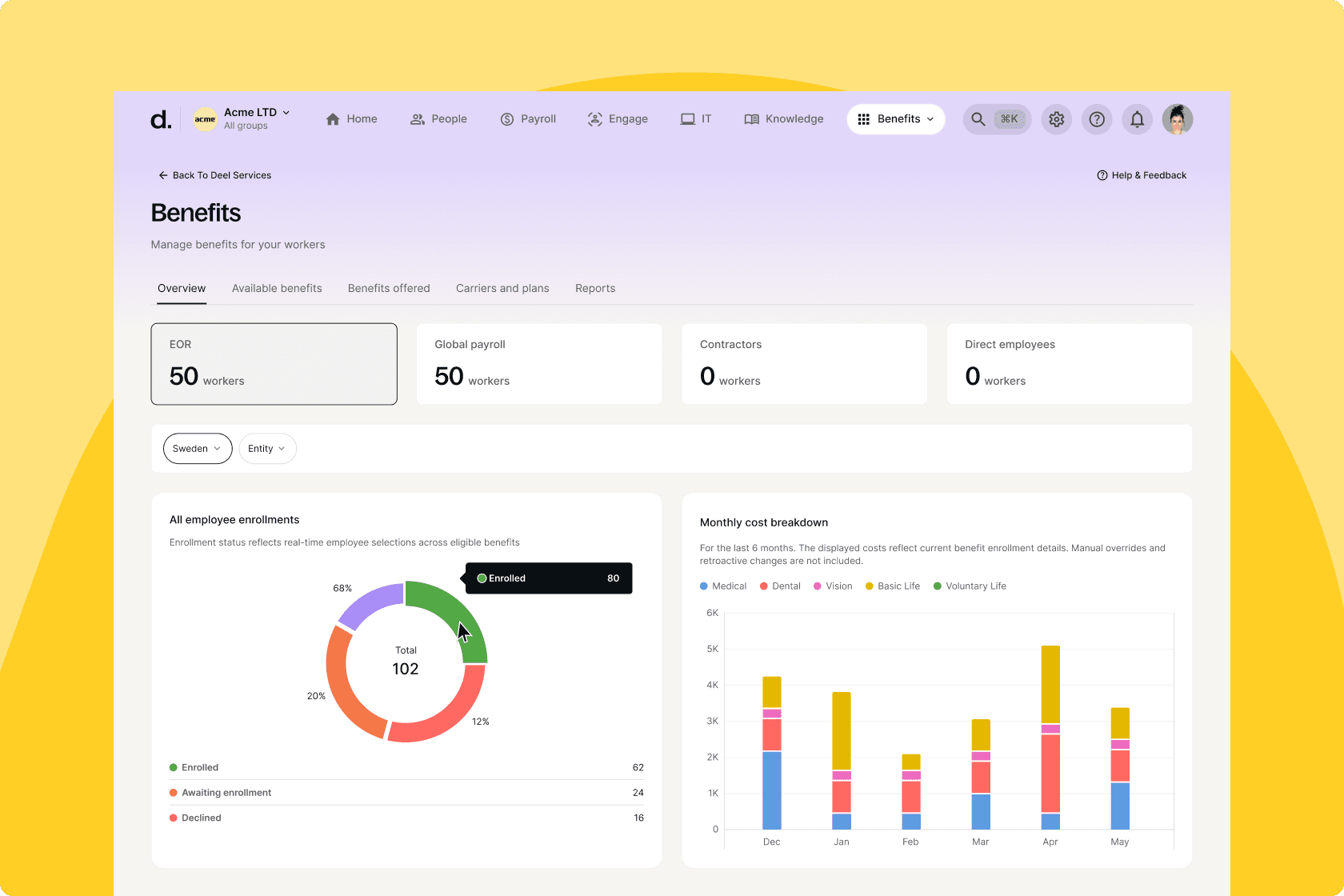

Deel Benefits Admin: Overview tab

How Deel Benefits Admin works

Payroll-native data model

When an employee enrolls or updates a contribution, payroll updates automatically. Automatic payroll updates mean fewer off-cycles, a faster close, and one clear process across every country. Admins get a unified view, and employees see one simple, consistent portal—no matter the country. Add markets without multiplying vendors or logins.

Enrollment that people actually finish

Guided flows make enrollment simple, with clear comparisons, eligibility guardrails, and costs shown per pay period. In the US, open enrollment and late-enrollment rules are already built in. Employees complete the process in one place, with document capture and reminders handled for them.

QLEs without the chaos

Life events no longer derail payroll. Marriage, adoption, address changes, and loss of coverage are supported with evidence captured in one place, deadlines enforced, and approvals tracked. Retroactive changes and refunds flow automatically into the next payroll run—no manual fixes required.

Global by design

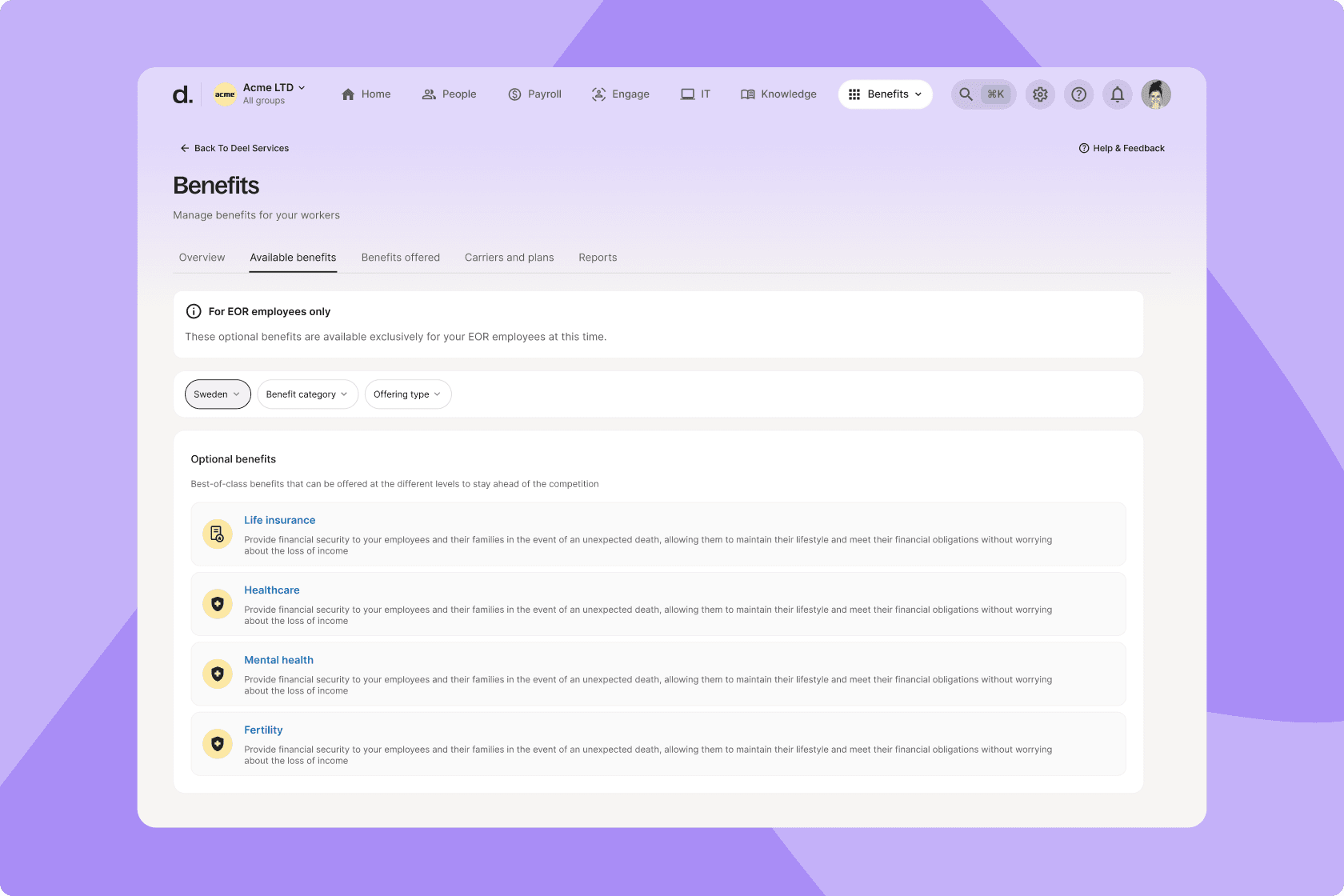

You can apply country-specific eligibility, waiting periods, and contribution rules, while handling the right tax treatment across entities. HR sees one clear view of uptake, spend, and exceptions by country and cohort, while employees enjoy a local experience.

Unified reporting

All benefit costs are visible at a glance, layered alongside payroll data for a full picture of workforce spend. Drill down by country, employee group, or benefit type to spot trends and underutilized plans, and make faster, more confident decisions.

Deel Benefits Admin: Benefits options for EOR workers

Why this matters to HR and Finance

HR gets time back. When enrollment runs where payroll lives, files stop flying, and small mistakes don’t snowball into escalations. That’s fewer off-cycles, fewer reissues, and fewer Monday-morning “my check is wrong” tickets.

Finance gets a cleaner close. With a single source of truth for elections and deductions, audits get cleaner, forecasts get tighter, and variance doesn’t drift. You control policy and risk with software-enforced guardrails, not spreadsheets.

Leaders get visibility. HR and Finance share one view of uptake, cost, and exceptions by country, entity, and cohort. That’s the foundation for a real Total Rewards strategy, not just an annual renewal exercise.

One view, one decision. HR can lead with less admin, brokers can focus on advising, and CFOs can approve with defensible numbers. The answer to today’s rising costs, complex compliance, and limited bandwidth is a unified solution: fewer vendors, automated handoffs, and one system everyone can trust.

How you get started

Ready to simplify benefits? Schedule a demo.

FAQs

What is Deel Benefits Admin, and who is it for?

Deel Benefits Admin is a payroll-native platform to design, enroll, and manage employee benefits across countries in one flow. It’s built for companies that want fewer vendors, accurate payslips, and a faster close. HR and Finance get one source of truth for plans, deductions, QLEs, and reporting, US and globally.

How does “payroll-native” benefits reduce errors and off-cycles?

Employee elections write directly to payroll with eligibility, limits, and tax rules enforced in software. No rekeying or manual mapping. Deductions, employer contributions, and prorations hit the right codes per pay period, so payslips are right the first time. Fewer exceptions means fewer off-cycles and cleaner month-end reconciliation.

How are open enrollment and QLEs handled end-to-end?

Employees compare plans, see per-pay costs, and complete required docs in guided flows. Admins set windows, rules, and approvals; the system enforces deadlines and waiting periods. For QLEs (marriage, birth/adoption, address changes, loss of coverage), evidence is captured, changes are prorated or back-paid automatically, and payroll updates on the next run.

Can we keep our current broker and carrier plans?

Yes. Bring your broker and existing plans. Deel is broker-friendly: your broker can access the admin workspace to help with plan setup, rates, and renewals. We run enrollment and sync deductions to payroll, while you retain carrier relationships and funding arrangements.

How does this work for global teams and EOR workers on one platform?

Deel applies country-specific eligibility, waiting periods, and tax treatment while keeping one admin view for uptake, spend, and exceptions. Employees enroll in their local experience; admins see unified reporting. Direct employees and EOR workers follow the same workflow, so benefits data and payroll deductions stay consistent.