Article

15 min read

Integrating Workday HCM and Payroll: 7 Criteria for Choosing a Global Payroll Solution

Global payroll

Author

Shannon Ongaro

Last Update

January 28, 2026

Table of Contents

What should you look for in a global payroll provider?

Optimize operations by integrating Workday with Deel Payroll

Key takeaways

- Integrating Workday HCM with a global payroll solution increases your operational agility, efficiency, and the ROI of your Workday investment.

- To find the best payroll solution, evaluate data integration, global compliance expertise, payroll coverage, scalability, user experience, reporting and analytics, service and support model, and customer feedback.

- Deel Payroll—one of the few providers that is Global Payroll Certified with Workday—enables you to manage everything in one place for a unified, real-time view of your payroll data.

Organizations running Workday HCM have already invested in a robust foundation for global HR operations. However, without a payroll solution designed to integrate effectively, gaps emerge in execution, visibility, and compliance.

Integrating Workday HCM with payroll enables a connected operating model that supports scale, strengthens compliance controls, and reduces reliance on manual workarounds—allowing teams to focus on higher-value, strategic initiatives.

Not all payroll solutions are architected to integrate cleanly with Workday. Selecting the right global payroll solution is critical to preserving data integrity, supporting multi-country complexity, and realizing the full value of your Workday investment.

The criteria below outline how to evaluate payroll solutions that integrate with Workday HCM and support compliant, efficient growth across regions.

What should you look for in a global payroll provider?

1. Prioritize certified Workday partners

Workday has partnerships with various global payroll providers through programs like Global Payroll Connect, offering pre-built, certified integrations to streamline data exchange and ensure compliance with local regulations.

These payroll partners facilitate real-time data flow between Workday and the payroll system, using APIs or certified connectors to efficiently exchange data and reflect changes across systems.

Look for certified Workday providers to ensure smooth, automated data exchange, so updates made in one system are instantly reflected in the other.

Any payroll solution you consider should integrate natively or seamlessly with Workday, enabling:

- Real-time data sync: Changes to employee details, compensation, and status automatically flow between systems, so you don’t have to leave Workday to view payroll data

- Operational efficiency: Save time and boost accuracy by eliminating duplicate data entry across systems

- Standardized employee records across HR and payroll: Maintain a single, accurate source of truth for every employee’s information

- Automated workflows and approvals: Expedite processes and reduce admin work with streamlined, trackable workflows

Deel Payroll

2. Evaluate built-in global compliance capabilities

Managing payroll in multiple countries means dealing with vastly different tax codes, labor laws, and reporting requirements. Look for a solution that offers:

- In-country compliance expertise across 100+ countries: The less they rely on third parties for compliance support, the more confident you can be in their accuracy and responsiveness

- Automated platform updates for local regulatory changes

- Audit-ready reporting capabilities

- Expert support for local tax filings, benefits, and country-specific requirements

Compliance

3. Assess scalability and global payroll coverage

Scaling a team involves more than just increased headcount—it means greater complexity. Make sure the solution can support your organization through M&A, expansion into new countries or regions, or new compliance risks.

As your organization grows, your payroll system should grow with it. Can the system support payroll in all the countries where you have employees (or plan to)? Can the platform support multiple currencies, payment types, and languages?

4. Evaluate the user experience for admins and employees

A great global payroll solution should be intuitive and easy to use, whether you’re a payroll administrator or an employee viewing a payslip.

Look for:

-

Employee self-service (accessible through Workday)

-

Localized payslips, tax documents, and leave tracking

-

Clear approval workflows and exception management for admins

-

Mobile access and language support

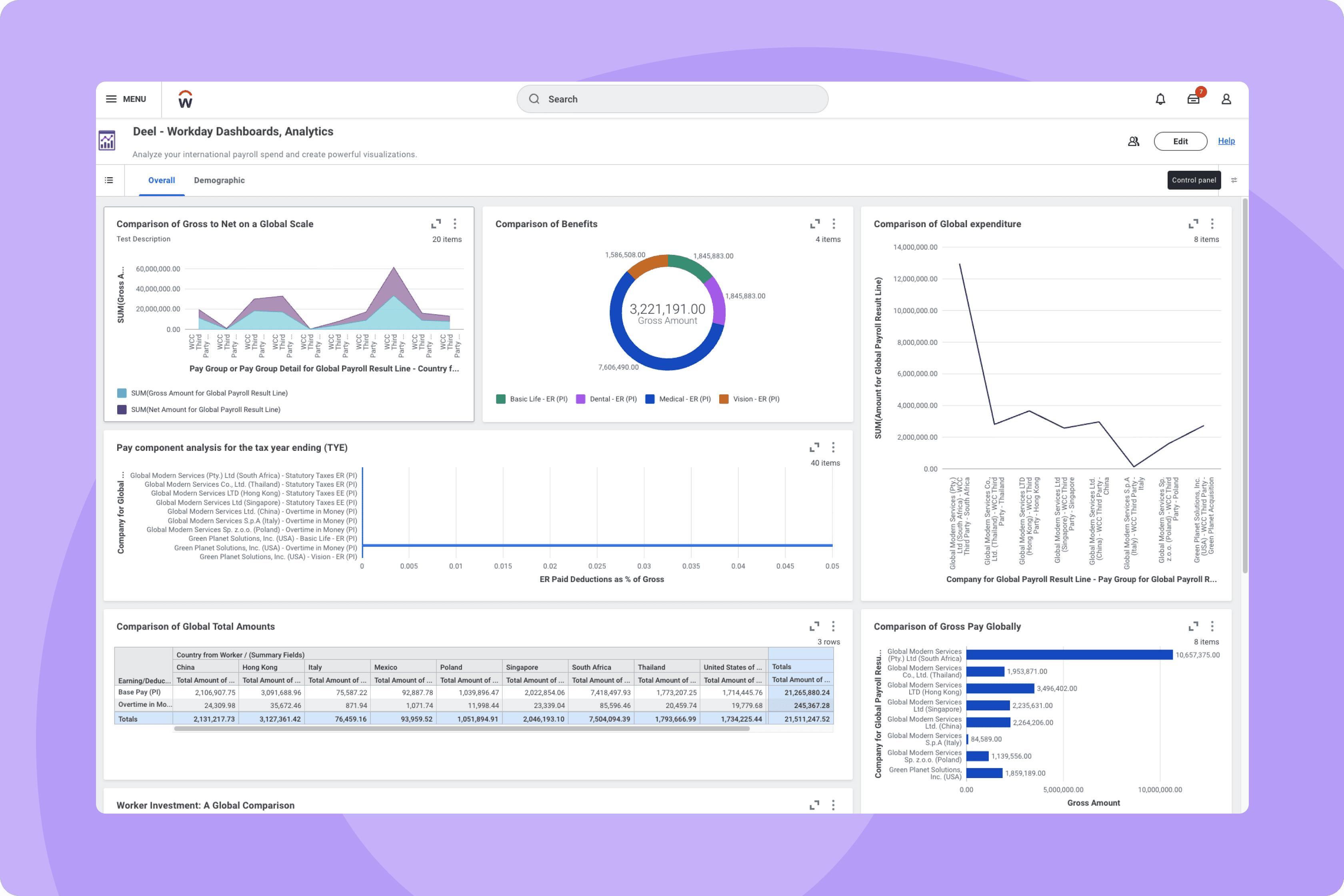

5. Ensure comprehensive reporting and analytics

With the right reporting and analytics, Finance and HR leaders can identify trends, control labor costs, forecast accurately, and mitigate risks. Integrated insights also make it easier to align payroll data with broader business goals and financial planning.

To ensure data visibility and accuracy, choose a global payroll system that delivers:

-

Consolidated global reporting dashboards

-

Labor cost and headcount analytics by country or region

-

Integration into Workday reports or financial planning modules

6. Find a service and support model backed by country-specific experts

Even the best payroll technology needs strong human support behind it. The right partner should offer expert help when and where you need it, whether that’s resolving an urgent payroll issue, navigating a new country’s regulations, or guiding you through integration.

Service quality can make the difference between smooth payroll cycles and costly delays. Add these key questions to your evaluation:

-

What level of customer support is offered—24/7, multilingual, region-specific?

-

Is there a dedicated payroll specialist per country you operate in?

-

Are there in-country support teams who are experts in local employment law?

Having a payroll partner knowledgeable in regional nuances is so important. It would take me a lot longer to learn them on my own, and we’d run a greater risk of payroll delays for our employees.

—Valerie Tazelaar,

Payroll Director, FICO

7. Ask for customer references and case studies

While a product demo provides helpful insight into a potential payroll solution, real-world results tell the full story. This is your chance to validate vendor claims, uncover potential red flags, and confirm that the solution works seamlessly for organizations like yours.

Ask for:

-

Case studies from other Workday HCM customers in your industry

-

Customer references you can speak with directly

-

Insights into implementation timelines, challenges, and ROI

We needed a partner with strong technology and the stability to handle our global complexity. Deel’s ability to centralize support and integrate seamlessly with Workday's latest tech made them the clear choice.

—Heather Ashley,

Director of HR Technology at Barings

Deel on G2

Optimize operations by integrating Workday with Deel Payroll

Get more control and efficiency in Workday HCM by integrating with Deel Payroll, one of only a few providers that is Global Payroll Certified with Workday.

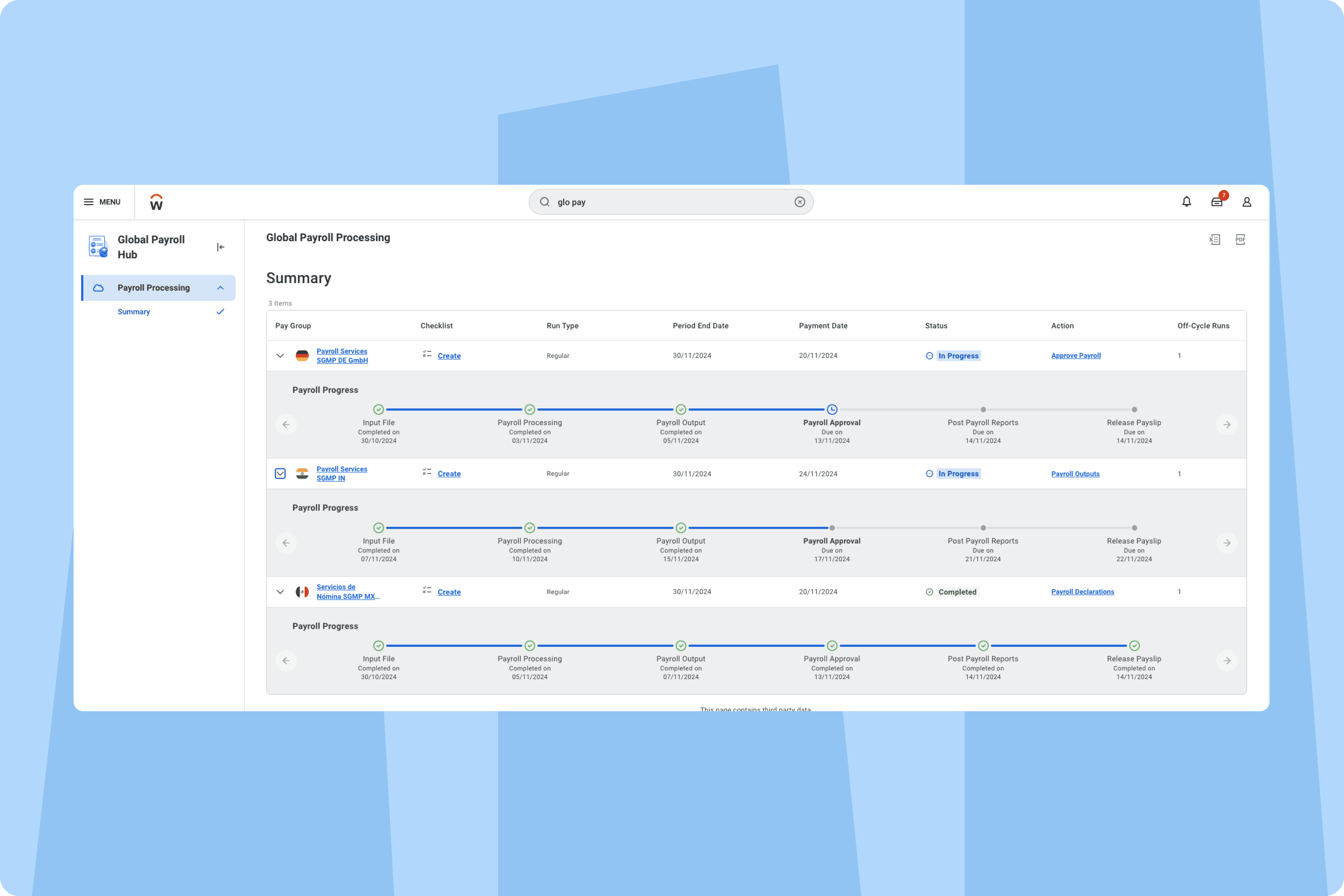

Gain real-time view of payroll data, streamline operations without overhauling existing systems, and optimize your Workday platform with automated payroll sync:

- Consistent managed payroll experience in all your countries

- More payroll data accuracy and real-time results

- Keep payroll results, payslips, and tax documents in Workday

- Easy payroll visibility for HR, Payroll, and Finance teams

With a single, comprehensive view of global payroll processes, payroll leaders can monitor cycles and statuses with ease, which further eliminates constant manual checks of individual processes.

—Valerie Tazelaar,

Payroll Director, FICO

At Deel, we ensure regular compliance updates to strengthen your operational continuity and protect against penalties. Receive timely alerts and guided action plans for changes to labor laws, taxes, or filing requirements:

- 2,000 in-house payroll, HR, and legal experts

- Dedicated Deel Payroll Managers local to your employees

- Deel AI included for instant compliance and HR answers

- 24/7 support via email, phone, live chat, Slack, and Teams

Book a demo to seamlessly integrate your Workday HCM platform with Deel Payroll.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.