Article

24 min read

Manage Employment & Payroll in Israel Easily

Employer of record

Author

Jemima Owen-Jones

Last Update

November 03, 2025

Table of Contents

Understanding Israel’s employment regulations

Hiring without a local entity in Israel

Hire employees in Israel with Deel

Managing payroll and tax complexity in Israel

Automate payroll and tax compliance with Deel

Managing statutory benefits and leave in Israel

Localized benefits management with Deel

Staying compliant with changing labor laws in Israel

Continuous compliance monitoring with Deel

Onboarding and managing remote employees in Israel

Streamlined onboarding and workforce management with Deel

Hire in Israel quickly and compliantly with Deel

Key takeaways

- Israel has strict employment, payroll, and social insurance laws that apply even to remote workers.

- Hiring without a local entity is complex, encompassing everything from payroll registration to benefits administration.

- Deel enables compliant hiring, payroll, and benefits management in Israel within days.

If you’re a startup or global company looking to hire talent in Israel, you’re probably searching for answers on how to manage payroll, benefits, and compliance—without opening a local entity. From understanding employment classifications to choosing between direct hiring or an Employer of Record (EOR), the process can feel complex at first glance.

Missteps in this process can be costly. Failing to comply with Israel’s National Insurance Law, mandatory pension contributions, or paid leave entitlements can expose your business to fines, legal risk, and reputational damage. Even well-intentioned employers often struggle to keep up with evolving labor regulations designed to protect employees, regardless of where they work.

At Deel, we’ve helped thousands of startups and enterprises scale remote teams in Israel compliantly—handling everything from payroll automation to statutory benefits. With localized legal expertise and technology built for distributed workforces, we know exactly how to simplify what can otherwise be a dense administrative burden.

Whether you’re hiring your first Israeli engineer or expanding a remote operations team, this guide breaks down what founders, HR leaders, and finance teams need to know to hire confidently and compliantly.

You don’t need a local office to tap into Israel’s world-class talent pool. With the right partner and systems in place, hiring in Israel can be seamless, compliant, and fast—empowering your team to focus on growth, not red tape.

Understanding Israel’s employment regulations

Israel maintains a robust employment framework designed to protect workers through comprehensive labor laws and social insurance coverage.

Under Israel’s National Insurance Law, remote and mobile workers retain the same labor rights and social insurance protections regardless of physical location. This universal coverage ensures that employees working from home or other remote locations receive the same statutory benefits and protections as office-based workers.

Key employer obligations

Employers must:

- Maintain accurate working hour records and respect weekly limits

- Provide electronic attendance tracking for remote workers

- Ensure timely employee salary and contribution payments

- Offer mandatory vacation days, sick leave, and holiday compensation

- Contribute to social insurance and severance funds

- Comply with occupational safety requirements—even for remote employees

With Deel EOR, we can send out a contract on the same day we decide to hire someone. Our hiring process has gone from 4 days to 1 day.

—Helen Yildiz,

Chief Customer Officer at Data Talks

See also: Employer costs for an employee in Israel

Check out our quickstart guide to hiring in Israel.

Leading Global Hiring Platform

Hiring without a local entity in Israel

Hiring Israeli talent typically requires setting up a local entity, which involves registering with tax authorities, opening a local bank account, and navigating benefits and payroll laws in Hebrew. This process can take months and demands ongoing filings with multiple agencies.

Employers face:

- Complex tax and insurance registrations

- Language and documentation barriers

- Contractor misclassification risks

- Mandatory electronic attendance tracking for remote workers

- Administrative overhead managing payments and filings

See also: How to Register a Sole Proprietorship (Osek Patur / Osek Murshe) in Israel

Hire employees in Israel with Deel

With Deel, you can hire employees in Israel quickly, easily, and compliantly—without setting up a local company. Deel acts as the Employer of Record, managing payroll, benefits, employment contracts, and compliance under Israeli law while you retain full control of day-to-day work.

| Key Fact | Details |

|---|---|

| Currency | New Shekel (ILS / NIS) |

| Capital | Jerusalem |

| Official Language | Hebrew |

| Payroll Cycle | Monthly |

All statutory benefits for Israel are built right into Deel’s localized platform, including:

- Pension Fund

- Public Health Insurance

- Private Health Insurance (Menorah Mivtachim)

- Private Healthcare (Allianz, optional)

- Global Life Insurance (Allianz)

Discover how Bitpanda expanded from 3 office hubs to 20+ jurisdictions with Deel.

We use Deel EOR every time we enter a new market. Itʼs our fast track to simple and compliant hiring before setting up entities.

—Lindsay Ross,

Chief Human Resources Officer at Bitpanda

Deel Employer of Record

Managing payroll and tax complexity in Israel

Payroll in Israel requires detailed reporting, multiple government submissions, and accurate application of changing tax and insurance rates.

The system is progressive, with tax rates up to 50%, and employer costs can reach over 22% of gross salary.

| Payroll Process Step | Key Requirements | Timeline |

|---|---|---|

| Registration | Tax and social insurance enrollment | 2–4 weeks |

| Employee Setup | Personal details, tax status, benefit elections | 1–2 weeks |

| Monthly Calculation | Gross pay, deductions, contributions | Monthly |

| Payment Processing | Bank transfers, payslips | End of month |

| Reporting | Government filings | Monthly/Quarterly |

Israel pay and tax overview

| Category | Details |

|---|---|

| Minimum Wage | NIS 6,247.67 per month / NIS 34.32 per hour |

| Income Tax Range | 10%–50% (progressive) |

| Employer Cost | 18.38%–22.43% of salary |

| Severance Contribution | 8.33% |

| Pension Fund | 7.50% |

| Bituah Leumi (Social Insurance) | 3.55–7.60% (based on income) |

Income tax brackets in Israel (2025)

| Annual Income (NIS) | Tax Rate |

|---|---|

| 0 – 84,120 | 10% |

| 84,121 – 120,720 | 14% |

| 120,721 – 193,800 | 20% |

| 193,801 – 269,280 | 31% |

| 269,281 – 560,280 | 35% |

| 560,281 – 721,560 | 47% |

| Over 721,560 | 50% |

Automate payroll and tax compliance with Deel

Deel automates Israel’s entire payroll lifecycle—from tax withholdings and social insurance contributions to payslip generation and government reporting.

Our localized payroll engine updates automatically when tax rates or minimum wage laws change, eliminating manual errors and ensuring 100% compliance.

Discover how LionsBot accelerated European expansion with Deel.

With Deel, we can hire top talent in new markets, onboard them seamlessly, and run payroll with full confidence. It lets us focus our energy on pushing the boundaries of automation, not managing admin.

—Tat Lin Lee,

General Manager, Operations, LionsBot

Deel Payroll

Managing statutory benefits and leave in Israel

Israeli law requires employers to fund and administer a range of benefits, from paid time off to severance and parental leave.

Calculating and tracking these benefits manually for remote teams creates administrative risk and potential non-compliance.

| Benefit Type | Statutory Provision |

|---|---|

| Annual Leave | 12 days per year (increases with tenure) |

| Sick Leave | 1.5 days/month (first day unpaid) |

| Recuperation Pay | Annual wellness stipend |

| Maternity Leave | 26 weeks paid (if 12+ months of service) |

| Paternity Leave | 1 month paid (conditional) |

| Severance Fund | 8.33% of salary/month |

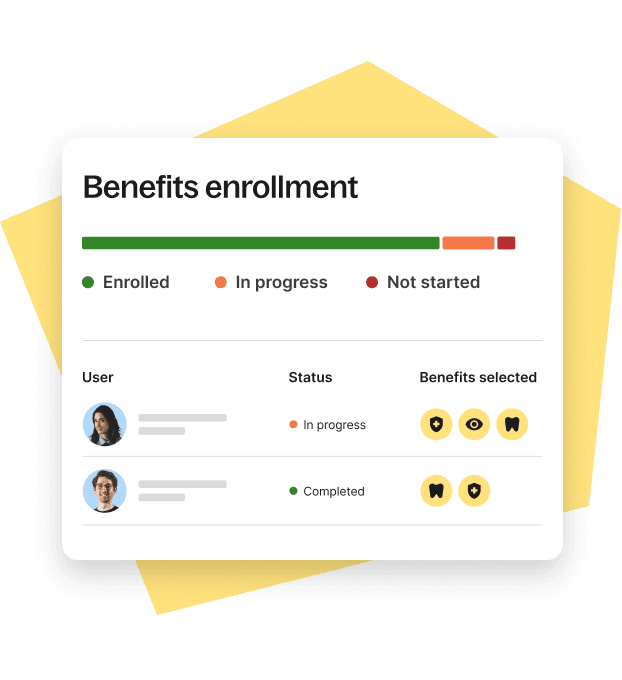

Localized benefits management with Deel

Deel integrates all Israeli statutory benefits into one automated dashboard.

Employers can provide mandatory and optional benefits (healthcare, pension, insurance) instantly, with contributions calculated and paid on schedule.

Digital self-service tools allow employees to view entitlements and manage benefits easily.

Discover how Wayfindr scaled global benefits in weeks with Deel.

For a logistics business like ours, speed and local knowledge are critical. We had to move fast—but without Deel, it would have been incredibly challenging to navigate the complex government policies and benefits across different markets.

—Yen Le,

Accountant at Wayfindr

Benefits Administration

Staying compliant with changing labor laws in Israel

Israeli employment regulations update frequently—tax rates, contribution thresholds, and reporting deadlines can shift multiple times a year.

Non-compliance carries steep penalties of up to 35,000 ILS per violation and reputational risk for global employers.

Continuous compliance monitoring with Deel

Deel’s compliance engine automatically applies Israeli legislative updates across payroll, tax, and benefits systems.

Employers receive real-time alerts, updated calculations, and fully localized reporting, reducing risk while maintaining audit-ready documentation.

| Key Feature | Benefit |

|---|---|

| Automated payroll calculations | Ensures correct tax and deduction rates |

| Digital payslips | Compliant, accessible documentation |

| Electronic attendance tracking | Meets Israeli labor law standards |

| Integrated benefits administration | Streamlined employee management |

| Multi-currency support | Simplifies cross-border payments |

| Real-time compliance monitoring | Reduces risk of outdated calculations |

Discover how Amilon cut 480 hours of monthly HR work with Deel.

Before Deel, we were drowning in complexity—separate providers for every country, endless emails, different languages, and paying €1,000 just to get basic legal advice. Now I just search Deel's Compliance Hub and get instant answers. It’s completely transformed how we work.

—Izacco Scattolin Neto,

Senior HR Recruiter, Amilon

Compliance

Onboarding and managing remote employees in Israel

Onboarding in Israel involves strict documentation requirements and ongoing compliance checks, including tax registration, social insurance enrollment, and attendance tracking.

Managing this remotely can become time-consuming and error-prone without the right infrastructure in place.

Streamlined onboarding and workforce management with Deel

Deel centralizes onboarding, document collection, and compliance workflows into one digital platform. Employees can submit IDs, tax forms, and bank details directly through Deel, while employers can manage benefits and attendance in real time.

Onboarding checklist:

- Collect identity, tax, and bank details

- Register for social insurance (Bituah Leumi)

- Enroll in benefits and pension fund

- Explain statutory rights and company policies

- Implement compliant time-tracking systems

- Provide access to payroll platform

- Schedule regular check-ins and reviews

Deel EOR enabled us to hire, onboard, and pay compliantly the talent we needed in 8 countries in a very simple and fast way.

—Pierre Puig,

Head of HR at Sim&Cure

Deel HR

Hire in Israel quickly and compliantly with Deel

Hiring in Israel no longer requires months of legal setup. Deel enables you to hire, pay, and manage top Israeli talent in days—compliantly and efficiently.

Our EOR and international payroll solutions remove complexity, ensuring your company meets every legal, tax, and employment requirement with ease.

Book a Deel demo today to learn how we can help you scale in Israel and beyond.

Global Hiring Impact

Recognized as a Leader on Everest Group’s PEAK Matrix®

More resources

FAQs

What are the mandatory wages and benefits for employees in Israel?

As of 2024, the monthly minimum wage is NIS 6,247.67. Mandatory benefits include annual leave (12+ days), paid public holidays, sick leave, maternity and paternity leave, and severance contributions equal to 8.33% of salary. Social insurance covers healthcare, unemployment, and other protections.

How can foreign organizations legally hire employees in Israel without setting up an entity?

Foreign organizations use Deel’s Employer of Record (EOR) service, which handles contracts, payroll, benefits, and compliance. The EOR acts as the legal employer while you manage day-to-day work.

What are the key payroll tax obligations for employers in Israel?

Employers must manage income tax withholding, social insurance and pension contributions, and severance payments. Deel’s payroll automation ensures these are always correct and filed on time.

How does remote work impact compliance with Israeli labor laws?

Remote employees in Israel are entitled to the same rights and benefits as office-based staff. Employers must implement compliant electronic attendance tracking and maintain equitable benefits coverage.

What risks should companies avoid when managing employment remotely in Israel?

Avoid misclassifying employees as contractors, missing registration deadlines, or using outdated payroll systems. Deel’s compliance automation prevents these errors through localized updates and built-in oversight.

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.