Article

22 min read

Manage Employment & Payroll in New Zealand Easily

Employer of record

Author

Jemima Owen-Jones

Last Update

November 03, 2025

Table of Contents

Understanding employment regulations in New Zealand

Built-in compliance for Kiwi employment law

Hiring without a local entity in New Zealand

Hire employees in New Zealand with Deel

Managing payroll and tax complexity in New Zealand

Automate payroll and tax compliance with Deel

Managing statutory benefits and leave in New Zealand

Simplified benefits administration with Deel

Staying compliant with changing employment laws in New Zealand

Continuous compliance monitoring with Deel

Onboarding and managing remote employees in New Zealand

Seamless onboarding and workforce management with Deel

Hire in New Zealand quickly and compliantly with Deel

Key takeaways

- New Zealand’s employment laws guarantee comprehensive protections for all workers.

- Setting up entities, payroll, and managing compliance independently is complex and time-consuming.

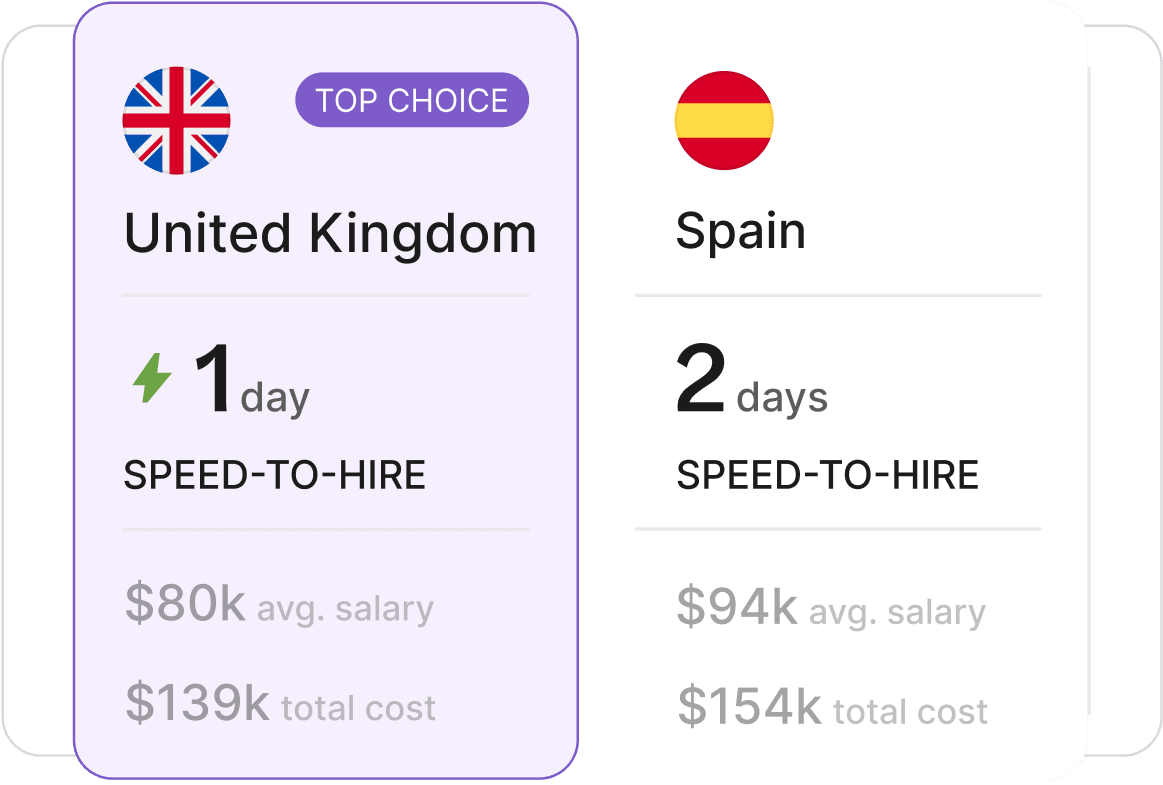

- Deel enables companies to hire, pay, and manage Kiwi talent in just 2 days — fully compliant, with no local entity required.

Expanding your team into New Zealand? You’re likely searching for clear guidance on how to hire employees, manage payroll, and stay compliant with local labor laws. From understanding the Employment Relations Act 2000 to managing KiwiSaver contributions, leave entitlements, and tax filings, the process can feel complex for even seasoned HR teams.

Yet getting it wrong can be costly. Missed filings or incorrect payments can lead to fines, back-dated benefits, and reputational risk under New Zealand’s strict employment standards. Manual systems and fragmented local providers often add to the burden, slowing expansion and creating unnecessary compliance exposure.

At Deel, we’ve helped thousands of startups and global enterprises onboard Kiwi employees quickly and compliantly. With automated payroll, built-in tax calculations, and localized employment contracts, our platform removes the guesswork from managing teams in New Zealand—so you can focus on growth, not red tape.

Whether you’re a startup hiring your first remote engineer or a multinational expanding operations across the Pacific, Deel gives you the tools and expertise to hire, pay, and manage Kiwi talent with confidence.

Understanding employment regulations in New Zealand

New Zealand’s employment framework centers on the Employment Relations Act 2000, which ensures fair treatment and strong employee rights. Employees can request flexible working arrangements, and employers must respond within 3 months.

Core employment requirements

| Requirement | Employer responsibility | Employee entitlement |

|---|---|---|

| Minimum wage | Pay at least NZD 23.15 per hour ( NZD 23.50 from Apr 2025 ) | Fair pay for all hours worked |

| Annual leave | Provide 4 weeks paid leave per year | Rest and recreation |

| Sick leave | Provide 10 days paid leave per year | Health recovery without income loss |

| Flexible work | Consider requests in good faith | Right to request schedule changes |

| Workplace safety | Maintain a safe environment | Protection from hazards |

| KiwiSaver / superannuation | Contribute 3 % ESCT | Retirement savings benefit |

With Deel EOR, we can send out a contract on the same day we decide to hire someone. Our hiring process has gone from 4 days to 1 day.

—Helen Yildiz,

Chief Customer Officer at Data Talks

Check out our quickstart guide to hiring New Zealand.

Global Hiring Tools

Built-in compliance for Kiwi employment law

Deel’s localized employment contracts and payroll engine automatically apply New Zealand’s statutory rules — including minimum wage updates, paid-leave entitlements, KiwiSaver contributions, and workplace-safety obligations.

Compliance is baked into every stage of the employment lifecycle, keeping your operations aligned with Inland Revenue requirements and labor law.

Hiring without a local entity in New Zealand

Traditionally, hiring in New Zealand requires establishing a local entity, registering with Inland Revenue, and opening a local bank account — a process that can take months.

Employers face:

- Multiple registrations and reporting obligations

- KiwiSaver setup and PAYE filings

- Manual tax documentation and record keeping

- Complex leave and benefit tracking

See also: How to Register a Sole Proprietorship (Sole Trader) in New Zealand

Hire employees in New Zealand with Deel

With Deel, your business can onboard, pay, and manage employees in New Zealand in just two days — no entity needed. Deel acts as the Employer of Record, handling local compliance, payroll, and benefits while you focus on operations.

| Key fact | Details |

|---|---|

| Currency | New Zealand Dollar (NZD) |

| Capital | Wellington |

| Official language | English |

| Payroll cycle | Monthly |

Built-in benefits with Deel:

- Holiday accrual and paid time off

- Pension (KiwiSaver) management

- Workplace accident insurance (ACC)

- Private healthcare (Unisure / Allianz)

- Global life insurance (Allianz)

Discover how Bitpanda expanded from 3 office hubs to 20+ jurisdictions with Deel.

We use Deel EOR every time we enter a new market. Itʼs our fast track to simple and compliant hiring before setting up entities.

—Lindsay Ross,

Chief Human Resources Officer at Bitpanda

Deel Employer of Record

Managing payroll and tax complexity in New Zealand

Setting up payroll in New Zealand requires accurate tax withholding (PAYE), KiwiSaver contributions, and Inland Revenue reporting. Rates change periodically, and manual processing increases error risk.

Payroll setup steps

- Register as an employer with Inland Revenue Department (IRD)

- Collect employee IRD numbers for PAYE

- Set up KiwiSaver and ACC levy contributions

- Implement leave and attendance tracking systems

Pay and tax overview

| Category | Details |

|---|---|

| Minimum wage | NZD 23.15 / hour ( NZD 23.50 from Apr 2025 ) |

| Training / starting wage | NZD 18.52 → NZD 18.80 (Apr 2025) |

| Income tax range | 10.5 % – 39 % (progressive) |

| Employer cost | ≈ 3.21 % salary (3 % KiwiSaver + 0.21 % ACC levy) |

Income tax brackets (2025)

| Gross annual income (NZD) | Tax rate |

|---|---|

| Up to 15,600 | 10.5 % |

| 15,601 – 53,500 | 17.5 % |

| 53,501 – 78,100 | 30 % |

| 78,101 – 180,000 | 33 % |

| Over 180,000 | 39 % |

Automate payroll and tax compliance with Deel

Deel automates New Zealand payroll from registration to reporting. The platform calculates PAYE, KiwiSaver, and ACC levy contributions automatically and updates instantly when tax rates change.

| Manual payroll | Automated with Deel |

|---|---|

| Time-intensive calculations | Instant processing with built-in compliance |

| High error risk | Automated accuracy checks |

| Manual records | Digital audit trails |

| Limited integration | Seamless system connectivity |

Discover how LionsBot accelerated European expansion with Deel.

With Deel, we can hire top talent in new markets, onboard them seamlessly, and run payroll with full confidence. It lets us focus our energy on pushing the boundaries of automation, not managing admin.

—Tat Lin Lee,

General Manager, Operations, LionsBot

Deel Payroll

Managing statutory benefits and leave in New Zealand

Employers in New Zealand must manage a range of leave and benefit entitlements accurately to stay compliant and competitive.

| Benefit type | Statutory provision |

|---|---|

| Annual leave | 20 working days per year |

| Sick leave | 10 days paid per 12 months |

| Maternity (primary carer) leave | 26 weeks paid (up to NZD 661.12 per week, govt-funded) |

| Paternity leave | 1 – 2 weeks unpaid |

| Parental leave | 26 weeks (shared, unpaid) |

| Public holidays | 12 national + 12 regional |

Simplified benefits administration with Deel

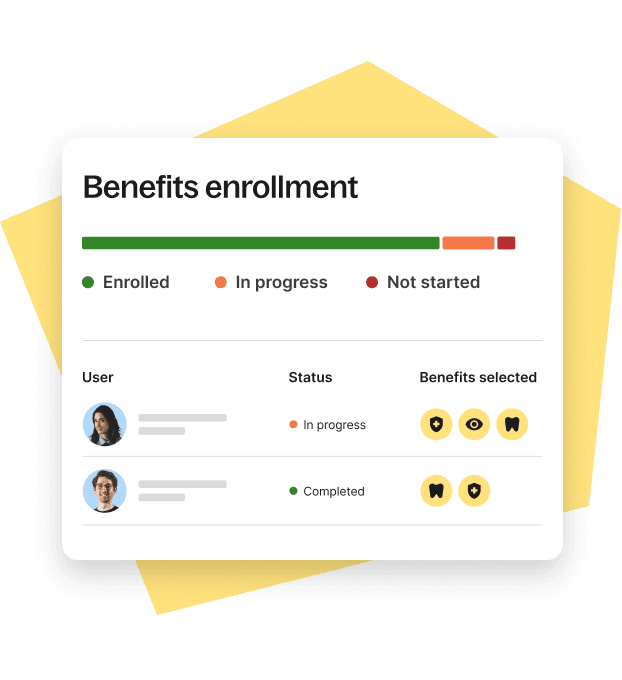

Deel integrates all mandatory and optional benefits into one platform — handling leave accrual, holiday pay, and KiwiSaver automatically.

Employers can add private health plans and global insurance options instantly, while employees get self-service access to benefits and balances.

Discover how Wayfindr scaled global benefits in weeks with Deel.

For a logistics business like ours, speed and local knowledge are critical. We had to move fast—but without Deel, it would have been incredibly challenging to navigate the complex government policies and benefits across different markets.

—Yen Le,

Accountant at Wayfindr

Benefits Administration

Staying compliant with changing employment laws in New Zealand

Tax rates, ACC levy caps, and employment regulations in New Zealand change regularly. Manual tracking creates risk of non-compliance and potential penalties from Inland Revenue.

Continuous compliance monitoring with Deel

Deel monitors New Zealand labor and tax regulations in real-time, automatically updating contracts and payroll. Built-in auditing and document storage simplify reporting and reduce risk for global teams.

| Key feature | Benefit |

|---|---|

| Automated payroll updates | Reflects current law and tax rates |

| Digital payslips | Compliant documentation |

| Integrated benefits management | Streamlined employee experience |

| Real-time compliance alerts | No missed regulatory changes |

| Cloud-based storage | Secure and accessible records |

Discover how Amilon cut 480 hours of monthly HR work with Deel.

| Before Deel, we were drowning in complexity—separate providers for every country, endless emails, different languages, and paying €1,000 just to get basic legal advice. Now I just search Deel's Compliance Hub and get instant answers. It’s completely transformed how we work. —Izacco Scattolin Neto, Senior HR Recruiter, Amilon |

|---|

See also: The Key to Continuous Company Compliance in Today’s Global Landscape

Compliance

Onboarding and managing remote employees in New Zealand

Onboarding in New Zealand requires collecting IRD numbers, tax forms, and written employment agreements. Employers must also accurately track leave, attendance, and KiwiSaver enrollments.

Seamless onboarding and workforce management with Deel

Deel digitizes the entire onboarding process — from contract generation and e-signatures to tax form collection and benefit setup.

Onboarding checklist:

- Collect identity and tax documents (IRD number)

- Register for KiwiSaver and ACC coverage

- Provide written employment agreement in English

- Implement leave and attendance tracking systems

- Automate payroll integration and benefits enrollment

- Schedule regular check-ins and performance reviews

Deel EOR enabled us to hire, onboard, and pay compliantly the talent we needed in 8 countries in a very simple and fast way.

—Pierre Puig,

Head of HR at Sim&Cure

Deel HR

Hire in New Zealand quickly and compliantly with Deel

Hiring in New Zealand doesn’t have to be complex. Deel enables you to hire, manage, and pay employees in days — without setting up a local entity.

Our EOR and global payroll solutions simplify compliance so you can focus on growth, not paperwork.

Book a Deel demo today to learn how to expand into New Zealand seamlessly.

Global Hiring Impact

Recognized as a Leader on Everest Group’s PEAK Matrix®

FAQs

What are the mandatory wages and benefits for employees in New Zealand?

The minimum wage is NZD 23.15 per hour, rising to NZD 23.50 in April 2025. Employees receive 4 weeks of annual leave, 10 days of paid sick leave, and 26 weeks of primary carer leave (government-funded). Employers contribute 3 % to KiwiSaver and 0.21 % to ACC.

How can foreign startups hire employees in New Zealand without a local entity?

Through Deel’s Employer of Record (EOR) service, which manages contracts, payroll, benefits, and tax compliance under New Zealand law while you direct daily operations.

What are the standard working hours and overtime rules?

Standard hours are 40 hours per week, Monday to Friday. Overtime pay is not mandated by law, but public-holiday work must be paid at 150 % of the regular rate.

What termination rules apply in New Zealand?

There is no at-will termination. Employers must have just cause and provide one month’s notice. Severance is not mandatory unless specified by contract.

How does Deel help maintain compliance for Kiwi teams?

Deel monitors all updates to tax rates, KiwiSaver, and local laws impacting employment, automatically adjusting calculations and documents to ensure your operations remain fully compliant.

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.