Article

17 min read

Independent Contractors vs. PEO: Is It Time to Switch?

PEO

Author

Shannon Ongaro

Last Update

April 09, 2025

- Hiring employees through a PEO reduces the administrative burden of payroll, HR, and compliance while enhancing control over your workforce and ensuring legal alignment.

- A PEO partnership helps businesses stay compliant with evolving worker classification regulations by handling tasks like tax filings, benefits administration, and HR management.

- Deel PEO provides an all-in-one solution for managing payroll, compliance, and employee benefits across multiple states, allowing businesses to scale their US workforce effortlessly.

Many businesses rely on independent contractors to avoid the time-consuming tasks of payroll, HR, and compliance.

At first glance, contractors seem like the more flexible, cost-effective option. But as your team grows and regulations tighten, the risks of misclassification, compliance penalties, and administrative inefficiencies can quickly outweigh the benefits.

That’s where a PEO comes in. A PEO allows you to hire employees while outsourcing payroll, benefits, and compliance management—giving you the best of both worlds: workforce stability without the administrative burden.

In this guide, we’ll compare the pros and cons of independent contractors and PEOs, explore the hidden costs and risks of contractor-heavy workforces, and show how a PEO can save your business time and money.

Whether you’re scaling across states or seeking more control over your workforce, this guide will help you make the right choice for your business.

Why convert independent contractors to employees?

Companies of all sizes often use a mix of employment types to suit different business needs and stages of growth. Once a business starts growing, it often has the financial capacity to handle the increased costs that come with hiring full-time employees. As a result, they can benefit from:

Enhanced control and supervision

Employers have more control over employees' work schedules, methods, and processes, which helps maintain consistency and alignment with company standards. This direct oversight makes it easier to monitor and improve productivity and work quality.

Improved compliance with the Department of Labor (DOL)

Managing employees is simpler in terms of following labor laws and regulations, which reduces the risk of misclassification penalties and legal issues. By hiring employees, employers can more easily follow wage and hour laws, workplace safety standards, and other employee protections, creating a fair work environment.

Watch: Hiring in the US: Pathways to Expansion for Growing Teams

In this webinar, we explore the complexities and strategies for expanding your team in the US. The session features insights from industry experts:

- Sasha Medvedovsky, Co-Founder & CEO, Diversion Company

- Shannon Schiltz, Operating Partner at Andreessen Horowitz

- Philip Alvarado, Director of PEO Solutions, Deel

Access to benefits and development opportunities

Employees can access health insurance, retirement plans, paid time off, and other benefits, which can boost job satisfaction and attract top talent. Employers can also offer training and development opportunities, helping employees improve their skills and advance their careers within the company.

See also: How to Leverage US Employee Benefits Trends to Shape Competitive Packages

Increased security and confidentiality

Employees are often subject to stricter security and confidentiality agreements, which protect sensitive company information. Employers typically retain ownership of intellectual property created by employees, protecting company assets and innovations.

Deel PEO

Understanding worker classification in the US

Before you convert a worker from contractor to employee, you have to ensure they fit the classification under US law.

The US Department of Labor (DOL)’s new rule for worker classification took effect in March 2024. This rule provides six factors that businesses should consider to analyze their business relationship with a worker and determine the correct worker classification.

These factors, also known as the Six Factors of Economic Reality Test, include:

- Does the worker have opportunities for profit or loss based on managerial skill that affect the worker's economic success or failure?

- Are any investments by a worker capital or entrepreneurial in nature?

- Is the work relationship indefinite in duration, continuous, or exclusive of work for other employers?

- Does the potential employer have control, including reserved control over the performance of the work and the economic aspects of the working relationship?

- Is the work performed an integral part of the potential employer's business?

- Does the worker use specialized skills to perform the work and do those skills contribute to business-like initiative?

To help determine the proper classification of a worker, use Deel’s Misclassification Assessment. This assessment combines AI with award-winning research to classify workers with over 90% accuracy.

Using PEO services to simplify the process

What if you have the financial capacity to hire full-time, salaried employees, but not the HR or payroll resources to support their classification, HR workload, and payroll management? That’s where a PEO can help.

What is a PEO?

A professional employer organization (PEO) is a third-party company that provides outsourced payroll and HR solutions to businesses.

To utilize a PEO, your business must have an entity in the state where you intend to hire employees. This ensures that the PEO can legally manage employment responsibilities in that jurisdiction.

Partnering with a PEO requires entering into a co-employment relationship, wherein the PEO shares some of your company's legal and financial responsibilities for payroll, taxes, benefits, and HR compliance.

This partnership provides an added layer of protection and expertise, helping to manage compliance risks effectively.

How Deel PEO is different

Deel’s in-house PEO is built to support fast-growing teams with the tools, coverage, and service they need, all in one platform.

Fully in-house support

Deel PEO is run entirely by internal specialists, including certified professionals, licensed advisors, and dedicated HRBPs. Clients get direct access to expert guidance across payroll, benefits, and compliance, with no third-party handoffs or delays.

Benefits admin made easy

Admins can choose, enroll, and manage health benefits for US employees directly in the Deel platform. They can view costs, track coverage, and handle renewals—all in one place, without chasing brokers or juggling paperwork.

Exclusive access to Aetna International plans

For teams with globally mobile employees, Deel is the only PEO to offer Aetna International health plans, ensuring continuous coverage across borders without needing to manage separate providers.

All-in-one platform

Admins can manage hiring, onboarding, payroll, and benefits in one place. Deel simplifies every step, from enrollment to renewals, reducing HR admin time.

Compliance coverage at every level

Deel helps businesses meet federal, state, and local employment laws, taking the guesswork out of US HR compliance.

Learn more about Deel PEO.

Deel PEO simplified and accelerated our hiring process in the US, cutting costs by 50%. Now, managing compliance for our US-based team members is fast, easy, and cost-effective.

—Pierre Puig,

Head of HR, Sim & Cure

Only need payroll support? Use Deel US Payroll

If you want to hire direct employees through your own entities, but don’t need all of the support of a PEO, you can use Deel US Payroll. Deel US Payroll takes care of everything from wage calculations and deductions to handling all federal, state, and local tax filings:

- Instant tax and pay calculations

- Federal, state, and local tax filings and payments

- Workers compensation coverage (Add on)

- Built-in HRIS features to manage your entire workforce

- Benefits administration (Add on)

- Registration support in all 50 states (Add on)

Platform Tour

Or, you can transition from hiring contractors to employer of record (EOR) employees with Deel EOR.

An EOR is a third-party organization that legally employs staff internationally on behalf of client companies. This arrangement involves the EOR handling all employment-related responsibilities, including drafting contracts, managing salaries and benefits, and overseeing tax obligations.

💡 Learn more in our free guide: Everything EOR: A Guide to Employer of Record

Platform Tour

No matter which approach to US hiring you take with Deel, you benefit from a completely centralized payroll and HR platform that combines your US workforce with your international workforce.

By centralizing all your administration, you can eliminate multiple logins and reduce manual work and errors. You’ll also be able to seamlessly manage your data by collecting and storing all enrollment and deductions data in one secure location, simplifying payroll calculations globally.

With an all-in-one solution, you can empower employees with access to their benefits data, and enable them to enroll in new benefits, decline options, and manage dependents.

Steps to transition from independent contractors to employees

Converting contractors to employees with the help of a PEO can make the transition smoother and keep you compliant with labor laws. Here’s a look at the process:

1. Assess your business needs

First, identify which contractor roles are essential to your business and would benefit from being full-time positions. Think about long-term goals, the nature of the work, and how integrated these roles need to be. Conduct a cost-benefit analysis to understand the financial impact, including salaries, benefits, taxes, and administrative costs.

2. Select the right PEO partner

Look for a PEO with a strong track record in managing worker classification and employment transitions. Evaluate their services, industry expertise, and client reviews. Compare what different PEOs offer in terms of payroll management, benefits administration, HR support, and compliance help, and choose the one that best fits your needs.

3. Develop a transition plan

Outline a detailed timeline for the transition, including key milestones and deadlines. Develop a communication plan to inform contractors about the changes, clearly explaining the benefits of becoming employees and addressing any concerns they might have. With Deel, you receive the support of a dedicated customer success manager (CSM) and onboarding manager (OBM) to guide you through the process and beyond.

4. Legal and compliance preparation

Make sure your company is registered in every state where you plan to hire employees. Deel can assist with state-specific registration requirements and entity setup, simplifying the process. You can also use Deel to correctly classify workers according to relevant regulations to reduce misclassification issues and stay compliant with the FLSA.

5. Onboarding new employees

Compile all necessary employment documents from your now-employees, such as employment contracts, tax forms (W-2, W-4), and I-9 verifications to onboard them into the system. Deel automates these processes, ensuring documents are properly completed and compliant with regulations. You can also collaborate with Deel to set up employee benefits programs, including health insurance and retirement plans, through their benefits provider partners or by integrating your existing providers.

6. Payroll management

Your PEO will handle all payroll processes, including wage calculations, deductions, and tax payments. This ensures payments are accurate and timely, and taxes are filed correctly. The PEO will also manage direct deposits and payslips, integrating these processes with your accounting systems.

7. Ongoing HR and compliance support

A PEO should provide continuous HR support, including employee onboarding, performance management, and keeping up with labor laws. Deel's built-in HRIS features, allow you to manage all HR tasks, from document management and time off tracking to expense handling. This helps new employees settle in smoothly and ensures your business remains compliant with regulations.

💡 Deel’s Compliance Hub helps companies stay compliant with changing regulations with:

- An AI-based Worker Classifier

- A Compliance Monitor that automatically scans, collects, and explains relevant regulatory changes

- A Monthly Workforce Insights report that proactively alerts you to expiring visas, misclassification risks, and other potential non-compliance risks

8. Monitor and optimize

Collect feedback from your newly transitioned employees to identify any issues or areas for improvement, and make necessary adjustments to your HR and payroll processes based on this feedback and ongoing business needs. Regularly review and update your practices to stay aligned with regulatory changes and business growth.

When it comes to US payroll, the amount of money saved exceeds thousands of dollars since we didn’t have to hire consultants to set up and maintain our payroll. We can just do it ourselves through Deel’s easy-to-use all-in-one global platform.

—Amir Podensky,

CEO & Co-founder, Strada

Build your US workforce with Deel

While contractors may seem like the more affordable and flexible option, the hidden costs and risks can add up quickly—especially as your business scales. A PEO reduces these challenges by letting you hire employees while offloading compliance, payroll, and HR tasks to an expert partner.

Deel makes payroll and human resources management a breeze, whether you’re hiring in one state or all 50. As your forever people platform, Deel scales with your team by providing a full suite of services to help you hire, pay, and manage an evolving workforce.

In addition to Deel PEO, you can use:

- Deel US Payroll to run payroll across the country

- Deel Employer of Record (EOR) to hire employees globally without setting up entities

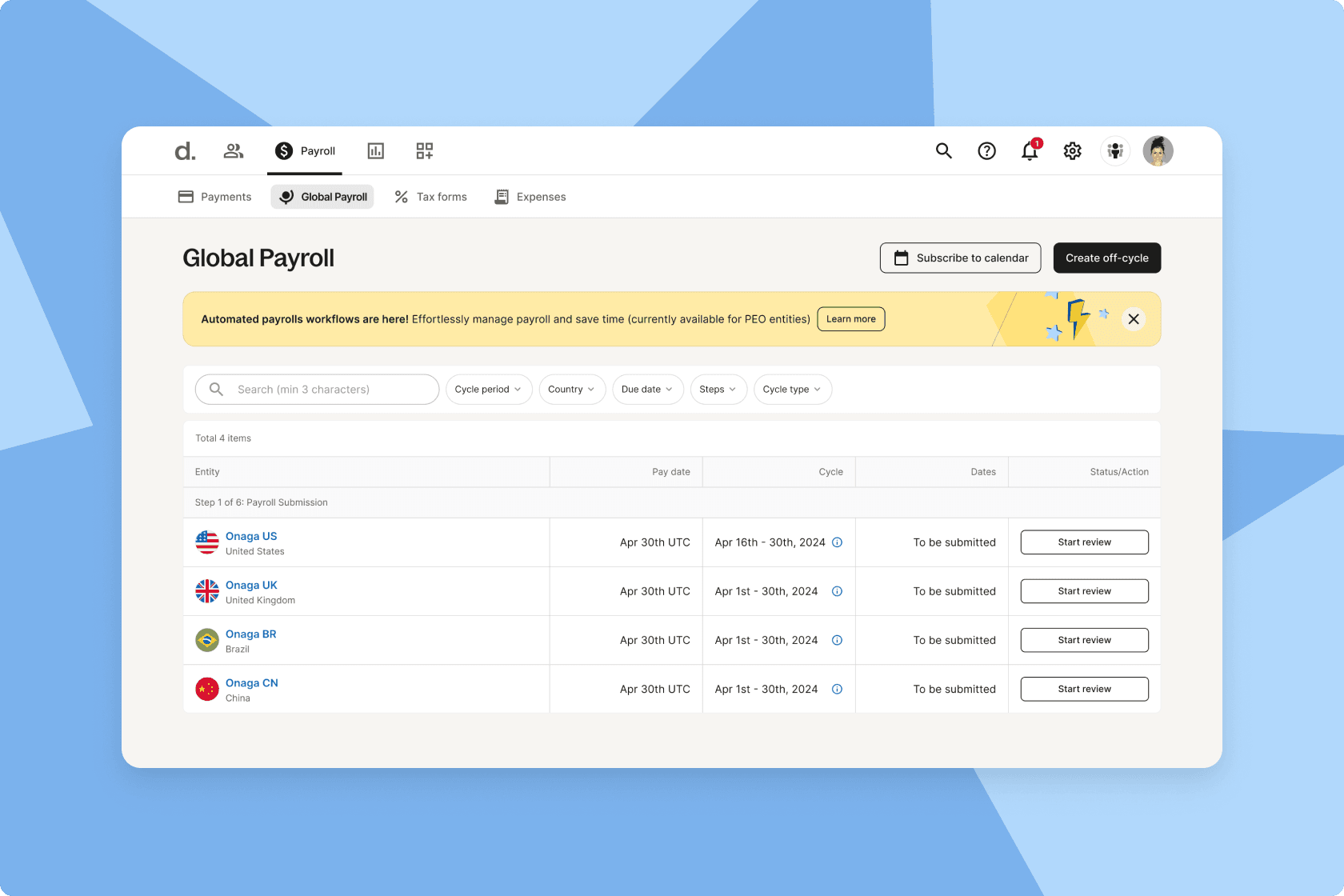

- Deel Global Payroll to pay direct employees under owned entities, everywhere

- Deel Contractor to compliantly manage independent contractors worldwide

- Deel Engage for performance metrics, training programs, and career paths

- Deel IT for global equipment provisioning

- And more

Book a 30-minute demo to explore the Deel platform, speak with a specialist, and get all your questions answered.

Deel on G2

About the author

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.