Article

22 min read

Enterprise Payroll Budgeting: Strategies for Global Cost Control

Global payroll

Author

Shannon Ongaro

Last Update

January 13, 2026

Key takeaways

- Most payroll budgets aren’t built for agility. Strategic budgeting requires continuous data-driven planning and advanced payroll tools.

- Techniques like headcount forecasting, scenario planning, and rolling forecasts help organizations anticipate costs, align labor with business goals, and adapt effectively.

- Deel empowers enterprises to manage payroll strategically. By combining real-time reporting with a unified platform for employees and contractors, it gives full visibility into labor costs.

Even carefully planned budgets can derail due to hidden costs, compliance changes, or workforce shifts. Surprises in labor costs can ripple across the organization, affecting cash flow, headcount planning, and strategic initiatives.

By anticipating these risks and building them into your planning, payroll budgeting becomes an opportunity to create adaptability, operational continuity, and global cost transparency.

The reality, however, is concerning. According to The Future of Payroll 2025 by HR.com, only 25% of payroll departments operate at optimized, strategic levels.

Without informed payroll budgeting, enterprises face escalating labor costs, fragmented processes, and reduced operational efficiency.

Here's how to optimize your payroll budget, plus a look into the tools you can use for more strategic decision-making.

Core strategies for effective and scalable payroll budgeting

Payroll budgeting starts with the right strategic pillars. These are the big levers that determine how resilient, accurate, and sustainable your payroll plan will be.

By putting these foundations in place—across headcount, compensation, workforce design, and compliance—you create a structure that supports reliable forecasting and long-term financial planning.

Establish accurate headcount forecasting

Accurate headcount forecasting keeps payroll budgets aligned with actual labor demand. It minimizes unexpected costs, cash flow strain, and over-allocation of resources.

Start by building dynamic models to accurately predict future staffing needs, factoring in turnover, seasonal hiring, and expected growth. Leverage historical workforce data, growth projections, and market trends to make forecasts realistic and actionable

This enables your company to align compensation planning with business goals, set aside funds for bonuses or overtime, and make informed hiring decisions without disrupting the budget.

With HR and finance working from the same projections, payroll planning becomes streamlined and reliable. Fewer last-minute changes make it a trustworthy foundation for long-term financial planning.

Leverage scenario planning to strengthen forecasting

Scenario planning helps your company prepare payroll budgets across best-case, worst-case, and mid-case workforce models.

It creates flexibility in the budget, ensuring the organization can absorb shocks such as higher turnover, delayed growth, geopolitical events, or unexpected compliance costs without destabilizing cash flow.

Scenario planning also gives you clear options for reallocating payroll funds when conditions improve, such as setting aside reserves for bonuses or other incentives. This helps you maintain employee satisfaction while keeping the budget intact.

An AI-powered tool like Deel’s Workforce Planning lets you compare multiple scenarios easily. You can forecast headcount and total payroll costs, with integrated compensation bands giving you a complete view of labor expenses.

Implement a clear compensation strategy

A clear, structured pay framework helps you attract and keep talent with competitive salaries and benefits while keeping labor costs predictable.

It also provides visibility into areas that drive labor costs, including benefits creep, employer contributions, and salary banding. This helps you spot rising costs early and adjust your payroll budgets before they strain cash flow.

Without this structure, payroll budgets risk ballooning due to unplanned raises, inconsistent pay practices, or reactive offers to counter competitors.

A shared playbook between finance and HR keeps payroll sustainable and strategic. It balances competitiveness in the talent market with cash-flow discipline.

Implementing and tracking a solid compensation strategy can be challenging with a growing, globally distributed workforce. Tools like Deel Compensation help you build custom salary bands backed by the latest market benchmarks, keeping you competitive across regions.

The platform allows finance, HR, and other stakeholders to view and communicate compensation decisions in one place, ensuring alignment and transparency. Built-in compliance features support adherence to local pay regulations, so your global compensation strategy stays compliant.

Compliantly manage costs across jursidictions

Payroll budgets get complex when employees are spread across multiple states, countries, or tax jurisdictions. Hiring the same role in two countries can carry different employer burdens, even when base salaries match.

In the US, for example, each state has its own rules for unemployment insurance and workers’ compensation premiums. You must also account for compliance costs and employer contributions for Social Security, Medicare, and other mandated benefits, all of which vary by location.

Factoring in state, federal, and international differences ensures your budgets reflect the true cost of employment across regions.

Include currency fluctuations as well. When wages are paid in local currencies but funded from a different base currency, exchange rate shifts can quickly raise overall payroll expenses. Even small movements can have a significant impact when applied across a global workforce.

A centralized global payroll system like Deel Payroll strengthens payroll budgeting by consolidating regional data into a single view. This visibility makes it easier to forecast labor spend more accurately and compare true employment costs across markets.

Deel also uses forward exchange rates to lock in foreign exchange costs ahead of time. It enables your team to budget in a single base currency without unexpected fluctuations.

Deel makes everything easier—it handles the heavy lifting, like calculations and currency exchange. Without it, managing payroll across multiple countries and currencies would be almost impossible for a global company like ours

—Yunjung (Rina) Bae,

Director of People, MarqVision

Balance contractor and full-time employee ratio

How you structure your workforce—contractor vs. employee— directly affects payroll budgets.

Full-time employees bring predictable costs through fixed salaries, statutory benefits, and employer contributions. But they also create longer-term obligations. Contractors often charge higher rates, but provide flexibility without the added costs of benefits or payroll taxes.

Balancing the two keeps payroll budgets aligned with business needs. For predictable, ongoing work, employees may make financial sense. For short-term projects or specialized expertise, contractors can reduce long-term payroll commitments and help avoid overstaffing.

Model different ratios to see how each labor type influences payroll spend. The right mix prevents overspending on roles that don’t require full-time hires and keeps strategic positions cost-efficient and sustainable.

Best practices to optimize your payroll budget

Once the foundations are set, the challenge is keeping payroll budgets updated, accurate, and aligned with business performance.

These best practices are scalable processes that help you track trends, anticipate risks, and refine allocations over time. The result is a payroll budget that evolves with your workforce and your company’s goals.

Audit past variances

Analyze where last year’s payroll budget missed expectations. Compare projected and actual costs across all categories, such as base salaries, overtime, bonuses, benefits, and employer contributions.

Identify over- or under-spending, recurring surprises, and unexpected obligations. These insights create a solid foundation for more accurate forecasts. They also reveal opportunities to improve allocation strategies in the next budget cycle.

Checklist

Global Payroll Audit Checklist

Benchmark payroll as a percentage of revenue

Calculate total labor costs and express them as a share of total revenue. Knowing how much revenue goes to payroll is critical for financial health.

Compare this figure with industry peers to see whether your payroll spend is efficient, under-resourced, or bloated.

Regular benchmarking supports informed decisions on headcount, compensation changes, and strategic hiring. It also acts as an early warning system: if payroll begins to consume an unsustainable share of revenue, you can take corrective action before impacting profitability.

Incorporate benefits creep analysis

Track year-over-year changes in healthcare, retirement contributions, perks, and other employee benefits. Even small increases—often called “benefits creep”—can quietly inflate your payroll budget if left unchecked.

Analyzing trends in benefit costs helps you spot spending that’s rising faster than planned. You can respond by:

- Finding opportunities to adjust contributions without hurting employee satisfaction

- Renegotiating benefit packages with providers, including pursuing volume discounts

- Exploring more cost-effective benefit providers without reducing benefit value

- Reviewing how often employees use each benefit and adjust funding based on actual usage rather than maximum allowances

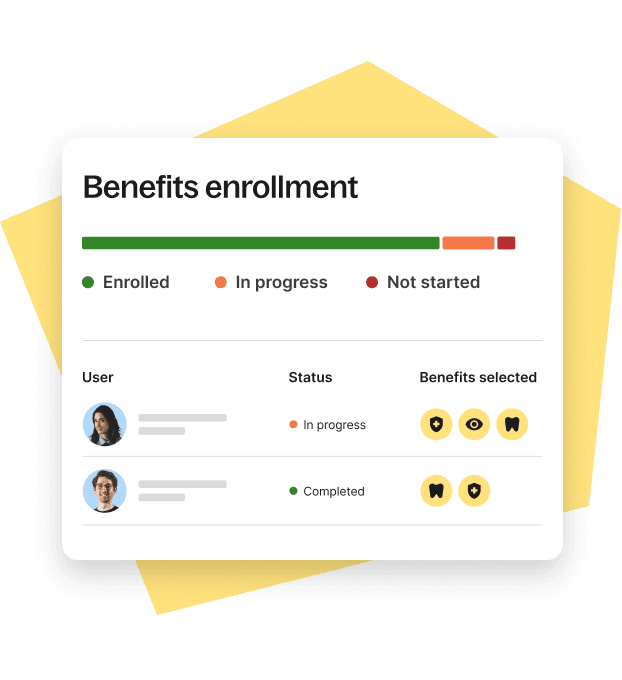

Deel Benefits Admin

Model currency and compliance risk

Simulate how foreign exchange shifts and regulatory changes could affect payroll before they occur. You can use scenario planning to test different currency exchange rates or tax adjustments across regions, then review the results to pinpoint where the greatest risk lies.

Be sure to stress-test extreme currency swings and regulatory shifts to understand potential worst-case scenarios.

Modeling these variables enables you to set aside data-driven contingency funds, adjust allocations, and keep budgets stable across regions.

Use rolling forecasts to ensure accuracy

Move from a static annual budget to quarterly or monthly re-forecasting. Instead of setting payroll projections once a year, rolling forecasts use current data—hiring timelines, turnover, compensation changes, and market conditions—to keep projections up to date and accurate.

These ongoing updates keep payroll budgets aligned with workforce shifts and business performance. You gain:

- More accurate projections through real-time data integration

- Earlier visibility into risks and opportunities for proactive decisions

- Smarter resource allocation across teams and regions

- Closer alignment between short-term workforce needs and long-term financial goals

Deploy automation to standardize data

Manual reconciliations in payroll budgeting invite hidden errors that distort forecasts. A mistyped figure, duplicate entry, wrong tax rates, or late adjustment may seem minor but can quietly inflate labor costs and throw budgets off track. The larger the workforce, the harder these issues are to catch in time.

Automation and AI in payroll processing close this gap. They standardize calculations, reconcile data automatically, and feed clean numbers into budgets in real time.

Modern payroll processing software also frees human resources and finance teams to spend less time on compliance checks and error fixes and more time analyzing trends and shaping strategy.

Common payroll budgeting mistakes

Even the best payroll budgets are liable to errors. Small oversights or outdated assumptions quickly disrupt forecasts and undermine the reliability of your budget. Here are some common mistakes to prepare for.

Relying on static, outdated payroll budgets

Annual payroll budgets lock in assumptions that rarely hold for a full year. Hiring plans shift, turnover rates change, and compensation adjustments occur mid-cycle. Relying on fixed numbers leads to inaccurate projections and reactive decision-making.

A better approach is to re-forecast quarterly or monthly. It keeps payroll budgets aligned with actual workforce activity and gives HR and finance teams more control over costs as conditions change.

Failure to account for total workforce costs

A common mistake that distorts your view of labor spend is focusing only on salaries while overlooking other expenses and indirect costs tied to employing people, such as:

- Immigration and relocation costs

- Employer-paid taxes and benefits

- Cost of fringe benefits

These costs can quietly add up to a significant share of payroll. Overlooking them creates blind spots that make budgets look healthier than they actually are, leading to underfunding and last-minute adjustments.

Always determine your total cost of employment. That means capturing every recurring and one-time expense, not just salaries.

Deel Payroll

Lack of routine payroll budget reconciliation

Waiting until the year-end payroll close to compare budgets with actual spend leaves little room for corrective action. By that point, small variances from hiring delays, turnover, or benefits usage can compound into major gaps. This often causes cash flow strain or missed targets.

Instead, set up regular checkpoints—quarterly or even monthly—to reconcile payroll assumptions against actual data. Frequent reviews allow you to catch creeping variances early, adjust allocations, and keep budgets realistic throughout the year.

Underestimated compliance and taxation volatility in new markets

Expanding into new states or countries without accounting for compliance and tax volatility can quickly derail payroll budgets.

Employer burdens rarely remain static. Mid-year changes to income tax brackets, social security thresholds, or mandatory benefits can reshape employment costs. Even minor shifts can create significant unplanned costs when multiplied across a workforce.

Budgeting as if today’s rates will hold steady leaves you exposed. A stronger approach is to model different regulatory and tax scenarios during budgeting.

Build in contingencies for potential shifts, especially in countries with a history of frequent policy updates. This cushions your HR budget against compliance surprises and prevents sudden funding gaps.

Fragmented tracking for contractor costs

Many HR and finance managers view contractors as flexible, easy-to-control costs since they can be scaled up or down as needed. But without proper tracking, contractor spend can escalate faster than expected, creating gaps in the payroll budget.

High hourly rates, inconsistent invoicing, and overlapping project scopes often slip through if contractors aren’t monitored alongside employee costs.

If contractors aren’t integrated into headcount planning, budgets may underestimate total labor spend and miss opportunities to optimize the employee-contractor mix.

The fix is to track contractor expenses with the same rigor as employee payroll. Include them in forecasting models, reconcile spending regularly, and review whether certain roles are better served by full-time hires.

Advanced tools and technology for global payroll optimization

Payroll technology has evolved beyond basic processing. Modern payroll software provides visibility to identify cost pressures early, test future scenarios, and align payroll planning with overall business strategy.

Core capabilities of advanced payroll tools that help reduce budget risk include:

- Payroll analytics dashboards: Visualize labor spend across departments, locations, and employment types. Dashboards highlight trends, anomalies, and cost drivers so you can act on insights quickly.

- Real-time payroll expense reporting: Instant access to up-to-date payroll data prevents delays between spending and reporting. It lets you spot overruns early and adjust allocations.

- Integrations with HRIS and ERP: Connecting payroll to core systems creates a single source of truth. It consolidates headcount, compensation, and benefits data for full visibility into total workforce costs.

- Advanced automation: Automated payroll feeds, calculations, and reconciliations speed up budgeting and reduce human error. This delivers more reliable numbers for faster, more accurate decisions.

See also: The Hidden Value in Payroll and HR Data—and How ERP Owners Can Unlock It

With Deel Payroll, all I have to do is log in, click ‘Approve Pay’, and that’s it. It’s the smoothest solution on the market.

—Marion Passalinqua,

Mobility and Legal Operations Specialist, Gecko Robotics, Inc.

Turn payroll budgeting into a strategic advantage

A well-optimized payroll budget supports talent strategy, maintains compliance, and reduces financial risks. With Deel Payroll, you get the tools you need to build data-driven, scalable, and accurate payroll budgets:

- Real-time payroll and reporting mean fewer surprises

- A unified platform for employees and contractors ensures clean cost forecasting

- Compliance automation across 100+ countries reduces budget variances

- Scalability enables finance teams to maintain resilient payroll budgets through mergers, acquisitions, and other major workforce changes

Book a demo to see how Deel can help you manage payroll strategically across your enterprise business.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.