Article

10 min read

US Benefits 101: What Employee Benefits Should You Offer?

PEO

US payroll

Author

Dr Kristine Lennie

Last Update

May 29, 2025

Table of Contents

Types of employee benefits

Admin basics for benefits management

How do benefits regulations differ by state?

The future of employee benefits: What should employers watch out for?

Supercharge your benefits offering with Deel PEO

Key takeaways

- As employees’ priorities continue to shift, employers and their recruitment teams must evolve their benefits offerings to meet the demands of the new talent market.

- Health insurance and retirement plans, paid time off, and work-life balance are the most desirable benefits for job-seekers as of 2025.

- Deel PEO offers US teams a comprehensive package of HR, payroll, and compliance services, as well as access to enterprise-level benefits that can catapult employers’ recruitment game.

A generous paycheck is only one of the ways in which US employers can draw in top talent. Another, and increasingly important tool, is benefits packages. A 2025 AON report found that as many as 42% of candidates globally would sacrifice pay for better pay.

Benefits not only help employees feel valued and motivated but could contribute to a healthier workforce, support career development, and promote a positive workplace culture. To build a compelling benefits package, employers and HR teams need to carefully consider their options, employee needs, and resources in order to deliver maximum value for the team and the company.

Small and mid-sized businesses often struggle to provide the same caliber benefits as large and enterprise-level organizations. Deel PEO can help bridge this gap by enabling access to high-quality carriers and extensive benefits plans for employers of any size—while also providing other HR, tax, and compliance services.

This article provides an overview of the different types of benefits you can offer your employees, how they can empower your organization and workforce, and which trends to look out for when it comes to employment packages.

Types of employee benefits

In the US, employee benefits fall into two broad categories: statutory (required by law) and voluntary.

For more details on these groups, see our comprehensive article on voluntary vs statutory benefits.

The following types of benefits are statutory:

- Social Security and Medicare: Under the Federal Insurance Contributions Act (FICA), these benefits are funded by both employer and employee taxes, and provide financial assistance for socially vulnerable people (such as disabled or retired individuals) and medical insurance for people over 65

- Family & Medical Leave (FMLA): This benefit entitles employees to up to 12 weeks of job-protected unpaid leave for serious medical and/or family situations

- Unemployment insurance (UI): An employer-funded benefit that provides financial support for employees who have lost their jobs through no fault of their own

- Workers’ compensation: Required by every state apart from Texas, this is an employer-funded insurance that financially aids employees who have suffered work-related illness or injury

Certain states, such as California and Connecticut, have additional mandatory benefits imposed on employers (such as paid parental leave). However, in general, most employers choose what additional benefits to offer at their discretion.

Below, we discuss the most common types of voluntary benefits offered as part of an employment package.

Healthcare plans

When it comes to different types of benefits, medical insurance consistently ranks highly in the talent market. A 2024 survey by the Forbes, found that two-thirds of employers and employees believe that employer-covered healthcare is the most important benefit to provide.

Healthcare plans usually cover medical, dental, and vision not only for employees but also for their families, making these benefits particularly attractive to candidates. This is also one of the benefits where the employer usually shares the cost of the premiums with the employees.

Several types of healthcare plans are typically offered to employees:

- Health Maintenance Organization (HMO) plan: A healthcare plan that operates with in-network providers and requires patients to choose a primary care physician (PCP) as a first point of contact for any specialist care

- Preferred Provider Organization (PPO) plan: A more flexible option that does not necessitate PCP referrals for specialist visits and allows both in and out-of-network care (but out-of-network is more costly)

- High-Deductible Health Plan (HDHP) and Health Savings Account (HSA) plans: HDHPs have cheaper premiums but more expensive deductibles and tend to work with HSAs, which are tax-advantaged savings accounts dedicated to paying qualifying medical expenses for those enrolled in HDHPs

- Flexible Spending Account (FSA): This is an employer-sponsored account that allows employees to allocate pre-tax funds for eligible healthcare costs, usually with a ‘use-it-or-lose-it’ by the end of the year rule

- Health Reimbursement Arrangement (HRA): This option reimburses employees for qualified medical expenses, and is funded by the employer alone

Having access to better healthcare can boost productivity and reduce absenteeism by contributing to the employees’ well-being. As such, this perk has value not only as an incentive for employees but also as a strategic business investment that can result in long-term returns.

Deel Benefits Admin

Mental health and wellness

Mental health support is becoming increasingly important. Data from the US Center for Disease Control and Prevention (CDC) found that, in 2024, one in four US adults struggled with a mental illness, costing the economy $280 billion USD per annum. Unsurprisingly, employer-sponsored programs that aim to combat these problems are also becoming more commonplace. In fact, 62% of employees report mental health has become a higher priority for their company in 2024 compared to 46% in 2023.

Mental health and wellness benefits include a range of services, such as:

- Counseling

- Employee assistance programs (EAP)

- Smoking cessation support

- Stress management

- Gym memberships

These programs are believed to enhance productivity, improve job retention, and boost worker satisfaction, with research indicating a significant return on investment for employers who engage in such initiatives.

Learn how Deel delivers access to top-tier mental health benefits.

Retirement

Pension plans are an employment benefit aimed at helping employees save for retirement. These plans are usually funded by both the employer and the employee, with the employer withholding a certain amount from the employee's paycheck and contributing a portion of their own to the employee's retirement pot. The money is typically invested in various stocks, bonds, and funds to help them grow over time.

The most common types of retirement plans that are currently being offered by employers include:

- 401(k): Both employers and employees pay into the plan, with salary deductions taken pre-tax and, in some cases, with a vesting schedule applied (the employer contributions are transferred to the employee only after a certain amount of tenure)

- Roth 401(k): Contributions are made after-tax, so future withdrawals will be tax-free, provided the individual is at least 59 ½ years old and the account has existed for a minimum of five years

- 403(b),457(b): Similar to 401(k) but for public sector and non-profit organizations

Self-employed and small business owners can also use (under certain conditions) employer-sponsored individual retirement accounts (IRAs), namely:

- Simplified Employee Pension (SEP) IRA: This plan is funded predominantly or exclusively by the employer, with taxes paid by the employee upon withdrawal

- Savings Incentive Match for Employees (SIMPLE) IRA: Both the employer and the employee contribute to this plan and taxes are also paid upon withdrawal

Other financial benefits

Apart from healthcare and retirement benefits, employers can also offer other financial benefits, through financial wellness programs, stock options, or equity. Examples of such benefits could be:

- Budgeting and student loan repayment programs

- Financial planning services

- Stock options or equity

- College savings accounts

These kinds of financial benefits can boost employee loyalty and provide better long-term financial security for employees, ultimately reducing turnover.

Stock options and equity can be difficult to grasp. This is why we prepared a thorough guide on the different types of stock options and how to offer them to foreign workers.

You might also be interested in stock options basics for startup employees or our piece about stocks and equity for contractors.

Paid time off (PTO)

PTO (your allowance of paid vacation days, sick leave, and personal days) is an essential part of a comprehensive benefits package. Opportunities for rest and recovery directly impact employee morale and productivity, with many candidates increasingly expecting this perk as part of a job offer.

Different states have their own PTO regulations, with no federal mandate in place. Employers with more generous or flexible PTO provisions have a competitive edge in the talent market.

Find out how to implement a successful PTO policy with our three-step guide.

Parental leave

This benefit grants mothers and/or fathers paid time off for childbirth, adoption, or fostering, to give the parents time to recover and/or bond with their child. While not mandated on a federal level, some states, such as California, Washington, and Oregon, require paid parental leave by law.

You can use our parental leave policy template to create a fair and attractive plan for your employees.

Work-life balance benefits

A 2024 survey by Gallup found that over 90% of workers in remote-capable jobs prefer remote or hybrid work. In fact, increasingly more data is showing that the majority of employees would prioritize flexibility and work-life balance over an increase in pay. This makes employers with less traditional nine-to-five work policies a significantly more desirable option for job-seekers, and one that employees would be willing to stick with for a while.

Unsure where to begin when it comes to working from home? Read our quick guide on how to navigate a remote company.

Career development and educational benefits

Career development and educational opportunities are another type of benefit that provides value to both employers and employees. These could take the form of classes, training programs, courses, or mentorship initiatives that help the employee build up skills and apply them to their role. For example, as AI tools become more widespread, many companies are looking to equip their employees with the expertise to manage these changes.

Career development benefits could be fully or partially employer-sponsored, available in-house, or at a discount through specific providers. Most importantly, however, they need to be suitable for your company's goals and business strategy.

We prepared this career development template to help you identify and implement a customized skill journey for your employees.

Additional benefits and perks

Employers can offer a wide range of additional benefits to reward and incentivize workers and promote company culture. This includes:

- Insurance: Life, disability, international business travel insurance, and even pet insurance plans, aimed at protecting employees and/or their families

- Subsidies for non-work related responsibilities: Childcare or eldercare support, transport or commuter benefits, housing or relocation assistance, food vouchers

- Bonuses: Additional performance-based or company-wide compensation provided on top of regular salaries or wages

- Company discounts: Various deals and special rates at partner stores and service providers

- Evens: Gatherings and engaging activities that promote teamwork, collaboration, and workplace relationships

- Food and drink: Usually office-based, this perk can include free coffee, tea, water, and snacks that help employees keep their energy, focus, and spirits up throughout the workday

- Other workplace benefits aimed at particular workforce demographics: Culture or faith-based holiday accommodations, fertility treatment coverage, daycare, and more

Admin basics for benefits management

With benefits in place, you need to ensure all associated admin is managed compliantly. Here are some tips and considerations to keep in mind:

- Communication: Using multiple channels, clearly and accessibly communicate to employees all the deadlines and benefit options, and provide relevant links to resources

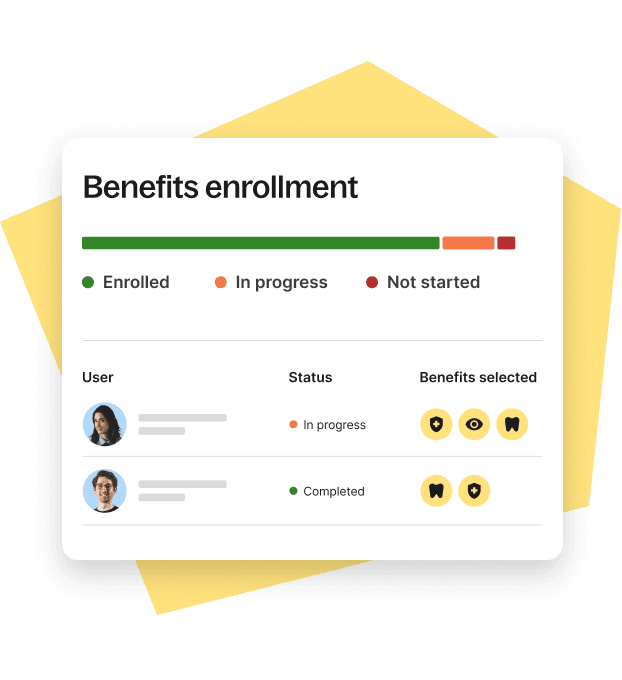

- Enrollment: Plan carefully for open enrollment—the annual period for assessing employee plan eligibility and submitting the required paperwork

- Records and reporting: Keep clear and accurate records of benefits enrollment, changes, and withdrawals

- HIPAA, COBRA, and ERISA laws: Ensure you comply with federal laws related to health information privacy, health insurance protections, and minimal standards for private sector health and retirement benefits

- Manage payroll: Verify that all benefits deductions are set up correctly for the relevant employees

- Handle claims and questions: Be prepared to work with carriers, employees, and any third-party administrators to resolve any claims or issues that may arise in relation to benefits admin

- Evaluate plans regularly: Periodically review different benefits plans, vendors, and providers to confirm optimal cost-efficiency and employee satisfaction

- Keep up with law changes: Stay on top of federal, state, and local legislation to ensure you are not in breach of regulations

How do benefits regulations differ by state?

In the US, the federal government does not impose a mandate on most employee benefits. However, state regulations are different.

Certain states require employers to provide benefits such as paid family leave (New York, New Jersey), disability insurance (Hawaii, Rhode Island), or minimum paid sick leave (California, Massachusetts). Each state might also have different conditions or funding rules for these compulsory benefits, meaning businesses and their HR and finance teams need to stay vigilant and informed. Failure to comply with these laws can result in penalties, legal fees, and other repercussions.

See also:An Employer's State-by-State Guide to Paid Sick Leave in the US and State-by-State Guide to Maternity Leave in the United States.

The future of employee benefits: What should employers watch out for?

As the US workforce evolves, so does the demand for different benefits. Employers and HR teams need to keep up with these changes in order to be able to compete for top talent.

Here are some of the key trends that can be observed in 2025:

- Mental health and wellness benefits are on the rise across all industries, with 91% of employers in 2024 investing more in such perks

- Flexible and remote work continues to be preferred by most candidates (as we saw above), and the majority of employers (82% according to a Zoom survey from 2024) report plans to improve their workstyle flexibility in the coming two years

- Figures from 35 countries (including the Americas) place work-life balance as the top factor for current employees and job seekers, suggesting employers embracing these values will have a hiring edge

- Customizable benefits packages might provide better value in an increasingly diverse talent market—for example, offering student loan repayment help for the younger generation or better health plans for older candidates

- As workers become more environmentally conscious, “green benefits” are increasing in popularity—for instance, installing EV charging stations at work, granting stipends for energy-efficient home improvements, and more

- AI is automating benefits management, security, and transparency, but is also expected to leverage data to suggest better solutions, personalized plans, and smarter decision-making surrounding cost and value

Supercharge your benefits offering with Deel PEO

Attracting and retaining talent is an essential aspect of any successful business, but generous compensation and bonuses are no longer enough to gain an advantage in the talent market. Businesses must also provide benefits packages that fit employees’ needs and core goals while promoting long-term engagement with the company culture and strategy.

Deel’s solutions solve your HR, payroll, and admin pain points while helping you stay ahead of the curve. Deel PEO gives you access to top-of-the-line benefit packages for your entire organization and leverages state-of-the-art AI tools for real insights on team satisfaction, performance, and more.

Think of PEO as the Ferrari of US payroll. It’s a full-service model—state registrations, tax filings, benefits, disbursements—all managed seamlessly by Deel.

—Justin Geaney,

Senior Director, Product at Deel HQ

Our products provide more than a service: we transform your operations with a comprehensive package that empowers you to prioritize scaling up. We offer:

- Federal, state, and local compliance expertise (tax, benefits, and more)

- Comprehensive payroll administration

- Access to benefit plans from leading carriers and benefits admin

- Streamlined onboarding, offboarding, and training

- Advanced tax and benefits compliance

Book a demo with our team to learn more.

Deel PEO

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult a certified professional for help with any legal and compliance questions.

FAQs

What benefits do employees value the most?

Preferences for employment benefits can differ between different employees based on age, demographics, location (for example, with distributed teams), and more. However, employer-sponsored health insurance, PTO, retirement plans, and flexible/remote working consistently emerge at the top of many rankings.

What is considered a fringe benefit?

Fringe benefits include various non-mandatory extra perks or rewards beyond salaries and wages, such as company cars, on-site childcare, mobile phones, tuition reimbursements, and more.

Fringe benefits might be taxable, depending on various federal, state, and local regulations.

What is the most common employee benefit?

According to multiple sources, including Indeed, as of 2025, the most common benefit in the US is health insurance.

What are mandatory and discretionary benefits?

Mandatory benefits in the US are compulsory benefits required by federal, state, or local law. Discretionary benefits are optional benefits that the employer can choose to offer their employees. Examples of discretionary benefits include health insurance, retirement plans, PTO, life and disability insurance, remote or hybrid work, and more.

Can I offer different benefits to different employees?

The short answer is yes, you can offer different benefits to different employees (based on job titles, performance, etc.) as long as this is done legally, and not in breach of any anti-discrimination laws.

Dr Kristine Lennie holds a PhD in Mathematical Biology and loves learning, research and content creation. She had written academic, creative and industry-related content and enjoys exploring new topics and ideas. She is passionate about helping create a truly global workforce, where employers and employees are not limited by borders to achieve success.