Article

14 min read

Employment Laws in Canada: How to Hire and Stay Compliant

Employer of record

Author

Jemima Owen-Jones

Last Update

January 22, 2026

Table of Contents

Step 1. Understand the Canadian employment law framework

Step 2. Navigate provincial requirements

Step 3. Classify workers correctly

Step 4. Consider whether to use an Employer of Record service

Step 5. Verify eligibility to work

Step 6. Draft compliant contracts

Step 7. Implement mandatory hiring and workplace policies

Step 8. Enroll in statutory benefits and protections

Step 9. Stay updated with Canadian employment laws

Simplify hiring and compliance in Canada with Deel

Key takeaways

- Hiring in Canada requires global employers to navigate federal, provincial, and territorial employment laws.

- Employment standards vary widely, making it essential to localise contracts, payroll, benefits, and policies based on where each employee works.

- Many international employers simplify compliance by using an Employer of Record like Deel to manage hiring, payroll, and benefits across provinces.

Hiring workers in Canada can look complex at first. Employment law is split between federal and provincial authorities, which often feels unfamiliar to companies used to a single national framework.

Where global employers tend to struggle the most is with the details. Determining which rules apply, keeping pace with various requirements, and avoiding compliance gaps can be challenging — especially when managing a distributed team.

The good news is that Canada’s system is well-defined and predictable once you understand its structure. This guide explores how to navigate Canadian employment laws to hire and pay workers and explains how an Employer of Record (EOR) service like Deel can help.

Step 1. Understand the Canadian employment law framework

Canada uses a dual system that splits authority for employment law between federal and local governments. Only a small percentage of employers fall under the Canada Labour Code, while the vast majority are regulated by provincial or territorial Employment Standards Acts.

Here are the only sectors to be federally regulated:

- Banking and financial services

- Telecommunications and broadcasting

- Uranium mining and atomic energy

- Interprovincial and international transportation

- Certain Crown corporations

Before hiring, determine which framework applies to your business. Note that this depends on the nature of your organization and where employees perform their work, rather than where you are headquartered. For example, a tech startup hiring remote workers in Toronto must follow Ontario’s Employment Standards Act, while a logistics company answers to federal law.

Step 2. Navigate provincial requirements

Once you’ve confirmed you’re provincially or territorially regulated, research which Employment Standards Act you need to follow. These laws aim to set fair standards for workers nationwide, but they vary enough that a one-size-fits-all approach often falls short.

You must account for differences across several core areas of employment, including:

- Minimum wage rates and adjustment schedules

- Overtime thresholds and premium pay rules

- Maximum work hours and rest period requirements

- Statutory holidays and eligibility rules

- Vacation entitlements and accrual increases with tenure

- Termination notice, payment in lieu, and severance obligations

- Temporary layoff rules and recall rights

Alongside baseline standards, some provinces introduce additional employment laws. Quebec requires most workplace documents in French, for example, while British Columbia has distinct rules around temporary layoffs and recall rights.

Step 3. Classify workers correctly

Determine whether an employee or an independent contractor should fill a role. This classification determines which employment laws apply, how you handle payroll and taxes, and what protections the worker receives.

While both employees and independent contractors work for your business, Canadian law regards them very differently. Here are the main distinctions between the two classifications:

| Category | Employee | Independent contractor |

|---|---|---|

| Legal relationship | Employment relationship | Services relationship |

| Employment standards | Covered by federal or provincial Employment Standards Acts | Not covered |

| Statutory benefits | Entitled to minimum wage, overtime, holidays, vacation, and protected leave | Not entitled to statutory benefits |

| Taxes and contributions | Employer withholds income tax and contributes to CPP/EI (or equivalents) | Contractor manages their own taxes and contributions |

| Termination protections | Notice and severance rules apply | No statutory termination rights |

| Typical agreement | Employment contract | Services agreement |

Note that Canadian authorities assess status based on the nature of the working relationship, not job titles or contracts. If you treat a freelancer like an employee, you may face compliance issues and have to pay back wages, taxes, and interest. Worker misclassification can also lead to significant penalties under federal and local law.

Unsure of a new hire’s classification? Use a service like Deel Contractor to verify worker status based on a few details about your arrangement. Our AI-powered tool classifies cases based on real-world local examples with 90% accuracy.

Deel Hire

Step 4. Consider whether to use an Employer of Record service

Decide how you want to engage your Canadian workforce. Your options are to hire employees directly or partner with an EOR service with a locally owned entity.

An EOR service hires workers on your behalf and becomes the legal employer on paper. While they take care of HR, payroll, and compliance, your company retains control over the day-to-day operations. This enables you to enter markets quickly and onboard employees in days instead of weeks or months.

Crucially, an EOR ensures compliance with Canada’s federal and local employment laws. Services like Deel EOR have a locally owned entity, on-the-ground experts, and powerful automation tools. Our entity also absorbs all the legal liability should your company ever face a compliance issue.

An EOR is ideal for when you need to:

- Test the Canadian market

- Hire a handful of workers across different provinces

- Move quickly before incorporating in Canada

- Get ongoing support with HR, payroll, and compliance

- Manage a short-term project

Plus, an EOR isn’t an all-or-nothing approach. Many companies use Deel EOR for a short time before getting our assistance with entity setup or use our service in some countries, but not others. The greatest advantage of the model is the flexibility it offers for international businesses.

We needed a provider who understood our plans. We’ve noticed that other providers were stuck in their structure and in how they did things, so if we needed changes they would take a long time.

With Deel, we can grow and cooperate together, they have the flexibility to support us in whatever we need. It’s become a true partnership with people we enjoy working with.

—Sanna Westman,

Head of People at Planhat

Deel Employer of Record

Step 5. Verify eligibility to work

Confirm workers are authorized to work in Canada before you extend an offer of employment. This requirement sits alongside all your other hiring obligations and applies regardless of role, position, or tenure at your company.

Canadian employers must check each worker’s Social Insurance Number (SIN) within three days of hiring. A SIN is a government-issued nine-digit number that confirms their right to work in Canada and access its public programs. Canadian citizens and permanent residents receive permanent SINs, while temporary foreign workers have numbers that begin with 9 and expire when their work authorization ends.

There are additional obligations when you hire foreign workers. You must confirm the employee holds a valid work permit and ensure the role and work location match its conditions. Some roles also require a Labour Market Impact Assessment (LMIA) to prove there’s a need for a foreign worker to fill the role.

If you’re hiring a foreign worker, an EOR can legally sponsor their visa. Deel Immigration also takes care of the entire visa process from eligibility verification and the LMIA through to the application. Our team provides you with regular updates via the dashboard so you can easily track progress.

Deel Mobility

Step 6. Draft compliant contracts

Start with a written employment agreement for every Canadian hire. While verbal contracts may be legally valid in limited situations, they leave too much open to interpretation and create unnecessary risk. A clear written contract sets expectations around rights and responsibilities from day one and provides a reliable reference if issues arise later.

Every clause must align with the applicable provincial Employment Standards Act. Employment standards set non-negotiable minimums, and any contract term that falls below them is void and automatically replaced by law. This means contracts cannot waive overtime pay, reduce statutory vacation entitlements, or shorten required notice periods, even if both parties agree.

Each contract should also cover a consistent set of core terms. At a minimum, make sure it includes:

- Job title, duties, and reporting structure

- Compensation details, including base salary, overtime rates, and pay frequency

- Work location and expected hours of work

- Vacation entitlement and statutory holiday provisions

- Benefits coverage and eligibility timelines

- Probationary period terms, where applicable

- Termination notice requirements or payment in lieu

- Confidentiality and intellectual property provisions

- Dispute resolution processes

- A governing law clause specifying the applicable province

Pay particular attention to termination clauses. Canadian common law can require notice well beyond statutory minimums, especially for long-service employees. Carefully drafted contracts can limit obligations to statutory requirements, but only if they’re precise and reasonable.

If you lack the in-house legal expertise, consult with a contract lawyer. Alternatively, use an EOR with compliance capabilities like Deel to generate the document. All our service needs is a few details about the role, location, and your company, and we can generate a localized, compliant contract.

Step 7. Implement mandatory hiring and workplace policies

Ensure that contracts and workplace arrangements ensure equal treatment. These obligations are in place from your first job posting through to termination and are enforced under the Canadian Human Rights Act for federally regulated employers and provincial laws for most other workplaces.

Workplace policies and practices must explicitly prevent discrimination based on:

- Race, national or ethnic origin, and colour

- Religion and age

- Sex, sexual orientation, and gender identity or expression

- Marital status and family status

- Disability

- Genetic characteristics

- Pardoned convictions

Start by putting a formal anti-discrimination policy in place. The policy should prohibit bias in employment decisions, explain how employees can raise concerns, and clearly state that your company won’t tolerate retaliation for good-faith complaints. It should also commit you to investigating complaints promptly and taking appropriate corrective action.

You also have a duty to accommodate employees’ needs related to protected grounds, up to the point of undue hardship. This may involve adjusting schedules, modifying duties, providing equipment, or granting leave, depending on the circumstances.

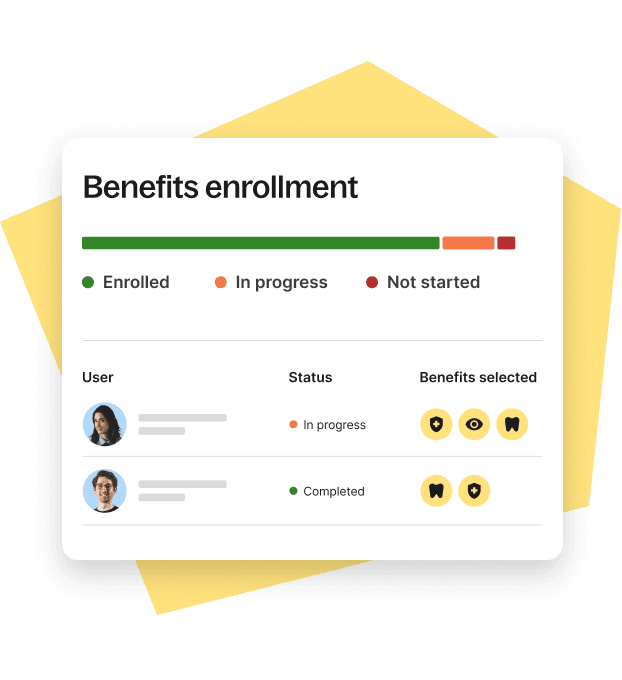

Step 8. Enroll in statutory benefits and protections

Enroll new hires in benefits programs based on their location. These requirements apply automatically from the start of employment and vary by province, so it’s important to identify what applies to each employee based on where they work.

At a minimum, Canadian employers must provide the following mandatory benefits and protections:

- Government contribution programs: Employers must make shared contributions to the Canada Pension Plan (CPP) and Employment Insurance (EI). In Quebec, these obligations are replaced or supplemented by the Quebec Pension Plan (QPP) and the Quebec Parental Insurance Plan (QPIP), which operate under different rates and rules

- Paid vacation and statutory holidays: Provincial law sets minimum vacation entitlements, typically starting at two weeks after the first year of employment and increasing with tenure in some jurisdictions. Employees are also entitled to paid statutory holidays, with dates, eligibility rules, and premium pay requirements varying by province

- Job-protected statutory leave: Provinces require employers to provide unpaid, job-protected leave for circumstances such as pregnancy and parental leave, serious illness, and bereavement

- Workers’ compensation coverage: Employers must register with the relevant provincial workers’ compensation authority and contribute to coverage for workplace injuries and occupational diseases

- Benefit continuation and reinstatement rights: During statutory leaves, employers must maintain employee benefits and reinstate employees to their original or a comparable role when the leave ends

Administering benefits also triggers privacy obligations. Employee information collected for benefits purposes is regulated under Canadian privacy laws, including the Personal Information Protection and Electronic Documents Act (PIPEDA) and provincial equivalents. Employers must collect only what is necessary, secure the data appropriately, and provide employees with access to their records when requested.

Benefits Administration

Step 9. Stay updated with Canadian employment laws

Federal and local laws frequently change in Canada. Continuously monitor regulatory updates to ensure your hiring and workplace practices remain aligned with requirements.

Provinces and territories regularly review and change the following:

- Minimum wage rates

- Employer and employee contributions

- Employment standards

- Leave entitlements

- Eligibility criteria for protections

- Notice periods and layoff rules

If you partner with an EOR provider, they’re responsible for maintaining compliance across all your HR and payroll processes. Leading providers like Deel continuously monitor regulatory updates and consult with local experts to ensure systems are up to date. Our team also provides regular updates via our Compliance Hub, accessible via the dashboard.

We’re confident in our compliance because Deel handles the legal side thoroughly, that gives us peace of mind.

—Kunal Patel,

Global Talent Partner, Hyqoo

Compliance

Simplify hiring and compliance in Canada with Deel

Hiring employees in Canada involves navigating complex federal and provincial laws. Employers that get these foundations right up front are far better positioned to avoid compliance issues as their Canadian teams grow.

Deel helps you lay these foundations as you set up in Canada. Through our EOR services and built-in compliance support, we handle payroll, contracts, benefits, and province-specific requirements on your behalf. This makes it easier to scale Canadian teams while staying aligned with changing employment laws.

With Deel EOR, you can access:

- Fully owned entity in Canada

- Localized, compliant employment contracts

- Automated payroll and statutory deductions

- Benefits administration aligned with provincial requirements

- Ongoing compliance monitoring and legal updates

- EOR-sponsored visas and immigration

- 24/7 localized expert support

The real difference between Deel EOR and other providers is that Deel actually removes the headaches of hiring globally—and you can't put a price on that,

—Helen Yildiz,

Chief Customer Officer, Data Talks

Looking for a simpler way to hire in Canada? Book a call with the Deel team to explore how we can support HR, payroll, and compliance across Canadian provinces.

FAQs

What employment laws govern hiring in Canada?

Canadian employment law operates under a dual system. The federal Canada Labour Code applies to a small group of federally regulated industries, while provincial and territorial Employment Standards Acts govern most employers. You must comply with the rules that apply to your industry and the province or territory where the employee works.

How do minimum employment standards affect hiring?

Minimum employment standards establish non-negotiable baselines for wages, hours of work, overtime, leave, holidays, and termination notice. Employers cannot contract out of these standards, even with employee consent. Because standards vary by province, employers must tailor contracts and policies to each employee’s work location.

What are employer obligations for work permits and foreign workers?

Employers must confirm that foreign workers hold valid work permits and that job duties, location, and employer details match permit conditions. Some roles require a Labour Market Impact Assessment, and employers must meet prevailing wage and reporting requirements.

What are the risks of non-compliance when hiring in Canada?

Non-compliance with Canadian employment laws can result in penalties and legal action. Employment standards officers can enforce remedies without a formal complaint. Immigration or discrimination violations may also lead to hiring restrictions, damages, and long-term reputational harm.

What works best for staying compliant when hiring full-time staff in Canada from another country?

The most effective approach combines a clear understanding of federal and provincial requirements with consistent processes for contracts, payroll, benefits, and eligibility checks. Many international employers reduce risk by using local expertise or an Employer of Record service like Deel to manage compliance while they focus on day-to-day operations.

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.