Article

4 min read

2025 Payroll Regulations: Taxes, Data Laws, and More

Global payroll

Author

Michał Kowalewski

Last Update

January 16, 2025

Key takeaways

- Navigating global payroll requires up-to-date knowledge of each country's unique laws and regulations on taxes, minimum wages and overtime pay, and employee benefits, highlighting the importance of specialized expertise.

- Failing to adhere to international payroll laws can lead to significant consequences, including financial penalties, legal issues, and harm to a company's reputation, underscoring the need to ensure compliance efforts.

- Implementing regular training and updates for finance teams on global payroll laws and best practices is crucial to adapt to legislative changes and optimize payroll processes.

Complying with global payroll regulations when paying employees across multiple countries is no easy task. Keeping up with the regulatory changes in different countries can get complicated, as each jurisdiction has its unique laws regarding taxes, benefits, social security, record keeping, payment methods, and data privacy laws.

At the same time, if you fail to comply with these regulations your business can potentially take a financial, legal, and reputational hit. Responsible business owners know how big of an impact payroll compliance requirements have on enterprise growth. That’s why they look for reliable solutions that can handle the intricacies of running global payroll.

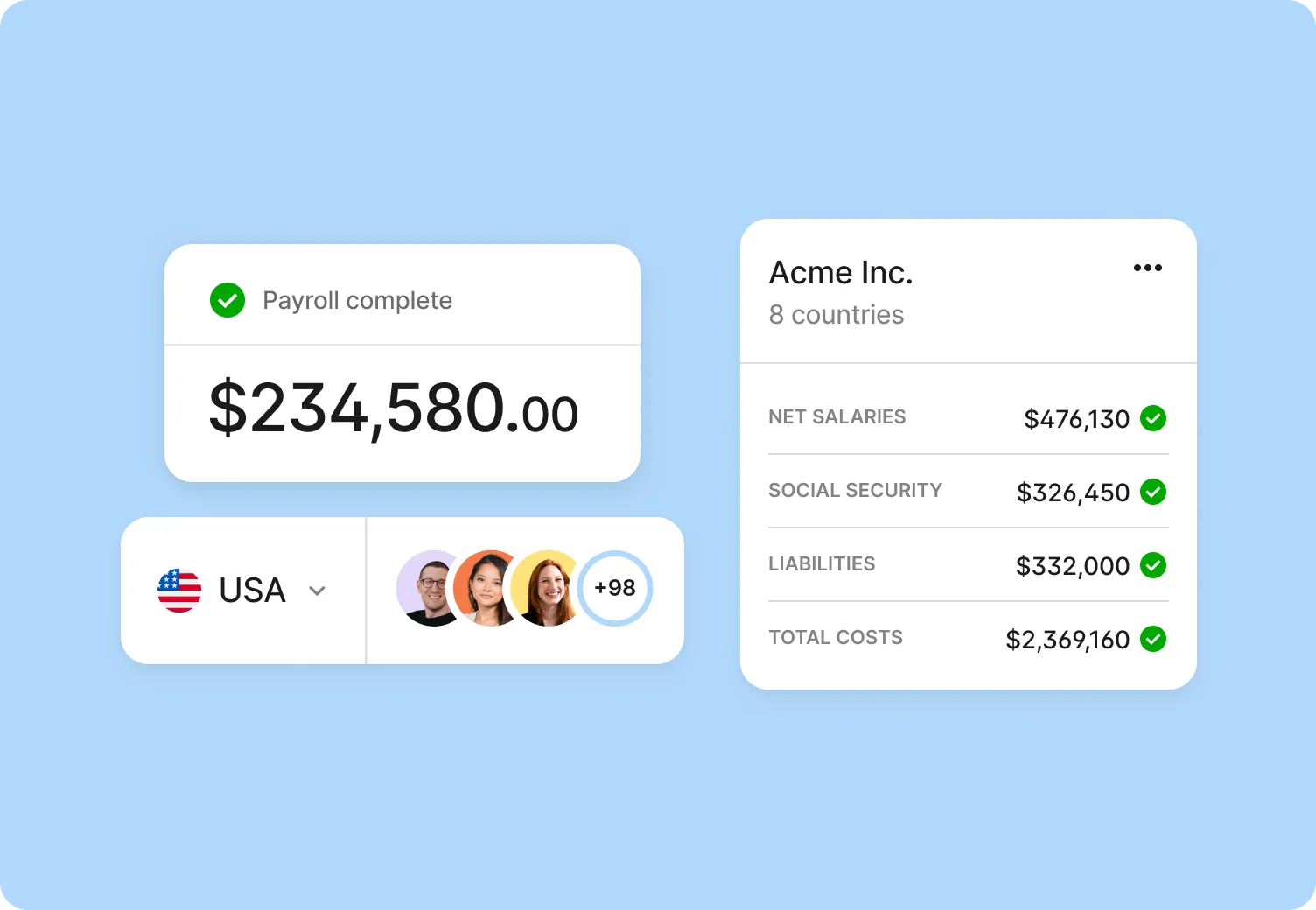

Deel stands at the forefront of global payroll solutions, streamlining how over 35,000 companies worldwide manage their payroll operations with unmatched efficiency and ease.

Read on to learn about the key regulations impacting how international finance teams will operate in 2025.

What is payroll compliance?

Payroll compliance refers to the adherence to laws and regulations governing employee compensation, tax deductions, benefits, and reporting requirements in a specific jurisdiction.

It ensures employers accurately calculate and remit taxes, maintain proper payroll records, and follow labor laws such as minimum wage, overtime pay, and social security contributions. Non-compliance can result in financial penalties, legal issues, and reputational damage.

Key global payroll laws and regulations

Understanding global payroll regulations is key for businesses stepping onto the international stage. These rules can range from tax deductions to equal pay for equal work and differ widely from one country to another. Staying informed can help you make the right decisions when hiring internationally and paying employees in foreign countries, reducing compliance risks.

Payroll tax compliance

Payroll taxes and compliance regulations typically cover the calculation, withholding, and remittance of taxes from employees' salaries, as well as the reporting of these amounts to the appropriate governmental authorities. These regulations are critical for ensuring that both employers and employees fulfill their legal tax obligations.

Some of the key tax laws include:

- United States - Federal Insurance Contributions Act (FICA): Includes information on withholding of Social Security and Medicare taxes in the US, stating that employers and employees each pay half of these contributions. In the US, payroll taxes vary by federal, state, and local regulations. For more information on federal income tax and local requirements, visit the IRS website

- United Kingdom - Pay As You Earn (PAYE): The system is used by HM Revenue and Customs (HMRC) to collect Income Tax and National Insurance from employment. This law requires employers to deduct tax and National Insurance contributions from wages as employees earn them. For more information visit the PAYE website

- Australia - Pay As You Go (PAYG) Withholding: Employers are required to withhold tax from employee wages and remit it to the Australian Taxation Office (ATO). This system helps employees meet their annual income tax liabilities. Visit ATO’s website for more information

- Australia - Superannuation Guarantee (Administration) Act 1992. Requires employers to contribute to a retirement savings plan for employees. The current minimum contribution rate increases to 12% of an employee's ordinary time earnings starting Jul 1 2025. For more information visit ATO’s website

- United Kingdom - Income Tax (Earnings and Pensions) Act 2003: Governs how much income tax you pay on earnings, pensions, and social security. It sets tax rates, defines taxable income, and dictates how businesses and individuals report and pay tax. For more information check the full act

Are you running payroll in multiple countries? Learn how global enterprise businesses can prevent double taxation.

Free course

Minimum wage compliance

Minimum wages vary from country to country and set the lowest hourly, daily, or monthly remuneration that employers may legally pay to workers.

The complexity arises from variations in wage rates, applicability, and adjustments across different countries and even within regions of a country, impacting global payroll operations and company finances.

Minimum wage compliance is crucial for international employers because it guarantees fair compensation for employees and compliance with local labor laws.

Here are some of the examples of minimum wage laws from across the world:

- Australia - Fair Work Act 2009: Fair Work Act 2009: Establishes standards for workplace rights and obligations, including a national minimum wage, which is currently AUD $24.10 per hour for adults. It covers various employment conditions like leave entitlements, termination, and dispute resolution. For details, visit the Fair Work Ombudsman website

- United States - Fair Labor Standards Act (FLSA): Sets the federal minimum wage at $7.25 USD per hour, mandates overtime pay at 1.5 times the regular rate for hours worked over 40 in a workweek, and establishes standards for youth employment, including age restrictions and work hours. It's designed to protect workers against unfair pay and working conditions. Minimum wage and hour regulations vary from state to state. For more specifics, visit the US Department of Labor website

- United Kingdom - National Minimum Wage Act 1998: The UK law guarantees a minimum hourly pay for most workers, varying by age. For those 21 and over, the hourly rate will be £12.21 starting April 1 2025, while younger workers have different, lower rates. The government enforces this, ensuring fair pay and protecting against exploitation. For more details, check the official UK government website

When we came to understand the importance that Deel places on individual country laws and making sure that contracts are structured in the right way, Deel really stood out. And even though some of your competitors have payments, it wasn’t with the same ease at which we could do it with Deel.

—Sudarshan Sivaram,

Head of Customer Success & Sales, Turing

Labor and employment

Labor and employment laws regulate workplace standards, including minimum wage, working hours, and employee rights. These laws impact global payroll services by dictating compensation, benefits, and legal requirements across different jurisdictions.

- United Kingdom - Employment Rights Act 1996: Sets minimum pay standards (mentioned previously), guarantees leave entitlements (5.6 weeks paid annual leave), and outlines fair dismissal procedures. It protects against discrimination, ensures workplace safety, and empowers whistleblowers, safeguarding employee rights and shaping fair working conditions in the UK. For more details visit the official website

- Labor Law of the People's Republic of China: Governs employment contracts (written contracts are mandatory), minimum wages (varying by region), capped workweeks (40 hours is the standard), overtime pay, and paid leave (including vacations, sick days, and maternity leave). For more details visit the official website of the Ministry of Human Resources and Social Security

- European Union - Directive 2008/104/EC (Temporary Agency Work Directive): Protects temporary workers, and independent contractors, ensuring equal pay, similar working conditions (hours, breaks, holidays), and access to amenities as permanent employees in the same company. This applies across all EU countries and most sectors, requiring equal treatment in pay, information, and non-discrimination. More information here

- India - Payment of Gratuity Act, 1972: Grants eligible employees a gratuity payment upon termination of employment after completing five years of continuous service. Eligibility and gratuity amount calculation are based on specific criteria outlined in the Act

Platform Tour

Working hours and overtime

These regulations define the normal working hours per week and the rules for compensating additional hours worked. Different countries have varying standards for what constitutes overtime and how it should be compensated, often requiring higher pay rates for hours worked beyond the norm.

- European Union - Directive 2003/88/EC (Working Time Directive): Regulates working hours, rest periods, and annual leave. It guarantees a maximum 48-hour average weekly working time (including overtime), at least four weeks of paid annual leave, and rest breaks for long working days. Check the Working Time Directive’s website for details

- Canada Labour Code: Sets the minimum standards for employee well-being and fair treatment, covering aspects like work hours (max 48 with overtime pay at 1.5 times), wages (minimum wage applies), breaks and rest periods, vacation (5.6 weeks minimum paid), holidays (10 paid statutory), termination procedures, parental leave, and health and safety. For more information check the Government of Canada’s website

- United States - FLSA: States that employees are entitled to overtime pay at 1.5 times their regular rate for hours worked over 40 per week. There's no limit to weekly work hours for those 16 and up, and weekend or holiday hours only qualify for overtime if they exceed the 40-hour threshold. A workweek under FLSA is a set 168-hour period, not necessarily matching the calendar week. For more specifics, visit the US Department of Labor website

Watch: Master Global Payroll: Strategies for Payroll Leaders

This informative global payroll webinar explores how you can simplify every aspect of paying and managing an international workforce.

We’ve tailored this webinar for payroll professionals who need effective, scalable solutions for running global payroll.

- Live demo of Deel’s global payroll solution: See our platform in action and learn how it can streamline your payroll processes.

- Q&A with Deel’s payroll experts: Get answers to your specific questions from industry leaders.

- Exclusive insights for payroll decision-makers: Discover strategies to simplify and optimize global team management.

Employee benefits and social security

Benefits and social security regulations mandate benefits such as healthcare, pensions, and unemployment support. Global employers have to account for contributions to social security systems, providing financial support for employees in various life circumstances.

- Canada - Employment Insurance Act: Governs employment insurance, providing temporary financial support to unemployed individuals and income replacement during sickness, maternity, or parental leave. Both employers and employees contribute to the program through payroll deductions. Companies operating in Canada must register for and contribute to the EI program, impacting local payroll calculations and reporting. More information can be found here

- China’s Social Insurance Law: Mandates participation in social insurance programs for employees and employers, covering pensions, medical insurance, unemployment insurance, work injury insurance, and maternity insurance. Contributions are based on employee wages and shared between employer and employee. Operating in China requires companies to register, calculate, and contribute to social insurance programs, adding complexity to payroll administration. Visit Congressional - Executive Commission on China for more details

- United States - Employee Retirement Income Security Act (ERISA): Applies to various employer-sponsored retirement plans (e.g., 401(k)s) and health insurance plans, impacting employee benefits offerings and plan management. Companies with US operations and ERISA-covered plans must comply with its complex regulations, affecting payroll administration, reporting, and potential liabilities. More information on the Department of Labor's website

- United Kingdom - Pensions Act 2008: Introduces automatic enrolment for employees into a workplace pension scheme, aiming to increase pension coverage and retirement savings. Employers must contribute alongside employees. More information on the official website

- India - Employees' Provident Funds and Miscellaneous Provisions Act, 1952: Mandates contributions to provident funds and pension schemes for eligible employees, promoting retirement savings and social security. The Act covers employees in specific industries and establishments, requiring contributions to provident funds and pension schemes based on their wages. Check this document from India’s Ministry of Labour and Employment for specifics

How bunq runs payroll compliantly in 5 countries with Deel Global Payroll

Founded in 2012 by Ali Niknam, bunq revolutionized European banking by putting users at the heart of its operations.

As bunq expanded globally, it faced the challenge of managing payroll and compliance across multiple markets. Using different providers for each region proved costly and inefficient, creating a need for a centralized platform to streamline payroll, hiring, and compliance.

“We were looking for a global partner that could support our rapid growth while ensuring compliance with local laws and regulations,” said Luc de Ridder, Talent Acquisition Lead at bunq.

By consolidating payroll in five countries with Deel, bunq saved over 20% on local setup costs and eliminated inefficiencies like vendor selection and scattered data. “Deel aligns perfectly with our needs and values, offering speed, communication, and tailored solutions,” added de Ridder.

Data protection and privacy laws

Data security and privacy compliance play a crucial role in securing employee information and averting data breaches that could lead to hefty fines, reputational harm, and litigation.

The following laws aim to safeguard the personal information of employees by regulating how companies collect, use, and store payroll data.

- European Union - General Data Protection Regulation (GDPR): Impacts the processing and movement of employee personal data across EU states. For more details visit the official website of GDPR

- Australia - Privacy Act 1988 (including the Australian Privacy Principles): Impacts the handling of personal information, including employee data. For more information, visit the Office of the Australian Information Commissioner

- China - Personal Information Protection Law (PIPL): China’s framework for data protection, impacting how employee data is processed and transferred. For more details, you can refer to this overview

- United States - Health Insurance Portability and Accountability Act (HIPAA): Affects the handling of employee health information. For a comprehensive overview, visit HHS.gov

Payment methods

These rules ensure employees are paid regularly, securely, and through approved channels like bank transfers, checks, or cash, depending on local laws and practices.

- United States - FLSA: According to the act, employers can offer various payment methods, including cash, checks, and direct deposit, as long as employees have access to their full wages. For more information, visit the FLSA website

- Australia - Fair Work Act 2009: Mandates that employers provide a payment method that is convenient for the employee, often resulting in payments through bank transfers. Check the Fair Work Ombudsman's guide on pay slips and record-keeping for more details

- United Kingdom - Employment Rights Act 1996: Requires that all employees receive a payslip and that wages are paid directly into a bank account unless otherwise agreed. More information on the UK Government website

Continuous Compliance™

Reporting and record-keeping

These laws list requirements for documenting employment terms, payroll records, and hours worked. Accurate record-keeping is essential for compliance, audit readiness, and resolving employment disputes.

- United States - Fair Labor Standards Act (FLSA): Requires employers to keep detailed records of employees' work hours, wages paid, and other employment conditions. This ensures compliance with minimum wage and overtime laws. More details can be found on the US Department of Labor website

- Australia - Fair Work Act 2009: Mandates employers to maintain employee records for seven years, including pay, hours worked, leave, and superannuation contributions, ensuring transparency and compliance. Visit the Fair Work Ombudsman website for more information

- United Kingdom - Employment Rights Act 1996: Employers are required to provide itemized payslips and keep records of wages paid and deductions made, supporting the enforcement of fair pay practices. Detailed guidance is available on the UK Government website.

Get your guides to running payroll

Read these country-specific payroll guides to learn more about their unique processes and requirements:

Compliance strategies for finance teams

For enhanced global payroll processing, finance teams in mid-market and enterprise sectors should focus on:

- Centralized payroll systems: Implementing a unified platform ensures consistency in applying payroll policies and adherence to regulations across all operating countries, minimizing discrepancies and errors. New AI-driven capabilities can enable proactive identification of potential compliance issues, allowing you to address them before they escalate

- Advanced payroll technologies: Utilizing sophisticated payroll compliance software for automation enhances efficiency, reduces manual intervention, and ensures accurate tax calculations and deductions, keeping the payroll process compliant and streamlined

- Collaboration with local tax experts: Building partnerships with local experts or establishing an in-country presence is crucial for understanding and navigating the complex web of local labor laws, tax regulations, and compliance requirements, ensuring that payroll operations are fully compliant with local standards

- Regular training and updates: Ensuring that finance and payroll teams receive ongoing training on the latest global payroll laws and regulations, as well as best practices. This keeps the team informed about changes in legislation and innovative payroll management strategies, contributing to overall compliance and efficiency

For more actionable information on payroll compliance, download our free resource: Global Payroll Compliance Checklist.

Whenever we have questions about local laws, our CSM is always happy to help and explain in detail; it's a true partnership.

—Sam Wiszniewski,

People & Talent, Flagship Founders

Managing international payroll compliance with Deel

Managing global payroll compliance independently exposes large organizations to the risk of non-compliance and financial issues due to the complexity of varying international laws and regulations. Missteps can lead to penalties, legal challenges, reputational damage, and slow down your global expansion plans. That’s why expert guidance in crucial when running global payroll.

Using Deel Global Payroll has proven to be an effective solution for many global teams struggling with staying compliant while paying international employees.

Book a 30-minute demo with an expert to learn more about Deel’s global payroll for mid-market and enterprise teams. During this time, an expert will walk you through the platform and answer any questions you have about Deel’s payroll, HR, and workforce management solutions.

Disclaimer: This content is provided for informational purposes only and should not be considered legal or tax advice. Always consult with professionals and ensure compliance with local regulations.

About the author

Michał Kowalewski a writer and content manager with 7+ years of experience in digital marketing. He spent most of his professional career working in startups and tech industry. He's a big proponent of remote work considering it not just a professional preference but a lifestyle that enhances productivity and fosters a flexible work environment. He enjoys tackling topics of venture capital, equity, and startup finance.