Article

6 min read

Customizing Payroll Across Countries: 8 Tips for Beginners

Global payroll

Author

Shannon Ongaro

Last Update

January 31, 2025

Table of Contents

Understanding taxation and withholdings

Setting salary and wage structures

Researching benefits and perks

Ensuring compliance and correct reporting

Setting payroll schedules

Managing currency conversions

Overcoming language barriers

Integrating with local banking systems

Simplify multi-country payroll with Deel

Key takeaways

- Payroll is an opportunity for your company to stand out and provide value to employees.

- Business owners must abide by local laws and regulations when processing payroll for international employees.

- Customizable payroll empowers businesses to attract and retain top talent anywhere in the world.

New to managing payroll across borders? Unlike domestic payroll, where rules are generally consistent, global payroll requires a deep understanding of diverse tax laws, labor regulations, and cultural practices.

For example, when it comes to taxes, Germany has a progressive income tax system with various deductions, while Singapore operates a simpler tax structure with lower rates overall.

Navigating these differences requires careful planning, expertise, and often, specialized tools, like customizable global payroll.

Here's how global payroll beginners can effectively customize their payroll in different countries.

Understanding taxation and withholdings

Managing taxes and withholdings becomes increasingly complex when paying employees in various countries, each with distinct tax laws. It is crucial to apply the correct income tax rates for each employee according to their local laws and to stay updated with tax code changes.

For instance, if your company is based in the US, you cannot apply the same payroll tax withholdings to an employee in Australia. Such discrepancies can lead to inaccurate payments and legal issues, including fines in both countries. Within the US, tax laws also vary by state.

Social security contributions represent another type of withholding. The structure and requirements of social security systems differ globally. Employees may need to pay social security taxes to their local government, the government where the company is located, or both. Companies are often required to contribute as well, making it crucial to understand the rates, limits, and jurisdiction for each case.

Other withholdings include unemployment insurance, workers' compensation, and pension funds, which also vary by region. Familiarize yourself with the laws in each region where you process payroll to ensure payroll compliance.

Continuous Compliance™

Setting salary and wage structures

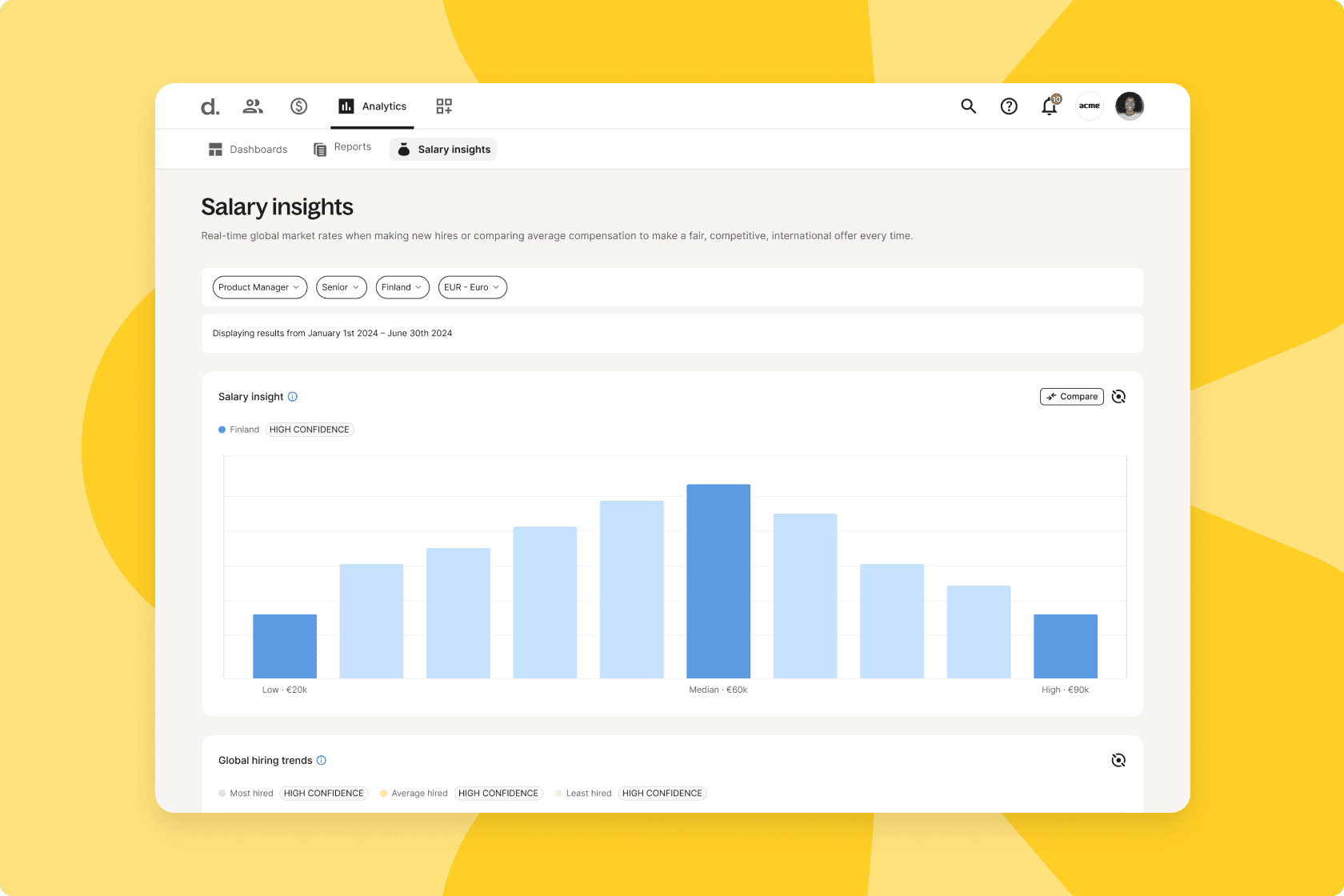

Beyond legal compliance, additional payroll considerations arise when hiring across multiple regions. Companies often consider local market standards and the cost of living when determining base salaries for employees.

For example, in 2020, the median income in Canada was nearly double that of Portugal. Consequently, employees in Portugal typically have different salary expectations as their Canadian counterparts due to differences in currency exchange rates, cost of living, and other factors.

Some companies may maintain uniform pay rates, while others adjust base salaries accordingly. Hiring internationally can yield cost savings, but many companies prioritize offering competitive compensation packages tailored to each region.

Regional considerations, such as holiday pay, overtime, allowances, and bonuses, may or may not be regulated by local laws. Balancing employee expectations with regional laws while ensuring fair policies is essential when expanding your business.

Researching benefits and perks

Depending on the regions where you hire, you may be required or expected to offer benefits such as health insurance, retirement plans, or other perks.

In the US, life insurance policies are not mandatory for employers, but many offer them to attract top talent. Understanding best practices beyond local laws and regulations is beneficial.

Leave policies vary significantly by country, sometimes mandated by the government and other times merely expected by workers. For example, Austria mandates 25 days of paid vacation and 13 paid public holidays annually. European countries often require extensive maternity leave, compared to the minimal requirements in the US.

See also: HR and Payroll Compliance Across EMEA: Your Expert Guide

While adherence to laws is necessary, standing out as an employer and attracting top candidates requires familiarity with local culture and expectations. Simple conversations with candidates or local contacts can provide valuable insights.

Global Hiring Toolkit

Ensuring compliance and correct reporting

Data privacy laws vary significantly depending on the employee's location. The General Data Protection Regulation (GDPR) sets a global standard for data privacy, affecting any company targeting EU citizens.

See also: How to Maintain GDPR Compliance Within Global Teams

Within a single country, regulations can also differ. For instance, the California Privacy Rights Act (CPRA) imposes stricter regulations than other US states.

Ensuring appropriate handling of employees' private data in each region is challenging. You must stay informed about evolving laws in each country, state, or province where your employees reside, or consider hiring a full-service payroll reporting company to manage this complexity.

Setting payroll schedules

While pay frequency isn’t generally controlled by laws and regulations, there are considerations based on cultural standards, social traditions, and the financial institutions in different parts of the world.

For example, in the US, a weekly or bi-weekly paycheck on Fridays is most common. Paydays on other days of the week aren’t unheard of, but other types of pay schedules are rare outside of specialty workers and independent contractors.

In other parts of the world, the financial infrastructure may present challenges when it comes to the speed and accessibility of banks. In these cases, less frequent pay schedules may be more convenient for both the employer and the employee.

Major holidays will also vary by region, which often pause payroll processing as financial institutions tend to be closed. For example, Christmas in the US or Golden Week in Japan. When possible, payroll schedules should be adjusted to minimize these disruptions.

Managing currency conversions

Processing payroll in multiple currencies is complex due to fluctuating exchange rates. Financial institutions often round exchange rates in their favor, on top of charging service fees, which can impact multinational companies' bottom line or employee satisfaction.

Some countries use multiple currencies, further complicating the process. Providing transparency about currency volatility and fees can enhance employee trust and contentment.

Learn more about Deel’s exchange rates and fees.

Overcoming language barriers

Global expansion involves hiring top talent worldwide, presenting the challenge of language barriers. Effective communication is essential for accurate payroll and employee satisfaction. Here are strategies to overcome these barriers:

- Translate payroll documents such as payslips, tax forms, and contracts into the local languages of your employees

- Partner with international financial services that offer translation and localization support

- Hire bilingual customer service representatives to assist employees with payroll-related questions, bridging the communication gap effectively

- Invest in global payroll software that supports multiple languages

- Work with local experts or bilingual employees to develop payroll templates tailored to specific languages and cultural nuances

- Offer language training to your HR and payroll teams to improve their ability to communicate with employees in different regions

- Use multiple communication platforms like email, chat, and video conferencing to ensure employees can easily seek assistance

- Seek feedback from employees on their payroll experiences to identify and address language barrier issues, leading to targeted improvements

Deel Global Payroll

Integrating with local banking systems

Financial infrastructures vary greatly between countries. In some cases, digital money transfers are seamless, while in others, employees may face challenges accessing foreign income.

Integrating with regional banking and money transfer systems is initially challenging but worthwhile in the long run. Registering with local tax authorities and understanding employer obligations for taxes and other programs is also crucial.

Tax codes differ worldwide, making compliance with multiple sets of regulations complex. Our guide to global payroll provides extensive information to help you navigate these challenges.

Simplify multi-country payroll with Deel

For companies hiring internationally, customized payroll is essential for tapping into diverse talent pools and enhancing your team’s skills. But since the complexity of payroll increases with global expansion, companies are often deterred from accessing a worldwide talent pool.

Deel Global Payroll ensures payroll compliance and efficiency, allowing you to focus on your business while we manage the intricacies of global payroll. Book a demo today to see the platform in action.

Deel on G2

About the author

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.