Article

9 min read

How to Solve Benefits Administration and Total Compensation Forecasting Challenges

Global HR

Author

Shannon Ongaro

Last Update

February 13, 2026

Explore this topic with AI

Key takeaways

- Total compensation forecasting improves when benefits, payroll, and pay data live in one unified, auditable system.

- Automation of eligibility, enrollment, and payroll deductions cuts errors, speeds cycles, and reduces compliance risk across regions.

- Multi-currency, multi-country analytics and scenario modeling give HR and finance real-time cost visibility for confident headcount and budget decisions.

When you need one solution that handles employee benefits and also helps you forecast total compensation for planning, the answer is an integrated platform that unifies benefits administration, payroll, and compensation analytics.

This article shows how to diagnose your needs, select the right tools, and automate key workflows so HR and finance can model costs accurately across roles, currencies, and countries.

With the right employee benefits and total compensation management software, you’ll reduce compliance risk, eliminate manual errors, and give leaders real-time scenario modeling to make confident headcount and budget decisions.

Understand your business needs and challenges

Start with a structured assessment so your solution fits how your company actually operates—not how software demos look. Map your workforce footprint, current benefits and payroll processes, and planning timelines.

Document pain points like compliance complexity across regions, forecast accuracy for merit cycles and variable pay, and integration challenges with your HRIS and payroll.

Total compensation is the complete value of employment, including salary, bonuses, benefits (healthcare, retirement, perks), and equity. Because these elements span systems and geographies, forecasting requires connecting enrollment choices, eligibility rules, and payroll deductions to compensation planning models.

Use a simple classification to align stakeholders:

- Compliance in multiple regions: Labor law, tax, reporting, works councils, carrier connections

- Administrative efficiency: Enrollment, eligibility, changes-of-status, deductions, carrier feeds, payroll sync

- Forecasting workforce and compensation costs: Headcount, salary bands, merit/bonus cycles, benefits cost trends, equity refresh

Fast-growing, global companies face increased complexity in legal risk, data fragmentation, and engagement expectations as they scale.

Choosing tools that unify benefits data with compensation planning significantly reduces overhead and errors. For distributed teams, international scaling adds multi-currency, localized benefits, and statutory requirements that must flow cleanly into planning models—otherwise forecasts drift and approvals stall.

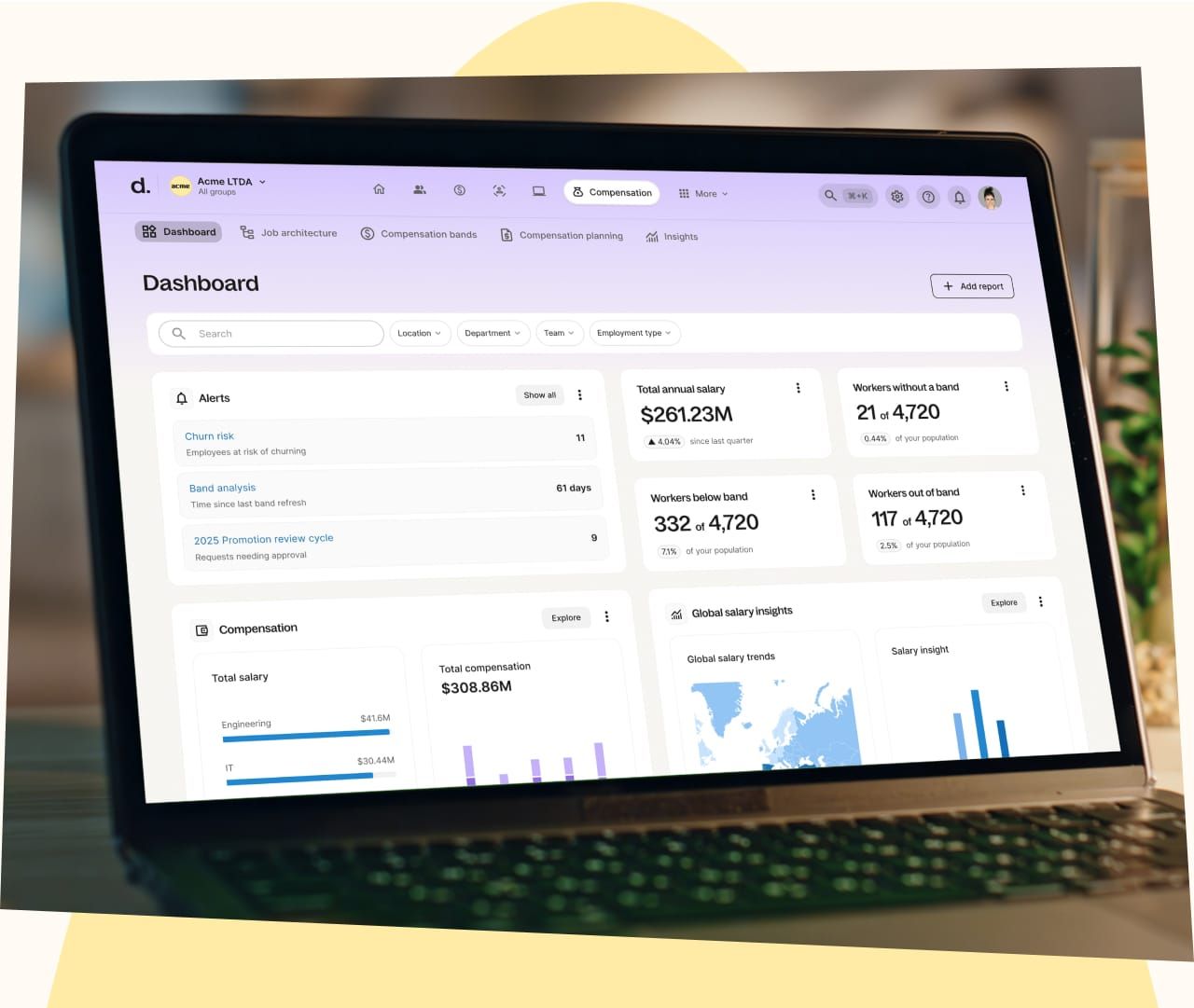

Compensation with Deel HR

Choose the right benefits and compensation tools

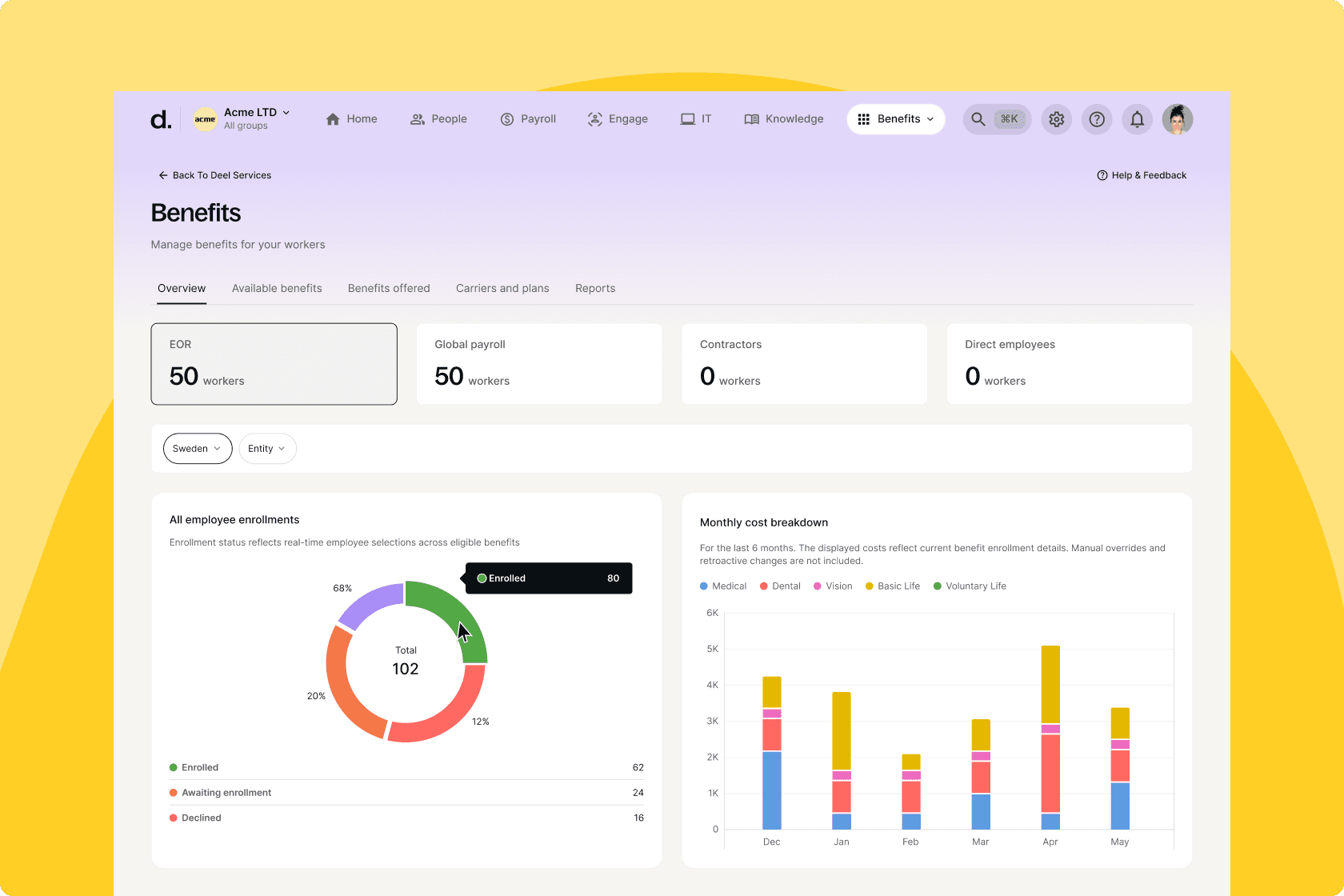

Prioritize platforms that centralize processes and connect benefits enrollment directly to payroll and compensation data. Integrated suites like Deel link eligibility, deductions, and employer contributions with salary, bonus, and equity data—improving forecasting accuracy across currencies and geographies while simplifying governance.

Understand the trade-offs between standalone benefits administration platforms and all-in-one HR suites:

| Approach | What it is | Strengths | Watchouts |

|---|---|---|---|

| Standalone benefits administration platform | A digital system to manage benefits enrollment, eligibility, communications, and compliance | Deep benefits features, carrier connections, advanced communications | Requires tight integration to HRIS/payroll; data latency can hinder forecasting |

| All-in-one HR suite with compensation + benefits | Unified HRIS, payroll, benefits, and compensation planning | Single data model, faster analytics and scenario modeling, fewer integrations | Feature depth varies by vendor; change management across modules is key |

What to look for:

- Seamless integration with existing HRIS/payroll (APIs, prebuilt connectors, carrier EDI)

- Automated workflows for eligibility, life events, and claims, with audit trails

- Predictive analytics and scenario modeling for merit, bonus, and equity cycles

- Automated headcount and compensation analytics that roll up multi-geo costs

- Multi-currency support, localized benefits catalogs, and compliance content

- Self-service enrollment with clear total rewards statements to boost engagement

- Robust role-based access and version control for budget owners and HRBPs

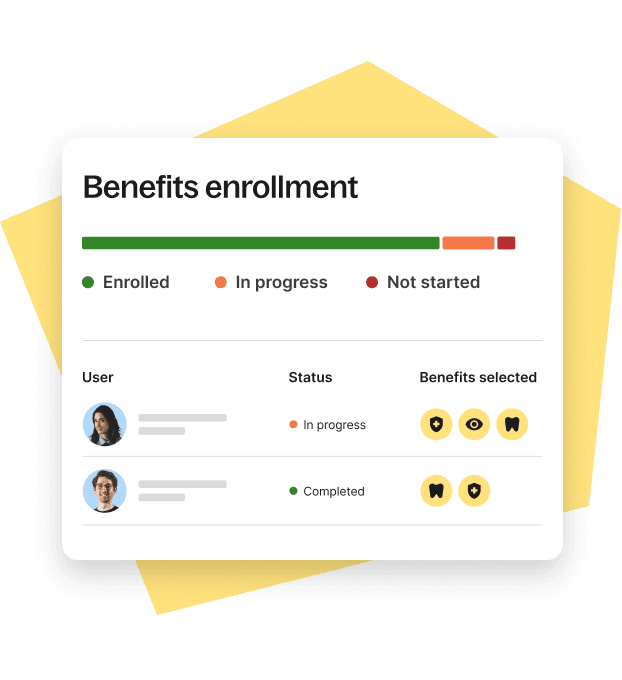

Benefits Administration

Implement automation for benefits and payroll processes

HR automation is the fastest way to cut admin time, increase accuracy, and free HR and finance for strategic work. In practice, that means letting your HRIS and benefits platform automate enrollments, eligibility checks, life-event changes, carrier file transmissions, and payroll deductions—so deductions and employer contributions update in sync with compensation cycles.

Reviews of modern benefits administration solutions consistently note reduced manual errors when eligibility and enrollment workflows are automated and integrated with payroll.

Deel HR

Define your system backbone clearly. An HRIS (Human Resource Information System) is a digital platform for storing and managing employee data and HR processes—core HR records, org structures, time, benefits, payroll, and workflows. Treat the HRIS as the source of truth that feeds benefits and compensation modules.

Practical automation wins to target first:

- Enrollment and eligibility: Rules-driven eligibility, dependent verification, and life-event processing with audit trails

- Payroll sync: Automated pre-tax and post-tax deductions, employer contributions, and arrears handling aligned to pay cycles

- Carrier connectivity: Scheduled EDI/file feeds with error handling and reconciliation

- Compensation cycles: Automated guideline calculations, budget guardrails, multi-currency conversions, and approval chains

- Analytics: Real-time dashboards showing headcount, benefits uptake, and total compensation cost projections by department, location, and scenario

To ground your plan, align automation phases with fiscal calendars. Stabilize enrollment and payroll sync first, then layer in compensation modeling and total rewards statements before merit and bonus cycles. Drawing on vendor playbooks will help you design scalable processes with fewer manual touchpoints.

The outcome: fewer errors, faster cycles, stronger compliance, and planning models that finally reflect reality. For global teams, platforms like Deel, which integrate benefits, payroll, and compensation across countries, can consolidate the entire flow—from enrollment to total compensation forecasting—so leaders can plan confidently as you scale into new markets.

Book a demo for a personalized platform walkthrough.

Leading Global Hiring Platform

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.