Article

11 min read

2026 Guide to Payroll‑Connected Benefits Platforms for Growing Companies

Global HR

Global payroll

Author

Shannon Ongaro

Last Update

December 05, 2025

Table of Contents

Why integrated payroll and benefits matter for growing companies

Key features to look for in payroll-connected benefits platforms

How payroll-connected benefits platforms improve compliance and reduce risk

Scalability and global growth support

1. Deel

2. Gusto

3. Rippling

4. TriNet

5. Ease

6. Collective Health

7. ALEX (Jellyvision)

8. Benefitfocus

9. Hibob

10. ThrivePass

Comparing payroll-connected benefits platforms

Integration with HRIS, time tracking, and accounting systems

Costs, pricing models, and calculating ROI

Enhancing the employee experience with payroll-connected benefits

Automation, analytics, and data security in modern platforms

How to choose the right payroll-connected benefits platform for your company

How Deel can help you unify payroll and benefits as you grow

Explore this topic with AI

Key takeaways

- Payroll-connected benefits platforms centralize payroll and benefits workflows to automate deductions, eligibility, compliance, and reporting.

- For growing companies, the right platform reduces manual work and risk while improving onboarding, enrollment, and employee self-service.

- Deel stands out for scaling benefits and payroll together across local and global teams with built-in compliance.

Payroll-connected benefits platforms integrate payroll processing and benefits administration so HR can automate deductions, eligibility, compliance, and reporting in one place.

For growth-stage companies, these tools cut manual work, reduce errors, and provide employees with a seamless experience from onboarding through open enrollment. In short: A payroll-connected benefits platform unites payroll and employee benefits in a single solution, streamlining data, compliance, and employee experience.

This guide compares leading options, including how Deel performs for distributed and international teams, and helps you quickly see which platforms connect with payroll and support your expansion plans.

Why integrated payroll and benefits matter for growing companies

When payroll and benefits reside in one system, HR teams eliminate duplicate data entry, reduce compliance mistakes, and accelerate onboarding and changes. As companies scale, fragmented tools can slow operations; integrated platforms standardize workflows, enforce policy, and surface issues early. The result is fewer discrepancies, timely pay, smoother benefits access, and a better employee experience that supports retention.

Key features to look for in payroll-connected benefits platforms

Use this checklist as you evaluate:

| Feature | Why it matters | What good looks like |

|---|---|---|

| Scalability | Supports rapid headcount growth and new markets without retooling | Handles multi-entity, multi-currency, and high-volume changes |

| Compliance management | Keeps up with evolving tax, leave, and eligibility laws | Real-time updates, localized rules, audit logs, alerts |

| Integration depth | Avoids silos between HRIS, time tracking, and accounting | Pre-built connectors and robust APIs for systems like QuickBooks, Xero, NetSuite, BambooHR |

| User experience | Reduces HR workload and employee inquiries | Intuitive self-service for enrollment, pay, and life events; mobile-first |

| Analytics & reporting | Drives decisions with real-time insights | Custom dashboards, error detection, and audit-ready reports |

| Security & privacy | Protects sensitive employee data | Strong encryption, role-based access, certifications (e.g., SOC 2) |

Deel HR

How payroll-connected benefits platforms improve compliance and reduce risk

Compliance means adhering to national, state, and local payroll and benefits regulations, including tax, leave, and eligibility laws. Modern platforms reduce exposure to fines or audits by enforcing rules in real time and maintaining a clear audit trail of changes, approvals, and communications. Look for dynamic regulatory updates, pre-programmed tax tables by location, and change logs that make audits straightforward.

Scalability and global growth support

As companies expand into new headcounts and countries, needs shift from “basic payroll + benefits” to multi-entity, multi-currency, and localized compliance. Leading platforms adapt by offering multi-country coverage, localized benefits, and in-region support—key differentiators for global growth.

A scalable payroll-connected benefits platform can manage payroll, benefits, and compliance for employees in multiple countries, adapting to each region’s requirements.

Use this quick lens when evaluating global readiness:

- International coverage: Supported countries, currencies, and tax jurisdictions

- Localized benefits: Regional plans, statutory benefits, leave rules

- Entity options: Employer of Record (EOR), Professional Employer Organization (PEO), or in-country payroll

- Cross-system scale: Batch changes, mass onboarding, and multi-entity reporting

- Support model: Follow-the-sun help and local expertise

See also: A Guide on How to Scale Global HR

Deel Payroll

1. Deel

Deel is a unified global HR, payroll, and compliance platform for every way companies manage and pay teams. It centralizes payroll, benefits, and compliance in over 150 countries through wholly owned entities, plus EOR, IT, HR, and contractor management.

Deel Payroll offers one product, one platform to pay teams locally or globally—so you can run payroll yourself or with Deel’s experts—delivering a consistent experience with global coverage, real-time accuracy, and built-in compliance across 130+ countries, with native gross-to-net in 50+ countries for instant results and faster pay cycles.

Its platform combines payroll and benefits end-to-end so deductions, eligibility, and reporting flow automatically via Deel Benefits. Real-time compliance monitoring, AI-driven analytics, and streamlined onboarding reduce risk and manual work while improving visibility for HR and finance. Learn more about Deel’s employee benefits software approach and global integration on Deel’s employee benefits software page.

Quick facts:

- One platform for domestic and global payroll across 130+ countries; run payroll on your own or with Deel’s experts; built-in compliance and real-time accuracy

- Global reach with local compliance via owned infrastructure and in-country expertise, with broader employment coverage across 150+ countries

- Real-time payroll: Native gross-to-net calculations in 50+ countries enable instant results, faster pay cycles, and smoother integrations

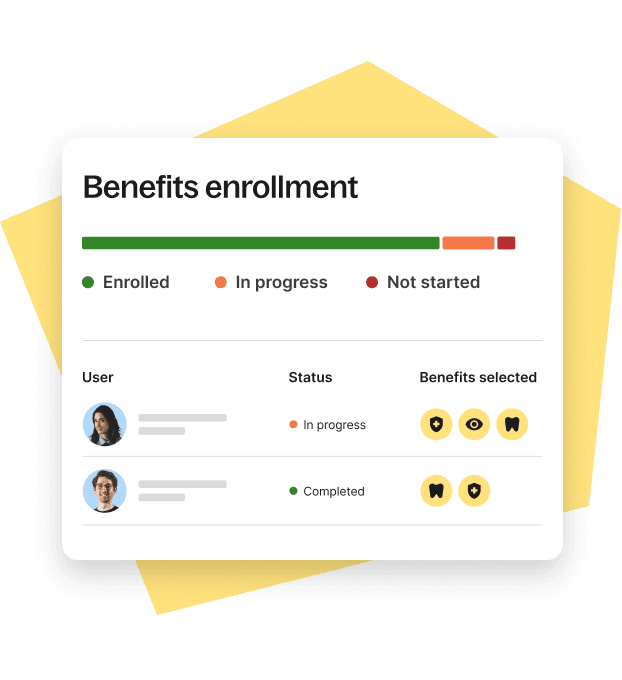

- Benefits that flow automatically: Direct integration with Deel Benefits keeps enrollments, deductions, and contributions synced each pay cycle

- Built for every stage: Fast onboarding, employee self-service (including mobile), and enterprise integrations with Workday and SAP

- Enterprise-grade reliability and analytics: Trusted by 37,000+ companies, backed by 2,000+ in-house specialists, 99.9% payroll accuracy, plus AI-powered analytics and anomaly detection for payroll-benefits data

2. Gusto

Gusto is a popular option for SMBs that want full-service payroll and basic benefits administration without complexity. Plans include automated tax filing, direct deposit, and compliance tools well-suited for teams under 100. Its SMB benefits integration focuses on simplicity, straightforward setup, and an approachable user experience for lean HR teams.

3. Rippling

Rippling takes a modular approach that unifies HR, IT, and payroll in one platform. Teams can automate custom workflows across onboarding, provisioning, and compensation changes, backed by a wide range of integrations and APIs. Rippling’s automation and data model can support complex approvals, multi-entity setups, and tight controls at scale.

4. TriNet

TriNet offers HR outsourcing and a payroll-connected benefits experience ideal for businesses entering new stages of growth. It includes payroll, talent management, benefits administration, and strong compliance guidance. TriNet’s expert support and flexible configuration make it a fit for companies increasing in size or complexity.

5. Ease

Ease emphasizes user experience and digital benefits management for lean HR teams. Its mobile-friendly platform makes plan comparison and enrollment straightforward, while integrations help keep payroll and deductions in sync. For smaller companies, Ease lowers the administrative burden with approachable interfaces and self-service.

6. Collective Health

Collective Health focuses on single-vendor benefits management for mid-market and enterprise organizations with complex eligibility and compliance needs. The platform centralizes plan administration, operations, and engagement to help HR manage high-volume, sophisticated benefits programs. It’s a fit for companies prioritizing deep data, claims visibility, and advanced reporting at scale.

7. ALEX (Jellyvision)

ALEX is designed to boost benefits engagement and reduce HR inquiries by guiding employees through coverage choices and life events. With personalized recommendations and self-service education modules, ALEX improves comprehension and helps employees choose cost-effective, suitable plans year-round.

8. Benefitfocus

Benefitfocus specializes in complex benefits orchestration with strong carrier connectivity and configurable employee portals. It centralizes eligibility, deductions, communications, and reporting for employers with many plan options and nuanced rules.

Key features:

- Extensive insurer/carrier integrations

- Customizable portals and communications

- Eligibility management and advanced reporting

9. Hibob

Hibob combines automation, analytics, and a consistent employee experience across teams and locations. For growing companies, it streamlines processes, provides actionable HR analytics, and supports global teams with a cohesive user experience that reduces friction across payroll-connected benefits workflows.

10. ThrivePass

ThrivePass enables lifecycle benefits and flexible account offerings such as Lifestyle Spending Accounts (LSAs), tuition reimbursement, and pre-tax accounts. Its integration with HRIS platforms helps personalize rewards and streamline administration, supporting retention through broader, customizable benefits.

Benefits Administration

Comparing payroll-connected benefits platforms

Use this platform comparison to focus your payroll software evaluation and selection of benefits administration tools:

| Platform | Best for | Payroll integration | International capabilities | Notable strengths | Pricing approach |

|---|---|---|---|---|---|

| Deel | Local or global teams of all sizes | Native payroll-benefits sync | 150+ countries with localized compliance | Owned entities, EOR + contractors, AI analytics | Per employee, per month |

| Gusto | SMBs prioritizing simplicity | Built-in | Limited international | Full-service payroll, easy benefits | Base + per-employee |

| Rippling | Tech-forward, fast-scaling | Built-in | Growing reach; varies by module | HR + IT + payroll automation, deep integrations | Modular; starts at $8/user/mo |

| TriNet | Growth-stage with complexity | Built-in | Multi-state; global via solutions | Compliance guidance, HR outsourcing | Quote-based |

| Ease | Lean HR teams | Integrations | US-focused | UX, digital enrollment | Tiered/through brokers |

| Collective Health | Mid-market/enterprise | Integrations | US-centric | Complex eligibility, analytics | Quote-based |

| ALEX | Engagement add-on | Integrations | N/A | Decision support, education | Per-employee/add-on |

| Benefitfocus | Complex carriers/portfolios | Integrations | US/carrier-led | Carrier connectivity, portals | Quote-based |

| Hibob | Modern HR stack | Integrations | Global teams supported | Automation, analytics, UX | Tiered/quote-based |

| ThrivePass | Flexible accounts/LSAs | Integrations | US-led | Lifecycle benefits, personalization | Modular |

Prioritize alignment with current and future needs: real-time reporting, audit readiness, integration scope, and international growth support. Shortlist platforms that demonstrate live data accuracy and clear audit trails.

Integration with HRIS, time tracking, and accounting systems

Seamless connectivity with HRIS, time tracking, and accounting systems eliminates data silos and manual reconciliations. Pre-built connectors and strong APIs help push and pull the right data at the right time—from time entries to GL postings.

Common integrations:

- Accounting/ERP: QuickBooks, Xero, NetSuite

- HRIS/Directory: BambooHR, Workday, Google Workspace, Microsoft Entra ID

- Time/Attendance: Clockify, Deputy, TSheets

- Identity/Apps: Okta, Slack

Typical implementation flow:

- Confirm data ownership, fields, and system of record

- Map fields and permissions; establish test environments

- Connect via pre-built integration or API/middleware (e.g., iPaaS)

- Pilot with a subset of employees and a payroll cycle dry run

- Validate GL mappings, tax/deduction rules, and edge cases

- Launch with monitoring and a rollback plan

Explore Deel’s integrations and powerful API.

Costs, pricing models, and calculating ROI

Pricing models typically include per-employee/month, modular (feature-based), and usage-based fees. For reference, SMB platforms often combine a base fee and per-employee rate, while global platforms may be quote-based. To estimate the ROI of HR and payroll consolidation, consider time saved from automation, fewer payroll errors, avoided compliance fines, and retention lift from a better employee experience.

Simple ROI approach:

- Annual savings = (HR/payroll hours saved × fully loaded hourly rate) + (error reductions × average cost) + (avoided fines) + (retention gains)

- ROI % = (Annual savings − Annual platform cost) ÷ Annual platform cost × 100

Checklist:

- Baseline current processing time and error rates

- Quantify compliance events and associated costs

- Model growth scenarios (headcount, countries)

- Include change management and training costs

Enhancing the employee experience with payroll-connected benefits

Employee experience improves when people can enroll in benefits, view pay, and manage life events on their own, from any device. Look for self-service portals, mobile access, digital enrollment, and real-time pay insights, plus personalized recommendations and clear plan comparisons. Automating eligibility and deductions reduces confusion, shortens resolution times, and builds trust.

See also: HCM and Payroll Integration: Top 5 Benefits

Automation, analytics, and data security in modern platforms

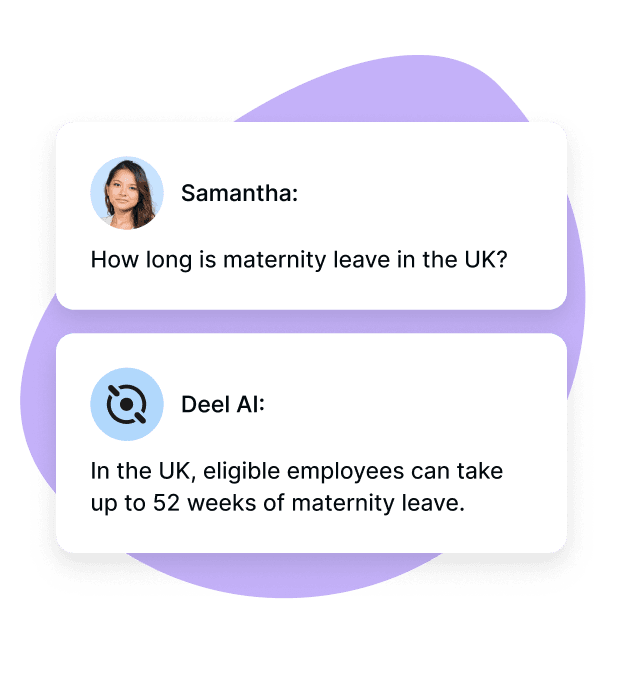

Automation in payroll-connected benefits platforms handles repetitive tasks like calculations and eligibility checks, reducing errors and freeing teams for higher-value work. AI in HR also improves accuracy and delivers real-time insights to spot anomalies and trends quickly. Seek platforms with robust dashboards, data-driven compliance alerts, and enterprise-grade security—encryption at rest and in transit, role-based access, regular pen tests, and compliance certifications.

Deel AI

How to choose the right payroll-connected benefits platform for your company

Decision criteria:

- Scalability and international coverage

- Compliance expertise and monitoring

- Integration depth across your tech stack

- Employee experience and admin usability

- Future-readiness (automation, analytics, AI, extensibility)

Selection steps:

- Assess current gaps and future growth (headcount, markets, complexity).

- Compare platforms against a structured checklist (features, integrations, compliance, analytics, price tiers, international).

- Validate integration and UX with live demos and a sandbox or pilot.

- Consult peer reviews, reference customers, and security documentation.

- Plan change management, training, and ongoing support.

How Deel can help you unify payroll and benefits as you grow

If you’re expanding headcount, entities, or countries, Deel gives you a single platform to run payroll and benefits together—without stitching tools or sacrificing compliance.

With native payroll-benefits sync, real-time gross-to-net, and automated eligibility and deductions through Deel Benefits, HR and finance get clean data, faster cycles, and a consistent employee experience worldwide.

Ready to see how it fits your stack and growth plan? Book a demo with Deel to walk through your payroll-connected benefits setup and get a tailored rollout approach.

Leading Global Hiring Platform

FAQs

What is a payroll-connected benefits platform and how does it support growing companies?

A payroll-connected benefits platform integrates payroll processing and benefits administration, allowing growing companies to efficiently manage pay, automate deductions, and ensure compliance as they expand.

What advantages does integrating payroll with benefits administration provide in 2026?

Integrated payroll and benefits reduce errors, streamline compliance, and offer real-time data, helping businesses save time and deliver a better employee experience.

How do payroll-connected platforms help manage compliance with evolving labor laws?

They automate compliance monitoring, update payroll calculations for new laws, and provide audit-ready reports so companies can stay ahead of regulatory changes.

How long does implementation typically take and who should be involved?

Implementations range from a few weeks to several months based on size and integrations; HR, payroll, IT, and finance should all be involved.

What types of employee benefits can be managed automatically through payroll integration?

Health insurance, retirement contributions, wellness stipends, and voluntary benefits can be auto-enrolled and deducted through integrated payroll platforms.

Disclaimer: The information on this page is subject to change or updates. Deel does not make any representations as to the completeness or accuracy of the information on this page.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.