Article

46 min read

PEO Services: A State-by-State Guide for US Employers

PEO

Author

Shannon Ongaro

Last Update

June 30, 2025

Key takeaways

- A PEO can streamline hiring, payroll, benefits, and HR administration so you can focus on expanding your business, not compliance paperwork.

- Every state has its own laws around payroll, labor, and employment, and its own rules for how professional employer organizations (PEOs) operate within them.

- With Deel PEO, you get built-in compliance, powerful automation, and state-specific expertise to support your team across all 50 states.

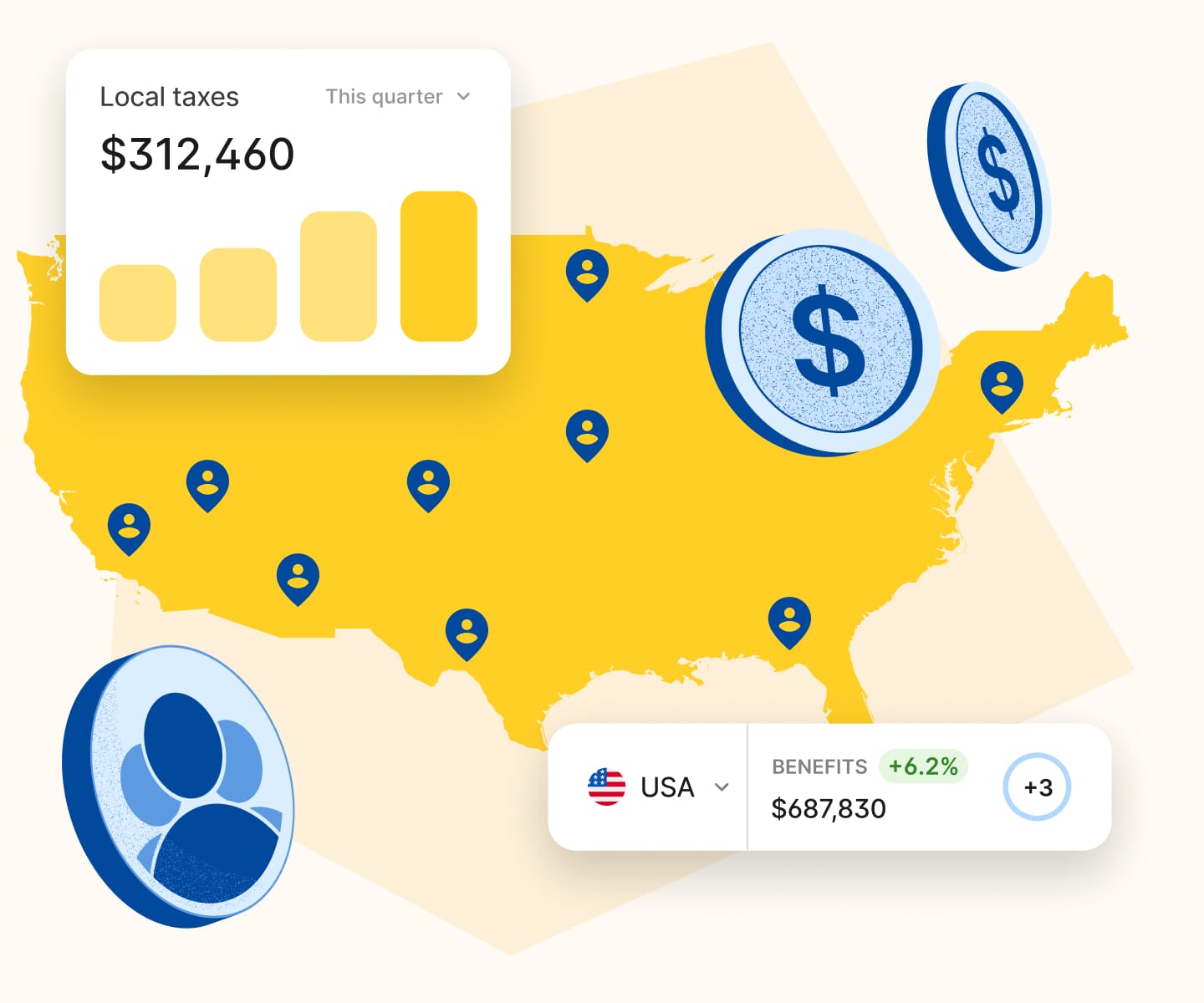

Whether you're entering from abroad or scaling domestically, setting up a team within the US comes with exciting opportunities and steep regulatory hurdles. From tax withholdings to benefits administration to employment classification, every state has its own playbook. These differences can create complexity fast, especially when managing hiring and payroll across multiple jurisdictions.

That’s where a professional employer organization (PEO) can help. A PEO acts as your co-employer, streamlining HR, payroll, benefits, and compliance responsibilities. But partnering with a PEO isn’t a one-size-fits-all solution. Each state has distinct legal and regulatory frameworks that govern how PEOs operate and how they can support your business.

Whether you're a founder setting up a team in Texas or a People Ops leader expanding into New York, understanding these state-level variations is essential.

Deel PEO helps you navigate them with expert, localized support so you can hire, pay, and manage teams compliantly in every state you operate.

Watch the video below to learn mre about Deel's professional employer organization, and other payroll solutions.

What is a PEO?

A professional employer organization (PEO) is a third-party partner that helps businesses manage employee needs—like payroll and benefits, taxes, onboarding, and legal filings.

Through a co-employment model, your business retains day-to-day control while the PEO handles administrative and compliance functions.

This partnership often leads to cost savings, more competitive retirement plans, and improved ability to scale across jurisdictions. PEOs are especially valuable when you need to include payroll, support multi-state teams, or streamline your human resource functions.

PEOs help small and mid-sized businesses streamline HR tasks, stay compliant, and cut costs. But PEO rules and benefits vary by state.

This guide links you to every local resource we’ve published—so you can make informed decisions for your business operations. We will be continually updating this list for additional coverage.

State-by-State PEO Services

Alabama

Reporting method: PEO-level

Deel files state unemployment insurance (SUI) taxes under its own employer identification number (EIN) in Alabama. Client companies must close their state UI accounts to prevent double-reporting or noncompliance.

Key labor, payroll, and employment laws

Alabama employers must adhere to a mix of federal and state-specific regulations that affect payroll, classification, and workplace rights. A PEO can assist with:

-

Adhering to federal labor standards, as Alabama does not have a state minimum wage or mini-WARN law but enforces key federal requirements like the Fair Labor Standards Act (FLSA) and Family and Medical Leave Act (FMLA)

-

Managing workers’ compensation obligations, which apply to employers with five or more employees under state law

-

Ensuring proper worker classification following IRS and DOL guidelines, critical in a state that closely aligns with federal standards

-

Navigating Alabama’s specific child labor laws, which limit the hours and duties minors may perform

-

Maintaining wage records and handling final pay processes as required under federal recordkeeping laws

-

Complying with leave policies, including mandatory voting leave, unpaid military leave, and jury duty leave

-

Operating within right-to-work protections and OSHA-aligned workplace safety laws

PEO oversight in Alabama

PEOs must comply with regulatory oversight from the Alabama Department of Labor

Key requirements include:

-

Registering with the Department of Labor before operating in the state

-

Maintaining valid workers’ compensation coverage

-

Managing unemployment insurance contributions appropriately and avoiding misuse of client accounts for SUTA rate advantages

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Alabama state tax form and new hire pre-existing conditions form

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

WSE (worksite employee) notice of PEO relationship

Learn more: A Guide to PEO Services in Alabama

Arizona

Reporting method: PEO-level

Deel reports and remits Arizona unemployment insurance (UI) taxes under its own EIN. Client businesses must close any existing state SUI accounts to avoid duplication or compliance issues.

Key labor, payroll, and employment laws

Arizona employers must comply with several state-specific regulations that go beyond federal requirements. A PEO can be especially helpful in managing:

-

The Fair Wages and Healthy Families Act, which mandates paid sick leave accrual and employee rights postings

-

Workers' compensation coverage, required for all employers with limited control over initial medical provider choice

-

Independent contractor classification, including the use of Arizona’s Declaration of Independent Business Status (DIBS) form

-

Recordkeeping and final pay laws, which include strict timelines and documentation requirements

-

Arizona’s “ban the box” policy (Executive Order 2017-07), delaying criminal background inquiries during public hiring

PEO oversight in Arizona

While Arizona does not require formal PEO licensing, providers must:

-

Notify the Industrial Commission of Arizona (ICA) when entering a client relationship

-

Inform insurance carriers about all co-employment agreements

-

Avoid using client data to secure more favorable SUTA rates

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Arizona state tax forms and employer information forms

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent

-

WSE (worksite employee) notice of PEO relationship

Learn more: A Guide to PEO in Arizona

California

Reporting method: Client-level

In California, employers must maintain their own state unemployment insurance (SUI) accounts. Deel requires third-party access (TPA) to file and remit SUI taxes on the client’s behalf.

Key labor, payroll, and employment laws

California’s labor laws are among the most comprehensive in the United States, often exceeding federal requirements. A PEO can help navigate:

-

The Fair Employment and Housing Act (FEHA), which governs anti-discrimination, harassment, and retaliation protections across a broad set of categories

-

The California Family Rights Act (CFRA), which mirrors and expands on federal FMLA protections, offering unpaid leave for family and medical reasons

-

The ABC test for independent contractor classification, as codified by Assembly Bill 5 (AB5), which imposes strict standards for determining worker status

-

Mandatory paid sick leave and detailed break period laws, including meal and rest requirements for hourly employees

-

Laws requiring pay transparency in job postings and salary records retention

-

Unique state mandates such as the Freelance Worker Protection Act and farmworker safety rules under SB 1105

California’s overlapping city, county, and state-level requirements add complexity. PEOs help ensure employers remain compliant with the most protective applicable standard.

PEO oversight in California

California does not license PEOs at the state level, but providers must:

-

Ensure all employers carry valid workers’ compensation coverage at all times, as required under Labor Code Section 3700

-

Verify that workers’ comp carriers are licensed with the California Department of Insurance

-

Comply with mandates enforced by the California Labor Commissioner’s Office, Cal/OSHA, and the Department of Fair Employment and Housing

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

California state tax form

-

California time of hire pamphlet

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Predesignation of personal physician and chiropractor notices

-

Notices for California paid family leave, disability insurance, pregnancy leave, sexual harassment rights, and victim protection rights

-

California Freelance Worker Protection Act compliance documents (as applicable)

Learn more: A Guide to PEO in California

Colorado

Reporting method: PEO-level

Deel reports and remits Colorado unemployment insurance taxes under its own EIN. Client companies must close any existing Colorado UI accounts to avoid duplicate filings or penalties.

Key labor, payroll, and employment laws

Colorado’s employment laws are both state-specific and locally variable, making compliance especially complex. A PEO can help manage:

-

Paid leave requirements under the Colorado Family and Medical Leave Insurance (FAMLI) program and the Healthy Families and Workplaces Act

-

Pay transparency laws under the Equal Pay for Equal Work Act, which mandate salary range disclosure, promotion tracking, and internal mobility guidance

-

Strict break and rest period rules, including paid and unpaid time based on shift duration

-

Compliance with the Colorado Overtime and Minimum Pay Standards (COMPS) Order and sector-specific rules like Agricultural Labor Conditions

-

Workers’ compensation requirements, which apply to all employers regardless of size and cover a broad range of benefits and rehabilitation services

-

Union protections across private, state, and local government sectors under laws such as the Labor Peace Act and the Colorado Partnership for Quality Jobs and Services Act

With overlapping local ordinances and evolving state requirements, a PEO helps ensure businesses stay aligned with the most protective standard.

PEO oversight in Colorado

While PEOs are not required to obtain a state license, they must comply with rules enforced by the Colorado Department of Labor and Employment (CDLE). Requirements include:

-

Ensuring continuous workers’ compensation coverage

-

Filing employment-related documentation under their own EIN

-

Adhering to laws prohibiting improper wage deductions and unpaid required breaks

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Colorado state tax forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Time of hire notices and paid leave disclosures

-

Compliance acknowledgments for Equal Pay for Equal Work, paid sick leave, and FAMLI policies

Learn more: Guide to Colorado PEO Services

Florida

Reporting method: PEO-level

Deel files state unemployment insurance (re-employment tax) under its own EIN. Client businesses must close their existing Florida UI accounts to avoid reporting duplication or compliance penalties.

Key labor, payroll, and employment laws

Florida businesses must navigate broad but moderate regulatory requirements, which often intersects with federal laws. A PEO helps employers remain compliant with requirements such as:

-

Re-employment tax obligations, paid by employers on the first portion of employee wages without wage deduction

-

Worker classification laws that define employees narrowly and consider misclassification a felony offense

-

Mandatory employment eligibility verification within three business days of hiring, using the state’s e-verify system

-

Leave protections for domestic violence victims and mandated break periods for minors under age 18

-

Discrimination laws ensuring equal pay for equal work, except in cases involving seniority or performance-based systems

-

Group insurance regulations requiring employee choice regarding participation in benefit plans

PEOs also help businesses track compliance with changes such as employment eligibility screening laws and background check requirements, which can carry daily fines for violations.

PEO oversight in Florida

Florida requires all PEOs to obtain a license from the Department of Business and Professional Regulation (DBPR).

Additional requirements include:

-

Taking responsibility for tax withholding, wage reporting, and compliance with the state’s re-employment tax rules

-

Ensuring workers’ compensation insurance is in place for all employees

-

Operating in alignment with regulations from both the Florida Department of Revenue and DBPR, which treat PEOs and employee leasing companies interchangeably

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Florida state tax forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Documentation supporting workers’ compensation and re-employment tax compliance

-

Verification and record retention documents required under Florida’s e-verify employment eligibility law

Learn more: A Guide to PEO in Florida

Guide

Expanding your business in the US?

Illinois

Reporting method: PEO-level

Deel files Illinois state unemployment insurance taxes under its own EIN. Client businesses must close their existing Illinois UI accounts to ensure proper reporting and avoid duplication penalties.

Key labor, payroll, and employment laws

Illinois imposes detailed payroll, leave, wage transparency, and worker protection requirements. A PEO can assist with:

-

Compliance with wage and hour laws, including overtime pay, mandatory break periods, and the Paid Leave for All Workers Act

-

Pay transparency and recordkeeping mandates under the Illinois Equal Pay Act, including requirements to include salary ranges in job postings and retain pay stubs for three years

-

Worker classification laws such as the Employee Classification Act, which imposes penalties for misclassification, especially in construction

-

Mandatory workers’ compensation insurance, with steep penalties and personal liability risks for noncompliance

-

Leave protections under the Illinois Human Rights Act and Victims' Economic Security and Safety Act

-

Enforcement of non-compete agreement restrictions under the Freedom to Work Act

-

Employment discrimination protections for a broad range of classes under state civil rights law

PEOs provide essential compliance guidance for managing these obligations, reducing the risk of financial, legal, and reputational exposure.

PEO oversight in Illinois

PEOs must follow all applicable federal and state laws while supporting clients in meeting Illinois-specific obligations.

Oversight includes:

-

Ensuring all employees are properly covered by workers’ compensation insurance

-

Managing payroll, tax filings, and employee classification under Illinois rules

-

Adhering to evolving wage transparency, recordkeeping, and leave compliance requirements

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Illinois state tax forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Illinois Human Rights pamphlet

-

Payroll records, wage statements, and job posting documentation aligned with Equal Pay Act mandates

Learn more: A Guide to PEO in Illinois

Indiana

Reporting method: PEO-level

Deel reports and remits Indiana unemployment insurance taxes using its own EIN. Client businesses must close their existing Indiana UI accounts to avoid duplicate reporting or noncompliance.

Key labor, payroll, and employment laws

Indiana’s employment laws often align with federal guidelines, but there are important state-specific requirements where a PEO can provide essential support. A PEO helps employers manage:

-

Workers’ compensation insurance mandates under IC 22-3-2-2, including requirements for either private coverage or certified self-insurance with financial guarantees

-

Flat income tax rules and employer payment deadlines under Indiana’s payroll statutes

-

Final wage deadlines and flexible pay frequency options, including biweekly or semi-monthly schedules

-

Compliance with tip credit provisions and minimum wage obligations

-

Overtime pay requirements and optional benefit offerings such as vacation or sick leave

-

Safety regulations under Indiana OSHA (IOSHA), which enforces federal OSHA standards in public and private workplaces

-

Right-to-work laws, anti-discrimination policies, and legal enforcement of non-compete agreements (pending FTC developments)

PEOs reduce risk by ensuring proper classification of workers and helping employers avoid steep penalties related to workers’ compensation violations or misclassification.

PEO oversight in Indiana

Indiana does not have a formal licensing process for PEOs, but providers must comply with the Indiana Department of Workforce Development (DWD) and the Worker’s Compensation Board.

Responsibilities include:

-

Maintaining valid workers’ compensation coverage for all employees

-

Adhering to payroll reporting obligations and unemployment tax laws

-

Providing documentation to demonstrate compliance with employment eligibility and tax requirements

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Indiana state tax forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Proof of workers’ compensation coverage or self-insurance certification

-

Payroll and wage records aligned with pay frequency and withholding laws

Learn more: A Guide to PEO in Indiana

Iowa

Reporting method: Client-level

Employers in Iowa must maintain their own state unemployment insurance (UI) accounts. Deel requires third-party access (TPA) to file and pay UI taxes on the client’s behalf.

Key labor, payroll, and employment laws

Iowa employers are subject to a range of labor and payroll regulations enforced across multiple agencies. A PEO can help manage:

-

Workers’ compensation requirements, including mandatory coverage or registration as a self-insurer with timely benefit payment obligations

-

Payday and payroll rules requiring payment at least once a month and no later than 12 days after the pay period ends

-

Flat-rate state income tax withholding and restrictions on wage deductions for shortages or damage

-

Uniform purchase policies, where employers may require specific attire but may not deduct the cost from wages

-

Discrimination protections under the Iowa Civil Rights Act, which prohibits bias based on age, race, disability, and other protected categories

-

Final paycheck and pay stub issuance, including detailed wage and deduction breakdowns

-

On-call work rules and non-compensable voluntary training time

-

Union and industry-specific agreements governing rest breaks and leave policies

Iowa follows at-will employment and uses a broad test to determine employee classification. Misclassification can result in fines or criminal penalties, making PEO guidance essential for risk mitigation.

PEO oversight in Iowa

Iowa does not require PEOs to register or hold a state license, but they must comply with all state employment regulations.

As co-employers, PEOs are required to:

-

Administer unemployment insurance and workers’ compensation on behalf of the client

-

Ensure tax filing and benefits obligations are met under Iowa Workforce Development rules

-

Stay current with overlapping federal and state labor law changes that could increase employer liability

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Iowa state tax forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out option)

-

Employee communication consent agreement

-

Iowa harassment pamphlet outlining employee rights

-

Payroll records and documentation for wage, hour, and benefit compliance

Learn more: A Guide to Iowa PEO Services

Kansas

Reporting method: Client-level

Employers in Kansas are required to register their own unemployment insurance (UI) accounts. Deel requires third-party access (TPA) to file and pay UI taxes on the client’s behalf.

Key labor, payroll, and employment laws

Kansas employers are subject to a unique mix of state and federal labor laws. A PEO helps reduce risk by supporting compliance with regulations including:

-

Overtime rules requiring payment at 1.5x for hours beyond 46 per week (though federal law may require payment after 40 hours)

-

State-mandated workers’ compensation coverage for most non-agricultural businesses exceeding $20,000 in payroll

-

Strict worker classification criteria defining whether someone is a contractor or employee based on control, supervision, and independence

-

Final paycheck timing and vacation pay policies, which do not require payout of unused leave unless company policy dictates

-

SUI obligations on the first $14,000 of wages per employee, with variable rates based on claims history

-

Meal and break periods, PTO, and health benefits, which are not required under state law but commonly offered

-

Safety standards set by the Kansas Department of Labor (KDOL), including mandatory reporting of workplace injuries within 28 days

-

‘Right-to-work’ protections prohibiting mandatory union membership or dues

-

Requirements for voting leave, unpaid jury duty leave, and maternity-related protections under FMLA equivalence

Kansas is also an at-will employment state and expects employers to observe all applicable anti-discrimination statutes that protect workers based on background, gender, disability, or family status.

PEO oversight in Kansas

All PEOs operating in Kansas must register with the Kansas Commissioner of Insurance. They are not permitted to sell insurance directly but may manage and administer benefit plans. PEOs are expected to:

-

File initial registration and disclose corporate and financial details

-

Coordinate employee benefits without holding insurance licenses

-

Comply with labor, tax, and employment laws as co-employers under the Kansas regulatory framework

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Kansas state tax withholding forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (with opt-out provision)

-

Employee communication consent agreement

-

Workplace injury reports and safety documentation for KDOL

-

Unemployment insurance records filed with the state

Learn more: Guide to Kansas PEO Services

Massachusetts

Reporting method: Client-level

Employers in Massachusetts must maintain their own unemployment insurance (UI) accounts. Deel requires third-party access (TPA) to file and pay UI taxes on the client’s behalf.

Key labor, payroll, and employment laws

Massachusetts has some of the most employee-friendly regulations in the US. A PEO can support compliance and reduce risk by assisting with:

-

Worker classification using the state’s strict three-prong test for contractors vs employees

-

Paid Family and Medical Leave (PFML), which mandates up to 26 weeks of paid leave for qualifying personal or family needs

-

Equal pay practices under the Massachusetts Equal Pay Act (MEPA), requiring salary transparency and prohibiting retaliation for wage discussions

-

State minimum wage, which is consistently higher than the federal rate and subject to periodic review

-

The Employer Medical Assistance Contribution (EMAC), an additional payroll tax to fund state health care programs

-

Blue Laws governing Sunday and holiday retail operations, which may require permits for certain businesses

-

The Right to Know Law, mandating chemical safety training and workplace disclosures

-

Compliance with non-compete agreement restrictions, which must meet time, geographic, and business-interest limitations

-

Pregnancy accommodations and lactation breaks under the Pregnant Workers Fairness Act (PWFA)

-

Termination rules, including final paycheck requirements that vary depending on whether an employee resigns or is terminated

Massachusetts also requires employers to offer workers’ compensation regardless of employee headcount or hours worked, and mandates meal breaks for shifts exceeding six hours.

PEO oversight in Massachusetts

All PEOs must register with the Massachusetts Secretary of the Commonwealth. Registered PEOs must:

-

Maintain active UI and workers’ compensation accounts

-

Comply with all co-employment disclosure requirements

-

Ensure all employee benefits plans meet Massachusetts coverage standards

-

Provide clients with clear division-of-responsibility documentation

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Massachusetts state tax withholding forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

PFML contribution and rights notices (employer size-specific)

-

Legal Rights of Domestic Workers notice

-

1099 contractor rights notification

-

Massachusetts-specific employment posters and notices

Learn more: A Guide to PEO in Massachusetts

Michigan

Reporting method: Client-level

Employers in Michigan must maintain their own unemployment insurance (UI) accounts. Deel requires third-party access (TPA) to file and pay UI taxes on the client’s behalf.

Key labor, payroll, and employment laws

Michigan’s labor regulations include several unique and evolving requirements where a PEO can offer significant support:

-

Compliance with Michigan’s Earned Sick Time Act, reinstated for enforcement beginning February 21, 2025

-

Adherence to mandatory UI account separation in co-employment relationships, requiring both the client and PEO to maintain distinct workers’ compensation policies

-

Coordination with city-specific income tax rules in municipalities such as Detroit, where local withholding may apply

-

Accurate implementation of tip credit calculations for tipped workers, which differ from federal guidelines

-

Transparency requirements around wage deductions and pay stubs, aligned with current and pending state laws

-

Ongoing monitoring of state-level non-compete and pay transparency legislation, including Senate Bill 142 and House Bill 4406

-

Classification of workers in accordance with IRS and state-specific guidance to avoid costly misclassification penalties

-

Implementation of Paid Medical Leave Act entitlements, including accrual and carryover of paid sick leave

-

Compliance with state-level protections against discrimination based on categories like height, weight, and genetic information, which are broader than federal standards

A PEO can also manage MIOSHA-related safety policies and ensure meal and break rules for minors are met.

PEO oversight in Michigan

PEOs operating in Michigan must:

-

Maintain separate workers’ compensation policies for themselves and their client companies

-

Comply with the Michigan Department of Insurance and Financial Services (DIFS) for employee benefit plan standards

-

Support compliance with state-mandated sick leave and payroll reporting obligations

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Michigan state income tax withholding forms

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

Notices related to paid sick leave accruals and usage

-

Final wage notices and wage statement disclosures

Learn more: A Guide to PEO in Michigan

Missouri

Reporting method: Provider-level

Deel acts as the Employer of Record for SUI tax in PEO-reporting states. We will manage the filing process under our EIN and SUI account number.

Key labor, payroll, and employment laws

Missouri businesses must navigate complex employment laws that include recent and pending changes. A PEO can assist with:

-

Administering newly required paid sick leave policies for businesses with 15 or more employees (effective 2025)

-

Ensuring accurate minimum wage calculations and tipped employee compliance, especially for businesses grossing under $500,000

-

Managing compliance with the Missouri Equal Pay Law and discrimination protections enforced by the Missouri Commission on Human Rights

-

Navigating nuanced overtime requirements, including exceptions for seasonal amusement and recreation businesses

-

Clarifying worker classification in accordance with state-level guidance on behavioral and financial control

-

Implementing non-compete agreements that are enforceable under Missouri law, ensuring they are reasonable and protect legitimate business interests

-

Managing final wage payments and related legal obligations to avoid wage claim litigation

A PEO can also assist with reporting requirements for occupational disease claims, such as those related to mesothelioma, and help companies remain OSHA-compliant through safety training and documentation.

PEO oversight in Missouri

Missouri does not mandate formal licensing for PEOs but expects full compliance with employment statutes and agency requirements. PEOs must:

-

Follow Department of Labor and Industrial Relations (DOLIR) guidelines on tax withholding and reporting

-

Coordinate with Missouri's Division of Workers’ Compensation for required insurance coverage

-

Abide by local and state leave, wage, and classification regulations

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Missouri state income tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

Missouri domestic violence and sexual assault leave notice

Learn more: A Guide to PEO in Missouri

Nebraska

Reporting method: Client-level

Employers in Nebraska are mandated to file SUI tax using an unemployment account linked directly to their EIN.

Key labor, payroll, and employment laws

Nebraska’s employment landscape includes laws and administrative practices that can be difficult for businesses to navigate without local HR expertise. A PEO can help you stay compliant with:

-

The Nebraska PEO Registration Act, which mandates provider registration and financial vetting by the Nebraska Department of Labor (NDOL)

-

Pay frequency requirements that allow employers to set their own schedule, as long as it is regular and predictable

-

The Employee Classification Act (ECA), which applies particularly to construction and delivery workers, emphasizing common-law principles over statutory tests

-

Legal mandates surrounding pump breaks and private nursing facilities for lactating parents in the workplace

-

Enforcement of final paycheck rules and PTO payouts at contract termination, especially when PTO is included in the employer’s internal policies

-

Specific supplementary income tax withholding (5%) on irregular compensation such as bonuses and commissions

-

Compliance with catastrophic and family military leave rules, which go beyond federal standards

-

Coordination of workplace safety protocols, especially via Nebraska’s OSHA-aligned consultation programs for voluntary compliance

-

Ensuring coverage and claims handling for workers’ compensation, including cumulative trauma and occupational illness

PEO oversight in Nebraska

PEOs operating in Nebraska must:

-

Register with the NDOL under the PEO Registration Act

-

Demonstrate sufficient financial stability and provide bonding or insurance coverage

-

Ensure compliance with Nebraska’s wage and hour, tax, and workplace safety regulations

-

Administer unemployment insurance and workers’ compensation benefits on behalf of their clients

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Nebraska state income tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

Nebraska-specific notices such as jury duty rights and nursing parent accommodations

Learn more: A Guide to Nebraska PEO

New York

Reporting method: Provider-level

Deel files and pays unemployment insurance (UI) taxes under its own state UI account in New York. Employers do not need to maintain a separate UI account.

Key labor, payroll, and employment laws

New York maintains one of the most extensive and protective employment law systems in the US. A PEO can assist with:

-

Licensing requirements under the New York Professional Employer Act, including proof of workers’ compensation and disability insurance

-

Administering earned sick leave based on business size and income under the New York Sick Leave Law

-

Ensuring Paid Family Leave (PFL) compliance, including coordination with FMLA when applicable

-

Managing responsibilities under the Pay Transparency Law and Salary History Ban

-

Implementing and documenting mandatory workplace postings such as sexual harassment prevention notices and pregnancy accommodations

-

Navigating nuanced wage and hour laws, including pay frequency by job type, call-in pay, and jurisdiction-based minimum wages

-

Handling electronic monitoring disclosures and worker notification under the NY Electronic Monitoring Law

-

Understanding whistleblower protections, particularly following recent legal expansions

-

Coordinating compliance under New York City-specific rules such as the Fair Chance Act and Clean Slate Act

-

Managing New York SDI tax (state disability insurance), which is a payroll tax requirement in some states

A PEO can also help businesses avoid serious penalties for misclassification of workers or wage theft, and ensure proper recordkeeping for required four-year retention periods.

PEO oversight in New York

PEOs in New York must:

-

Be licensed through the New York State Department of Labor

-

Maintain required insurance coverage for disability and workers’ compensation

-

Comply with all federal, state, and city-level employment statutes, including those enforced by the Division of Labor Standards and Division of Safety and Health

-

File periodic renewals and maintain accurate records of all employer-related activities

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

New York State tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

New York Electronic Monitoring Notice

-

New York Pay Rate Form and Employer Information Notice

-

NYC Earned Safe & Sick Time Notice

-

Pregnancy Accommodations Notice

-

Sexual Harassment Prevention Notice and Factsheet

Learn more: A Guide to PEO in New York

Ohio

Reporting method: Client-level

In client-reporting states, employers are mandated to file SUI tax using an unemployment account linked directly to their EIN.

Key labor, payroll, and employment laws

Ohio employers must comply with both state and federal labor regulations. A PEO can assist with:

-

Registration and ongoing compliance with Ohio’s Bureau of Workers’ Compensation (BWC) requirements

-

Navigating minimum wage thresholds and tipped worker rules (e.g., $10.70/hour for most workers in 2025)

-

Administering overtime pay for hours worked over 40 per week, with exemptions based on annual earnings

-

Managing compliance with semi-monthly pay schedules, mandatory payment deadlines, and cash payment requirements in the absence of written agreements

-

Supporting wage deduction policies, employee sales restrictions, and performance-based job disclosures

-

Understanding state-level pay transparency expectations, including city-level salary history bans

-

Advising on optional leave practices and meal breaks, as they’re not mandated under state law

-

Administering workers’ compensation through the BWC and maintaining accessible records for inspection

-

Ensuring safe work environments and adherence to equipment and scheduling regulations

-

Complying with FMLA and Ohio's application of it for family leave, medical leave, and sick leave

Additionally, employers must pay UI tax on Ohio workers.

PEO oversight in Ohio

PEOs must:

-

Register annually with the Ohio BWC

-

Prove they have adequate working capital to support their client companies

-

Comply with state laws to avoid license revocation

-

Apply for limited registration if out-of-state and serving fewer than 50 workers without physical presence

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Ohio state tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

Learn more: A Guide to Ohio PEO Services

Oregon

Reporting method: Provider-level

Deel files and pays unemployment insurance (UI) taxes under its own state UI account in Oregon. Employers do not need to maintain a separate UI account.

Key labor, payroll, and employment laws

Oregon’s progressive policies and evolving labor laws can pose compliance challenges. A PEO helps ensure:

-

Adherence to minimum wage rates across regions (e.g., $15.95/hour in Portland Metro Area)

-

Correct classification and payment of tipped and non-tipped employees

-

Compliance with mandatory sick leave, Paid Leave Oregon, and OFLA/FMLA protections

-

Accurate administration of overtime rules, especially for employees in manufacturing and specific industries

-

Timely payment of wages, including final paychecks per legal deadlines

-

Paid breaks and unpaid meal periods per shift length

-

Compliance with laws around discrimination, non-compete agreements, equal pay, and military family leave

-

Appropriate worker classification under Oregon’s control and economic dependence tests

-

Support with Oregon OSHA inspections and workplace safety programs

Employers must also register and contribute to Oregon’s unemployment insurance (UI) program.

PEO oversight in Oregon

PEOs must:

-

Comply with Oregon’s co-employment regulations and registration requirements

-

Ensure workers’ compensation coverage is secured through a certified carrier

-

Maintain compliance with Oregon Bureau of Labor and Industries (BOLI) employment standards

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Oregon state tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

Oregon Workplace Accommodation and Fairness notices

Learn more: A Guide to PEO in Oregon

Texas

Reporting method: Provider-level

Deel files and pays unemployment insurance (UI) taxes under its own state UI account in Texas. Employers do not need to maintain a separate UI account.

Key labor, payroll, and employment laws

Texas law is generally employer-friendly, but businesses still face key state and federal compliance obligations. A PEO helps ensure:

-

Adherence to minimum wage laws (currently $7.25 per hour) and correct pay frequency rules (monthly for exempt, semi-monthly for others)

-

Timely payment of final wages within six calendar days for terminations, and on the next payday for resignations

-

Correct handling of overtime pay or compensatory time off at 1.5x the regular rate, up to 240 hours

-

Proper application of PTO, sick leave, and unused benefits payout policies, where written policies apply

-

Classification of employees vs. independent contractors in accordance with Texas Workforce Commission guidance

-

Adherence to Equal Employment Opportunity (EEO) and Whistleblower Act protections

-

Compliance with at-will employment doctrine while avoiding discriminatory termination practices

Texas does not require private employers to offer workers’ compensation insurance, but if they do, the policy must meet state standards. Deel PEO ensures appropriate coverage and handles any required filings.

PEO oversight in Texas

PEOs must:

-

Obtain a license from the Texas Department of Licensing and Regulation (TDLR)

-

Maintain compliance with co-employment rules and applicable insurance regulations

-

Adhere to wage payment, reporting, and benefits administration standards

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Texas state tax withholding form

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

-

Texas Workers' Compensation Notice (if applicable)

Learn more: A Guide to PEO in Texas

Washington

Reporting method: Client-level

In Washington state, the employer (client) maintains its own state unemployment insurance (SUI) account. Deel requires third-party access to file and pay on the client’s behalf.

Key labor, payroll, and employment laws

Washington’s labor laws are notably progressive and often exceed federal standards. A PEO helps employers navigate key regulations such as:

-

A high state minimum wage, with even higher local rates in cities like Seattle and Tukwila

-

A Paid Family and Medical Leave (PFML) program that provides eligible employees with paid leave for certain family and medical reasons

-

Required overtime pay at 1.5x for hours worked over 40 in a workweek

-

Strict pay transparency laws that apply to employers with 15 or more employees

-

Meal and rest break rules requiring paid 10-minute breaks and unpaid 30-minute meals on longer shifts

-

Workers’ compensation coverage, which must be administered through the state’s Department of Labor & Industries (L&I)

-

Non-compete restrictions and equal pay enforcement under the Equal Pay and Opportunities Act

Washington also enforces its own workplace safety standards through WISHA, which expands upon federal OSHA rules. A PEO ensures businesses meet these state-specific expectations and avoid enforcement actions by L&I.

PEO oversight in Washington

-

All PEOs must register each of their client companies doing business in Washington

-

Registration is required even if the client has no employees physically working in the state

-

The Washington State Department of Labor & Industries (L&I) oversees employment law enforcement

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Washington State Tax Form

-

Washington Paid Sick Leave notice

-

Washington Sexual Harassment Law summary

-

WSE (worksite employee) notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

Learn more: A Guide to PEO in Washington

Wisconsin

Reporting method: Provider-level

Deel acts as the employer of record for SUI tax in PEO-Reporting states. We will manage the filing process under our EIN and SUI account number.

Key labor, payroll, and employment laws

Wisconsin labor laws are complex and span a wide range of employer obligations. A PEO can help companies manage these effectively, including:

-

Worker’s compensation insurance requirements that apply even to small employers and out-of-state companies with in-state workers

-

Tip wage allowances and “opportunity employee” rates with specific thresholds and credits

-

Overtime laws requiring 1.5x pay for hours worked over 40 per week, with exemptions for some job categories

-

Required final paycheck timelines depending on whether an employee quits or is terminated

-

Progressive income tax withholding obligations and minimum wage standards tied to federal benchmarks

-

Required breaks for minors under 18, though breaks for adults are not mandatory

-

Employment discrimination laws under the Wisconsin Fair Employment Law covering a broad range of protected classes

-

Worker classification rules that must be met to avoid penalties and enforcement actions

A PEO helps businesses stay on top of changing wage, benefit, and employment regulations while reducing the risk of non-compliance and penalties.

PEO oversight in Wisconsin

-

Wisconsin PEOs must comply with all Department of Workforce Development (DWD) requirements

-

Employers must have workers’ compensation insurance in place if they meet certain thresholds

-

Out-of-state companies with employees working in Wisconsin must hold WC policies issued by licensed Wisconsin carriers

Typical compliance documentation

-

IRS Form W-4 and Form I-9

-

Wisconsin State Tax Form

-

WSE notice of PEO relationship

-

PEO arbitration agreement (opt-out available)

-

Employee communication consent agreement

Learn more: A Guide to PEO in Wisconsin

PEO reporting states

When companies engage a Professional Employer Organization (PEO) like Deel, they enter a co-employment relationship that changes how payroll taxes, especially State Unemployment Insurance (SUI), are reported and paid. Each US state determines its own method for how this reporting must occur.

Understanding these requirements is critical for maintaining compliance, avoiding fines, and ensuring smooth payroll operations.

PEO reporting methods explained

Each state follows one of the following three reporting models in a co-employment setup:

-

PEO-level reporting: The PEO (such as Deel) acts as the employer of record (EOR). SUI filings and payments are made under the PEO’s Employer Identification Number (EIN) and SUI account. Clients must close existing state SUI accounts to avoid double-reporting or penalties

-

Client-level reporting: The client (employer) remains responsible for maintaining their own state SUI account. Deel will require Third-Party Access (TPA) to file and pay on the client’s behalf. If no account exists, clients must register one using the applicable state’s process

-

Hybrid-level reporting: States assign each client a unique SUI account that is linked to Deel’s EIN. Deel files and pays SUI taxes through these client-linked accounts

PEO reporting requirements by state

Here is a breakdown of all 50 states (plus DC and USVI) and their designated reporting model under a Deel co-employment arrangement:

| State | Reporting method |

|---|---|

| Alabama | PEO-Level |

| Alaska | Client-Level |

| Arizona | PEO-Level |

| Arkansas | Hybrid-Level |

| California | Client-Level |

| Colorado | PEO-Level |

| Connecticut | Client-Level |

| Delaware | Client-Level |

| District of Columbia | PEO-Level |

| Florida | PEO-Level |

| Georgia | PEO-Level |

| Hawaii | PEO-Level |

| Idaho | PEO-Level |

| Illinois | PEO-Level |

| Indiana | PEO-Level |

| Iowa | Client-Level |

| Kansas | Hybrid-Level |

| Kentucky | Client-Level |

| Louisiana | Hybrid-Level |

| Maine | Hybrid-Level |

| Maryland | PEO-Level |

| Massachusetts | Client-Level |

| Michigan | Client-Level |

| Minnesota | Client-Level |

| Mississippi | Client-Level |

| Missouri | PEO-Level |

| Montana | PEO-Level |

| Nebraska | Client-Level |

| Nevada | Client-Level |

| New Hampshire | PEO-Level |

| New Jersey | PEO-Level |

| New Mexico | PEO-Level |

| New York | PEO-Level |

| North Carolina | PEO-Level |

| North Dakota | Client-Level |

| Ohio | Client-Level |

| Oklahoma | PEO-Level |

| Oregon | PEO-Level |

| Pennsylvania | Client-Level |

| Rhode Island | Client-Level |

| South Carolina | Client-Level |

| South Dakota | Client-Level |

| Tennessee | Hybrid-Level |

| Texas | PEO-Level |

| Utah | PEO-Level |

| Vermont | Client-Level |

| Virginia | PEO-Level |

| Virgin Islands (US) | PEO-Level |

| Washington | Client-Level |

| West Virginia | PEO-Level |

| Wisconsin | PEO-Level |

| Wyoming | Client-Level |

Which states are PEO reporting states?

The following states are recognized as PEO reporting states, where the PEO is the employer of record for SUI and handles the reporting and tax filings on behalf of client companies:

- Alabama

- Arizona

- Colorado

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Maryland

- Missouri

- Montana

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Oklahoma

- Oregon

- Texas

- Utah

- Virgin Islands (US)

- Virginia

- West Virginia

- Wisconsin

Deel PEO

Why choose Deel PEO?

Deel PEO supports small and mid-sized businesses with multi-state teams and ambitious growth goals.

Watch the video below to hear how Superfiliate uses Deel PEO to streamline US expansion.

With Deel, you get:

- In-house infrastructure for payroll services, onboarding, and benefits administration

- Certified in-house experts and a dedicated HRBP

- Exclusive access to Aetna International master plans for globally-mobile US W-2 employees

- Built-in tools for compliance support in all 50 states

- Support for ACA-compliant health plans, 401(k) retirement plans, and PTO policies

- Clear, fixed pricing with transparent cost savings vs internal admin

- Tools to reduce admin load and improve accuracy when managing HR

With Deel, you spend less time on manual work and more time growing your business.

Talk to our team to explore how Deel PEO helps improve efficiency while keeping you compliant, everywhere you hire.

About the author

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.