Article

9 min read

7 Flexible Benefits to Make Your Job Offer Irresistible

Global HR

Author

Shannon Ongaro

Last Update

December 03, 2025

Table of Contents

What are flexible benefits?

Why flexible benefits matter in recruitment

Deel's approach to offering flexible benefits easily

7 flexible benefits that attract top talent

How to implement flexible benefits successfully

Measuring the impact of your flexible benefits

Simplify employee benefits with Deel

Explore this topic with AI

Key takeaways

- Flexible benefits help employers win talent by letting candidates personalize coverage and perks to their life stage, which increases offer appeal and retention.

- HSAs/FSAs, remote-work stipends, professional development, mental health support, family benefits, flexible PTO, and lifestyle stipends signal a modern, employee-centric culture.

- Platforms like Deel reduce local and global complexity through automated enrollment, eligibility, and payroll sync.

Today's top talent expects more than a competitive salary—they want benefits that adapt to their lives. Flexible employee benefits for recruitment have become essential for companies competing in tight labor markets.

These customizable offerings let employees choose the perks that matter most to them, from health savings accounts to remote work stipends. Research shows that 39% of employees would consider leaving their current job for one with better benefits, making benefit flexibility a critical differentiator in job offers.

This guide explores seven flexible benefits that can transform your recruitment strategy and help you attract exceptional candidates.

What are flexible benefits?

Flexible benefits, also called cafeteria plans or flex benefits, allow employees to select from a menu of benefit options rather than receiving a one-size-fits-all package. Employees typically receive a benefits allowance or credits they can allocate across various categories—health coverage, retirement contributions, wellness programs, or lifestyle perks—based on their personal priorities.

This approach recognizes that a recent graduate's needs differ dramatically from those of a parent with three children or an employee nearing retirement. While traditional benefits packages offer the same coverage to everyone, flexible benefits empower individuals to build a package that reflects their life stage, family situation, and personal values.

Companies implementing flexible benefits can experience higher employee satisfaction and improved retention rates, as workers feel their employer genuinely understands and supports their unique circumstances.

Benefits Administration

Why flexible benefits matter in recruitment

The competition for skilled talent has fundamentally changed how candidates evaluate job offers. Salary remains important, but recent research shows benefits and perks rank among the top considerations when evaluating offers. Flexible benefits address this shift by demonstrating that your organization values employees as individuals.

When candidates compare offers, flexible benefits provide several recruitment advantages. They signal a modern, employee-centric culture that attracts forward-thinking professionals. They also level the playing field for smaller companies that can't match enterprise salaries but can offer meaningful choice and personalization.

Flexible benefits particularly resonate with younger workers. Millennials and Gen Z employees prioritize work-life balance, mental health support, and professional development—areas where flexible benefits shine. By offering choice, you're more likely to include at least several benefits that deeply matter to each candidate, making your offer memorable and compelling.

Deel's approach to offering flexible benefits easily

Managing flexible benefits across multiple countries and regions traditionally requires significant administrative resources and compliance expertise. Deel’s integrated benefits platform transforms this complexity into a streamlined process, enabling HR teams to deliver easy global benefits administration without expanding their headcount, including:

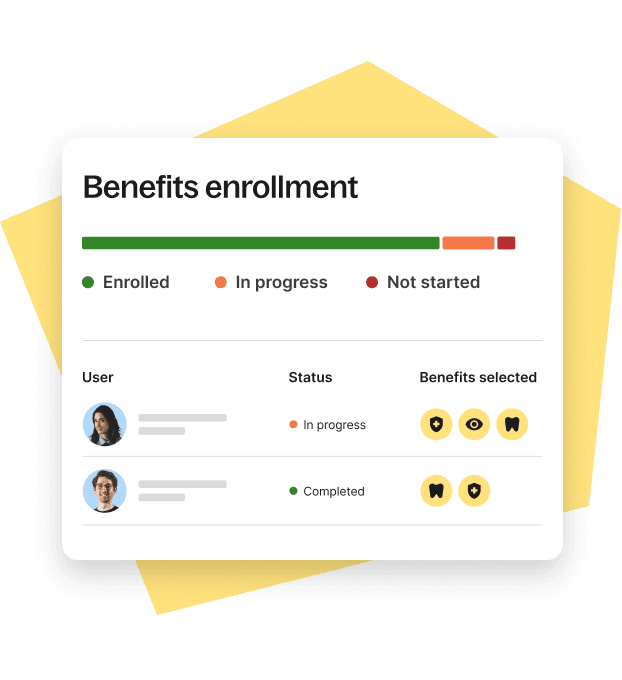

- Automatic payroll deductions: Elections, changes, and cancellations sync to pre/post-tax deductions with audit logs.

- Open enrollment management: Configure dates, eligibility, and defaults. Track progress and send nudges to finish.

- Qualifying life event management: Easily capture and approve marriage, birth, loss of coverage, and more.

- Plan builder and eligibility: Set plans, tiers, and employer contributions. Apply rules by location, org, or cohort.

- Cost and coverage comparisons: Show employee and employer costs side-by-side with coverage details to guide decisions.

- Detailed global and US views: Combine US data into global reporting, including plan and cohort breakdowns for Finance.

Live Demo

Get a live walkthrough of the Deel platform

7 flexible benefits that attract top talent

Health Savings Accounts and Flexible Spending Accounts

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) give employees tax-advantaged ways to pay for medical expenses. HSAs pair with high-deductible health plans and allow employees to save pre-tax dollars that roll over year to year, building a healthcare nest egg. FSAs offer similar tax benefits but typically require employees to use funds within the plan year.

These accounts appeal to candidates because they reduce out-of-pocket healthcare costs while providing financial flexibility. Employees can use HSA and FSA funds for everything from prescription medications and dental work to vision care and certain over-the-counter items. For employers, offering HSAs can reduce healthcare premium costs while still providing valuable benefits.

Consider offering employer contributions to HSAs as part of your benefits package. Even modest contributions—$500 to $1,000 annually—demonstrate investment in employee health while remaining cost-effective compared to traditional low-deductible plans.

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Requires high-deductible health plan | Available with any health plan |

| Rollover | Funds roll over indefinitely | Use-it-or-lose-it (some plans allow small carryover) |

| Portability | Employee owns account, keeps when changing jobs | Tied to employer |

| Contribution Limits (2026) | $4,400 individual / $8,750 family / $1,000 catch-up (55+) | $3,400 individual / $7,500 household / $3,750 filing separately |

| Investment Options | Can invest unused funds | No investment option |

Remote work and home office stipends

The shift to remote and hybrid work has created new benefit opportunities. Home office stipends help employees create productive workspaces by covering expenses like ergonomic furniture, monitors, lighting, and internet upgrades. These stipends typically range from $500 to $2,000 annually, depending on company size and budget.

Remote work stipends send a clear message that your organization supports flexible work arrangements—a major draw for candidates. Research indicates that remote work flexibility ranks among the most desired benefits for knowledge workers. By formalizing this support through a dedicated stipend, you differentiate your offer from competitors who merely allow remote work without providing resources.

Structure these benefits with clear guidelines about eligible expenses while keeping the approval process simple. Some companies provide a flat monthly allowance, while others reimburse specific purchases up to an annual cap. Both approaches work—choose based on your administrative capacity and company culture.

Professional development allowances

Professional development allowances fund employee growth through courses, certifications, conferences, books, and coaching. These benefits typically range from $1,000 to $5,000 per year and can be structured as reimbursements or direct payments to educational providers.

Top candidates view learning opportunities as investments in their career trajectory. Research links robust professional development benefits with higher retention, as employees feel supported in building skills that increase their long-term value. This benefit particularly attracts ambitious, growth-oriented professionals who plan to stay and advance within your organization.

Make professional development allowances flexible by allowing employees to choose their learning path. Some may prefer technical certifications, others leadership training, and still others industry conferences. Requiring manager approval ensures alignment with business needs while preserving employee autonomy in selecting specific opportunities.

Wellness and mental health benefits

Wellness benefits encompass gym memberships, fitness app subscriptions, meditation programs, mental health counseling, and preventive care initiatives. Mental health benefits have become especially critical, with 76% of employees reporting at least one mental health symptom in recent surveys.

Modern wellness programs go beyond traditional gym memberships to include holistic offerings like therapy session coverage, mindfulness app subscriptions, wellness coaching, and stress management workshops. Many companies now provide mental health days as part of PTO policies or offer Employee Assistance Programs (EAPs) with confidential counseling services.

Flexible wellness benefits let employees choose what supports their specific health goals. A runner might use funds for race registrations, while a parent might prefer family yoga classes or therapy sessions. This personalization increases utilization and demonstrates genuine care for employee well-being beyond productivity metrics.

Childcare and family support benefits

Childcare benefits address one of working parents' most significant financial and logistical challenges. Options include childcare stipends, backup care services, subsidized daycare spots, or partnerships with childcare providers. These benefits can also extend to elder care support, recognizing that many employees manage care responsibilities for aging parents.

Family support benefits powerfully differentiate job offers, especially for candidates with young children or family care responsibilities. The average cost of childcare in the United States is $13,128 annually per child, making even partial support meaningful. Candidates often remember companies that acknowledge and address this real-world concern.

Consider tiered approaches based on employee tenure or role, or offer flexible credits that parents can apply toward various family needs, from daycare to summer camps to tutoring services. Some companies partner with backup care providers, offering a set number of emergency care days when regular arrangements fall through.

Global Hiring Toolkit

Flexible time off policies

Flexible time off goes beyond traditional vacation days to include unlimited PTO, flexible holidays, sabbatical programs, or volunteer time off. These policies recognize that employees need time away for various reasons—rest, family obligations, personal projects, or community service.

Unlimited PTO has gained traction, though implementation matters significantly. When structured with clear expectations and manager modeling, unlimited PTO increases employee satisfaction and trust. PTO reduces the likelihood of employees quitting by 35% compared to those with rigid vacation structures.

Flexible holiday policies let employees swap standard holidays for days meaningful to their culture or religion. Volunteer time off—typically one to three days annually for community service—appeals to socially conscious candidates and strengthens company culture. Sabbatical programs, offering extended paid or unpaid leave after several years of service, attract candidates planning long-term careers.

Lifestyle and personal interest stipends

Lifestyle stipends provide funds for employees to spend on personal interests—hobbies, entertainment, travel, or passion projects. These might include pet care allowances, streaming service subscriptions, book budgets, or "experience" funds for concerts and activities.

While lifestyle benefits may seem less essential than health coverage, they significantly impact employee satisfaction and company culture. These perks communicate that your organization values employees as whole people with lives and interests beyond work. Small and mid-sized businesses using lifestyle benefits can increase employee engagement scores without substantial budget increases.

Keep lifestyle stipends simple with minimal restrictions. Some companies provide a monthly allowance employees can spend however they choose, while others offer specific categories like pet care or entertainment. The key is demonstrating trust in employees to use these benefits in ways that enhance their lives.

How to implement flexible benefits successfully

Start by surveying your current team and recent candidates to understand which benefits matter most. Anonymous surveys reveal honest preferences and help you avoid investing in underutilized perks. Look for patterns across demographics, departments, and career stages to build a diverse menu that appeals to your entire workforce.

Design your benefits structure with clear categories and spending limits. Most companies use a credits or allowance system where employees receive a set amount to allocate across benefit categories. This approach provides choice while maintaining budget predictability. Ensure your benefits platform or HR system can track selections, deductions, and utilization without creating an administrative burden.

Communicate benefits clearly during recruitment and onboarding. Create simple visual guides showing benefit options, eligibility requirements, and selection processes. Train hiring managers to discuss flexible benefits confidently during offer conversations, emphasizing the personalization aspect. Many candidates won't fully appreciate flexible benefits unless you explicitly highlight the choice and value they provide.

Review and adjust your offerings annually based on utilization data and employee feedback. Benefits that seemed attractive may go unused, while gaps may emerge as your workforce evolves. Regular refinement ensures your flexible benefits remain competitive and relevant.

Deel HR

Measuring the impact of your flexible benefits

Track key metrics to demonstrate your flexible benefits program's value and identify improvement opportunities. Monitor offer acceptance rates before and after implementing flexible benefits, segmenting by role, level, and candidate source. Improved acceptance rates directly indicate that your benefits package has become more competitive.

Measure benefits utilization across categories to understand which offerings resonate most. Low utilization may indicate poor communication, confusing enrollment processes, or misaligned benefit choices. High utilization signals benefits that genuinely meet employee needs and justify continued investment.

Survey employees regularly about benefits satisfaction and perceived value. Include questions about whether benefits influenced their decision to join or stay with the company.

Calculate the cost per employee and compare against recruitment and retention improvements. While flexible benefits require investment, they often cost less than the expenses associated with extended job searches, signing bonuses, or replacing departed employees. Building this business case helps secure ongoing leadership support.

Simplify employee benefits with Deel

Ready to offer flexible benefits without the administrative headache? Deel makes global benefits administration simple, compliant, and scalable—so you can give every employee meaningful choice while HR and Finance stay in control. Explore Deel Benefits to build an irresistible, flexible package for your team or book a demo for a platform tour and expert Q&A.

Leading Global Hiring Platform

FAQs

What's the difference between flexible benefits and traditional benefits packages?

Traditional packages provide the same benefits to all employees, while flexible benefits let individuals choose from a menu of options based on personal needs and priorities.

How much should companies budget for flexible benefits?

Most companies allocate 20–30% of total compensation to benefits, with flexible programs typically requiring similar budgets but offering greater perceived value through personalization.

Do flexible benefits work for small companies?

Yes—small companies often find flexible benefits more manageable than comprehensive traditional packages, and many low-cost options like professional development allowances and flexible PTO require minimal infrastructure. See also: A Guide to Offering Small Business Employee Benefits For US Teams

How do you prevent benefits costs from spiraling with flexible options?

Set clear annual allowances or credit limits per employee, establish spending categories with caps, and regularly review utilization data to adjust offerings.

What flexible benefits matter most to candidates?

Health-related benefits, flexible work arrangements, and professional development consistently rank highest, though preferences vary by generation, life stage, and industry.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.