Article

14 min read

Outsourcing Payroll Explained: Benefits, Watch-Outs & Examples

Global payroll

Author

Anja Simic

Last Update

November 04, 2025

Table of Contents

What is payroll outsourcing?

How does outsourcing payroll work?

What are the benefits of outsourced payroll services?

What are the challenges and risks of outsourcing payroll?

What are your payroll outsourcing options?

What are the best payroll outsourcing solutions in 2025?

See how Deel simplifies payroll outsourcing

Key takeaways

- Payroll outsourcing is the practice of hiring an external service provider to handle the payroll functions for your company.

- By outsourcing payroll, you minimize the risk of misclassification and fines that can cost hundreds of thousands of dollars.

- Outsourcing payroll to an all-in-one solution like Deel can result in a net present value (NPV) of $936,000 and an ROI of 67%.

According to Deloitte, 80% of executives plan to maintain or increase their use of third-party outsourcing, and 83% are already leveraging AI within these outsourced services.

But what exactly does payroll outsourcing mean for your team? How much control will you retain over your processes and data? And how will it impact your existing payroll staff?

This guide answers those questions and more, providing you with a clear understanding of what is and isn’t covered in payroll outsourcing, as well as today’s best payroll vendors.

For example: Deel Payroll offers global businesses flexible, technology-driven payroll outsourcing that integrates compliance, automation, and expert support. Read on to learn more.

What is payroll outsourcing?

Payroll outsourcing is the practice of hiring an external service provider to handle the payroll functions for your company. A payroll service provider ensures that:

- All payroll funds are distributed on time and according to your employee agreements

- Payments are made accurately and compliantly with local laws

- Payroll documentation and employee information is safely and securely managed

Payroll service providers only handle making payments to your employees. Some mistakenly believe outsourcing payroll services include HR services that help you hire new people, but HR and payroll outsourcing are different. Human resources can be outsourced to a separate service, and while some companies offer both, a payroll company only handles payroll.

Learn more in our complete guide to HR outsourcing.

How does outsourcing payroll work?

When you outsource payroll, the provider takes over the administrative and compliance tasks involved in paying employees. The process typically follows these steps:

-

Setup and onboarding

You’ll provide the payroll company with essential details, such as employee names, roles, pay rates, and working hours. This setup stage ensures the provider has accurate data before the first pay run. -

Collecting pay period information

At the end of each pay period, you’ll share information such as hours worked, overtime, or commissions. The payroll provider inputs this data into their system to calculate gross pay. -

Gross pay calculations and deductions

Once gross pay is determined, the provider applies pre-tax and post-tax deductions. These can include income taxes, social contributions, retirement savings, child support, workers’ compensation, and employee benefit contributions. -

Net pay distribution

After deductions, the provider calculates net pay and delivers funds to employees—usually through direct deposit or checks. They also handle tax filings and other statutory payments on your behalf. -

Payroll reporting and compliance support

As the employer or payroll manager, you’ll receive detailed reports for each pay cycle. These reports provide visibility into wages, deductions, and compliance, helping you maintain accurate records and meet audit requirements.

What are the benefits of outsourced payroll services?

Outsourcing payroll helps companies save time, reduce errors, and stay compliant with tax and labor laws. Here are the main advantages:

Improved compliance

Payroll rules vary by country—and sometimes by state or county. Misclassification or filing mistakes can result in costly fines. A global payroll provider with local expertise ensures employees are paid accurately and on time, while keeping your business compliant wherever you operate.

Cost savings

Building and staffing an in-house payroll department is expensive. Outsourcing is often more cost-effective, especially for global teams. A 2025 Forrester Total Economic Impact™ study found that fragmented payroll processes cost an average of $480 more per employee annually and require twice as many full-time payroll staff compared to a unified solution.

Scalable support for growing teams

Fast-growing companies often struggle with payroll errors and delays. Outsourcing ensures payroll keeps pace with expansion, freeing your in-house finance team to focus on strategic work. This is especially important when breaking into new, complex markets.

According to a 2025 Deloitte survey, managed services are more common in regions like LATAM, EMEA, and APAC, where companies typically have small headcounts but face more complex legal and regulatory frameworks.

Stronger data security

Payroll data is highly sensitive. Trusted providers follow strict data protection standards like GDPR and SOC 2, with encryption and risk controls that reduce the chance of fraud, identity theft, or breaches.

Fewer mistakes

Payroll errors damage employee trust and can trigger penalties from tax authorities. Because outsourced providers specialize in compliance and payment accuracy, the risk of errors is lower than with an in-house team juggling multiple responsibilities.

For example, when the team at Clipboard Health started outsourcing their global payroll, they found that "it handles complex payroll processes with ease, accommodating various payment schedules, deductions, and tax requirements. This adaptability has saved us countless hours and reduced the margin for error.”

Greater efficiency

Payroll employees spend nearly half their week on manual fixes instead of strategic work. To alleviate that workload, leading providers use automation and AI-driven payroll tools to cut manual work and human error.

A centralized solution also makes payroll faster and easier to manage across multiple regions. By consolidating global payroll into one centralized, outsourced solution, payroll professionals expect an 88% improvement in process improvements.

Deel Payroll

What are the challenges and risks of outsourcing payroll?

Outsourcing payroll can reduce admin work and improve compliance, but there are risks to payroll outsourcing to keep in mind:

- Data security: Payroll involves sensitive information, and weak providers may expose you to breaches or fines.

- Compliance liability: Employers remain legally responsible for filings and payments, even if the vendor makes mistakes.

- Loss of flexibility: Some providers can’t handle unique pay cycles, global teams, or complex pay structures.

- Hidden costs: Extra fees for filings, garnishments, or multi-country payroll can add up quickly.

- Service quality: Vendors with slow support or reporting gaps can frustrate employees and HR teams.

- Vendor lock-in: Switching payroll providers later can be expensive or disruptive, unless you’re well-prepared.

The right partner can help you avoid these risks. Key factors to check include:

- Robust security – encryption, GDPR/SOC 2 compliance, and regular audits.

- Compliance expertise – proven knowledge of local and international payroll regulations.

- Flexibility – support for multiple pay cycles, currencies, and complex compensation models.

- Transparent pricing – no hidden fees; clear SLAs outlining what’s included.

- Reliable support – dedicated account managers, fast response times, and multilingual help.

- Easy offboarding – standardized, exportable data formats to prevent vendor lock-in.

What are your payroll outsourcing options?

When selecting an outsourced payroll provider, consider your budget, expansion goals, and payroll team’s bandwidth.

| Option | What It Is | Key Features | Best For |

|---|---|---|---|

| Full-Service Payroll Company Example: Deel Payroll | Provides payroll processing and ensures tax compliance. Some also offer global coverage. | Covers wage calculation, taxes, payroll processing, generating pay stubs, and filing tax forms. Saves significant time and effort | Businesses seeking comprehensive payroll and compliance, especially international teams |

| Professional Employer Organization (PEO) Example: Deel PEO | Co-employer that handles payroll, HR, benefits, compliance, and risk management.US only. | Payroll processing, tax reporting, deductions. HR services: benefits, claims, risk management. Negotiates health benefits, provides compliance across states, and includes scalable integrations with existing systems | Businesses of all sizes needing payroll plus HR infrastructure and benefits management |

| Employer of Record (EOR) Example: Deel EOR | Acts as the legal employer for staff in a specific country or region. | Manages payroll, taxes, and benefits. Ensures compliance with local labor laws, with no need to set up local entities. Company keeps day-to-day employee management | Companies hiring globally without opening entities |

| Self-Serve Payroll Software Example: Deel Local Payroll for US, UK, South Africa, Brazil | Software platform to run payroll in-house. Not outsourcing. | Automates calculations, deductions, reporting. Replaces spreadsheets/manual processes, but still requires internal payroll team involvement | Businesses not ready to outsource but want efficiency improvements |

What are the best payroll outsourcing solutions in 2025?

The best payroll outsourcing solution depends on the size and complexity of your business. Here’s what to prioritize in 2025:

For small businesses

Small teams need simplicity and affordability without sacrificing compliance.

Key features to look for:

-

Easy setup and intuitive dashboards

-

Automated tax filings and reporting

-

Bundled HR tools (time tracking, benefits)

For medium-sized businesses

Growing organizations need scalability and integrations as headcount and locations expand.

Key features to look for:

-

Support for multiple pay cycles and locations

-

Seamless integrations with HR, finance, and accounting systems

-

Advanced reporting and workforce insights

Explore: Best Enterprise Payroll Software

See how Deel simplifies payroll outsourcing

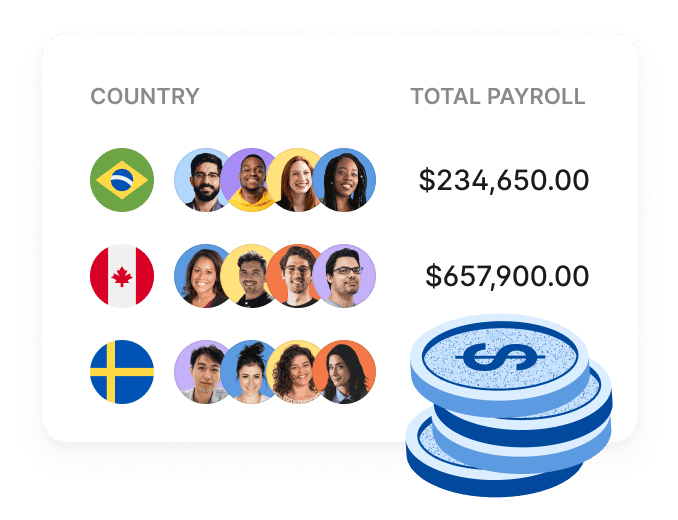

Having an international team increases innovation, creativity, and diversity, but it also complicates payroll management. You have to navigate different currencies, exchange rates, bank laws, and compliance requirements. And as your team grows, so do your payroll needs.

With Deel Payroll, you can manage payroll around the world from one platform, streamline international operations, and eliminate the ongoing admin of local compliance, taxes, benefits, and more.

Deel is an all-in-one payroll and HR platform for global teams. In addition to payroll management, you can use Deel to:

- Hire, pay, and manage independent contractors

- Streamline equipment management with global IT operations

- Manage workforce development, performance, training, and more

- Simplify immigration and visa support with global mobility services

- Offer equity to workers in 110+ countries

Book a demo to see the platform in action and speak with a specialist about your outsourcing options.

FAQs

Can I partially outsource payroll?

Yes, you don’t need to commit to fully outsourcing payroll all at once. Many businesses adopt a hybrid approach, outsourcing specific functions or geographic segments, while keeping other parts in-house or managed by a local provider. Deel offers a purpose-built solution to support this model: Payroll Connect.

Payroll Connect is a feature in Deel’s Global Payroll suite that allows you to consolidate payroll data from multiple providers into one unified view.

How does payroll outsourcing work with benefits?

Payroll and benefits are closely connected, as contributions to health insurance, retirement plans, or other perks must be factored into gross-to-net calculations.

When you outsource payroll, your provider should integrate benefits data directly into each pay cycle so deductions are accurate and compliant. Some vendors offer bundled payroll and benefits administration, but coverage varies by country.

Does outsourcing payroll help with multi-currency/multi-country teams?

Absolutely. One of the biggest advantages of payroll outsourcing is support for international workforces. Managing multiple currencies, tax rules, and local labor laws in-house is time-consuming and risky.

A global payroll provider automates currency conversions, ensures local tax compliance, and consolidates everything into one platform, so you can pay employees and contractors globally without juggling multiple vendors.

Anja Simic is a passionate advocate for remote work and leveling the playing field for diverse talents worldwide. She’s the Director of Content Marketing at Deel. As a content marketing professional, she thrives on shaping impactful narratives through different formats such as long-form content, webinars, and newsletters (to name a few).