Article

21 min read

Is Payroll Outsourcing Right for You in 2025?

Global payroll

Author

Anja Simic

Last Update

May 23, 2025

Key takeaways

- Payroll outsourcing is becoming a standard practice, with 73% of organizations outsourcing their functions in the last year.

- By outsourcing payroll, you minimize the risk of misclassification and fines that can cost hundreds of thousands of dollars.

- Outsourcing payroll can reduce inaccurate data input, which is the top barrier to effective payroll operations.

Navigating the complexities of payroll in 2025 is no small feat, especially as global workforces become the new norm.

Managing international compliance, tax filings, and accurate payroll data input can be a logistical nightmare—leading to costly penalties and inefficiencies if mishandled.

Deel understands these challenges deeply, having supported thousands of businesses worldwide with seamless payroll solutions tailored to their growth ambitions. In this guide, we’ll explore how outsourcing payroll can save your business time, reduce errors, and shield you from compliance risks.

By leveraging Deel’s all-in-one global payroll platform, you gain an integrated, stress-free solution to manage payroll anywhere in the world, all while streamlining operations. Imagine the confidence of knowing your team is paid accurately and compliantly every time—freeing you up to focus on scaling your business.

What is payroll outsourcing?

Payroll outsourcing is the practice of hiring an external service provider to handle the payroll functions for your company. A payroll service provider ensures that:

- All payroll funds are distributed on time and according to your employee agreements

- Payments are made accurately and compliantly with local laws

- Payroll documentation and employee information is safely and securely managed

Payroll service providers only handle making payments to your employees. Some mistakenly believe outsourcing payroll services include HR services that help you hire new people, but HR and payroll outsourcing are different. Human resources can be outsourced to a separate service, and while some companies offer both (like Deel), a payroll company only handles payroll.

How do payroll outsourcing services work?

Payroll processing by a service provider may include the following steps:

- The setup period—providing the chosen payroll company with all the necessary information. You will need to confirm the rate and working hours for each employee

- During the pay period, the payroll provider will need the number of hours worked for every employee so they can enter the data into their software and calculate the wages and salaries. You may need to confirm the information for them

- When the gross pay is calculated, the payroll service will make the pre-tax and post-tax deductions, if applicable. These can include taxes, child support, workers’ compensation, and employee benefits

- When the net pay is calculated, your payroll service provider will make deposits or deliver checks to your workers and make other necessary payments, including taxes during tax season

- As the business owner or payroll manager, you will receive payroll reports for each pay cycle

See the process in action

Hear from Deel’s payroll implementation experts in our webinar: Navigating Global Payroll: Challenges and Solutions with Deel. In this one-hour session, you’ll see:

- See Deel in action: Experience a live demo of Deel's Global Payroll platform, led by our in-house experts

- Implementation and onboarding: Watch as our Director of Payroll Implementation leads you through Deel’s straightforward implementation and onboarding process

- Dedicated customer service: Learn about the level of support our account management and client success teams provide, ensuring you have the assistance you need, when you need it

Top 6 benefits of outsourcing payroll services

Why outsource payroll? Handing some or all of your payroll functions over to a third party can help streamline payroll processes, reduce the risk of non-compliance, and ensure correct tax payments and pay stubs. Let’s take a closer look at the advantages.

Reduced risk of non-compliance

Whether you’re running payroll domestically or internationally, you must ensure you’re operating in compliance with the employee’s payroll laws.

Payroll laws vary by country—and sometimes by state or county. These laws dictate how employees can receive their compensation, when you have to pay them, and their payroll deductions, such as health insurance and social security.

If your payroll or HR team isn't familiar with local labor classification laws, you may be at a greater risk for misclassification. Working with a global payroll provider that has experience with international payroll laws can reduce that risk, which could otherwise lead to fines and penalties that cost hundreds of thousands of dollars.

Keeping up with compliance laws in one region requires a lot of time and expertise. If your company expands internationally, that workload grows. By outsourcing these payroll responsibilities to a service provider with localized specialists, your team will gain peace of mind and reassurance that you comply with international payroll and employment laws.

Continuous Compliance™

Cost savings

Typically, outsourcing payroll services costs less than creating an in-house payroll department. These cost savings are greatest for companies in high-cost-of-living regions, where recruiting, hiring, onboarding, and training an entire payroll department is a significant investment (unless they hire remote workers).

Payroll outsourcing also enables globally dispersed organizations to save money if they use one global payroll provider. Hiring and paying employees in multiple countries requires more payroll administrators and legal advisors.

Using a full-service solution that combines payroll, HR, and more in one platform—like Deel does—will provide even more valuable insights.

Deel provided us with the convenience of being able to pay all our employees in literally one click. Our internal teams finally had something that made their lives easier.

—Tom Benians,

Head of Finance

Better experiences for scaling teams

Processing payroll and maintaining compliance standards is difficult for overwhelmed payroll departments, especially if their organization is growing quickly. This overwhelm can often lead to payroll delays and mistakes.

If your business is growing, you need a payroll provider that can grow with you. By outsourcing payroll tasks, you can ensure your payroll is getting the attention to detail it requires to run smoothly. Your in-house accounting team can instead focus on core tasks to support your team as you grow.

Increased data security

Outsourcing payroll can ensure maximum data security and even prevent fraud, identity theft, and other risks.

If a provider handles payroll data for employees in the European Union (EU), they have to meet General Data Protection Regulation (GDPR) standards. Your provider should also have a data processing agreement (DPA), which outlines how the parties will process and store your data in compliance with the GDPR. This includes appropriate security policies, encryption, physical data protection measures, and risk assessments.

Fewer payroll mistakes

For organizations, inaccurate data is the top barrier to effective payroll operations. A payroll provider's sole responsibility is to ensure payments are made correctly and tax laws are followed. As a result, the chances of making a mistake are lower than with an in-house accounting team.

Payroll errors can negatively impact your workers, disrupting their budgets and lives and causing unnecessary stress. Payroll mistakes and delays can also dilute their trust and positive perception of your organization and lead them to question your financial status and management capabilities.

Sometimes, the consequences of a payroll error are more severe than having an employee complain about a portion of money missing from their paycheck. Inaccurately filed federal payroll taxes may result in penalties and legal issues with local government agencies.

More efficient processes

Most payroll service providers stay up to date with the latest technology because it allows them to take their service to the next level and provide the best for their clients. This includes automation and AI capabilities, which allow payroll professionals to focus on optimizing your payroll system, ultimately making it more efficient and reducing human error.

To further increase payroll efficiency, look for a centralized payroll provider, such as Deel.

Deel AI

What are your payroll outsourcing options?

When selecting an outsourced payroll provider, consider your budget, expansion goals, and payroll team’s bandwidth.

Full-service payroll company

Full-service payroll companies have broad experience with running payroll and ensuring tax compliance for businesses. If you’re hiring internationally, look for a global payroll provider like Deel that can take on the responsibility of navigating unfamiliar payroll laws and best practices for you.

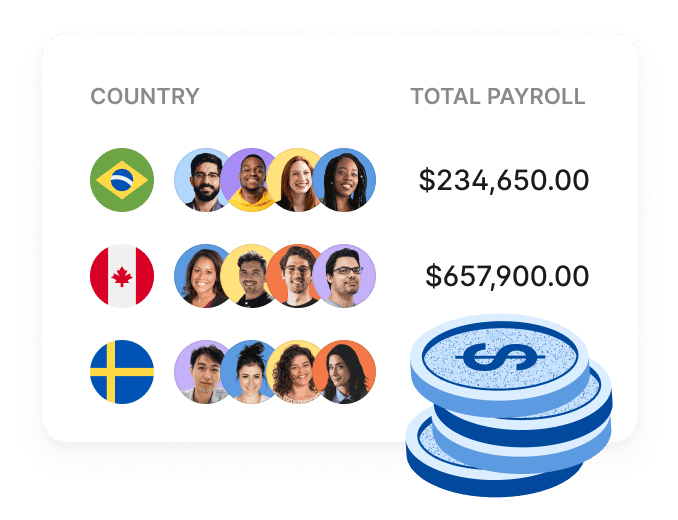

Deel Global Payroll is a fully-managed payroll service that features:

- Centralized payroll process for domestic and international entities

- In-house infrastructure and owned entities, with coverage across 100+ countries

- 350 in-house payroll managers and 200 legal experts

- Flexible payroll funding options

- 68+ integrations, API, and Payroll Connect to unify your payroll and HR data

- Global payroll reporting for holistic workforce insights

- 24/7 customer support, dedicated customer success managers, and a 42 seconds response time

Free download: A Buyer's Guide to Global Payroll for Enterprises

Platform Tour

Professional employer organization (PEO)

Engaging a professional employer organization (PEO) will also provide you with HR services such as benefits, compliance, and risk management in addition to handling payroll processing, deductions, and tax reporting tasks. PEOs are suitable to businesses of all sizes as they have the flexibility and expertise to handle the different legal jurisdictions and tax laws.

A PEO service may come with a higher price tag than basic payroll outsourcing options. However, this cost reflects the wide-ranging HR services it offers. While a standard payroll service just handles paychecks and taxes, a PEO also negotiates favorable rates on health benefits, handles claims processing, and manages many additional HR tasks that can consume significant time and resources.

Look for a PEO with international experience and robust integrations with your existing software. This scalability eliminates the need for additional investments in HR infrastructure, enabling your team to focus on your core business operations.

See also: Should You Use a PEO vs Payroll Provider? Benefits, Limitations, and Alternatives

Deel PEO

Employer of record (EOR)

An employer of record is a service provider that acts as the legal employer for your employees in a specific country or region.

While your company manages the employees' day-to-day work and responsibilities, the EOR handles administrative and compliance-related tasks like payroll, taxes, benefits administration, and adhering to local labor laws. This arrangement allows businesses to hire talent globally without needing to establish a legal entity in each location.

Payroll software

Using payroll software isn’t typically considered outsourcing since it still requires work from your team. But if your team is currently using spreadsheets to manually manage payroll, investing in payroll software is a good first step to improving your processes.

Deel US Payroll

Contractor accountant

Small businesses may benefit from working with a contractor as it’s less costly. If you choose this option, ensure your contract with the accountant is clear to avoid potential employee misclassification issues.

How Deel helps SafetyWing’s Finance team save $10k annually

SafetyWing is a health insurance provider for remote workers and teams.

Before partnering with Deel, they faced many challenges paying workers across borders, as it had to be done manually without a centralized system. Their processes took a lot of time, and they lacked a network of experts to help them navigate international compliance.

“What made Deel stand out for SafetyWing was the extreme focus on the customer and how friendly and easy [it is] to use the platform. Definitely the best I have seen in this category,” said Karl Schroeder, Head of Finance at SafetyWing.

Thanks to Deel, the HR and Finance teams from SafetyWing have saved more than 30 hours a month on admin and $10,000 USD yearly.

Simplify global payroll with Deel

Having an international team increases innovation, creativity, and diversity—but it also complicates payroll management. You have to navigate different currencies, exchange rates, bank laws, and compliance requirements. And as your team grows, so do your payroll needs.

With Deel Global Payroll, you can manage payroll around the world from one platform, streamline international operations, and eliminate the ongoing admin of local compliance, taxes, benefits, and more.

Deel is an all-in-one payroll and HR platform for global teams. In addition to payroll management, you can use Deel to:

- Hire, pay, and manage independent contractors

- Streamline equipment management with global IT operations

- Manage workforce development, performance, training, and more

- Simplify immigration and visa support with global mobility services

- Offer equity to workers in 110+ countries

Book a demo to see the platform in action and speak with a specialist about your outsourcing options.

FAQs

How do choose a payroll outsourcing company?

It’s vital to complete tax-related tasks accurately and make payments on time, whether to the state or your employees. That’s why the first thing you should consider when hiring a payroll outsourcing provider is establishing trust.

- Costs and fees: A payroll outsourcing company should always present its offer and costs transparently. Any hidden costs may lead to you ending your business relationship, so thoroughly vet your options before you engage them

- Compatibility: Determine if the payroll provider is compatible with how your company handles payroll. They may not be a good fit for your business if you’re uncomfortable with their processes or values

- Support: Ask how the payroll company will help you manage garnishments, sick leave, benefits administration, and other factors

- Self-service: Check if the company offers specific self-service employee payroll options, which can help you manage a large workforce. For example, having employees sign in to a program and upload their tax forms can be a great time-saver

- Reporting: Ask the payroll company what reports they provide—for example, if they provide fiscal year-end reporting. You’ll want to track your payroll system’s efficiency and check if everything is going according to the plan

When should you keep payroll in-house?

This may be a critical question for CEOs and other decision-makers. Should you outsource payroll services? How do you know it’s the right thing to do?

Consider the following:

- How many employees do you have?

- Do you have any foreign employees or contractors?

- Do you have the means to purchase payroll or accounting software and its integrations?

- Can you provide the necessary training for your employees or hire new ones to manage payroll?

- Do your employees work different hours every week/month?

Generally, outsourcing payroll can be a time-saving and cost-effective solution if you:

- Have several employees whose working hours vary every week

- Can’t justify the expense of buying payroll software to use in-house

- Often hire foreign contractors

Can my employees use payroll software, too?

Yes, they can, and it’s one of the biggest benefits of outsourcing your payroll to a payroll service provider. Plenty of payroll processing programs allow self-service, which can significantly impact employee satisfaction, as employees can make time-off requests or obtain personal payroll information more freely and flexibly.

How much does it cost to outsource payroll?

Payroll outsourcing costs will vary depending on the complexity of your payroll transformation project, as well as your workforce’s size. See Deel’s pricing for global payroll, PEO, and other services for more information.

About the author

Anja Simic is a passionate advocate for remote work and leveling the playing field for diverse talents worldwide. She’s the Director of Content Marketing at Deel. As a content marketing professional, she thrives on shaping impactful narratives through different formats such as long-form content, webinars, and newsletters (to name a few).