Article

16 min read

The Ultimate Guide to Recruitment Metrics: What and How to Track Them

Global HR

Author

Lorelei Trisca

Last Update

September 02, 2025

Table of Contents

What are recruitment metrics?

The most important recruitment metrics to track for hiring success

Four reasons why every HR team should track recruitment metrics

Best practices for tracking and analyzing recruitment metrics

How to optimize your recruitment strategy with data

Global hiring made easier with Deel

Key takeaways

- Limitless recruitment data exists, but focusing on a handful of essential metrics is enough to drive your hiring strategy without information overload. Time to hire or fill, quality of hire, and cost per hire are some of the most important numbers to consider.

- Alongside tracking recruitment metrics, HR teams can also implement best practices such as regular reviews to inform their decision-making and create the most efficient processes.

- An applicant tracking system (ATS) is one of the easiest ways to collect and analyze data from a central location.

If your current hiring processes aren’t producing the caliber of candidate you’re looking for, then tracking certain recruitment metrics could turn this situation around. After all, you can’t improve what you don’t measure.

This guide explores a range of essential recruitment metrics, including why they’re important, how to track them, and some best practices to improve the efficiency and quality of your hiring process.

What are recruitment metrics?

Recruitment metrics are data points that hiring teams may use to measure the effectiveness of their hiring process. Tracking different aspects of the recruitment life cycle with precision allows organizations to hire faster and better while improving the candidate experience.

The most important recruitment metrics to track for hiring success

It’s easy to get carried away with tracking a wide range of metrics and then struggle to make sense of the information. Avoid data overwhelm by focusing on the following essential recruitment metrics:

Time to hire and time to fill

Although time to hire and time to fill are two terms often used interchangeably, they represent different aspects of the recruitment process. It’s important to understand these terms and how they impact your hiring strategy.

- Time to hire measures the time from when a candidate applies or is sourced to when they accept the offer.

- Time to fill measures the time between when a job opening occurs and when the position is filled by a candidate.

Recent data from Ashby’s 2025 Talent Trends Report reveals key insights into how time to hire and time to fill metrics are evolving:

75% of all open roles are filled in 60 days or less. Typically, companies fill business roles in ~50 days. In comparison, technical roles take slightly longer at ~60 days due to the complexity of sourcing candidates with specialized skills.

Meanwhile, time to hire has remained stable across various job functions. However, recruiters interview 40% more candidates per hire now than in 2021, which indicates that teams spend more time assessing each applicant before making an offer. This uptick in interview volume further impacts the overall speed of the hiring process.

Cost per hire

Cost per hire measures the total cost involved in hiring a new employee beyond the cost of their salary and benefits. This metric provides valuable insights into the financial efficiency of the talent acquisition process so HR teams and organizations can better manage their hiring budgets and allocate resources accordingly.

Recruiters can use this calculation formula: Cost per hire = Total recruitment costs divided by the number of hires

The total figure involves a wide range of recruitment costs, including:

Internal costs

- The cost of HR personnel involved in the recruitment process (e.g., recruiters, interviewers, HR managers)

- Expenses for tools such as applicant tracking systems (ATS), candidate relationship management software (CRM), and recruiting software for tasks like sourcing or skills testing

- Time and resources spent on training HR staff to optimize the recruitment process

- Costs related to scheduling interviews, phone screenings, and other candidate outreach

External costs

- Fees for placing job ads on job boards, social media platforms, or specialized recruitment sites

- Payments to external agencies for sourcing candidates or providing headhunting services

- Costs related to background checks, reference checks, and other screening processes

- Expenses for candidate travel, accommodations, and relocation.

Onboarding costs

- Tools and platforms used for managing the new hire’s onboarding process (e.g., document signing, training modules).

- Time and resources spent on integrating the new hire into the company culture and providing role-specific training.

According to the Society for Human Resources Management, the average cost per hire in the United States is approximately $4,700. However, this figure can vary widely depending on factors such as role complexity, industry, and geographic location. For this reason, SHRM’s chair-elect Edie Goldberg reports that the actual cost could be three or four times the employee’s annual salary in specialized or senior roles.

Example: If a new hire’s annual salary is $50,000, the total cost per hire could potentially be as high as $150,000-$200,000.

Quality of hire

Quality of hire looks beyond the recruiting funnel; it examines the success of a new hire once they’re onboarded into the role and are actively contributing to the organization’s long-term success. Essentially, this metric checks that your candidate picks thrive in the job you’ve hired them for. Quality of hire is also important for:

- Saving costs: When organizations have confidence in the caliber of their employees, they allocate fewer resources to rehiring and training new employees.

- Enhancing team performance: Higher-quality hires tend to be more productive and know how to work effectively with their peers to achieve exceptional results.

- Improving recruitment strategies: If the quality is low, you likely need to refine your sourcing, screening, or interviewing methods and learn how to pinpoint the talent your company actually needs. For example, your job descriptions may not align accurately with the role or entice top-tier talent effectively.

Capturing the quality of hire metric takes time, as it’s not something you can calculate accurately on the first day or even the first month. The following methods may be useful:

- Performance reviews: Regular feedback from managers and colleagues provides valuable insights into the employee’s impact.

- Retention rates: A high new hire retention rate indicates the company is hiring capable individuals who fit well with the culture and perform effectively.

- Probation period reviews: Assessing performance during probation provides early feedback on whether the new hire is on track to succeed in the long term.

Learn more about how to conduct probation period reviews in our detailed guide. We also offer a free probation review template to kickstart your process.

Candidate experience score

How people feel treated during the hiring process can often speak volumes about what it’s like to work at your company. Every job seeker who goes through your company’s hiring process, whether sending in an initial application form or progressing through to the job offer stage, has an overall perception known as candidate experience. So, this metric plays a huge role in shaping your employer brand and directly influences whether top talent chooses your organization over a competitor.

Gallup research reveals a clear link between candidates who accept a job offer from a company and reporting positive candidate experience scores. Two out of three people hired within the past year say the experience was either “exceptional” (27%) or “very good” (39%.)

The following methods can gauge overall satisfaction:

- Net Promoter Score (NPS): This metric gauges how likely candidates are to recommend your hiring process to others. High NPS scores indicate a positive experience, while low scores suggest room for improvement.

- Third-party review sites: Check out platforms like Glassdoor, Blind, or Ghostedd to learn more about candidates’ experiences when applying for a role at your company.

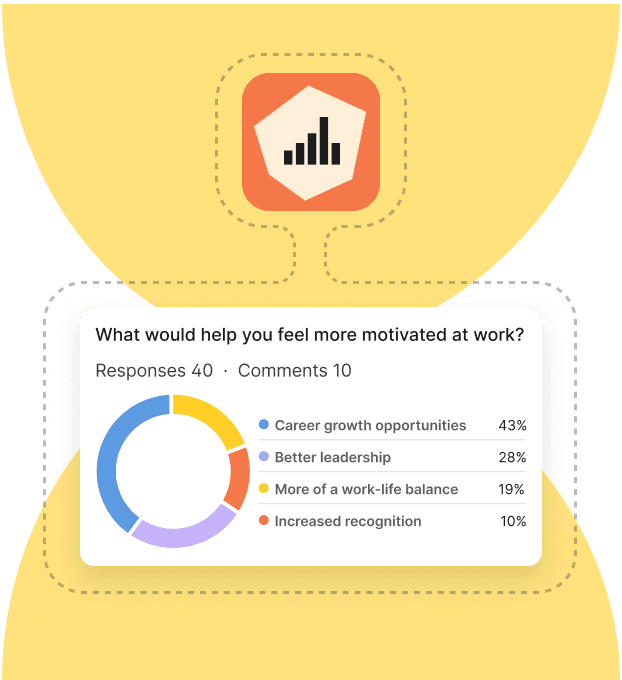

- Surveys: After the interview process, use anonymous surveys to gain candidate feedback on their experience. This step can pinpoint areas where your process may be too lengthy, impersonal, or unclear.

Complementary resource

Use our list of candidate experience survey questions, complete with best practices, to design the perfect feedback collection process.

Surveys

Offer acceptance rate

Recruiters can be disheartened to reach the end of their hiring process and extend an offer, only for the candidate to reject them. The truth is that many employers forget that candidates are evaluating them throughout the entire process. Jobseekers are adept at picking up on red flags, bad vibes, and hints that the realities of the actual role may not align with the shiny description in the job ad.

Offer acceptance is a straightforward metric to capture. This formula may be useful, particularly in high-volume hiring scenarios:

Offer acceptance rate = Number of offers extended divided by Number of offers accepted x 100

The great news for employers is candidates are now slightly more likely to accept job offers—(84%)—than they were in 2021 (81%).

Sourcing channel effectiveness

Relying on traditional sourcing channels for every hire might flood your pipeline with a large volume of applications. It can also lead to inefficiencies in converting those applications into actual hires. For example, Gem’s research finds that job boards and social sites account for nearly 49% of all applications but contribute to only 24.6% of actual hires. This indicates that while these channels generate plenty of interest, they might not always provide the best-fit candidates for your roles.

Tracking sourcing channel effectiveness lets you identify which recruitment sources and job boards deliver high-quality candidates for your hiring funnel. By evaluating this data, organizations can:

- Optimize spending across channels: Understanding which channels produce the highest-quality candidates enables you to allocate your recruitment budget better. Suppose job boards attract many applications, but many are unsuitable for the role. In that case, focusing on high-performing channels like employee referrals or targeted social media campaigns may be more strategic.

- Eliminate ineffective channels: Eliminate or deprioritize channels that consistently lead to a low conversion rate or fewer qualified candidates, ensuring resources target more effective platforms.

- Improve candidate quality: By analyzing the success rate of candidates from different sources (e.g., job boards, referrals, social media, etc.), companies can learn where the best-fit candidates come from and refine their sourcing strategy accordingly.

The best way to monitor sourcing channel effectiveness is to use an applicant tracking system with built-in tools to track where applicants are coming from and how many candidates from each source make it to later stages of the hiring process, such as interview rounds or job offers.

Learn more

Check out our recruitment strategies examples guide to explore 10 ways recruiters can attract top talent.

Four reasons why every HR team should track recruitment metrics

Collecting data on every aspect of your recruitment process can feel overwhelming, but it’s vital for HR teams to shine a light on which areas are working and which need more attention. Here are the specific benefits for HR teams:

1. Measuring efficiency

The right mix of metrics reveals how long it takes to fill roles and where things might be slowing down. You’ll spot bottlenecks, allowing you to adjust your process and ultimately get top talent in the door faster.

2. Controlling costs

Keeping track of how much you spend at each stage of the recruitment process allows you to optimize your budget. If certain channels or processes eat up resources without delivering quality candidates, you can make adjustments. For example, do you really need to waste internal resources on those fourth and fifth-round interviews, or could you condense the process and make it more cost-effective and efficient?

3. Improving candidate quality

Measuring quality of hire and retention rates enables you to assess whether your hires thrive in their roles and how long they’re likely to remain there before departing voluntarily or otherwise.

4. Uncovering bias

Data-driven insights can identify patterns that might indicate unconscious bias. For example, you may notice that minority candidates are less likely to progress beyond the application stage or that you have a higher proportion of white male applicants receiving job offers than any other group. This would be your signal to dig deep and design a fairer and more inclusive hiring process.

Best practices for tracking and analyzing recruitment metrics

While each recruitment metric is best suited to a specific collection method, there are some best practices to bear in mind:

Using an ATS or HR analytics platform

An applicant tracking system or analytics platform takes the legwork out of your metrics collection and analysis. Instead of manually tracking and storing the data in spreadsheets, an ATS automatically gathers, organizes, and analyzes the recruitment data for you. This streamlined approach to data allows HR teams to save time and focus on strategic decision-making instead of getting bogged down by administrative tasks.

Another core benefit of using an ATS is the ability to monitor key recruitment metrics in real-time. The platform will capture your time-to-hire, cost-per-hire, and source of hire data, then present and update it in one centralized location.

Creating a recruitment dashboard

A recruitment dashboard displays your key metrics in one place. It gives HR teams a quick, comprehensive view of how the hiring process is performing. Use the following tips to create an effective board:

- Keep it focused: Limit the dashboard to key performance indicators (KPIs) that matter most to your recruitment goals—this ensures it stays actionable and avoids overwhelming the user.

- Make it visual: Use charts, graphs, and other visual aids to make the data easy to interpret at a glance. Clear presentation allows HR teams to quickly identify trends and issues.

- Update regularly: Ideally, your dashboard will update in real-time, so you’re always working with the most current data.

Benchmarking against industry standards

Your company’s recruitment performance doesn’t happen in a vacuum. To attract the best talent, it’s crucial to benchmark your metrics against industry standards. By comparing key metrics like time-to-hire, cost-per-hire, and quality of hire with your competitors, you can identify areas for improvement.

To benchmark effectively, gather data from industry reports or HR associations and compare your results. For example, Deel’s 2025 Global Hiring Report highlights trends like the 104% increase in domestic hiring, which can provide insights into shifting industry priorities and help you adjust your strategy accordingly so you remain competitive in the talent marketplace.

How to optimize your recruitment strategy with data

We might think of data as being the result or output of a hiring process, but it actually feeds into the recruitment process, too. Companies can shape their hiring processes by doing the following:

Setting hiring goals based on metrics

Establishing clear goals grounded in data helps you focus on what truly matters. Whether it’s reducing time-to-hire by a certain number of days or weeks or improving applications from candidates from underrepresented minority groups, these goals guide the team toward measurable outcomes.

Improving decision-making with predictive analytics

In 2025, companies are increasingly using artificial intelligence to predict who may excel. LinkedIn reports that 61% of talent acquisition professionals believe AI’s predictive analytics features can improve how they measure quality of hire.

Watch the webinar

Learn more about how to master AI tools to elevate your recruitment practices.

Reducing hiring costs without losing quality

Companies can use the data to make measurable improvements to the hiring process, with the overarching goal of developing a strong talent pipeline. For example, one cost-effective way to do this is to build and maintain a talent pool. This will be filled with highly skilled and pre-vetted candidates, often people who have previously expressed an interest in working for you. From here, you can reach out periodically with company updates and relevant job postings to sustain the connection.

Understanding how to interpret recruitment metrics

Data can mean different things depending on how you look at it. But misreading your metrics can lead to misguided decisions, making it important to avoid these common pitfalls:

- Overemphasizing one metric: Focusing too much on a single metric, like time-to-hire, can overlook other important factors like candidate quality, leading to imbalanced decisions.

- Ignoring context: Metrics should be interpreted as part of the bigger picture. For example, a longer time-to-hire rate could indicate a thorough screening process and not necessarily inefficiency.

- Failing to connect data to outcomes: Metrics without a clear connection to hiring results, such as performance or retention, won’t provide actionable insights. It’s important to track how your metrics impact long-term success.

Global hiring made easier with Deel

As businesses expand their talent pools and tap into new markets, Deel makes global hiring simpler and more efficient. Here’s how Deel supports companies in managing a global workforce:

- Hire talent anywhere in the world without needing to establish offices in new locations or navigate complex local regulations

- Streamline onboarding and payroll with an all-in-one platform, ensuring smooth processes from start to finish

- Ensure compliance with global laws and regulations, eliminating the complexities of managing international teams

- Leverage powerful data analytics to make data-driven decisions, optimize hiring strategies, and monitor payroll performance across borders

- Access HRIS features built directly into the Deel platform and manage all worker types in a streamlined platform

Ready to learn how Deel effortlessly helps companies manage a global workforce? Book a free platform demo today.

Deel's infrastructure handles 90% of the heavy lifting for us. Whether we’re hiring contractors, expanding with EOR, or paying employees, Deel saves us time, money, and resources.

—Stephen Epling,

Vice President of Global Rewards and Workplace, Outreach

FAQs

How do recruitment metrics vary by industry?

Recruitment metrics differ across industries, both in terms of the data employers want to track and the output itself. For example:

- Technology: Hiring in tech is highly competitive, with a focus on speed and efficiency. Metrics like time-to-hire and cost-per-hire are critical.

- Retail: With high turnover rates, retail companies often prioritize metrics like retention and employee satisfaction to ensure long-term success.

- Healthcare: Quality of hire is key in healthcare, as hiring the right candidates can have a significant impact on patient care and outcomes.

- Manufacturing: In manufacturing, time-to-fill, and cost-per-hire are often top priorities due to the industry’s productivity pressures.

How do you track passive vs. active candidate success rates?

Passive and active candidates engage with the hiring process differently, which will shape how you track their journeys.

- Active candidates respond quickly to job postings and move faster through the hiring pipeline. They typically have a shorter time-to-hire and higher conversion rates.

- Passive candidates are not actively job-hunting but are open to opportunities. They require longer engagement and outreach, often resulting in a slower process but potentially higher retention and performance over time.

An ATS can categorize your candidates, enabling you to monitor relevant time-to-hire and quality-of-hire rates for each group. From here, you can further refine your strategies for sourcing and engaging both active and passive talent.

How can recruitment metrics impact DEI initiatives?

There are clear business cases for blending DEI initiatives with your hiring processes. For one, data from McKinsey reveals that top-quartile companies for diversity have a 39% greater likelihood of financial outperformance versus their bottom-quartile peers.

By collecting the right recruitment metrics, companies can drive effective DEI initiatives by:

- Identifying gaps: Metrics like candidate diversity (race, gender, etc.) pinpoint underrepresented groups in the hiring process.

- Setting targets: Data enables companies to set measurable diversity goals and track progress.

- Improving practices: Analyzing metrics eliminates biases in sourcing, screening, and selection, leading to more inclusive hiring.

Lorelei Trisca is a content marketing manager passionate about everything AI and the future of work. She is always on the hunt for the latest HR trends, fresh statistics, and academic and real-life best practices. She aims to spread the word about creating better employee experiences and helping others grow in their careers.