Article

16 min read

How to Choose a Global Payroll Provider

Global payroll

Author

Shannon Ongaro

Last Update

August 20, 2025

Table of Contents

What are the top global payroll providers?

1. Assess country coverage and infrastructure ownership

2. Determine their service scope

3. Test their platform and customer support

4. Review their worker and payment options

5. Look into real-time global reporting features

6. See how scalable they are

7. Review their data security and privacy standards

8. Get information on their implementation process

9. Review their ratings and recommendations

10. Look into their integration capabilities

11. Submit a request for proposal (RFP)

Simplify global payroll with Deel

Key takeaways

- Choose a global payroll provider with high-quality customer support. If you’re a small team or a new business, you want experts you can turn to anytime.

- Check that your global payroll provider can manage payroll processing for different types of workers and assist with classification.

- Deel is an all-in-one payroll and HR platform for global teams. You can use Deel to centralize international payments, workforce management, benefits, immigration, and more.

Expanding your business globally can open doors to incredible opportunities, but navigating international payroll can quickly feel overwhelming.

Managing diverse tax regulations, compliance laws, and currencies can delay payments and create logistical headaches for growing companies.

Deel, with its proven expertise as a top-rated global payroll provider, understands these challenges better than anyone. With in-house payroll experts, local compliance teams, and streamlined solutions, Deel redefines what’s possible for handling international payroll.

In this article, we’ll explore how to choose a global payroll provider, what features to prioritize, and how Deel’s innovative platform outshines its competitors. If your company is ready to simplify payroll and focus on growth, this guide has the insights you need to get started.

What are the top global payroll providers?

Companies have many options for payroll solutions. Here’s a quick look at how Deel’s payroll solutions compare to similar products and services.

| Feature | Deel | Others |

|---|---|---|

| Payroll variance: We help you identify, provide context, and communicate reasons for pay changes every month | Yes | No |

| 15+ payment and withdrawal methods, including PayPal, Payoneer, Wise, Coinbase, a global debit card, and more | Yes | No |

| 24/7 multi-channel support: phone, video call, web chat, email, WhatsApp, WeChat, Slack, and Teams | Yes | No |

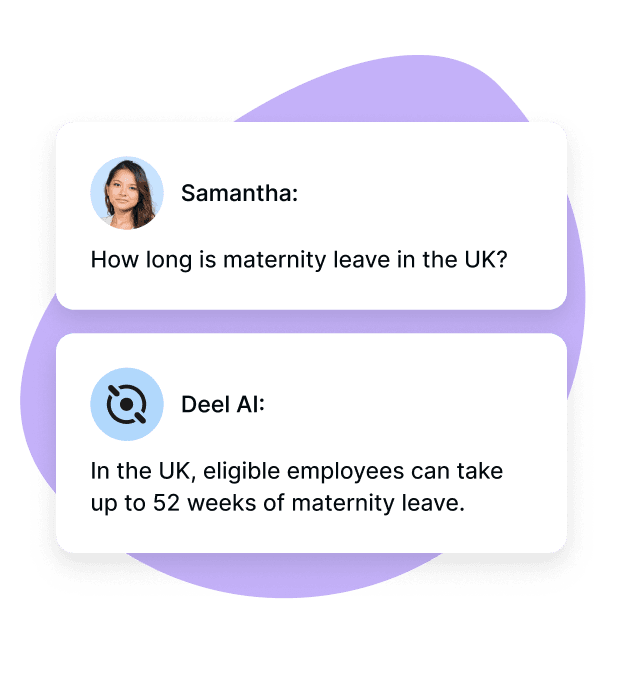

| AI assistant for instant global HR and compliance insights in 100+ countries, in-app and integrated into Slack | Yes | No |

| Owns a network of entities in 150+ countries | Yes | No |

| 50+ payroll engines owned | Yes | No |

| In-house operated payroll and professionals in every country in which they provide services to ensure direct support and maintain uniform standards | Yes | No |

| Payroll cutoff date is 20th of the month | Yes | No |

To learn more about how Deel compares to these companies and other payroll and HR software, including Rippling, ADP, and more see: How is Deel different from other providers?

1. Assess country coverage and infrastructure ownership

Finding a new payroll provider whenever you hire in a new region takes valuable time and resources—instead, partner with an international payroll provider that offers multi-country payroll coverage and doesn’t outsource to third parties.

Document the following information before you start your search:

- Where current employees and contractors reside

- Where you want to hire workers in the next 6-12 months

- Where you may hire workers in the next five years

- Where you don’t want to hire workers from

- Whether they have owned infrastructure and payroll engines

You should not only be country-specific, but jurisdiction-specific, as some regions have different labor, tax, and employment laws for each state or province.

Review the information with potential payroll providers to ensure you’ll get the coverage you need in the short and long term. Ask them about their expansion plans, too—a good international payroll service will consistently expand their operations to handle a new country’s payroll.

2. Determine their service scope

You can save time and money (especially if you’re a small business or start-up) by bundling your payroll services with other HR solutions.

Sticking with a basic international payroll solution makes sense if:

- You’re only outsourcing basic payroll tasks

- You have a limited budget

- You have a well-functioning HR team but no payroll specialist

However, if you need help with the following, you’ll benefit from full-service payroll and HR solutions:

- Benefits administration

- International hiring (but don’t want to set up a foreign subsidiary)

- Employee and contractor onboarding and offboarding

- Human resources support and general workforce management

- Management tools such as time tracking, time and attendance monitoring, and equipment provisioning

- Compliance monitoring and support to ensure correct worker classification and stay ahead of regulatory changes

As an all-in-one payroll and HR platform for global teams, Deel features everything a growing company needs to scale compliantly, including:

- US payroll and PEO services for your US workforce

- Immigration and visa support to enhance global mobility

- EOR and contractor management solutions

- Global IT services for equipment, software, and hardware

- Built-in HRIS features and performance management tools

- And more

3. Test their platform and customer support

Your team will interact with your provider’s system, so it must be user-friendly—especially if you plan to onboard new hires in large numbers. A bad user experience will become a frustrating, time-consuming experience for your full-time employees and contractors.

A great user experience takes more than technical features. High-quality customer service and support will make the payroll experience more enjoyable and efficient. Ask yourself the following questions when comparing global payroll companies:

- Does the system have a self-service portal that enables workers to withdraw funds in different ways, add expenses, and view transactions?

- Can employees easily upload tax forms, banking information, and other documents?

- Can you sign documents electronically?

- Does the payroll software feel intuitive to use?

- Does the software offer clear, detailed paycheck confirmations and invoice automation?

- Does the service include a team of in-house experts who can answer questions about compensation, benefits, and international hiring costs?

- Can you access customer support 24/7 via a chatbot, a direct email address, or a phone number?

- Does the payroll integrate with your other tools, like human capital management (HCM) and human resources information software (HRIS)?

- Does the service provide helpful online resources like blogs, guides, or video tutorials?

Platform Tour

4. Review their worker and payment options

Not all platforms can help you pay foreign contractors. Some providers have limitations based on the contractor and company locations since countries have different definitions and payment requirements for independent contractors.

Check that your international payroll software can also process payments for contractors and assist with worker classification and compliance. Due to the complexity, many companies outsource these tasks to a multinational payment system. Without a payroll expert to guide you, you can’t be sure you’re complying with the contractor’s local payroll and labor laws.

With Deel, you can manage direct employee payroll with Deel Payroll or US Payroll, as well as contractor payments, EOR employees, and PEO employees.

5. Look into real-time global reporting features

A great global payroll partner will enable you to produce real-time payroll reports that tell you where your money is going and when. See how they use AI in their HR and payroll systems, as it can help you gain easy access to vital information and data. This function is vital to stay prepared for a potential audit.

Your provider should also offer an easy-to-use dashboard that gives you payroll data at a glance. At a minimum, you should be able to filter your data by employee, date, and location.

Make a list of the quarterly, annual, and ad-hoc reports and data sets your team will need and compare them against the provider’s reporting functions. Here are a few ideas to get you started:

- Fiscal year-end reports

- Year-to-date reports

- Tax collections

- Tax filings

- Wages paid

- Hours worked

- Overtime paid

- Bonuses paid

- Pension costs

- Social security contributions

- Reimbursements paid

- PTO tracking

Deel provides global gross-to-net reports so you can see your payroll costs for your entire workforce in one place. You can filter down by entity, worker type, and more, and see costs in a unified currency for even more clarity and customization.

Deel AI

6. See how scalable they are

If you don’t pick a global payroll provider that can scale with your business, you’ll have to go through the provider search again in a few years. You’ll also have to transfer your employee data and retrain your team on new processes and systems.

The right global payroll service will make growing your global company easier, not harder. Having a long-term payroll provider also helps you maintain a positive employee experience and reduces disruptions to your workflow. Here’s how to identify a scalable global payroll provider:

- They regularly add new features and services

- They consistently update their security protections

- They don’t limit the number of remote employees or international contractors you can have on the payroll system

- They’re expanding their operations to new regions

- They offer a variety of payment methods for payees

- They offer mass-payment options

- They offer easy integrations with your favorite HR tools

7. Review their data security and privacy standards

Your international payroll provider will need access to sensitive employee data, including names, contact details, banking details, and tax information (Social Security Numbers and Tax Identification Numbers). Only work with providers who offer top-shelf payroll security.

Your provider should have a data processing agreement (DPA) to protect your worker’s data and information. A DPA ensures the provider handles data correctly and follows GDPR guidelines to prevent potential data breaches and abuse. These protections also guarantee secure data processing and legally protect your company if the provider mishandles data.

Ask these questions to understand a provider’s security measures:

- Where can I review your publicly available privacy policy

- How are passwords stored?

- Is your software cloud-based with automatic updates, data recovery, and backup?

- Do you require two-factor authentication and single sign-on authentication (SSO)?

- How is your customer data encrypted?

- What is your data retention policy?

- What is your procedure for granting users access to sensitive information?

- What is your process if a breach of information or unauthorized access occurs?

8. Get information on their implementation process

Understanding a payroll provider’s implementation process will clarify your team’s role within it. Ask your potential provider which of your team members needs to be involved in the process and what their time commitment will be so your team can plan accordingly.

You’ll also want to know how long it will take to implement the service and how quickly you can start to run payroll. Ask for a sample timeline to give your team a general idea of the process.

This is also your opportunity to learn more about their payroll transformation process and ensure information security. Ask the provider how they add new countries and employees to the system, whether they outsource any part of the implementation to a third party, and the documentation they provide during the process.

Watch: Navigating Global Payroll: Challenges and Solutions with Deel

Curious about Deel’s payroll implementation and onboarding methods? In this webinar, you’ll hear from Deel’s team of experts as they walk you through our multi-country payroll process:

- See Deel in action: Experience a live demo of Deel Payroll, led by our in-house experts

- Implementation and onboarding: Watch as our Director of Payroll Implementation leads you through Deel’s straightforward implementation and onboarding process

- Dedicated support: Learn about the level of support our account management and client success teams provide, ensuring you have the assistance you need, when you need it

9. Review their ratings and recommendations

Do as much research as you need during the sales process. Read customer reviews to see what others say and check multiple sources to get a wide range of feedback. We recommend websites like G2 and TrustPilot for global HR solutions or Capterra for Canadian businesses.

Deel continues to be one of the top-ranked international payroll providers, with a 4.8/5 rating on G2 and 4.8/5 rating on TrustPilot.

How Change.org used Deel to elevate their global payroll

Distributed across more than 25+ countries, Change.org is the world’s largest tech platform driving people-powered social change.

Change.org initially worked with a legacy payroll provider but encountered several hurdles, including a lack of automation, slow support, and clunky user experience. So, they turned to Deel.

“Other providers are stuck in the past in the way their platforms are built and the way their customer service works. We wanted the elevated experience Deel provides, and we don’t think we can get that elsewhere.” — Allie Shulman, Director of People Operations, Change.org

Since using Deel’s Global Payroll, Change.org has saved more than 300 hours on admin each month. They’ve also taken advantage of all the services Deel offers, including using EOR to retain employees needing visa sponsorship.

Reach out to your network of business owners and HR professionals for recommendations. If you have an extensive network, share a post asking for recommendations on LinkedIn. If you don’t have an extensive professional network, post your message on a related message board on Facebook or Reddit. Most providers offer a free 30-day trial.

Or, at a minimum, they’ll walk you through their offer with a free demo. The provider will need basic information before you can book a trial or demo, like your business name, location, number of employees, and the services you need.

10. Look into their integration capabilities

When selecting a global payroll service, teams should prioritize integration capabilities to ensure seamless connectivity with their existing HR, finance, and workforce management systems.

A payroll solution that integrates with platforms like Workday, BambooHR, and NetSuite can significantly streamline operations by eliminating manual data entry, reducing errors, and enhancing efficiency.

Integration ensures that payroll data flows smoothly across systems, enabling real-time reporting and compliance while saving valuable time for HR and finance teams. By considering integration capabilities upfront, companies can build a cohesive tech stack that supports scalable, efficient global workforce management.

With Deel, you can sync payroll data across systems using Deel Payroll Connect, 68+ integrations, or our customizable API.

11. Submit a request for proposal (RFP)

A request for proposal (RFP) is a document companies send to potential vendors to learn more about their services. Companies can send RFPs to multiple vendors and use the information they gather to make an informed purchasing decision.

In this scenario, you can use an RFP to invite potential international payroll companies to provide information on their company, services, security, implementation process, and more.

Free template: Global Payroll RFP

We’ve created a straightforward global payroll request for proposal (RFP) template you can send out to potential payroll providers. The template is a Google Drive file, so it’s easy to customize and share. This template includes:

- Company goals and project objectives

- Product evaluation

- Implementation review

- Support assessment

- And more

Simplify global payroll with Deel

Making global payments shouldn’t be a challenge. With Deel Payroll, you can fund payroll with just a click and automatically calculate taxes without lifting a finger, so your team gets paid on time every time—but Deel is more than just a payroll platform.

Whether you want to hire employees directly, make contractor payments, or use employer of record services to tap into international talent pools, Deel is an all-in-one payroll and HR platform for global teams.

Sound like something your business could use? Learn more about global payroll or book a demo to see Deel in action.

FAQs

What are the benefits of outsourcing global payroll?

Outsourcing global payroll benefits your HR team and any worker you pay through the system. It’s more cost-effective than hiring and retaining an in-house department for international payroll processing and minimizes the risk of payroll errors. Most global payroll companies have in-country experts to guarantee payroll is always in compliance with international regulatory obligations.

The best global payroll software providers have high data security standards, so you can rest easy knowing your employees’ and company’s sensitive information is well protected. Dive deeper into the benefits of outsourcing global payroll.

What is the difference between global and international payroll?

Global payroll and international payroll are two names for the same process. But remember, standard payroll and global payroll/international payroll are different. Standard payroll providers follow domestic labor and tax laws. They can’t help you maintain labor and payroll compliance when paying foreign employees or contractors.

When should you outsource payroll operations?

If recurring payroll tasks pull your HR team away from core initiatives, it’s time to outsource your payroll operations. Some business owners turn to outsourcing because of the convenience—they want a one-click solution to streamline the payment process.

Most global teams outsource global payroll management to protect themselves. They want to comply fully with different countries’ labor laws and local tax regulations. Plus, they don’t want to deal with the complex processes of paying international employees or contractors.

What is the best global payroll for small businesses?

Most global payroll solutions will work for small businesses payroll, mid-level companies, and enterprises. But there are some specific features and services that small business owners should seek out.

Choose an international payroll service provider with high-quality customer support. If you’re a small team or a new business, you want experts you can turn to anytime. If the provider has a collection of informational resources for your team, like blog posts, videos, or guides, that’s a bonus.

You may also want a global PEO or EOR instead of just remote payroll services. They can take on more HR functions and minimize your legal and financial risk—and you can focus on building and growing your business.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes in thought leadership and global payroll content.