Article

32 min read

Hiring in Canada: 2026 Employment Law & Compliance Guide

Employer of record

Author

Jemima Owen-Jones

Last Update

January 20, 2026

Table of Contents

Understand Canadian employment laws and regulations

Comply with provincial differences in labor standards

Define compliant hiring policies and procedures

Use legal and compliant employment contracts

Manage payroll, benefits, and statutory contributions

Meet immigration and work permit requirements

Train HR teams on compliance and workplace standards

Partner with an Employer of Record to simplify compliance

Monitor and update policies to reflect legal changes

Hire in Canada confidently and compliantly with Deel

Explore this topic with AI

Key takeaways

- Navigating Canadian employment law is complex. Employers must manage overlapping federal and provincial regulations on pay, benefits, contracts, and compliance — all of which vary by jurisdiction and change frequently. Without local expertise, it’s easy to face compliance gaps and costly penalties.

- Building compliant hiring, payroll, and HR processes — supported by clear documentation and regular policy reviews — helps employers stay aligned with evolving legal standards while protecting both their business and their team.

- With Deel’s Employer of Record (EOR) solution, companies can hire Canadian talent quickly, manage payroll and benefits seamlessly, and stay compliant across every province — all through one trusted global platform.

Expanding your team into Canada in 2026 means more than finding great talent — it means understanding how federal and provincial employment laws intersect. From the Canada Labor Code to varying provincial standards on wages, benefits, and workplace safety, compliance is anything but uniform.

For global employers, these complexities can slow down hiring, expose teams to penalties, and create costly compliance gaps. Misclassifying workers, overlooking statutory contributions, or missing province-specific updates can quickly derail growth plans.

At Deel, we’ve helped thousands of companies navigate multi-jurisdictional hiring across 100+ countries, and Canada remains one of the most nuanced. Whether you’re opening an entity, testing a new market, or hiring remote employees, success depends on getting payroll, benefits, and documentation right from day one.

With the right partner — or an Employer of Record (EOR) solution — you can simplify compliance, reduce risk, and focus on scaling your business, knowing your Canadian workforce is fully protected under local law.

Understand Canadian employment laws and regulations

Canada’s employment law system is uniquely layered. Depending on your industry and where you operate, both federal and provincial regulations may apply. The Canada Labor Code sets the rules for federally regulated sectors — including banking, telecommunications, and interprovincial transportation — while provincial employment standards govern most private-sector employers.

Each province’s Employment Standards Act outlines the core framework for employment relationships, but it’s the supporting regulations that define the finer compliance details — from wage calculations to overtime, vacation, and record-keeping. Understanding both levels matters: the act provides the structure, but the regulations hold the specifics that can trigger penalties if missed.

Across all jurisdictions, human rights legislation protects workers from discrimination and ensures equal treatment in hiring, promotions, and workplace practices. For global employers, demonstrating due diligence isn’t optional — it’s the foundation of compliance and a safeguard against costly legal exposure.

| Jurisdiction Type | Applies To | Key Areas Covered |

|---|---|---|

| Federal | Banks, airlines, telecommunications, interprovincial transport | Canada Labor Code, federal human rights |

| Provincial/Territorial | Most private employers, retail, manufacturing, services | Employment standards, workers’ compensation, human rights |

Discover how Cohabs navigated country-specific employment laws with Deel.

I’m not an expert in every country’s laws. Deel’s Compliance Hub and human advisors help us stay compliant without the guesswork.

—Akésia Doubrere,

HR Manager, Cohabs

Deel Employer of Record

Comply with provincial differences in labor standards

Most private employers in Canada must follow provincial labor standards, which shape key areas like minimum wage, working hours, overtime pay, and leave entitlements. These rules differ across provinces and territories — and they’re updated regularly to reflect inflation and new policies.

While a 40-hour workweek is common, overtime thresholds and pay rates vary by jurisdiction. Minimum wage rates are reviewed annually or semi-annually, creating ongoing compliance tasks for employers operating in multiple locations.

For companies hiring across provinces, multi-jurisdictional compliance is non-negotiable. Employers typically take one of two approaches:

- Standardize HR policies to meet the strictest provincial requirements — easier to manage but often more costly.

- Tailor policies for each jurisdiction — more complex to administer, but cost-efficient.

Key areas that differ across provinces include:

- Minimum wage rates and update schedules

- Overtime calculation methods and premium rates

- Statutory holidays and pay rules

- Vacation accrual and entitlement periods

- Termination notice and severance requirements

Failing to meet local standards can lead to employee complaints, audits, and legal action. Staying current with provincial labor laws isn’t just good practice — it’s essential for compliant, sustainable operations in Canada.

Discover how FEMSA ensures labor laws around the world with Deel.

In our search for talent, especially in fields like the digital sector, we’ve found the right skills often lie in countries where we donʼt operate. Fortunately, with Deel EOR, we can hire exceptional talent from anywhere, all while following the necessary legal and labor laws.

—David Holguín,

Benefits and Mobility Manager at FEMSA

Global Hiring Toolkit

Define compliant hiring policies and procedures

Building a compliant hiring process in Canada starts with fair and inclusive recruitment. Every job post, interview, and candidate evaluation must be free from discrimination. Under Canadian Equal Employment Opportunity laws, employers cannot make decisions based on race, gender, religion, age, disability, sexual orientation, or other protected characteristics.

Documentation is your best defense in the event of an audit or dispute. Keep detailed records at every stage — from job postings and interview notes to reference checks and final hiring decisions. Well-documented processes show due diligence and help protect your organization from discrimination claims.

To ensure consistency, use standardized policy templates that can be customized across teams and locations. Key templates include:

- Inclusive job descriptions and posting guidelines

- Structured interview guides with compliant questions

- Standard offer letter templates that meet legal requirements

- Onboarding checklists covering all required documents

- Termination procedures that align with provincial rules

Finally, employers should provide regular compliance training for hiring managers. Ongoing education helps reduce risk, promotes fair practices, and ensures every candidate experiences a consistent, compliant hiring process — no matter where they’re based.

Discover how Outfittery streamlines global hiring with Deel.

Deel's platform is very innovative and easy to use. It simplified our hiring process and reduced the onboarding time from a week to just one day.

—Pascal Erlach,

Senior Talent Acquisition Manager at Outfittery

See also: Employer costs for an employee in Canada

Deel Talent

Use legal and compliant employment contracts

In Canada, employment contracts must meet legal standards to protect both the employer and the employee. Each contract should clearly outline the role, compensation, benefits, and termination terms, along with key protections like confidentiality and intellectual property ownership.

Contracts must always meet or exceed provincial employment standards. If any term falls below these minimums, the statutory rules automatically apply — which can override restrictive clauses and expose employers to legal risk.

A common compliance pitfall is misclassifying employees as contractors or leaving out essential details. Classification depends on several factors, including who controls the work, who bears financial risk, and how integrated the role is within the business. Getting this wrong can lead to investigations, fines, and back pay liabilities.

Key elements every Canadian employment contract should include:

- Job title, duties, and reporting structure

- Salary or wage details and payment frequency

- Benefit entitlements and eligibility periods

- Intellectual property and confidentiality clauses

- Termination notice and severance terms

- Probationary period and performance criteria

- References to workplace policies and code of conduct

Watch for red flags such as vague job descriptions, missing termination clauses, terms below statutory minimums, or weak IP protections. A clear, compliant contract builds trust from day one — and protects your business from costly disputes.

Deel EOR surpassed our previous solution in both compliance and customer support. Its user-friendly platform provides peace of mind with safe contracts and exceptional client support.

—Pierre Puig,

Head of HR, Sim&Cure

Global Hiring Tools

Manage payroll, benefits, and statutory contributions

In Canada, employers must handle several mandatory payroll deductions and contributions, including the Canada Pension Plan (CPP), Employment Insurance (EI), and federal and provincial income taxes.

Under the CPP, both employers and employees contribute 5.95% of pensionable earnings between $3,500 and $68,500 each year — with employers matching employee contributions dollar for dollar.

For Employment Insurance, employers contribute 2.21% of eligible earnings, which is 1.4 times the employee’s rate. These rates and annual earnings limits are reviewed and updated every year.

Beyond these core contributions, statutory benefits may also include:

- Workers’ compensation coverage through provincial boards

- Vacation pay accrual and payout rules

- Statutory holiday pay and eligibility criteria

- Sick leave entitlements under provincial law

- Parental and family leave coordinated with federal programs

Accurate record-keeping of all deductions, payments, and remittances is essential for compliance and audit readiness. Most employers follow biweekly or monthly payroll cycles, and remittances to government agencies must be made on strict timelines.

To simplify these processes, HR and payroll platforms like Deel can automatically calculate deductions, manage filings, and maintain compliant records, reducing administrative effort and compliance risk.

Discover how the Chief of Staff Association made global hiring fast, compliant, and stress-free with Deel.

Deel handled the hiring, payroll, and benefits—even the legal questions. Taking those important matters off our plate while we focused on growth was invaluable.

— Nicholas Eastwood,

Chief of Staff, Chief of Staff Association

Global Hiring Toolkit

Meet immigration and work permit requirements

A work permit is the legal authorization that allows a foreign national to work in Canada for a specific employer, role, and time period. Employers hiring foreign workers must confirm that each employee has a valid work permit and that the company complies with federal immigration rules and Canadian labor standards throughout the employment relationship.

In most cases, the process begins with a Labor Market Impact Assessment (LMIA) — proof that hiring a foreign worker won’t negatively affect the Canadian job market. Employers must show that they made genuine efforts to recruit Canadians and can justify the need for international talent.

Employer obligations include:

- Verifying work permit validity before employment starts

- Ensuring job conditions match the permit’s details

- Meeting wage and working-condition requirements

- Reporting any changes in employment status or duties

- Cooperating with government audits and inspections

Typical work permit process:

- Determine if an LMIA is required

- Submit the LMIA application with supporting documents

- Wait for government review and approval

- The employee applies for the work permit

- Verify the permit before employment begins

- Track expiry dates and manage renewals

Partnering with experienced immigration counsel or an HR provider like Deel helps navigate visa requirements, sponsorship obligations, and ongoing compliance — ensuring your international hires start and stay on the right side of Canadian law.

Discover how Revolut streamlined employee relocation with Deel.

Deel's provided amazing support to relocate employees. From sponsoring visas in various countries to all the requirements needed: paperwork, documentation, and other things that were challenging for us.

—Luka Besling,

HR Manager, Revolut

Deel Mobility

Train HR teams on compliance and workplace standards

Regular training on labor laws, workplace safety, diversity, and conflict resolution is essential for reducing compliance risks and strengthening workplace culture. HR teams need up-to-date knowledge of evolving regulations, effective complaint handling, and investigation procedures to maintain a fair and legally compliant environment.

Manager training is especially critical. Leaders must know how to handle employee complaints, conduct fair investigations, and take corrective action that protects both employees and the organization. Well-trained HR and management teams help create positive, compliant workplaces that reduce turnover and minimize legal exposure.

Core compliance training topics include:

- Current employment standards and recent legislative updates

- Anti-discrimination and harassment prevention

- Workplace health, safety, and incident reporting

- Privacy laws and employee data protection

- Proper documentation and record-keeping practices

- Termination procedures and severance calculations

Establishing an annual training plan keeps teams aligned with the latest legal requirements and builds long-term expertise in complex compliance areas that demand consistent attention and skill development.

Discover how Beatgrid scaled global HR with one HR lead and Deel.

Without Deel, I’d need to hire three full-time specialists: one for payroll, one for compliance, and one for HR support. Deel saves us their salaries and over 500 hours of manual work every single month.

—Shawnda Kohr,

HRBP, Beatgrid Media

Partner with an Employer of Record to simplify compliance

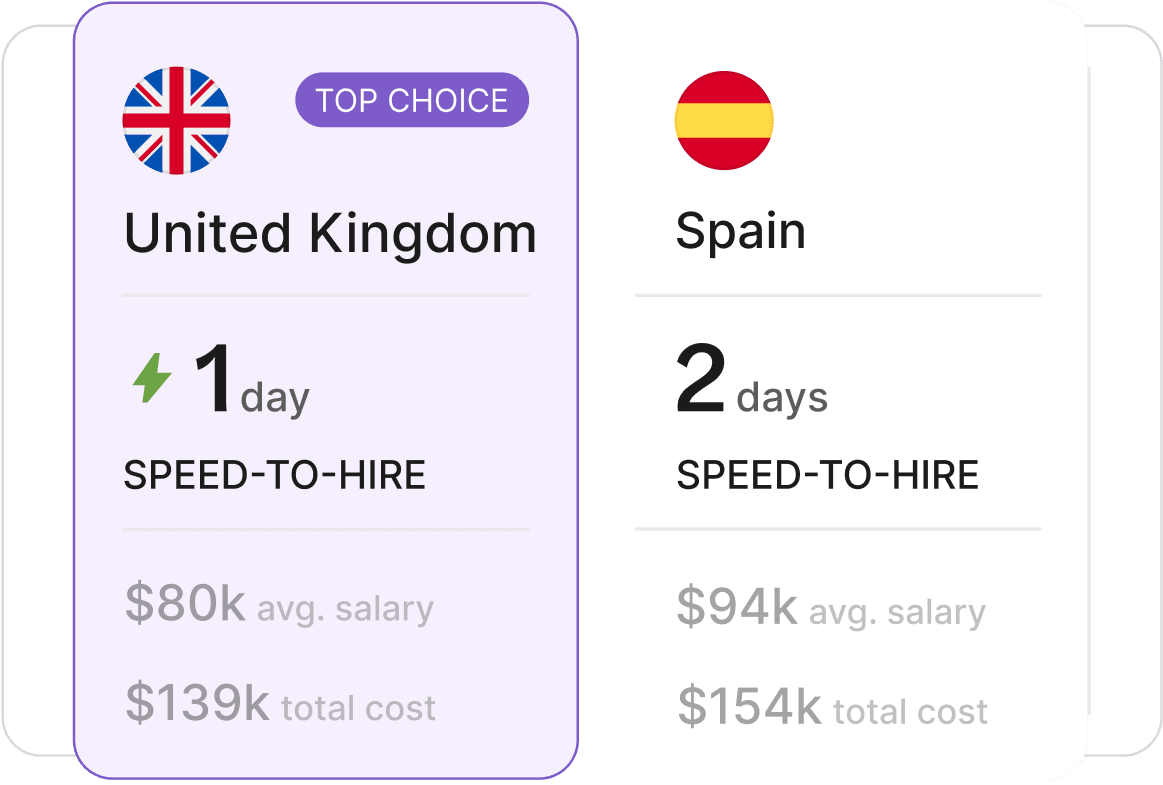

An Employer of Record is a third-party partner that legally employs workers on your behalf — handling payroll, taxes, benefits, and compliance with local employment laws. This model allows international companies to hire talent in Canada without opening a local entity or navigating complex regulations alone.

By partnering with an EOR, businesses can simplify compliance and reduce risk. The EOR becomes the legal employer, managing all statutory requirements, while you retain day-to-day control over your team’s work and performance.

| Approach | Speed to Market | Setup Costs | Compliance Risk |

|---|---|---|---|

| EOR Partnership | 1-2 weeks | Low | Low (transferred to EOR) |

| Local Entity | 3-6 months | High | High (full responsibility) |

See also: EOR vs. Entity Costs: What’s More Affordable?

Key benefits of using an EOR in Canada:

- Fast, compliant market entry

- Reduced legal and administrative complexity

- Access to local HR and legal expertise

- Scalable workforce management for growing teams

This approach is ideal for companies testing the Canadian market, hiring small remote teams, or operating without local HR infrastructure.

With Deel’s EOR solution, you can hire and pay Canadian employees with full compliance confidence. From contract creation and payroll to benefits administration and reporting, Deel manages the complexity — so you can focus on building and scaling your business.

Discover how Data Talks accelerated global hiring with Deel EOR.

| Deel EOR has allowed us to hire quickly and confidently, reducing headaches, saving time, and helping us build a healthier remote work culture. — Helen Yildiz, Chief Customer Officer at Data Talks |

|---|

See also: How to Hire Using an Employer of Record in Canada (2025 edition)

Global Hiring Impact

Recognized as a Leader on Everest Group’s PEAK Matrix®

Monitor and update policies to reflect legal changes

Canadian employment law is constantly evolving. Legislative updates, regulatory changes, and new court rulings can all impact employer obligations. In fact, research shows that 95% of noncompliance cases in Canada happen because employers are unaware of the latest requirements — highlighting the importance of staying informed.

Regularly reviewing and updating HR policies, with guidance from legal or compliance experts, helps organizations stay ahead of change. A proactive approach not only prevents costly violations but also supports smoother operations and stronger workforce management.

Employers can strengthen compliance by monitoring legal updates across federal and provincial levels and applying policy changes as soon as new rules take effect. This ensures teams remain aligned with current employment standards and minimizes regulatory risk.

Regular compliance audit checklist:

- Review minimum wage and overtime rate changes

- Update statutory holiday and leave entitlements

- Check for workplace safety regulation updates

- Verify tax rate and contribution limit adjustments

- Confirm human rights legislation changes

- Review termination and severance requirements

Setting a routine for quarterly policy reviews and annual full audits helps maintain compliance, close regulatory gaps, and support a competitive, well-managed workforce.

Discover how Amilon cut 480 hours of monthly HR work with Deel.

Before Deel, we were drowning in complexity—separate providers for every country, endless emails, different languages, and paying €1,000 just to get basic legal advice. Now I just search Deel's Compliance Hub and get instant answers. It’s completely transformed how we work.

—Izacco Scattolin Neto,

Senior HR Recruiter, Amilon

Compliance

Hire in Canada confidently and compliantly with Deel

Expanding into Canada shouldn’t be slowed down by compliance complexity. With Deel’s fully compliant Employer of Record, you can hire Canadian talent fast, without setting up a local entity or managing separate payroll tax registrations.

Deel’s platform provides transparent pricing, automated compliance, and end-to-end visibility across 150+ countries, so you can grow globally with peace of mind.

Ready to hire in Canada?

Book a Deel demo today and see how our EOR solution helps you scale quickly, stay compliant, and save costs — all backed by G2 and Everest Group’s top industry rankings.

Leading Global Hiring Platform

FAQs

What employment laws govern hiring in Canada in 2025?

In 2025, Canadian hiring is regulated by the Canada Labor Code for federally governed sectors like banking and telecommunications, and by provincial employment standards for most private employers.

Each province sets unique rules on minimum wage, overtime, statutory holidays, and termination, creating multi-jurisdictional compliance obligations for companies operating nationwide.

What should a Canadian employment contract include in 2025?

A compliant Canadian employment contract in 2025 must define job duties, pay structure, benefits, confidentiality, and termination terms that meet or exceed provincial minimums. If any clause falls below statutory standards, government rules override it, which can invalidate restrictive terms and expose employers to risk.

How do employers manage termination and severance in Canada?

Employers must provide notice or pay in lieu under provincial legislation and follow non-discriminatory, documented processes. Severance pay requirements differ by province and length of service — some jurisdictions mandate additional compensation beyond notice periods. Staying aligned with current provincial rules prevents costly disputes.

What are the 2025 rules for hiring foreign workers in Canada?

To hire foreign workers in 2025, employers must verify valid work permits and, in most cases, obtain a Labor Market Impact Assessment (LMIA) proving local recruitment efforts. Employers must comply with immigration and labor laws, maintain accurate records, and report any employment changes to remain compliant.

What are employer obligations for workplace safety and discrimination in Canada?

In 2025, Canadian employers must follow provincial workplace safety laws — including hazard assessments, training, and incident reporting — and uphold human rights legislation ensuring equal treatment and a discrimination-free workplace. Employers must promptly investigate complaints and take corrective action to maintain compliance and trust.

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.