Article

12 min read

6 Fintech Industry Trends and Challenges Solved with Deel

Employer of record

Author

Jemima Owen-Jones

Last Update

January 31, 2025

Key takeaways

- The fintech industry offers significant growth opportunities. But it also brings intense pressure. Key fintech industry trends and challenges include regulatory compliance, data security threats, and a constant demand for specialized tech skills, all while keeping up with rapid growth.

- Deel’s Global People Platform provides a comprehensive solution to these trends and challenges. It tackles the internal and external obstacles that limit efficiency while supporting strategic efforts for sustainable fintech industry growth.

- As an all-in-one solution, Deel enhances every aspect of workforce management. It helps you build a high-performing workforce that can adapt to the changing demands of the fintech sector.

The fintech industry is booming, reshaping how financial services are delivered and consumed.

But amidst this rapid growth lies a storm of trends and challenges — soaring demand for specialized tech talent, navigating the maze of ever-evolving regulations, safeguarding sensitive data from cybersecurity threats, and scaling operations efficiently across borders. These obstacles can hinder even the most innovative companies from maintaining their competitive edge.

At Deel, we understand the complexity of these challenges. As the all-in-one Global People Platform, we’ve empowered fintech businesses to tackle these hurdles head-on, enabling them to focus on what matters most — expanding their impact and driving innovation.

This article explores how Deel addresses the six most pressing trends and challenges in fintech workforce management. By leveraging our expertise, you’ll overcome operational roadblocks and position your organization for sustainable growth in an industry worth over $1 trillion by 2032.

1. Attracting and retaining tech talent

The fintech industry is characterized by continuous innovation. Big data, artificial intelligence (AI), blockchain technology, and other tech innovations are constantly enhancing the delivery of financial services.

However, as fintech companies adopt these advanced technologies, they create a constant demand for skilled professionals to implement and manage them.

Unfortunately, the supply of professionals with these specialized skills does not meet the demand, creating a significant skills gap.

Moreover, fintech firms are not the only ones competing for this talent. Tech companies across various industries also seek individuals with similar expertise, further increasing demand.

This intensifies the competition, particularly for fintech startups that may be less attractive to job seekers than established businesses.

Failing to onboard the right skills can lead to the development of fintech products that do not meet industry standards.

The solution lies in a global people platform like Deel that empowers you in two ways:

- Expanding your talent search to the global labor market

- Providing the tools to create a compelling employee value proposition that attracts and retains talent

Deel’s platform has Employer of Record EOR and Contractor of Record hiring solutions, so you can engage talent in 150 countries without setting up local entities or risking compliance mishaps.

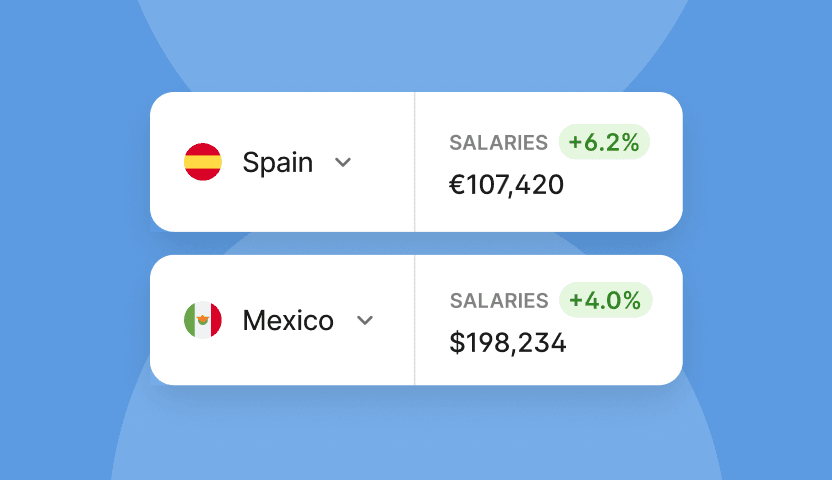

You can attract this talent through competitive compensation guided by our free Global Salary Insights and Global Benefits tools.

Once you secure top talent, Deel creates a good employee experience by offering:

Fast and engaging onboarding

Deel integrates background checks into the onboarding process and provides a workflow builder to automate repetitive admin work. This cuts onboarding time to just three days.

A shorter onboarding process impresses new hires and reduces the time-to-hire.

Easy relocations

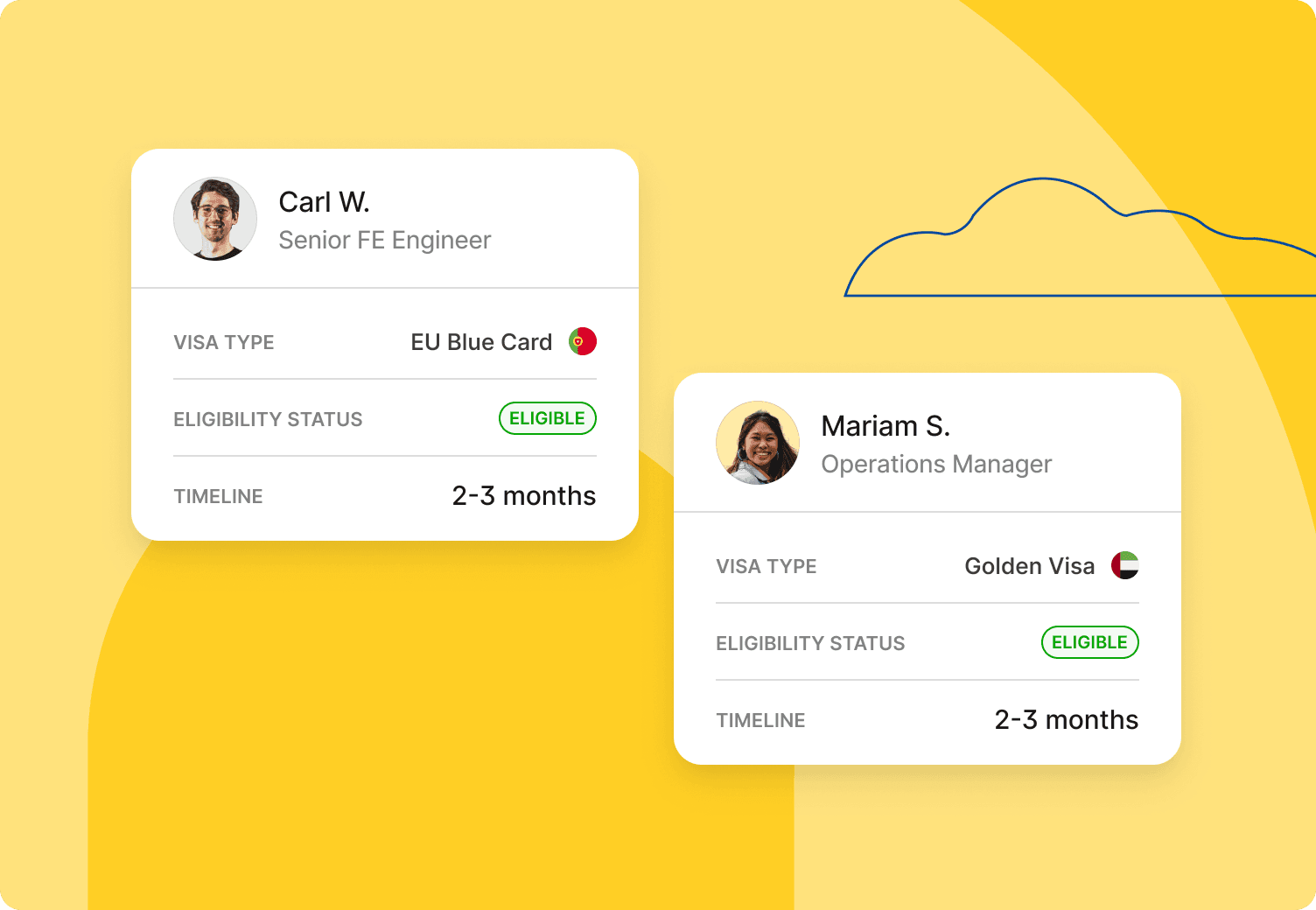

You can support expat employees in their relocation through Deel’s visa and immigration services. We handle essential tasks like immigration compliance and visa processing and offer EOR visa sponsorship services.

Additionally, workers gain access to relocation service providers in their destination countries at a discount. This makes it easier for them to settle into their new environments.

Effective remote work setups

Deel IT ensures that remote employees and contractors have the necessary devices and software to perform their tasks.

Moreover, you can support them with workspace memberships to create a productive and comfortable work environment.

Career development opportunities

Deloitte’s research shows that workers who see chances for skill development and advancement are 2.7 times less likely to resign within a year. Conversely, workers who feel stagnant are 2.5 times more likely to switch organizations within a year.

Deel addresses employee dissatisfaction by providing access to Deel Engage. Deel Engage is an AI-powered people suite to manage career development, performance, and training programs.

What you get are:

- 360° reviews to provide workers with comprehensive feedback on their strengths and areas of improvement

- Learning and development tools to build an engaging training library of internal and external courses for upskilling workers

- Competency-based career progression frameworks that provide workers with a clear path to advancement

- Slack HR plugins like Kudos recognize and celebrate employee achievements and motivate ongoing growth

Deel Engage is our go-to platform for all things talent management, saving us up to 180 hours in feedback processes alone.

—Caroline Randazzo,

Head of Human Resources and Recruitment, Aquatic Capital Management

Platform Tour

Transform employee learning

Flexible payment methods

Late payments and inflexible payment options can undermine job satisfaction.

Deel provides global payroll and global payment services, ensuring timely cross border payments for your international workers in their local currency. It also offers a local point of contact for any questions.

To enhance employee satisfaction, workers benefit from embedded finance solutions directly within the platform, including:

- A Deel Card and digital wallet for easier spending

- Deel Advance for workers receive payments up to 30 days early

- Multiple options for digital payments, including Instant Card Transfer, bank transfers, PayPal, Payoneer, Revolut, and Wise

Our contractors prefer getting paid through Deel as it allows them to self-manage their finances. They particularly value the ability to exchange their payments into various currencies.

—Estefania Tejo,

VP of People, d.local

Self-serve features

Deel provides your workers with a self-service portal. It gives them access to a variety of resources, information, services, and tools, including:

- Important documents like company policies

- Payslips

- Options to update personal information

- Training materials

- Communication and collaboration tools

The portal reduces the sense of distance for global employees and removes the hassle of back-and-forth emails with HR for routine tasks.

Attractive perks

Through Deel, you can offer competitive perks and benefits to your workers, making them feel valued and supported. Our perks cover a wide range of solutions to:

- Boost their health and wellness

- Optimize their remote workspace and improve productivity

- Manage their finances

- Access top-tier insurance at an affordable rate

Discover how Outfittery addressed its tech talent shortage by broadening its search to 7 countries with Deel. It reduced costs by 50% compared to previous providers.

Finding affordable tech talent in Germany was tough, and Work Motion and Oyster didn't meet our needs. Deel allowed us to hire globally, slashing our costs by 50%.

—Pascal Erlach,

Senior Talent Acquisition Manager at Outfittery

Deel's Built-In HRIS

2. Maintain regulatory compliance with less hassle

The financial services industry is heavily regulated. As a fintech business, you must comply with standards like PCI DSS, GDPR, and GLBA, along with anti-money laundering and KYC laws. This doesn’t even account for the additional requirements of tax and labor laws.

Fortunately, tax and labor laws are areas you can delegate to Deel, which offers extensive compliance solutions.

Deel provides a Compliance Hub designed to keep your fintech business compliant, with minimum effort from you.

Key features include:

- Monthly Workforce Insights, delivered as a personalized report to your inbox. It includes alerts on upcoming visa expirations and the latest compliance updates in the countries your workers operate

- A Compliance Monitor that scans and gathers global regulatory changes in real-time. It turns them into concise, easy-to-understand summaries that help you quickly assess the impact on your business

- An AI driven worker classification tool that classifies workers with over 90% accuracy using local laws and legal precedents

Deel also ensures compliance in your hiring process by guiding you on the necessary documentation. We take charge of localizing your employment agreements and contracts to align with local laws.

This continuous compliance support allows your legal team to focus on critical legal matters instead of monitoring labor laws.

Discover how a fintech company, Finder, ensures 100% hiring compliance in over ten countries through its partnership with Deel.

Having Deel’s team handle compliance and statutory requirements frees up my time to focus on providing better workplace experiences, like onboarding to building the capabilities of our workforce,

—Isaiah James Peralta,

Head of Distributed Services at Finder

See also: Compliance Challenges Companies Face When Growing Globally

3. Enhance data security

Cybersecurity threats pose a significant challenge for fintechs. Their business model, similar to that of a traditional bank, relies on sensitive information like social security numbers, transaction history, and account numbers.

This dependence on sensitive data makes them particularly attractive targets for cybercriminals.

As the fintech industry embraces modern technologies, cyber threats increase. Tech innovations boost efficiency, but they also expand the attack surface for cybercriminals.

The consequences of a data breach can be severe, particularly for financial institutions. For instance, a breach at Equifax exposed the personal information of 147 million customers. It cost the company up to $700 million in settlements with various regulatory bodies and about $14 million in fines from the Financial Conduct Authority.

Ensuring the security of all adopted systems, especially HR systems, is crucial for strengthening your cybersecurity.

HR systems often have access to other critical business functions, making them a potential entry point for cybercriminals.

Vulnerabilities increase in hybrid or remote work settings where workers access HR systems from different locations and personal devices. It creates risks associated with insecure connections, unprotected devices, and unauthorized access.

Deel addresses these risks and more by implementing robust security measures. It meets the highest data security and risk management standards in the industry.

As a Deel user, you benefit from advanced infrastructure and comprehensive compliance certifications, including:

- Full global certifications, including SOC1, SOC2, SOC3, ISO 27001, and GDPR

- Resilient and reliable AWS-hosted infrastructure with 24/7 SIEM SOC monitoring

- Advanced data access controls, including role-based access and SSO options

- Annual penetration tests

- Proactive vulnerability and patch management

- Strong password policies

- Extensive and multi-layered network security setup

See also: A Guide to Standardizing Global Expansion for Enterprises

4. Scale with confidence

The global fintech market is rapidly growing and shows no signs of slowing down. Analysts project the market, valued at $294.74 billion in 2023, will reach $1.152 trillion by 2032.

While this growth is impressive, it poses significant challenges for fintech companies. They must accommodate this expansion without sacrificing service quality and efficiency or incurring excessive costs.

Proper workforce management is key to maintaining high-performance levels while scaling operations, and Deel offers a long-term solution.

As your workforce grows, Deel provides a single, easy-to-use platform with the tools necessary to manage all aspects of your team. This includes:

- Onboarding and offboarding

- Payroll and benefits administration

- Performance management

- Career development

- Expense management

- Time off requests

- App provisioning

- Ongoing employee support

- Data management and reporting

These are cloud-based solutions that easily scale with your fintech business.

Additionally, Deel Integrations enable you to connect your existing systems and applications, improving workflows, simplifying data exchange, and boosting overall efficiency.

Discover how Clara, a B2B fintech app and web platform, achieves growth while maintaining constant spending with Deel.

With Deel, we can hire no matter where the people are, at the same time we're being budget conscious because the company grows but the costs remain the same.

—Carolina Astaiza,

Global People Director at Clara

5. Succeed in international expansion

As digital-first solutions, fintech companies bridge the gap for consumers lacking access to brick-and-mortar financial institutions. This creates fertile ground for international expansion that has helped companies like PayPal operate in over 200 countries.

International expansion is a powerful growth catalyst. Companies that go global are 1.2 to 1.3 times more likely to generate significantly higher returns than their peers.

However, for fintech companies, success in foreign markets often depends on building trust with local consumers.

Deel’s EOR solution addresses this need. It enables you to hire local talent in target markets before establishing a presence in those countries.

Hiring individuals who understand local culture and consumer behavior helps you build stronger customer connections and enhance the overall customer experience. This understanding allows you to tailor your products and user experiences to effectively meet consumer preferences and needs.

In addition, Deel provides a unified platform to manage these EOR workers alongside other contractors and employees. This facilitates consistent workforce management practices across your entire team.

It ensures that all workers have a positive experience and maintain consistent work standards aligned with your business objectives.

Discover how bunq, which offers digital banking services, ventured into five countries with Deel. It saved about 20% in local setup costs and slashed time spent on payroll and HR processes by 30%.

We explored various vendors, and Deel stood out as the only provider capable of supporting every phase of our local growth, enabling swift onboarding without the need for a local entity. Their responsive communication and proactive approach completely aligns with our values and needs,

—Luc de Ridder,

Talent Acquisition Lead at bunq

6. Manage mergers and acquisitions with ease

Mergers and acquisitions are critical strategies for growth and innovation in the fintech industry. They’re often a faster route to achieving strategic goals, such as launching new features or entering new markets.

However, M&As come with labor-related complexities, particularly in cross-border transactions. Poor integration planning can cause issues that can undermine the value of the acquisition, such as:

- Misclassification of workers

- Compliance violations

- Difficulties in retaining talent

The good news is you can leave these challenges to Deel while you focus on maximizing the benefits of your M&A activities.

Deel handles the onboarding of inherited workers, as well as compliance, payroll, taxes, benefits, and everything else needed for a smooth and compliant transition.

Its Slack integration promotes open communication with these workers, maintaining transparency throughout the M&A process. This open dialogue also supports their smooth integration into the company culture and team dynamics.

Discover how EEG efficiently managed an M&A and onboarded 48 workers from the acquired company. With Deel’s support, it successfully integrated talent from 20 different countries.

See also: 7 Strategies for Effective Compliance Monitoring and Integration Post-Merger

Streamline your fintech operations with Deel

Staying ahead in the fintech industry demands more than just innovation in product and service delivery. It requires a creative, comprehensive approach to address industry challenges that can leave fintech businesses vulnerable to stagnation.

Deel provides all the tools you need to tackle these critical issues while positioning your business for long-term success. From one flexible and user-friendly platform, you can:

- Attract and hire specialized talent from over 150 countries, facilitate their relocation, and provide the necessary work equipment

- Maintain compliance with local tax and labor laws, relieving the burden on your legal team

- Thrive in international markets by building and managing effective global teams

- Future-proof your workforce through ongoing learning and development

- Safeguard your systems against cybersecurity threats

- Expand your operations without sacrificing efficiency or productivity

"We are future-proofing our growth with Deel," —Alex Nicolaus, Chief People Officer, Paysend

Book a demo to see how Deel can tackle your unique fintech challenges.

About the author

Jemima is a nomadic writer, journalist, and digital marketer with a decade of experience crafting compelling B2B content for a global audience. She is a strong advocate for equal opportunities and is dedicated to shaping the future of work. At Deel, she specializes in thought-leadership content covering global mobility, cross-border compliance, and workplace culture topics.